BOPP Films Market Outlook:

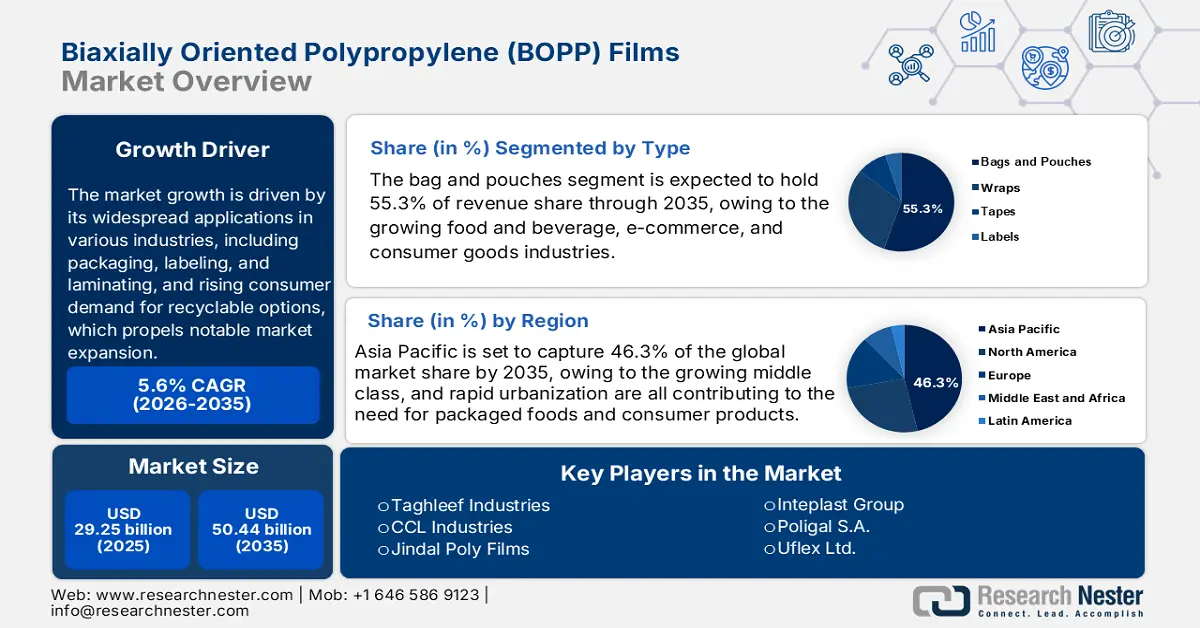

BOPP Films Market size was over USD 29.25 billion in 2025 and is anticipated to cross USD 50.44 billion by 2035, witnessing more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of BOPP films is estimated at USD 30.72 billion.

The biaxially oriented polypropylene (BOPP) films market growth is driven by its widespread applications in various industries, including packaging, labeling, and laminating, which propels notable market expansion. Due to its exceptional tensile strength, great clarity, and superior barrier qualities, biaxially oriented polypropylene (BOPP) films are favored for use in consumer goods, industrial, and food packaging. Improvements in manufacturing technology are aiding the BOPP films market by enhancing the quality and functionality of products. The use of BOPP films is also increasing, fueled by rising consumer demand for recyclable and sustainable packaging options, due to their environmental friendliness and ability to be recycled repeatedly without losing key characteristics.

Metalized electrical-grade BOPP films for capacitor applications, especially for AC and DC capacitors, are provided by Cosmo Films, a division of Cosmo First Limited. Electronics, industrial, power electronics, automotive, and renewable energy systems are just a few of the electronic components that use these films. These films, which have thicknesses ranging from 2.5 to 12 microns, are manufactured by Cosmo Films using clean room conditions and micro-slitting capabilities.

BOPP films' adaptability and versatility have made them an essential component of the packaging industry. These films are widely utilized in a variety of packaging types, such as laminates, pouches, and wraps, and they give a wide range of items the presentation and protection they require. Their exceptional barrier qualities and high clarity make them perfect for food packaging, guaranteeing that the contents stay fresh and enticing to customers. Furthermore, businesses aiming to lessen their environmental impact choose BOPP Films due to its recyclability, which satisfies the growing demand for sustainable packaging solutions.

Key Biaxially Oriented Polypropylene (BOPP) Films Market Insights Summary:

Regional Highlights:

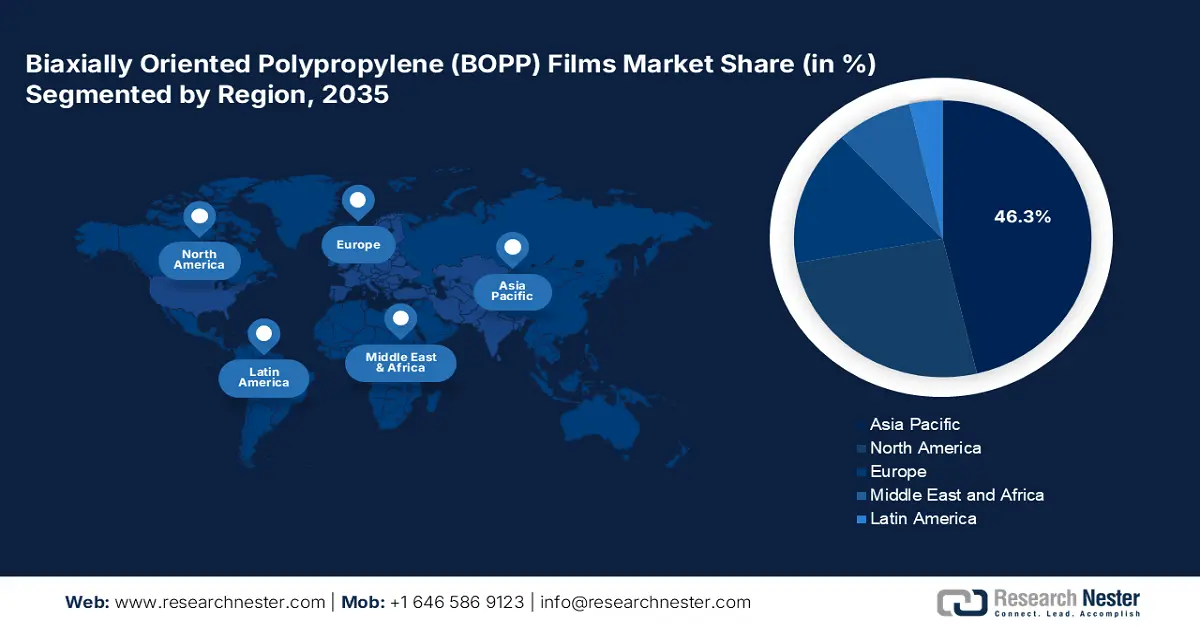

- Asia Pacific BOPP films market will dominate over 46.30% share by 2035, driven by rising disposable income and thriving e-commerce sector.

Segment Insights:

- The bags and pouches segment in the bopp films market is expected to capture a 55.3% share by 2035, driven by high demand in food and consumer goods packaging due to durability and barrier qualities.

- The 15–30 microns segment in the bopp films market is anticipated to hold a significant share by 2035, driven by a strong balance between strength and flexibility for applications like personal care and food packaging.

Key Growth Trends:

- Growing usage in the personal care and cosmetics industry

- Technological innovation in the BOPP

Major Challenges:

- Competition from alternative materials

- Environmental concerns

Key Players: Jindal Poly Films, Sibur Holdings, Zhejiang Kinlead Innovative Materials, Inteplast Group, Poligal S.A., Uflex Ltd., Polinas, Polibak, Gulf Packaging Industries Co., and Oben Group.

Global Biaxially Oriented Polypropylene (BOPP) Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.25 billion

- 2026 Market Size: USD 30.72 billion

- Projected Market Size: USD 50.44 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Mexico

Last updated on : 8 September, 2025

BOPP Films Market Growth Drivers and Challenges:

Growth Drivers

-

Growing usage in the personal care and cosmetics industry: One of the main factors contributing to the BOPP films market expansion is the expanding personal care and cosmetics industry. Growth was concentrated on the personal care industry, which includes skincare, haircare, and cosmetics, since consumers are now prioritizing grooming, wellness, and beauty. BOPP films are utilized extensively in this biaxially oriented polypropylene (BOPP) films market because of their excellent protection, freshness, and appealing appearance when printed with high-grade quality. These films offer improved clarity and ensure that branding and product details are shown enticingly.

In addition, they are long-lasting and moisture-resistant, making them ideal for sealing and wrapping cosmetics, which typically require tamper-proof and airtight packaging. The Ministry of Commerce and Industry of the Indian government projects that the country's cosmetics and personal care sector would expand rapidly, reaching a market value of over USD 20 billion by 2025. Urbanization, shifting consumer preferences, and growing disposable incomes are the main drivers of this expansion. This growing BOPP films market is expected to be accompanied by an increase in the need for packaging materials, such as BOPP films, in this industry. - Technological innovation in the BOPP: BOPP film's technological advancements are expanding its uses and improving functionality. Under stringent food safety regulations, high-barrier coatings (such as metallized or transparent oxide layers) improve resistance to oxygen, moisture, and UV light. Improvements in surface treatment give inks and adhesives more adherence, which is necessary for superior labeling and lamination. To reduce material consumption without compromising performance, thinner yet more durable films are being developed.

These developments benefit specialized sectors where accuracy and safety are crucial, like electronics and pharmaceuticals. In March 2024, TOPPAN, a leading global provider of printing and packaging solutions, announced that GL-SP, an award-winning barrier film for environmentally friendly packaging, is being developed and will soon be introduced in India. In collaboration with TOPPAN Specialty Films (TSF) of India, the novel product uses biaxially oriented polypropylene (BOPP) as its film material.

Challenges

- Competition from alternative materials: Biodegradable films and flexible packaging are two alternatives to biaxially oriented polypropylene (BOPP) films that compete with them. BOPP films must adjust and develop to preserve their BOPP films market share in the face of these changing tastes, as sustainability and adaptability become more important considerations when choosing packaging.

- Environmental concerns: Growing environmental laws about plastics and packaging materials may present difficulties for producers of biaxially oriented polypropylene (BOPP) films. The operations and strategy of the sector will be impacted by the need to invest in environmentally friendly production methods and materials in order to comply with these rules.

BOPP Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 29.25 billion |

|

Forecast Year Market Size (2035) |

USD 50.44 billion |

|

Regional Scope |

|

BOPP Films Market Segmentation:

Type Segment Analysis

The bags and pouches segment is projected to gain a 55.3% share through 2035. Bags and pouches have a significant BOPP films market share since they are widely used in food and consumer goods packaging. They provide outstanding printability, durability, and barrier qualities, all of which are critical for preserving product freshness and increasing shelf life. As consumers look for dependable and easy packaging options, the demand for flexible packaging solutions is fueling this segment's expansion.

Due to BOPP film's superior barrier qualities, longevity, and visual attractiveness, the region's growing food and beverage, e-commerce, and consumer goods industries are the main drivers of this expansion. As consumer awareness of packaging sustainability and quality has increased, Middle Eastern BOPP film companies are well-positioned for major expansion in response to these shifting BOPP films market expectations.

Wraps, another important market, benefit from BOPP films' robustness and clarity. Wraps are perfect for packaging a wide range of products, from industrial supplies to food items, because of these qualities, which provide product protection and shelf appeal. The demand for wraps is further increased by consumers' growing preference for convenience and ready-to-eat items. Labels and tapes are also very important in the market for BOPP films. Labels are in high demand because of their better printability and visual properties, which are crucial for branding and promotional activities, while tapes constructed from BOPP films are preferred for their strength and durability as adhesives.

Thickness Segment Analysis

The 15-30 microns segment is poised to grow at a significant BOPP films market share by 2035. With a significant market share, this segment provides a balance between strength and flexibility. These films' exceptional barrier qualities and longevity make them useful for a wide range of applications, including personal care items and food and beverage packaging. The 30–45 micron range is especially well-suited for more demanding uses, such as heavy-duty wraps and industrial packaging, where improved mechanical qualities and protection are necessary. This thinner version serves applications such as food packaging, where flexibility and material efficiency are critical factors. The BOPP films market is driven by the reduced environmental impact and lower production costs that result from using less material.

Films thicker than 45 microns are utilized in specific situations where the highest level of protection and durability is needed. These thicker films offer sturdy packaging options and are perfect for applications involving large or heavy objects. Lightweight objects are usually packaged with films smaller than 15 microns, which offer adequate protection without significantly increasing weight. This biaxially oriented polypropylene (BOPP) films market is prominent in the food packaging sector, where it's critical to use as little material as possible without sacrificing quality.

Our in-depth analysis of the global biaxially oriented polypropylene films market includes the following segments:

|

Type |

|

|

Thickness |

|

|

Production Process |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

BOPP Films Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific is expected to lead the BOPP films market with a share of 46.3% during the forecast period. Rising disposable incomes, the growing middle class, and rapid urbanization are all contributing to the need for packaged foods and consumer products, which in turn is driving up demand for BOPP films. The BOPP films market is expanding due in large part to the region's thriving e-commerce sector, which calls for effective and long-lasting packaging solutions. Furthermore, Asia Pacific is becoming a center for BOPP film production due to the construction of sophisticated manufacturing facilities and the availability of inexpensive labor, drawing investments from international companies.

In India, the increased need for flexible and affordable packaging options is driving the nation's biaxially oriented polypropylene films market expansion. Furthermore, the maker of BOPP films has made significant investments to increase manufacturing capacity, which has contributed to the market's growth. A new BOPP plant in Nashik, Maharashtra, would increase capacity, according to JPFL Films Private Limited, a division of the massive flexible packaging company Jindal Poly Films Ltd. The new line will require a capital expenditure of USD 3,498.55 billion and is anticipated to be put into service in H2 FY 25–26. The expansion follows a 142% increase in EBITDA in the first quarter of FY'25, which was supported by excellent top-line growth. It also aims to preserve its market leadership in the face of business difficulties.

On the other side, in China, the established packaging sector and a strong focus on high-performance and sustainable packaging materials are driving the BOPP market's consistent expansion. The food and beverage and pharmaceutical industries, where BOPP films are essential to preserving product safety and prolonging shelf life, are the key drivers of demand. The use of BOPP films is further encouraged by the regulatory environment, which is moving toward recyclable and environmentally friendly packaging options.

It is anticipated that the industry in this area would keep growing, albeit slowly, due to advancements and the growing popularity of smart and customized packaging. At least five more BOPP film/sheet converters are expected to enter the Chinese biaxially oriented polypropylene films market in the first quarter of 2024, bringing the total number of completed goods to 265,000 tons annually. Currently, China produces an estimated 7.305 million tons of BOPP film and sheet annually. These startups typically signify increased demand for raw materials, in this case, BOPP and homo-PP yarn.

North America Market Insights

The North America BOPP films market due to high-performance barrier films are required to safeguard delicate items due to strict regulatory requirements, which is driving the market's expansion in pharmaceutical packaging. Continuous technological developments, such as metallization and co-extrusion, are also enhancing the functionality of BOPP films and increasing their marketability. Furthermore, the industry's increasing emphasis on mono-material packaging and recyclability is driving manufacturers to create environmentally friendly BOPP films that satisfy industry standards. Furthermore, the growing trend of premiumization in consumer products packaging is increasing demand for BOPP films with high clarity and aesthetic appeal, hence strengthening their position in improving product aesthetics and competitiveness in the market.

In the U.S., the existence numerous BOPP producers who are making significant research and development investments to enhance the qualities of BOPP films. BOPP films are in a favorable position because of the region's strict environmental laws and dedication to lowering carbon footprints, which has increased demand for recyclable materials. The demand from the pharmaceutical, personal care, and food and beverage sectors are driving the market. Additionally, developments in film technology and the creation of specialty films for particular uses support market expansion.

In Canada, the government's significant emphasis on environmentally friendly packaging options and the quick development of technology are driving the country's market expansion. Because BOPP films can be used in a variety of life situations, their demand has also grown. This film is thought to be the greatest option for food packaging because it is made of non-toxic basic materials. The plastic sheet adheres precisely to the paper's surface when the heat melts the adhesive and applies pressure. Numerous packaging machines are compatible with BOPP thermal laminating film. It is the best option for prints and photographs. The printed region is shielded by the thin, translucent layer without becoming overly noticeable. Kingchuan Packaging offers matte, textured, metallic, gloss, metallic, PVC, acrylic, and silk laminates.

BOPP Films Market Players:

- Taghleef Industries

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CCL Industries

- Jindal Poly Films

- Sibur Holdings

- Zhejiang Kinlead Innovative Materials

- Inteplast Group

- Poligal S.A.

- Uflex Ltd.

- Polinas

- Polibak

- Gulf Packaging Industries Co.

- Oben Group

Leading businesses in the biaxially oriented polypropylene films market are constantly conducting research and development to stay ahead of the competition and launch new products. Most of the major firms are developing new production facilities domestically and abroad to increase their geographic footprint strategically. To attain sustainable growth in the BOPP films market, long-term strategies include investment, production, expansion, distribution agreements, collaborations, new establishments, mergers, and acquisitions.

Recent Developments

- In May 2024, the 'B-UUB-M' Outstanding Barrier Metallized BOPP Film, introduced by Uflex Limited, is used to package chocolates, other confections, chips, nibbles, biscuits, cookies, and dried fruits. Its moisture barrier (<0.05 gm/m2/day) and oxygen transmission rate (<0.1cc/m2/day) ensure its long-term freshness and quality preservation. To seal the migration and scent, it also provides a barrier. Its capacity to substitute aluminum foil, strong metal adhesion, and chlorine-free PVDC-coated film further establishes it as a flexible and environmentally friendly option. High-speed processing is also supported by the material, increasing production efficiency.

- In March 2022, Innovia Films introduced a new line of eco-friendly label and packaging films in Germany. Prominent material science pioneer InnoviaFilms, which manufactures polyolefin film materials for labeling and packaging, has extended its product line to include floatable polyolefin shrink film. According to the company, the 8.80-meter-wide line can produce multilayer BOPP films in thicknesses between 15 and 50 µm and with a recycled content. 35,000 t/y was the plant's capacity, according to Brückner Maschinenbau.

- Report ID: 2895

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biaxially Oriented Polypropylene (BOPP) Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.