Bile Acid Sequestrants Market Outlook:

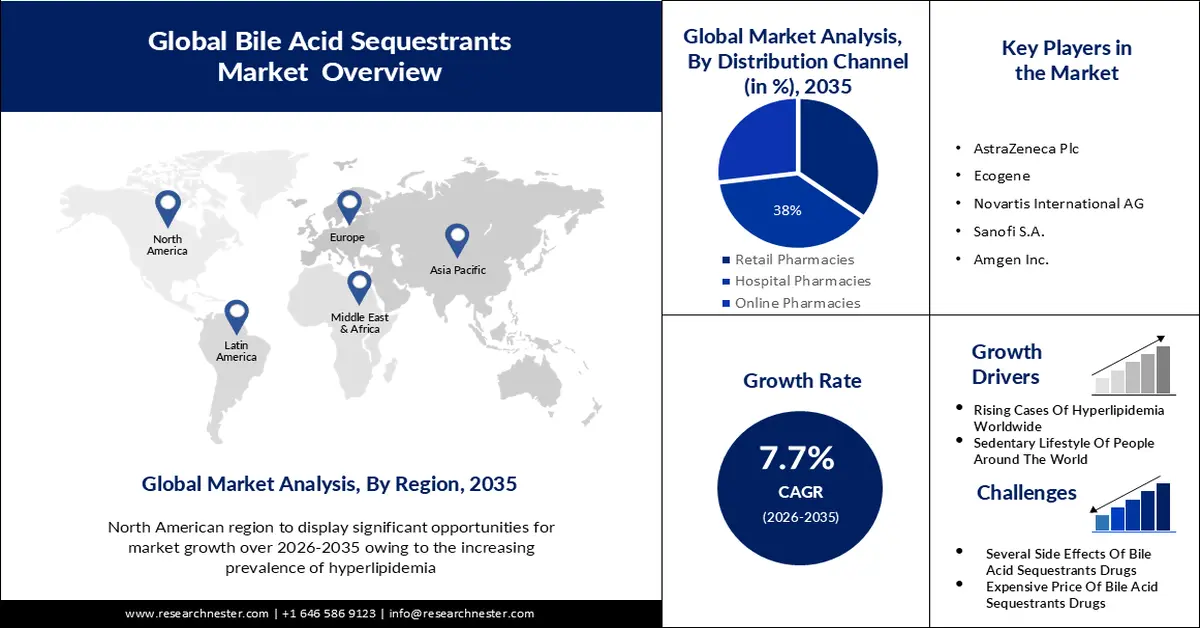

Bile Acid Sequestrants Market size was valued at USD 21.8 billion in 2025 and is set to exceed USD 45.77 billion by 2035, registering over 7.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bile acid sequestrants is estimated at USD 23.31 billion.

The increasing frequency of hyperlipidemia worldwide will drive the market in the anticipated period. Between 2017 and 2020, 10% of adults age 20 or older worldwide had entire hyperlipidemia cases above 240 mg/dL and about 17% had high-density lipoprotein (HDL, or “good”) cholesterol levels below 40 mg/dL. The entire frequency of hyperlipidemia was 33.8%, with the following risk values: triglyceride (TG), 12.8%; hypercholesterolemia, 16.1%; high-density lipoprotein cholesterol (cHDL), 15.0%; and low-density lipoprotein cholesterol (cLDL), 42.2%.

Another factor that is set to increase the revenue rate of the bile acid sequestrants market further is the continuous research and development in this field of bile acid sequestrants globally. For example, the Gastrointestinal Drugs Advisory Committee of the FDA on May 19, 2023, voted 12-2 that the 25-mg dose of OCA, a bile acid sequestrant does not outbalance the risks of drug-inspired liver injury notwithstanding modifications in liver damaging that were showed in the REGENERATE trial. The committee also suggested against speeding up licensing for OCA, recommending the FDA mark time to look for extra data from an ongoing phase 3 trial. Some bile acid sequestrants are also FDA-licensed for adolescents (10 to 17 years of age). Moreover, bile acid sequestrants are one of the few drugs secure for kids with allelomorphic familial hypercholesterolemia. Various research is still ongoing to understand the effect of bile acid sequestrants on other chronic diseases.

Key Bile Acid Sequestrants Market Insights Summary:

Regional Highlights:

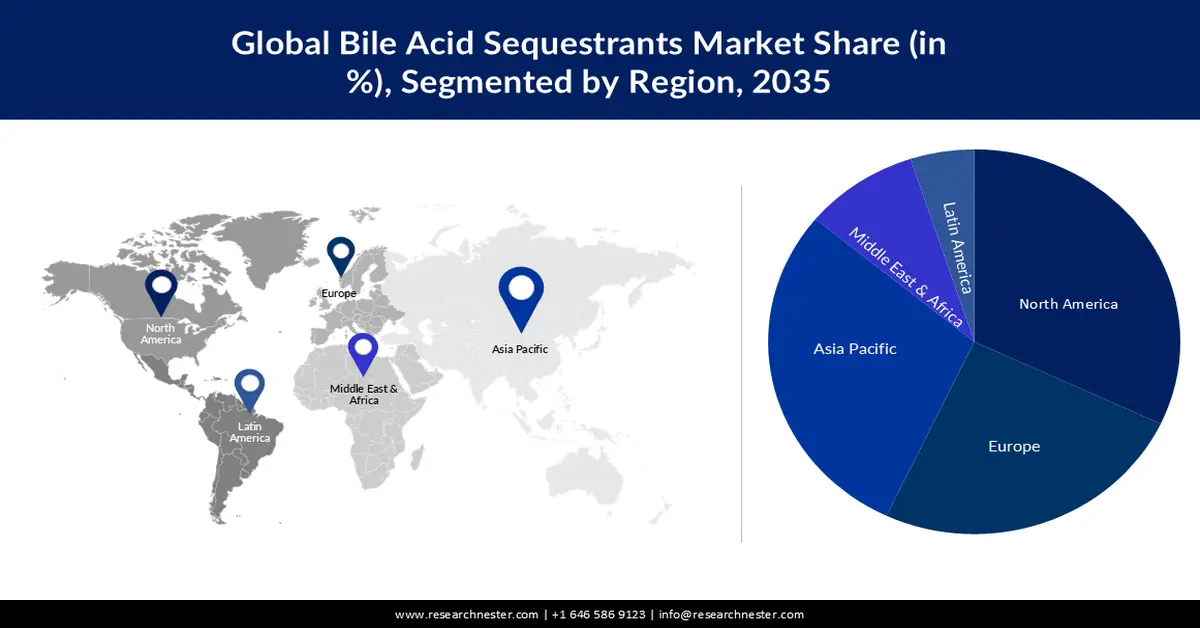

- North America is projected to secure the leading share in the bile acid sequestrants market by 2035, supported by the widespread use of cholestyramine for relieving pruritus symptoms in liver cirrhosis patients.

- Europe is anticipated to experience substantial growth through 2026–2035, underpinned by rising diabetes prevalence and heightened demand for advanced hyperlipidemia therapies.

Segment Insights:

- The colestipol segment is expected to hold a 35% share of the bile acid sequestrants market by 2035, propelled by its broad therapeutic use in lowering LDL-C and managing hypercholesterolemia.

- The hospital pharmacies segment is forecasted to capture a 38% share by 2035, reinforced by growing reliance on hospital-based dispensing for patients requiring specialized cardiovascular and hyperlipidemia treatments.

Key Growth Trends:

- Unhealthy Lifestyle, The Diet of People Around the World

- The Increasing Ratio of The Geriatric Population in The World

Major Challenges:

- The Side Effects of Bile Acid Sequestrants

- Rigorous Regulatory Atmosphere of The Industries

Key Players: Pfizer Inc., AstraZeneca Plc, Ecogene, Novartis International AG, Sanofi S.A., Amgen Inc., Merck & Co., Inc., AbbVie Inc., GlaxoSmithKline plc., Octapharma AG, Daiichi Sankyo Company, Limited, Eisai Co., Ltd., Mochida Pharmaceutical Co., Ltd., Astellas Pharma Inc.

Global Bile Acid Sequestrants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.8 billion

- 2026 Market Size: USD 23.31 billion

- Projected Market Size: USD 45.77 billion by 2035

- Growth Forecasts: 7.7%

Key Regional Dynamics:

- Largest Region: North America (Highest Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, United Arab Emirates

Last updated on : 26 November, 2025

Bile Acid Sequestrants Market - Growth Drivers and Challenges

Growth Drivers

- Unhealthy Lifestyle, The Diet of People Around the World - A sedentary lifestyle such as a diet high in saturated and trans fats, taking alcohol, smoking, and insufficiency of workouts leads to severe chronic diseases, and one of these is hyperlipidemia which further increases the demand for bile acid sequestrants. A chemical called acrolin, noticed in cigarettes, prohibits HDL from transferring cholesterol from fatty deposits to the liver, leading to the tapering of the arteries (atherosclerosis). A poor involvement in physical activity or working out is anticipated to be impacted by various factors. Some ecological factors comprise traffic congestion, air pollution, lack of parks or pedestrian walkways, and a shortage of sports or spare time facilities. Watching television, video watching, and cell phone utilization are affirmatively correlated with an acceleration of a sedentary lifestyle. Physical sluggishness is the fourth leading risk factor for international mortality, attribution for 6% of international mortality. Bile acid sequestrants help in lowering bad cholesterol and help you lead a healthy life.

- The Increasing Ratio of The Geriatric Population in The World - Globally the number of aged people and their multiple health issues are increasing. Additionally, the market profit expansion is because of the increasing number of aged people, who are weak to hyperlipidemia. By 2050, the geriatric population (those 65 and more aged), which recently stands at 524 million, is predicted by the UN to have tripled to 1.5 billion. The primary cause of mortality internationally, attributing to 31% of all casualties in 2020, is cardiovascular disease, in line with the World Health Organization. As a hitch precaution, hyperlipidemia drugs such as bile acid sequestrants are in high demand because of the increasing frequency of cardiovascular sickness.

- Safe to Use for Pediatric Prescription - The bile acid sequestrants are safe to give to children who are suffering from cholestatic liver diseases. These involved diseases like biliary atresia, Alagille syndrome, advanced intrahepatic cholestasis entities, ductal plate abnormalities comprising Caroli syndrome and inherent hepatic fibrosis, primary sclerosing cholangitis, bile acid synthesis defects, and specific metabolic disease. Agents like ursodeoxycholic acid, bile acid sequestrants, and rifampicin have been pillars of treatment for years with the comprehension that they may reduce or change the composition of the bile acid pool, though the clinical outcome to these drugs is often not enough and their influences on disease advancement stay restricted.

Challenges

- The Side Effects of Bile Acid Sequestrants - Several side effects of the bile acid sequestrants may cause a bumper in the market growth of bile acid sequestrants in the anticipated period. Since bile acid sequestrants are not preoccupied with the gastrointestinal tract, they have restricted systemic side effects. Some of the most general negative effects are gastrointestinal, involving constipation, stomach ache, bloating, vomiting, heartburn, loss of appetite, nausea, and upset stomach. Constipation is encountered by 10% of patients having colestipol and 28% of those having cholestyramine. These adverse impacts appear more generally with larger doses and older patients (older than 65 years). They can worsen peptic ulcer disease and hemorrhoids. Implementing it is chronically associated with bleeding issues in high doses, which is avoidable by implementing oral vitamin K treatment.

- Rigorous Regulatory Atmosphere of The Industries

- Shortage of investments across the world for new bile acid-sequestrants drugs.

Bile Acid Sequestrants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 21.8 billion |

|

Forecast Year Market Size (2035) |

USD 45.77 billion |

|

Regional Scope |

|

Bile Acid Sequestrants Market Segmentation:

Type Segment Analysis

The colestipol segment is anticipated to hold 35% share of the global bile acid sequestrants market by the end of 2035 and this growth will be wheeled by its extensive use in reducing bad cholesterol. Colestipol is increasingly used for the therapy of basic hypercholesterolemia. It is implemented as an adjunctive treatment to dietary improvements and exercise. Daily doses of 4 to 16 grams are related to a 12 to 24% lowering in low-density lipoprotein cholesterol (LDL-C) levels. It may also lower the risk of coronary artery disease. Colestipol is also utilized off-label to cure cholestatic pruritus and irritable bowel syndrome or bile acid diarrhea. This activity reviews the symptoms, mechanism of action, negative event profile, toxicity, dosing, pharmacodynamics, and monitoring of colestipol appropriate for interprofessional team members included in maintaining primary hypercholesterolemia and related situations.

Distribution Channel Segment Analysis

The hospital pharmacies segment in the bile acid sequestrants market is predicted to hold the highest share of 38 % by the end of 2035. The reason behind this segment’s huge growth is that when a patient has a massive heart attack and requires more specific care and therapy, hospital pharmacies are the primary source of drugs for those people. These pharmacies also often give a bigger selection of bile acid-sequestrant medications and give patients customized dose guidelines and advice, both of which can increase patient outcomes. The global population in 2023 is 8 billion. Of these, roughly 620 million people are living with heart and circulatory diseases across the planet and are appointed to hospital pharmacies. Each year around 60 million people around the globe encounter a heart or circulatory disease. Also, as the number of hospitals globally has escalated and hyperlipidemia is becoming more general, the exercise of purchasing drugs from hospital pharmacies has become more famous.

Our in-depth analysis of the global bile acid sequestrants market includes the following segments:

|

Type |

|

|

Application |

|

|

Distribution Channels |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bile Acid Sequestrants Market - Regional Analysis

North American Market Insights

The bile acid sequestrants market in the North American region to hold the highest position in the coming years due to bile acid sequestrants' high usage to treat pruritus in liver cirrhosis patients. For instance, multiple case series and randomized controlled trials (RCTs) discovered that cholestyramine is effective in substantially limiting pruritus symptoms and serum bile acids, with 75% of patients in North America reporting indication relief. cholestyramine is used for the treatment of pruritus for its activity in reducing the “pruritogens” that gather in cholestatic forms of liver disease.

European Market Insights

The bile acid sequestrants market is expected to extend substantially in Europe throughout the anticipated time frame. Some factors affecting the market growth involve the increasing prevalence of type 2 diabetes in the area. Diabetes is more common among older people: 19.3 million people 60-79 years old have diabetes across EU countries, in comparison with 11.3 million people 40-59 years old and only 1.7 million 20-39 years old. While more men than women have diabetes in middle age (between 40 and 59 years old), a higher number of women have diabetes after age 70 primarily because they live longer. Also, the region is experiencing a demand for potent drug treatments because of the region's substantial patient base of people with cardiovascular disorders, particularly hyperlipidemia. For market players in the region, technological developments in drug delivery methods and the creation of novel medications should present profitable growth prospects.

Bile Acid Sequestrants Market Players:

- Pfizer Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AstraZeneca Plc

- Ecogene

- Novartis International AG

- Sanofi S.A.

- Amgen Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- GlaxoSmithKline plc.

- Octapharma AG

Recent Developments

- Pfizer Inc. released top-line outcomes from the Phase 2b study of vupanorsen (PF-07285557), an investigational treatment being formulated for possible symptoms in cardiovascular (CV) risk reduction and severe hypertriglyceridemia (SHTG). The study showed that vupanorsen accomplished a statistically substantial limiting of non- HDL-C, triglycerides, and other lipoproteins associated with cardiovascular disease.

- The U.S. Food and Drug Administration (FDA) Center for Drug Evaluation and Research (CDER) has obtained the Biologics License Application (BLA) for nirsevimab for the prohibition of respiratory syncytial virus (RSV) lower respiratory tract disease in toddlers and infants coming or during their first RSV season and for kids up to 24 months of age who stay exposed to acute RSV disease through their second RSV season.

- Report ID: 5452

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bile Acid Sequestrants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.