Bioethanol Market Outlook:

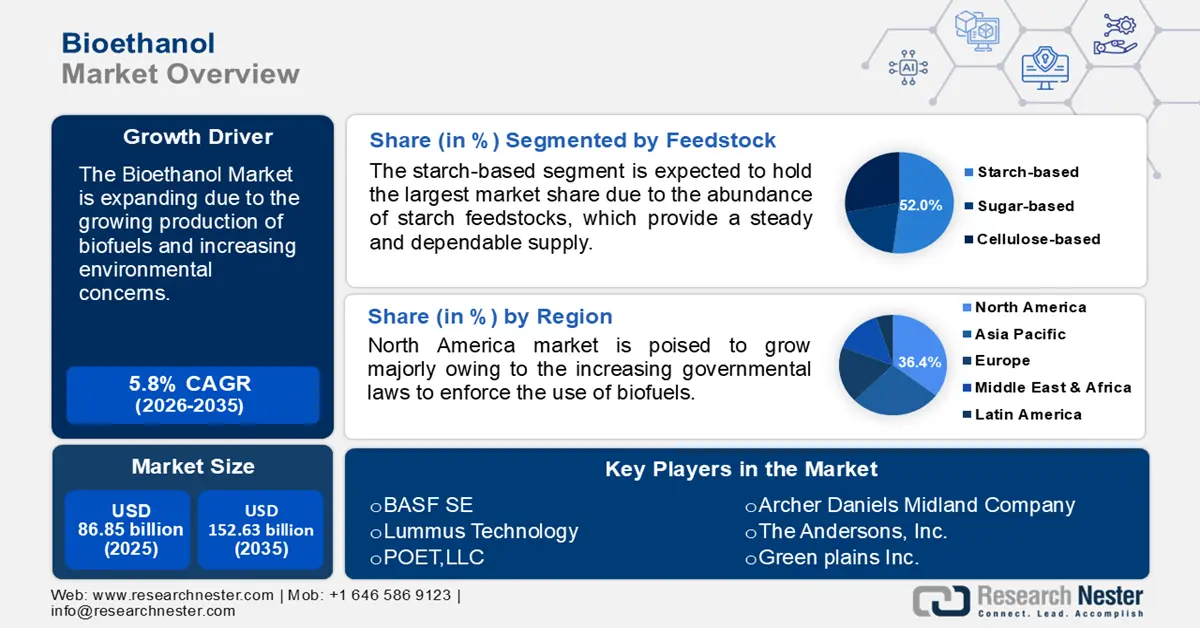

Bioethanol Market size was valued at USD 86.85 billion in 2025 and is likely to cross USD 152.63 billion by 2035, expanding at more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bioethanol is assessed at USD 91.38 billion.

The primary growth driver of market is the increasing demand for renewable energy sources as a means to reduce greenhouse gas emissions and dependence on fossil fuels. Government policies and incentives supporting the use of biofuels, such as blending mandates and subsidies, also play a crucial role in driving market growth. For instance, the Renewable Fuel Standard (RFS) in the U.S. mandates the use of renewable fuels, including bioethanol, to reduce greenhouse gas emissions. Additionally, rising consumer awareness of environmental issues and the growing adoption of bioethanol in the automotive industry, particularly in flexible fuel vehicles, contribute to the market expansion.

Key Bioethanol Market Insights Summary:

Regional Highlights:

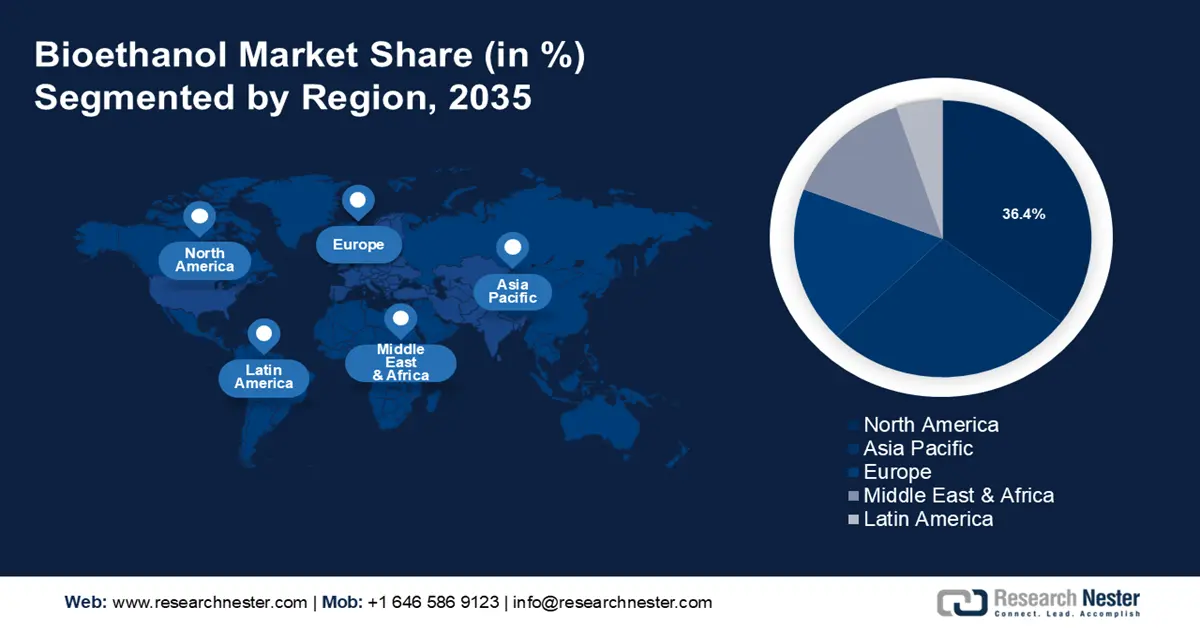

- North America’s bioethanol market will account for 36.4% share by 2035, driven by strict renewable fuel standards and high ethanol consumption in transportation.

- Asia Pacific market will register huge growth during the forecast timeline, driven by rising energy demand and supportive government policies in countries like India and China.

Segment Insights:

- The starch-based feedstock segment in the bioethanol market is projected to hold a 52% share by 2035, driven by the abundance of starch feedstocks and existing infrastructure for ethanol production.

- The e10 fuel blend segment in the bioethanol market is projected to hold a significant share by 2035, influenced by government initiatives enforcing E10 fuel use in cars.

Key Growth Trends:

- Increased integration as transportation and cooking fuel

- Chemical suppliers adapting to bioethanol shift

Major Challenges:

- Technological and production limitations

- Infrastructure and distribution

Key Players: BASF SE, Lummus Technology, POET, LLC, Archer Daniels Midland Company, The Andersons, Inc., Green Plains Inc., Alto Ingredients Inc., Valero Energy Corporation, Flint Hills Resources, BlueFire Ethanol Fuels Inc..

Global Bioethanol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 86.85 billion

- 2026 Market Size: USD 91.38 billion

- Projected Market Size: USD 152.63 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Brazil, China, Germany, India

- Emerging Countries: China, India, Brazil, Thailand, Argentina

Last updated on : 18 September, 2025

Bioethanol Market Growth Drivers and Challenges:

Growth Drivers

- Increased integration as transportation and cooking fuel: Bioethanol is more environmentally friendly than petroleum fuels as pure ethanol from sugarcane reduces greenhouse gas emissions by up to 88% compared to fossil gasoline. Ethanol reduces emissions even at low gasoline blends (5-10%, E5, or E10), which are ordinarily difficult to attain.

Additionally, the growing use of clean-burning ethanol stoves instead of inefficient traditional cooking methods has greatly decreased indoor air pollution. This is particularly important in developing countries, where indoor air pollution is a significant health issue, especially for women and children. According to the World Health Organization, an estimated 3.2 million deaths annually, including over 237,000 deaths of children under the age of five, were attributed to household air pollution in 2020. - Chemical suppliers adapting to bioethanol shift: Suppliers are focusing on the development of eco-friendly and sustainable products to meet stringent environmental rules, which is a driving force behind the bioethanol market expansion in the chemical industry. Also, growing collaborations with bioethanol producers to co-develop technologies and enhance production processes have led to innovative solutions. For instance, in May 2020, a collaboration agreement was struck by Sekab E-technology AB and Praj Industries, India, to improve and commercialize technical solutions for the manufacture of sustainable chemical products and biofuels.

- Technological innovations in production processes: Bioethanol production is being enhanced by ongoing research and technological breakthroughs, which are also researching new feedstock sources including algae and seaweed, and improving efficiency. Over the past 20 years, governments, big businesses, and academic researchers have been more interested in second-generation bioethanol or mixed biorefineries since they offer a compelling renewable substitute for finite fossil fuels. The general public also views its production as universally acceptable as it can help prevent climate change and is seen as non-competitive with the food and feed sector. Also, the use of lignocellulosic substances for producing bioethanol is gaining popularity as they can be grown with a small amount of water and manure.

Challenges

-

Technological and production limitations: Traditional bioethanol production methods, such as those using food crops, have limited efficiency and can result in lower yields. Advancements in technology are needed to improve these processes and increase productivity. Moreover, costs associated with advanced technologies, such as cellulosic ethanol production, are high which makes bioethanol less competitive compared to conventional fossil fuels.

-

Infrastructure and distribution: Limited infrastructure for the distribution and blending of bioethanol with gasoline can restrict its market penetration, especially in regions without established bioethanol fueling networks.

Bioethanol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 86.85 billion |

|

Forecast Year Market Size (2035) |

USD 152.63 billion |

|

Regional Scope |

|

Bioethanol Market Segmentation:

Feedstock Segment Analysis

Starch-based segment is anticipated to dominate over 52% bioethanol market share by 2035. The starch-based bioethanol segment’s growth can be attributed to the abundance of starch feedstocks, which provide a steady and dependable supply. According to the National Institutes of Health, sugar cane and sugar beet account for around 40% of the world's bioethanol production, whereas feedstocks containing starch account for approximately 60% of it. Moreover, the existing infrastructure and expertise for manufacturing and transporting ethanol provide similar advantages for starch-based bioethanol. Also, several countries have implemented methods and equipment for turning starch feedstocks into bioethanol. This system, which fosters a market for bioethanol made from starch, includes blending facilities, transportation networks, and ethanol plants.

Fuel Blend Segment Analysis

The E10 segment in bioethanol market is expected to garner a significant share by 2035. The segment is witnessing growth due to the various initiatives by several governments to enforce the use of E10 fuel mixes in cars. According to a report by the US Grains Council in 2022, the UK started transitioning its gasoline supply in September 2021 from an E5 basis to an E10 blend. The country currently consumes 280 million gallons of gasoline-ethanol or 7% of its total fuel blend. However, soon the region expects to reach a 9.7% ethanol blend.

End use Segment Analysis

The pharmaceutical segment in bioethanol market is anticipated to gain a notable revenue share during the forecast period. The segment’s expansion can be attributed to the ability of bioethanol to improve the solubility of hydrophobic active pharmaceutical ingredients (APIs), as a result enhancing the bioavailability and efficacy of drugs. Moreover, bioethanol meets the strict regulatory criteria and quality standards implemented on pharmaceutical products, making it a recognized safe and compliant solvent for pharmaceutical applications. It is gaining momentum among drug producers because it offers safety and compliance with regulations.

Our in-depth analysis of the market includes the following segments:

|

Feedstock |

|

|

Fuel Generation |

|

|

Fuel Blend |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bioethanol Market Regional Analysis:

North America Market Insights

North America industry is estimated to hold largest revenue share of 36.4% by 2035. The market is growing in the region due to the government’s strict laws to implement the use of biofuels. Higher renewable fuel standard requirements and rising domestic motor gasoline consumption which is currently blended with 10% ethanol by volume have led to an increase in the production of bioethanol.

In the U.S., ethanol is mostly produced from corn and it is widely used across the nation. With 205 ethanol plants across the country, the United States can produce an estimated 15.8 billion gallons (59.8 billion liters) of ethanol per year, providing enough worldwide supply.

In Canada, the biofuel industry is witnessing a significant increase in investment, driven by rising global demand for biofuel. Also, the government is implementing stringent laws to increase the use of biofuels which is accelerating the growth of market. For instance, Canada's Clean Fuel Regulation (CFR) intends to reduce the carbon intensity of liquid transportation fuels and has the potential to raise the use of low carbon-intensity diesel by 2.2 billion liters and ethanol by 700 million liters by 2030.

APAC Market Insights

The bioethanol market in Asia Pacific will encounter huge growth during the forecast period owing to the of growing biofuel demand in countries such as China, India, and Thailand as well as regional government policies and initiatives that encourage the use of renewable fuel sources.

In China, the economy is expanding at a rapid pace, which has increased energy demand and raised concerns over the nation's energy security. According to the International Energy Agency, in 2021 electricity consumption in China increased from 489% from 2000. The nation is supporting the growth of the fuel to guarantee national energy security, lessen reliance on oil imports, cut greenhouse gas emissions, and boost farmers' incomes.

In India, to lessen dependency on imported fossil fuels and fight environmental pollution, the government has launched several policies and programs to encourage the development and use of biofuels. These regulations include the Ethanol Blending Program and the National Policy on Biofuels, which set a minimum amount of ethanol blended back into gasoline.

The market in South Korea is expected to increase significantly due to changes in customer preferences, government backing, and technological advancements. Businesses are encouraged to adopt greener practices and make investments in cutting-edge technologies by consumer demand for premium, environmentally friendly products.

Bioethanol Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lummus Technology

- POET, LLC

- Archer Daniels Midland Company

- The Andersons, Inc.

- Green Plains Inc.

- Alto Ingredients Inc.

- Valero Energy Corporation

- Flint Hills Resources

- BlueFire Ethanol Fuels Inc.

To increase their client base and fortify their position in the bioethanol market, major firms are branching out across different areas and breaking into new markets in developing nations. In order to meet the increasing demands of the customers, the corporations are also launching new, cutting-edge products.

Recent Developments

- In September 2023, Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced the commercial launch of their ethanol to sustainable aviation fuel (SAF) process technology. The technology offers operators a large-scale, commercially demonstrated option for lowering the aviation industry's greenhouse gas emissions.

- In May 2022, BASF introduced its new brand Spartec to the North American bioethanol market. With the new brand, BASF sets a new bar for performance and service. The new brand emphasized the company's dedication to meeting important client needs such as raising plant yields, improving plant efficiency, and lowering carbon intensity.

- Report ID: 6396

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bioethanol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.