Biliary Interventional Radiology Devices Market Outlook:

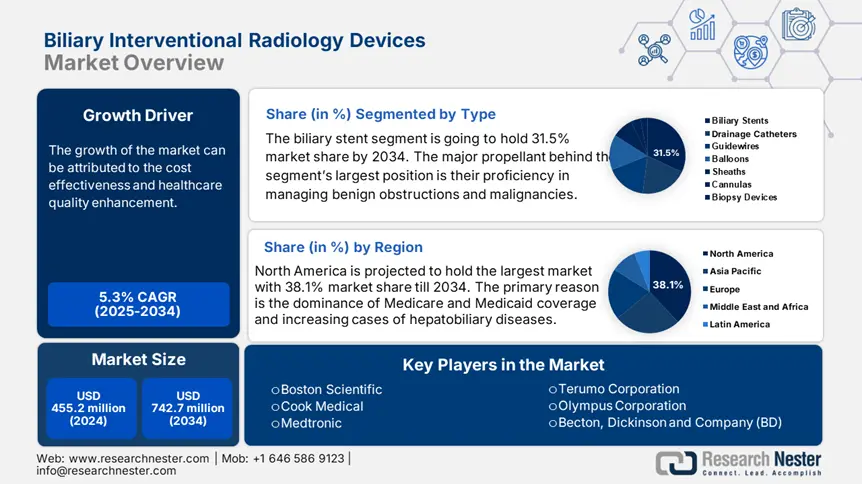

Biliary Interventional Radiology Devices Market size was valued at USD 455.2 million in 2024 and is projected to reach USD 742.7 million by the end of 2034, rising at a CAGR of 5.3% during the forecast period, 2025-2034. In 2025, the industry size of biliary interventional radiology devices is estimated at USD 480.2 million.

The reimbursement data for Medicare in the U.S. shows that procedures associated with biliary interventional radiology have undergone adjustments in costs. There has been a reported mean decrease of USD 21.3 per procedure related to the biliary interventional radiology, showing modest downward pressure. Likewise, CPI and PPI figures for supplies and equipment are embedded within broader healthcare indices for the equipment. The data published by the National Institutes of Health shows that almost 20.1 million Americans annually suffer from biliary diseases. The data shows that the patient pool needing such devices is surging significantly.

The supply chain is vulnerable and faces regulations from stringent regulations on medical devices. These devices are supposed to clear FDA examinations and are supplemented by precise marking of the labeling of the country. Also, there is a huge investment in research and development for these devices, garnering funding of USD 681 million in 2023. Also, trade dynamics illustrate that the total value of imports of biliary devices in the U.S. is almost USD 1.1 billion. Countries are focusing on supply chain resilience, with the country-wise stockpiling of crucial components surging by 12.1% from 2021.

Biliary Interventional Radiology Devices Market - Growth Drivers and Challenges

Growth Drivers

- Healthcare quality improvement and cost effectiveness: A study conducted by the Agency for Healthcare Research and Quality in 2022 stated that early-stage interventions using advanced radiology biliary devices resulted in an 18.2% lower hospitalization rate, saving a projected USD 1.3 billion in U.S. healthcare. The adoption of minimally invasive procedures has become more frequent to reduce the complication rates. Research Nester estimates that these protocols have resulted in 23.3% fewer readmissions compared to conventional surgical methods. Additionally, the Society of Interventional Radiology has adopted quality standards for biliary interventions.

- Rising preference for the minimally invasive treatment: There has been a rise in the adoption of minimally invasive procedures, as it is helpful in lowering hospital stays and saving costs. Additionally, stent placement and Percutaneous transhepatic cholangiography (PTC) have now become standard therapies after the failure of ERCP, fostering the demand for significant IR systems. There has been a surge in demand for minimally invasive techniques to allow the short stay treatment to lower the healthcare costs. Various ambulatory surgical centers are adopting biliary interventional radiology devices.

- Surge in technology adoption: The surge in adoption of advanced imaging and minimally invasive technologies is significantly fueling the growth of the market. The modern suites now include a hybrid C-arm fluoroscopy. This helps in enabling 3D visualization for conducting intricate biliary procedures such as drainage and stent placement. The inclusion of AI leads to real-time localization and accurate optimization of the catheter navigation. Also, the next generation of biliary stents is preferred due to better biocompatibility and reduced migration. The cloud-based image management systems allow for the remote review and decision-making.

Challenges

- Government-imposed pricing caps and reimbursement barriers: Governments in a plethora of countries are imposing price caps on medical devices to control healthcare costs, restricting the profit yield for manufacturers. For instance, European countries such as France and Germany are utilizing reference pricing, compelling companies make compliance with the regional benchmarks.

- Strict regulatory approval delays: The stringent and lengthy approval from the FDA, CE Mark, etc., causes delays for market entry. For example, in 2022, Olympus Corporation faced a 6-month delay in Japan owing to the Pharmaceuticals and Medical Devices Agency safety review process.

Biliary Interventional Radiology Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

5.3% |

|

Base Year Market Size (2024) |

USD 455.2 million |

|

Forecast Year Market Size (2034) |

USD 742.7 million |

|

Regional Scope |

|

Biliary Interventional Radiology Devices Market Segmentation:

Type Segment Analysis

The biliary stents segment is projected to garner 31.5% market share by 2034, owing to their high usability in managing benign obstructions and malignancies. According to the National Institute of Health, the usage of biliary stenting remarkably enhances the survival rate of unresectable cholangiocarcinoma patients. The adoption in the inpatient and outpatient settings is also increasing due to increased reimbursement support for the drug-eluting as well as metallic stents under the Medicare policies. Also, there is a huge investment in research and development in making biodegradable stents, further fueling the segment's growth.

End User Segment Analysis

The hospital segment is anticipated to gather a 45.2% share by 2034. The segment growth can be attributed to the accessibility of hospitals to state-of-the-art IR suites. According to the Agency for Healthcare Research and Quality, various hospitals have included quality improvement initiatives, such as image-guided biliary intervention, as a standard for high-risk cases. The procurement of the device is made possible via public tenders to ensure long-lasting growth and cost efficiency. Hospitals are hiring specialized interventional radiologists to give adequate treatment to the patients.

Our in-depth analysis of the global biliary interventional radiology devices market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Procedure |

|

|

Material |

|

|

Applications |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biliary Interventional Radiology Devices Market - Regional Analysis

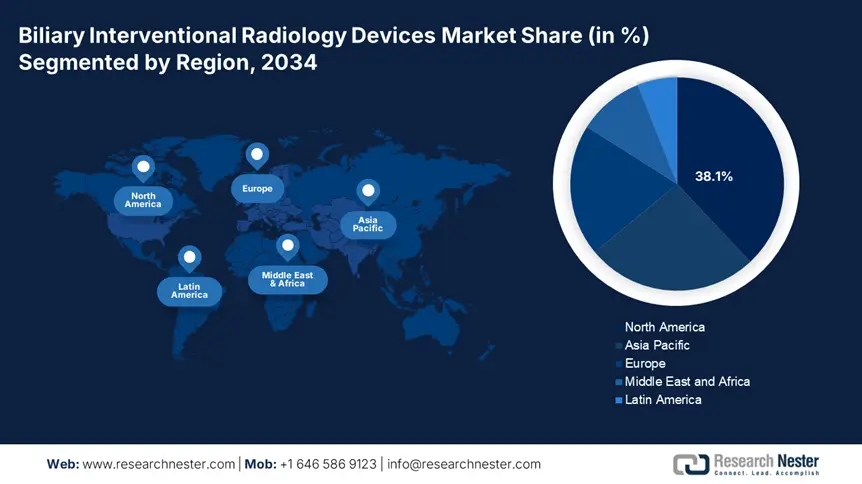

North America Market Insights

The North America market is projected to garner 38.1% of the revenue share by 2034, owing to the widespread expansion of Medicare and Medicaid coverage and increasing cases of hepatobiliary diseases. Hospitals are including AI-enabled imaging, CBCT-assisted IR suites, and biodegradable stents. In the U.S., the market is experiencing sturdy growth fostered by a surge in the prevalence of hepatobiliary disorders and an exponential demand for minimally invasive procedures. According to the National Institute of Health in 2023, the federal government has allocated USD 5.1 billion for the biliary interventions.

The market in Canada is thriving, primarily driven by the rising usage of interventional therapies and increasing government investment. The Health Canada in 2023 has allocated USD 3.1 billion to biliary interventions. The increment in the funding aligns with the national health priorities, focusing on a reduction in the wait time and widespread expansion in the image-guided procedures. As reported by the Ontario Ministry of Health, the government has supported more than 200,100 patients per year. The market in the country is also driven by the implementation of a combined health strategy and robust public funding.

Asia Pacific Market Insights

The market in Asia Pacific is poised to garner a CAGR of 8.2% during 2025-2034, driven by rising efforts from the government for healthcare advancements and rapid technological adoption. In China, the government is supporting the inclusion of advanced medical technologies, further propelling the market growth. According to the National Cancer Center in 2024, liver and gallbladder cancers are the top ten most common cancers. Also, gallstones affect over 10.1% of adults in the country, with a surge in cases owing to changes in dietary habits.

The market in India is also growing rapidly with rising advancements in healthcare initiatives. There has been a rise in incidences of biliary diseases. According to the Indian Council of Medical Research in 2023, gallbladder cancer is the most common type of biliary tract cancer in the country. Under the National Health Authority 2024, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana covers biliary stenting. The National Health Authority in 2024 stated that Ayushman Bharat has given 60.1 million hospital admissions.

Latest Developments & Government Initiatives: Biliary Interventional Radiology Devices (2023–2025)

|

Country |

Latest Developments |

Government Initiatives |

|

Japan |

Nationwide upgrade of interventional radiology suites across public hospitals |

MHLW allocated 12% of the healthcare budget in 2024

|

|

Indonesia |

Introduction of fluoroscopy-guided biliary drainage in tertiary hospitals |

The Ministry of Health launched “Smart Hospital 2025,” including IR tech investments |

|

Malaysia |

Major public-private partnerships for biliary device trials |

Government funding for Biliary IR Devices rose by 20% (2013–2023) |

|

Australia |

Increasing use of biodegradable stents and hybrid IR-surgical systems |

Medicare extended coverage for biliary procedures (2023) |

|

South Korea |

Deployment of robotic catheter navigation systems |

MOHW supports digital IR infrastructure and hospital equipment upgrades |

Europe Market Insights

The biliary interventional radiology devices market in Europe is witnessing sturdy growth, bolstered by increasing incidences of hepatobiliary diseases. Various EU-backed funding programs are supporting interventional healthcare infrastructure. The data published by the European Health Data Space stated that USD 2.6 billion has been spent in recent years. In the UK, the demand is witnessing steady growth due to a surge in the burden of liver-associated diseases. According to NHS England, between 2021 and 2023, more than 2.1 million biliary procedures were conducted.

Additionally, Germany is also maintaining its place as the largest market in the region, as there is a surge in the integration of AI and various robotic navigation systems. Local players are including state-of-the-art robot-assisted IR procedures to render upscaled treatment. According to the Federal Ministry of Health in Germany in 2023, the Digital Healthcare Act strengthens advanced IR techniques in hospitals. The strong reimbursement policies from the government, coupled with a rising aging population, are promoting the market growth in the country.

Key Data & Initiatives by Countries in Europe

|

Country/Region |

Government Spending & Budget Allocation |

Latest Initiatives / Trends |

|

France |

7% of healthcare budget in 2023 (↑ from 5.5% in 2021) |

AI-supported biliary imaging endorsed by HAS |

|

Italy |

~6.5% of national health budget toward diagnostic/interventional radiology (est. 2023) |

AIFA fast-tracks approval for IR technologies |

|

Spain |

~6% of the healthcare budget allocated to IR and imaging in 2023 |

AEMPS supports centralized device registration & training |

|

Russia |

MoH budget includes ~5% for advanced diagnostics and radiology equipment |

Local production of biliary catheters encouraged |

|

NORDIC (e.g., Sweden, Norway, Denmark) |

~7–8% of healthcare budgets are dedicated to minimally invasive imaging & radiology |

E-health integration for radiology decision-making |

|

Rest of Europe |

Varies by country (average 5–6.5% of healthcare budget for radiology) |

Centralized radiology registries and tele-radiology investments |

Key Biliary Interventional Radiology Devices Market Players:

- Boston Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cook Medical

- Medtronic

- Terumo Corporation

- Olympus Corporation

- Becton, Dickinson and Company (BD)

- Merit Medical Systems

- AngioDynamics

- Stryker Corporation

- Abbott Laboratories

- B. Braun Melsungen AG

- Siemens Healthineers

- Philips Healthcare

- Fujifilm Holdings Corporation

- Micro-Tech Endoscopy

- Nipro Corporation

- Jindal Medical & Scientific Instruments

- Samyang Biopharmaceuticals

- Cook Asia (Cook Medical Subsidiary)

- Device Technologies

The competitive landscape of the biliary interventional radiology devices market is rapidly evolving as established key players, healthcare giants, and new entrants are investing in including novel medicines. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Top 20 Global Manufacturers in the Biliary Interventional Radiology Devices Market:

Recent Developments

- In March 2024, Boston Scientific launched the Next Generation Biliary Stent called the VisiPro biliary stent system. The product is designed for enhanced flexibility and radiopacity in intricate biliary obstructions. The market has achieved 15.1% higher sales in Europe after the launch.

- In May 2024, Cook Medical launched an AI-enabled biliary drainage catheter having a smart track. The product integrates real-time AI guidance for precise placement, lowering the procedure time by 21%. The launch of the product captured 8.1% additional market share in Germany.

- Report ID: 3162

- Published Date: Jul 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biliary Interventional Radiology Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert