Beryllium Market Outlook:

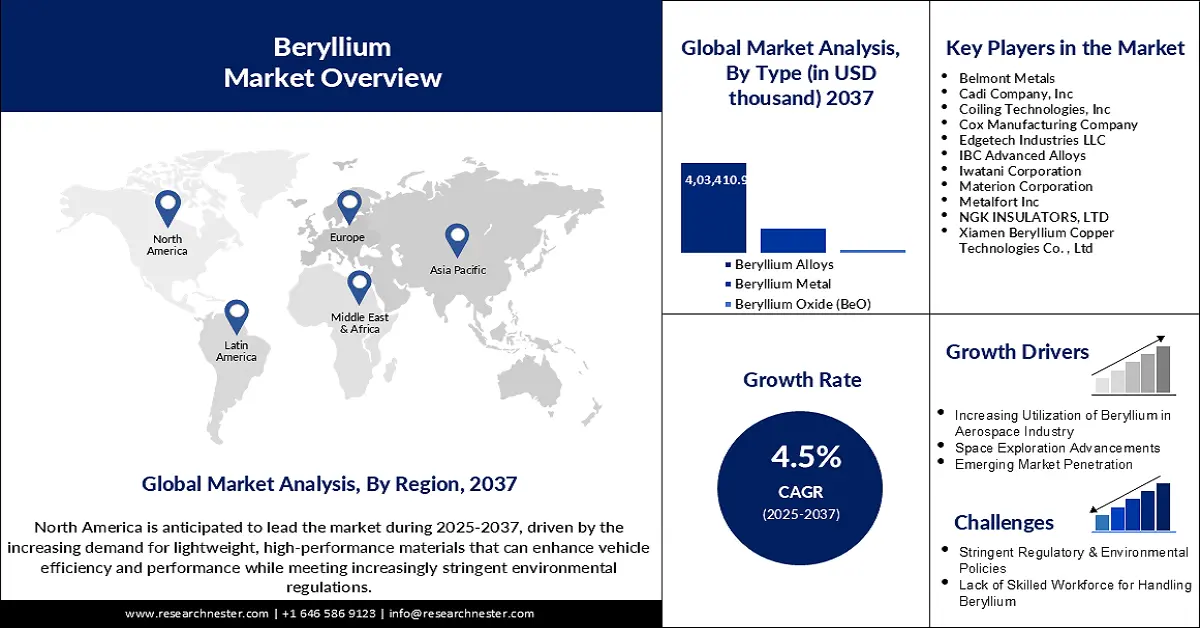

Beryllium Market size was valued at USD 226,228.8 thousand in 2024 and is projected to reach a valuation of USD 403,410.9 thousand by the end of 2037, rising at a CAGR of 4.5% during the forecast period, i.e., 2025-2037. In 2025, the industry size of beryllium is assessed at USD 235,860.4 thousand.

The global beryllium market is anticipated to expand as industries demand lightweight, high-strength material for defense electronics and energy applications. Aerospace and semiconductor industries are still considered the key growth markets due to the unique properties of beryllium, including its high thermal stability and conductivity. The rising interest in semiconductors and electronics, as well as the improvement of manufacturing technology in Japan, has also contributed to the demand for beryllium. As stated by the World Economic Forum in 2023, Japan government’s plan to spend about USD 13 million to increase the production of semiconductors locally increases the demand for beryllium in the country. The global market is adapting to electrification and miniaturization by making R&D investments in new alloys and guaranteeing the supply chains.

The growing need for clean energy and advanced power generation technologies is another factor that is expected to increase the demand for beryllium. Beryllium is an important neutron moderator, and this has made it incorporated in the current and future designs of nuclear reactors. In February 2024, Beryllium Limited introduced IkonSpot which incorporated HR technology platforms from Microbridge and Ikonworks, an example of how beryllium companies are expanding their portfolios while remaining on target on key business applications. Energy, innovation, and advanced materials remain key drivers of beryllium’s future developments.

Beryllium Market - Growth Drivers and Challenges

Growth Drivers

- Expanding aerospace & defense applications: The high strength to weight ratio and heat resisting capacity of beryllium makes it ideal for aerospace applications, satellite and missile components. In July 2023, IBC Advanced Alloys received a large order from a U.S. defense firm to meet the increasing demand for beryllium-aluminum alloy in some critical military applications. Global political instability and the further development of military technologies require increasing the use of lightweight, high-strength metals. Beryllium has unique structural benefits primarily in inertial guidance and surveillance equipment that are strategic components of next generation air and space systems internationally.

- Rising semiconductor and electronics production: The development of semiconductors because of AI, IoT, and 5G is making the demand for beryllia since it provides good thermal conductivity and fine tolerance limits. The Semiconductor Industry Association forecast that global semiconductor sales were USD 166.0 billion in Q3 2024, which is 23.2% higher YoY. Beryllium is used in alloys and ceramics for making connectors, heat sinks, and X-ray windows. The increased use of beryllium in electronics arises from the miniaturization of electronic devices, heat resistance, and the use in high-frequency circuits. As countries spend money on fabs, beryllium becomes fundamental in production equipment.

- Global shift toward clean energy and nuclear expansion: The application of beryllium in nuclear energy is also on the rise, owing to the material being highly efficient as a neutron moderator and neutron shield. According to IAEA statistics in 2023, there are 413 power-generating nuclear reactors in operation globally; the nuclear power capacity is expected to grow 2.5-fold by 2050. This growth trajectory increases the consumption of beryllium in nuclear fission substantially. In addition, beryllium plays a crucial role in fusion projects such as ITER and SPARC, where it is used to coat the plasma-facing structures. The increasing trend towards the utilization of clean energy sources such as nuclear fission and nuclear fusion is creating a firm and sustainable demand for beryllium. This increased demand is due to the fact that beryllium is a vital material in the development of nuclear technologies and the move toward a low-carbon society.

Challenges

- Environmental and regulatory constraints on mining: The extraction and processing of beryllium pose significant environmental challenges due to the generation of toxic byproducts. The environmental requirements and compliance laws call for significant spending on pollution and waste treatment. These requirements can raise operating costs and act as barriers to the expansion of the mining business. Also, the environmental impacts may result in a public outcry and legal actions against the beryllium mining activities. Therefore, managing legal requirements and minimizing environmental effects are two major issues of concern for beryllium producers.

- Limited global supply and strategic dependency: The classification of beryllium as a critical mineral is based on the fact that the supply of the mineral is limited, and it is mainly found in certain areas of the world. This leads to strategic dependencies and risks of supply disruptions, geopolitical tensions, and changing price levels for minerals. The dependence on a few key producer countries may result in supply chain disruptions, which may be detrimental to industries that depend on beryllium. Also, the scarcity of beryllium may be a problem in the growth and advancement of technologies that use this material. It is important to minimize the risks and promote the sustainable development of industries to ensure a secure and diverse supply of beryllium.

Beryllium Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

4.5% |

|

Base Year Market Size (2024) |

USD 226,228.8 thousand |

|

Forecast Year Market Size (2037) |

USD 403,410.9 thousand |

|

Regional Scope |

|

Beryllium Market Segmentation:

Type Segment Analysis

The beryllium alloys segment is anticipated to contribute a 64.1% share through 2037 due to its extensive applications in aerospace, electronics, and automotive industries, among others. Beryllium-copper and beryllium-aluminum alloys possess good electrical and thermal conductivity and high strength and corrosion resistance. In February 2024, Schmelzmetall AG stated that it was extending its range of services to include additive manufacturing for its beryllium copper alloys, a key development in its innovation strategy which opens up further possibilities in aerospace, electronics, and tooling. This development allows for the creation of quick prototypes and intricate parts with high thermal and electrical conductivity. In addition, beryllium alloys are used for connectors, bushings, and heat dissipation elements in high-reliability systems.

End user Segment Analysis

The electronics & telecommunications segment is projected to hold around 35.6% market share by 2037, attributed to the increasing data center, the adoption of 5G, and generative AI. JEITA (2024) has estimated that electronics and IT production will be USD 3,990.9 billion in the global market by 2025. The properties of Beryllium to improve the reliability of connectors, heat dissipation, and signal clarity cannot be replaced in routers, servers, and satellites. With additional support from AI, AR/VR, and edge computing, beryllium remains an essential component of digital frameworks. With such technologies being developed, there are tendencies that show that there will be increased use of beryllium in electronics and telecommunications. This growth is further supported by rising investments in telecommunications infrastructure and the growth of data centers all over the world.

Our in-depth analysis of the beryllium market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beryllium Market - Regional Analysis

North America Market Insights

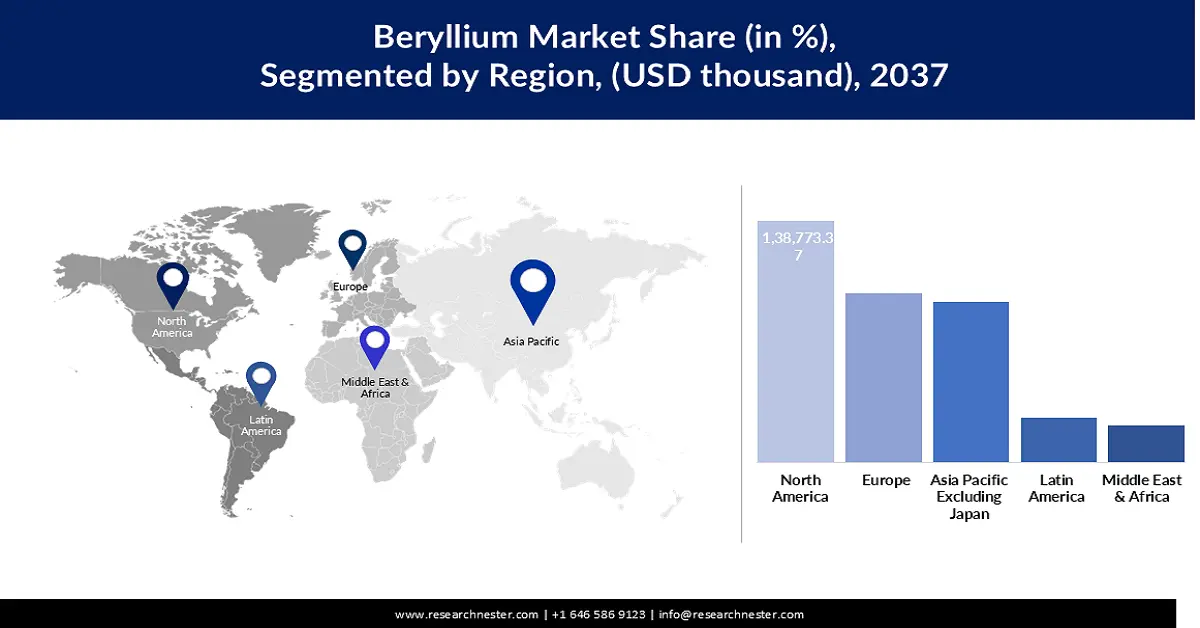

North America is expected to contribute 34.3% of the beryllium market in the forecast period due to the well-developed aerospace and defense industry, the high production of electronics, and the growth of nuclear research. The U.S. is the global leader in beryllium processing, with facilities for both commercial and defense purposes. In January 2023, Bema Capital Investments supported Beryllium InfoSec Inc. in developing cybersecurity solutions for the defense industrial base. This strategic investment demonstrates the increasing relevance of beryllium applications to national security technology. Furthermore, continuing federal investments in the development of semiconductors have a net positive effect on the demand for beryllium alloys.

The U.S. continues to play a significant role in the global beryllium market due to its defense and nuclear applications and the technology industry. As stated by the National Institute of Standards and Technology, the manufacturing sector in the U.S. contributed to USD 2.3 trillion of the GDP in 2023, further strengthening the need for high-performance metals. As federal agencies and OEMs prioritize the critical material supply chain, the U.S. is anticipated to be a core part of the beryllium value chains. Moreover, the current emphasis on local procurement and manufacture of critical materials also enhances the position of the U.S. in the beryllium market.

The beryllium market in Canada is projected to expand, owing to the increased focus on nuclear and clean technology industries, as well as the growth of advanced manufacturing regions in Ontario and Quebec. In March 2024, BWXT Nuclear Energy Canada signed an innovation collaboration agreement geared toward the development of additional nuclear energy solutions. This collaboration addresses the increasing demand for beryllium as a neutron moderator and structural material in reactors. As the government of Canada shifts policy to push the development of critical minerals and net-zero infrastructure, beryllium usage is expected to rise in accordance with the growth in clean energy installations and defense exports.

Asia Pacific Excluding Japan Market Insights

The beryllium market of Asia Pacific excluding Japan is expected to rise at a CAGR of 5.5% through 2037 owing to increasing semiconductor, electronics, and defense industries. In January 2024, Emerald Technology Ventures invested USD 4 million in India’s INDRA, which indirectly supports wastewater recycling technology, a key beryllium application in filtration and instrumentation. As China produces over 30 million vehicles by 2023 and India faces rising water scarcity, the use of beryllium for automotive and infrastructure high-durability components is critical. This is because governments in the regions have been implementing various policies to support materials innovation.

The demand for beryllium in China has been driven by automotive, electronics, and fusion energy applications. In September 2024, China laid down its vision to have a USD 25 billion semiconductor industry by 2030. These trends continue to increase the need for high-temperature and conductive beryllium alloys for chip manufacturing and testing equipment. Also, research and development projects such as the Chinese Fusion Engineering Test Reactor are opening up new applications of beryllium in the country’s energy plan. With China’s growing investment in technology and infrastructure, the consumption of beryllium is likely to increase in the future. This growth is further backed by the government’s policy on critical minerals and a move toward the production of these minerals locally rather than importation.

India beryllium market is on an upward trajectory due to defense manufacturing, renewable energy, and electronics production-linked incentive (PLI) schemes. In February 2024, TERI and Ion Exchange India Ltd. successfully implemented the TADOX wastewater treatment technology in the commercial market and demonstrated the application of beryllium in high-efficiency system parts. Over 50% of the population of India is experiencing water scarcity, and the electronics industry is on the rise, which means that there is a growing need for materials that are durable and resistant to corrosion. India has been pursuing the development of domestic defense manufacturing and the clean technology sectors, pointing to the long-term demand for beryllium in crucial structures.

Key Beryllium Market Players:

- Belmont Metals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cadi Company, Inc

- Coiling Technologies, Inc

- Cox Manufacturing Company

- Edgetech Industries LLC

- IBC Advanced Alloys

- Iwatani Corporation

- Materion Corporation

- Metalfort Inc

- NGK INSULATORS, LTD

- Xiamen Beryllium Copper Technologies Co., Ltd

The beryllium market is relatively concentrated and is dominated by a few players who compete based on new alloys, supply chain management, and military-grade accreditation. Some of the prominent players in the beryllium copper market are Materion Corporation, IBC Advanced Alloys, Belmont Metals, NGK Insulators Ltd., and Xiamen Beryllium Copper Technologies Co., Ltd. These companies sell various products to the aerospace, medical, and semiconductor industries globally. The market also has smaller players, such as Edgetech Industries LLC and Cadi Company Inc., that deal in beryllium copper rods, plates, and special parts.

In October 2023, Materion signed a USD 5 million contract with the U.S. Air Force Research Laboratory for the advancement of additive manufacturing of beryllium alloys. This project’s goal is to reduce lead times for critical components such that aerospace systems can incorporate high strength-to-weight ratio materials with higher thermal conductivity than aluminum. The development also serves the purpose of defense modernization and the new direction of sourcing critical minerals domestically. It also strengthens the position of 3D printing as a factor that defines beryllium in terms of cost and scalability in advanced industries.

Here are some leading companies in the beryllium market:

Recent Developments

- In March 2025, Rockland Resources Ltd. acquired the Claybank Beryllium Project in Juab County, Utah, located approximately five kilometers northeast of the Spor Mountain Beryllium Mine, the world's largest beryllium producer operated by Materion Corp. This strategic acquisition enhances Rockland's position in the beryllium sector and aligns with its goal to become a significant player in the global beryllium market.

- In August 2024, Materion Corporation secured a USD 5 million contract from the U.S. Air Force Research Laboratory to advance additive manufacturing techniques for beryllium and aluminum-beryllium alloys. The two-year project focuses on developing processes for multiple deposition technologies, aiming to enhance the production of complex components for aerospace and defense applications.

- In August 2024, CORE Industrial Partners' portfolio company, PrecisionX Group, acquired Ditron, Inc., a New York-based provider of micro precision stamping solutions. This acquisition strategically expands PrecisionX's capabilities to include high-speed, high-volume micro and micro-miniature stamping, strengthening its position in the precision manufacturing sector.

- Report ID: 7539

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beryllium Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert