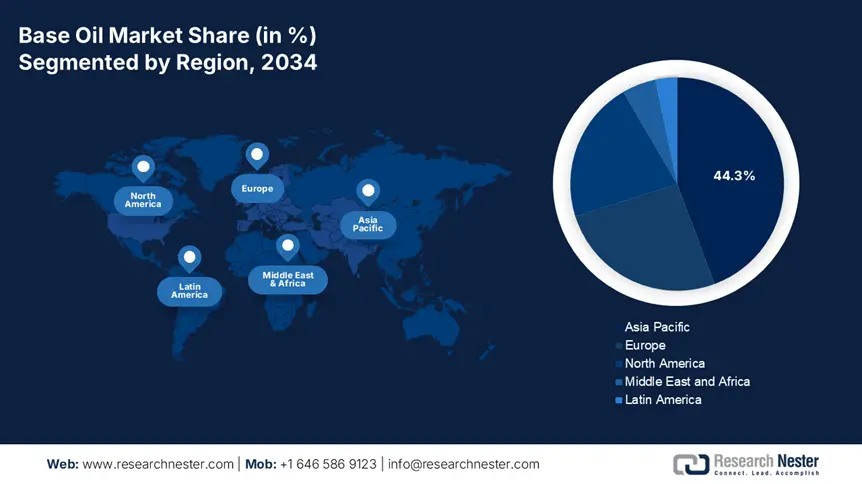

Base Oil Market - Regional Analysis

Asia Pacific Market Insights

By 2034, the Asia Pacific market is expected to hold 44.3% of the base oil market share due to the growing need for automotive, industrial, and marine lubricants. The region accounted for a major share of base oil consumption in 2023, spearheaded by China and India. Increased automobile ownership, coupled with industrial output and refinery upgrades to Group II/III, is further propelling the market. As reported by ICIS, base oil production in the Asia Pacific region exceeds twenty million tons per year, and China, South Korea, and Singapore remain major Group II and III export grade hubs.

China is now the top consumer of base oil, with over 8.6 million tons consumed yearly by 2023—more than 22% of worldwide consumption. The demand for industrial lubricants, the growth of local refining, and the rapidly growing auto sector are the primary drivers of this. China used to be a net importer but is now enhancing self-sufficiency due to new Group II/III base oil plants coming online. A good example is Sinopec and PetroChina, which currently operate several plants generating more than two million tons of Group II base oils, assisting high-end lubricant formulation.

Country-level Base Oil Market Statistics

|

Country |

Estimated Share of APAC Demand (%) |

Base Oil Production Capacity (Approx.) |

Notable Fact |

|

Japan |

~9% |

~3 million metric tons/year |

High Group III usage due to the advanced automotive industry |

|

China |

~31% |

~7+ million metric tons/year |

Largest consumer and producer in APAC |

|

India |

~16% |

~2.6 million metric tons/year |

Rapidly expanding automotive & industrial lubricant market |

|

Indonesia |

~8% |

~1.3 million metric tons/year |

Growing demand for Group II base oils |

|

Malaysia |

~6% |

~2 million metric tons/year |

Major export hub for Group III base oils |

|

Australia |

~5% |

~0.6 million metric tons/year |

Small domestic production, large imports |

|

South Korea |

~13% |

~5 million metric tons/year |

Leading Group III exporter globally |

|

Rest of Asia Pacific |

~20% |

~4 million metric tons/year (combined) |

Includes Thailand, Singapore, Vietnam — emerging markets |

Europe Market Insights

The European market is expected to hold 25.8% of the base oil market share due to the demand for automotive lubricants and industrial applications. The European Automobile Manufacturers Association (ACEA) estimates that 6.5 million metric tons of lubricants will be needed in 2023. Group II and III base oil share is being driven by rising sulfur and aromatic content standards under REACH and ECHA directives. Europe's refinery rationalization has lowered Group I capacity, thereby changing imports from Asia and the Middle East. Till 2034, the market CAGR is estimated at 2.5%.

With a market size of over 1.4 million metric tons in 2023, according to VCI, Germany is still the largest consumer of base oil in Europe. Driven by Germany's 49 million registered passenger vehicles, automotive lubricants rule demand. The electric vehicle expansion and emission reduction objectives under the Federal Environment Agency (UBA) are changing lubricant compositions. Strict OEM requirements cause rising South Korean and Middle Eastern imports of Group III base oils. Till 2034, market CAGR is estimated at 2.2%.

Country-level Base Oil Market Statistics

|

Country |

Market Size (2023, ‘000 MT) |

CAGR (2024-2034) |

Key Note |

|

UK |

711 |

2.1% |

Shift towards Group II imports due to refinery closures |

|

Germany |

1,301 |

2.2% |

Largest EU market; demand driven by the automotive sector |

|

France |

651 |

1.8% |

Increasing EV adoption is affecting lubricant consumption |

|

Italy |

591 |

2.1% |

Moderate growth; reliant on Group I and II imports |

|

Spain |

521 |

2.3% |

Rising industrial lubricant demand |

|

Russia |

1,481 |

1.6% |

Production-driven market; large Group I exporter |

|

Nordic |

311 |

1.9% |

Low volume, high premium synthetic usage |

|

Rest of Europe |

1,411 |

2.2% |

Includes Eastern Europe; rising imports from Asia |

North America Market Insights

North America market is expected to hold 21.5% of the market share due to strong automotive lubricant demand and strict environmental regulations encouraging higher-grade Group II and III base oils. Although traditional lubricants will only experience a modest decline in demand with the growth of electric vehicles (EVs), as projected by the U. S. Department of Energy (DOE), the market for specialty base oils used in transmission fluids and thermal management fluids will offset this decline. Through its clean fuel and sulfur reduction programs, the EPA incentivizes refineries to enhance their basic oil manufacturing processes to comply with more stringent regulations.