Battery Energy Storage Market Outlook:

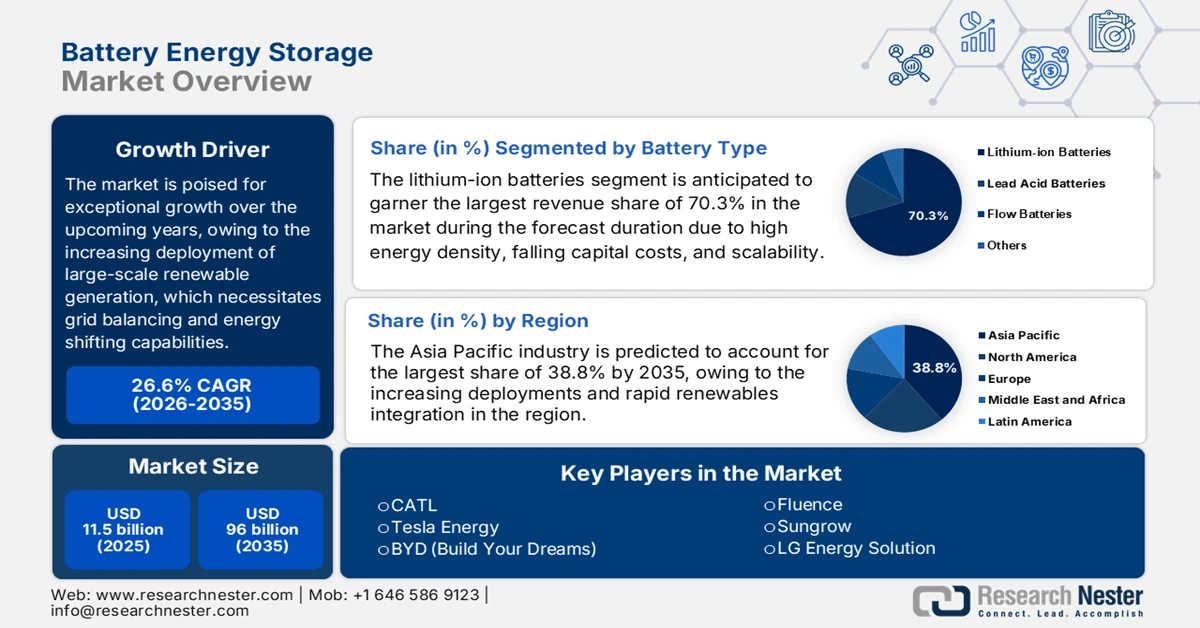

Battery Energy Storage Market size is projected to reach USD 11.5 billion in 2025 and is expected to grow to USD 96 billion by 2035, rising at a CAGR of 26.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of battery energy storage is estimated at USD 14.5 billion.

The battery energy storage market is poised for exceptional growth over the upcoming years, owing to the increasing deployment of large-scale renewable generation, which necessitates grid balancing and energy shifting capabilities. The U.S. federal planning analyses project rapid expansion of storage capacity to accommodate variable wind and solar generation, with policies channeling significant public investment and incentives toward energy storage deployment and supply chain resilience. In this context, in May 2024, the U.S. Department of Energy’s Office of Electricity announced that it has awarded USD 15 million to three projects demonstrating long-duration energy storage technologies, with each project receiving around USD 5 million in federal funding. Selected projects include hybrid lithium-ion, vanadium redox flow, and community-scale storage systems to validate cost, reliability, and field performance while integrating renewable energy sources, hence strengthening domestic manufacturing of energy storage solutions.

Furthermore, the trade aspect also drives continued growth in the market. Over the recent years until 2024, U.S. imports of lithium-ion energy storage batteries grew, which represented a rise from 17% to 84% of total battery imports, wherein China is supplying 69% of finished lithium-ion batteries and 33% of parts for non-lead-acid batteries in 2024. Moreover, the U.S. exports also increased, particularly to Mexico, where exports of non-lead-acid battery parts increased from USD 43 million in 2023 to USD 1.9 billion in 2024, reflecting growing domestic production. Meanwhile, the domestic battery manufacturing output expanded, with inflation-adjusted gross output increasing 359% in a span of five years, reaching record levels in 2024. The supply chain continues to focus growth on downstream assembly modules and packs, whereas the upstream material processing remains partially dependent on imports, though planned U.S. cell assembly investments aim to meet projected domestic demand through 2035.

U.S. Lithium-Ion Battery Manufacturing: Production, Employment, and Investment Trends (2024-2025)

|

Category |

Details |

Implication |

|

U.S. Market Price (Li-Ion Batteries) |

Approximately 90% higher than China's imports without subsidies |

Domestic subsidies & tariffs reduce cost gap → encourages local production & competitiveness |

|

Domestic Manufacturing Output |

Increased 359% (2020–2024) |

Strong growth in domestic production → opportunity for suppliers & integrators |

|

Employment |

54,400 in 2024 |

Highest ever → growing workforce supports scale-up & R&D |

|

Non-Lead-Acid Battery Shipments |

USD 16.6 billion in 2022 (up from USD 0.7 billion in 2013) |

Shift to lithium-ion → larger market share, export potential |

|

Lead-Acid Battery Shipments |

USD 2.2 billion in 2022 (down from USD 5.3 billion in 2013) |

Declining market → opportunity to reallocate resources to advanced batteries |

|

Projected Cell Assembly Capacity |

Increasing through 2035 |

Onshoring potential → meet EV and grid storage demand |

|

Component Supply Capacity (Anode, Cathode, Foil, Separators) |

Lagging behind cell assembly |

Investment gap → opportunity for component manufacturers |

|

Policy Support |

IIJA & FY2022 Reconciliation Act |

Stimulates domestic production and investment → reduces reliance on imports. |

Source: Congress.gov