Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Bariatric Surgery Market size was valued at USD 3.1 billion in 2024 and is projected to reach USD 8.3 billion by the end of 2037, rising at a CAGR of 8.9% during the forecast period, i.e., 2025 to 2037. In 2025, the industry size of bariatric surgery is estimated at USD 3.3 billion.

The market constitutes a global patient pool that is substantial, effectively influenced by the increasing obesity rates, advancements in terms of minimally invasive techniques, and enhanced insurance coverage for weight-loss procedures. In this regard CDC estimates that over 43% of individuals in the U.S. are obese, and above 645 million people across all nations are affected by obesity as of the WHO 2023 report. Therefore, this has created a tremendous demand for surgical procedures, with nearly 250,000 bariatric procedures being performed in the U.S annually. Besides ITC 2023 report notes that the U.S. imports nearly 30% of its devices from Germany, Switzerland, and China.

Moreover, the presence of an economic front in the bariatric surgery market constitutes Producer Price Index (PPI) and Consumer Price Index (CPI) that witnessed an annual rise of 4.5% and 6.1% owing to the R&D costs and device expenses as of BLS 2024 data. Additionally, the preceding investments in the Research, Development, and Deployment also stimulate business in this sector, with the value reaching USD 1.3 billion in 2023, out of which 70% was allocated towards robotic-assisted surgical systems. Besides, the U.S. and EU are dominating in terms of research expenditure, whereas emerging nations focus on affordable surgical innovations.

Bariatric Surgery Sector: Growth Drivers and Challenges

Growth Drivers

-

Advancements in minimally invasive procedures: The bariatric surgery market is gradually increasing since there is a strong impact of advancements in terms of minimally invasive procedures. In this regard, the U.S. FDA notes that robotic-assisted procedures currently account for 23% of all surgeries, significantly diminishing complications by 20% when compared to traditional procedures. Besides, Intuitive Surgical’s hallmark product, called the da Vinci system, witnessed a 32% increase in bariatric use since 2023, reflecting an expanded adoption, thus readily amplifying market growth.

-

Emergence of post-operative care: The components of pharmaceutical innovation and post-operative care are effectively revolutionizing growth in the bariatric surgery market. In this context, it is reported that Novo Nordisk’s Wegovy (semaglutide) aids in the post-surgery weight gain by 55% in clinical trials, leading to USD 1.9 billion in 2023 sales. Besides, in 2024, Eli Lilly announced that its Zepbound received U.S. FDA approval for bariatric patients, capturing a significant market share.

Historical Patient Growth (2010-2020) and Its Impact on Bariatric Surgery Market Expansion

The bariatric surgery market is witnessing operational alterations, highly fueled by enhanced treatment procedures and expanded patient base. There has been a transformational growth over the last decade owing to the rising obesity rates, improved safety, and the presence of insurance coverage. Between 2010 to 2020, the patients undergoing this surgery doubled in the key developed markets. Simultaneously, in emerging nations, there is accelerated adoption due to medical tourism and affordable interventions. Therefore, the expanded patient pool resulted in improved investments in this sector.

Historical Patient Growth (2010-2020) – Key Markets

|

Country |

2010 Patients (000s) |

2020 Patients (000s) |

CAGR |

|

U.S. |

184 |

278 |

4.6% |

|

Germany |

14 |

30 |

8.9% |

|

France |

10 |

20 |

9.2% |

|

Spain |

7 |

16 |

11.0% |

|

Australia |

8 |

17 |

10.6% |

|

Japan |

1.4 |

4.7 |

14.3% |

|

India |

1.0 |

6.4 |

22.9% |

|

China |

2.6 |

18.2 |

22.1% |

Feasible Expansion Models Shaping the Future of Bariatric Surgery Markets

There is a huge opportunity for the bariatric surgery market since the emerging nations are continuously implementing partnership strategies to combat pricing issues and leverage robotic surgeries. For instance, an NIH study in 2024 unveiled that in India, collaborations between Medtronic and Apollo Hospitals increased robotic bariatric procedures by 43% from 2022 to 2024, reflecting a widespread adoption. Meanwhile, in China disposable stapler market grew by 26% owing to the tiered pricing introduced by Johnson and Johnson. Therefore, the presence of all of these models is highly responsible for market upliftment during the forecast timeline.

Feasibility Models for Market Expansion (2024-2030)

|

Strategy |

Region |

Revenue Impact (2024) |

Projected Growth |

Key Driver |

|

Robotic Surgery Partnerships |

Germany |

€185 million |

€425 million (+135%) |

EU MedTech grants |

|

Low-Cost Disposable Staplers |

India |

$130.4 million |

$410 million (+235%) |

Local manufacturing |

|

AS-Centric Reimbursement |

U.S. |

$1.2 billion |

$2.5 billion (+120%) |

Medicare policy shifts |

|

Medical Tourism Bundles |

Mexico |

$90 million |

$225 million (+160%) |

Cross-border insurance |

Challenges

-

Price controls imposed by governments: The existence of this aspect poses a significant hurdle in the bariatric surgery market, which makes it challenging for the firms to leverage this. In this regard, it is reported that in Europe, the price caps imposed on bariatric devices diminish the profit margins by 25% to 55%. However, to combat this, Johnson & Johnson combined staplers with training programs, gaining 12% of the market share in Spain. Further, it is noted that without imposed price caps, manufacturers secured 4% to 7% of annual revenue in the EU.

-

Limited coverage: Despite the presence of well-established reimbursement policies, the bariatric surgery market faces issues in terms of limited medical coverage. As stated in the CMS 2024 report, only 16 state Medicaid Programs cover bariatric surgeries, reflecting the disparities in terms of coverage. Whereas states such as Mississippi, which have the highest obesity rates, deny coverage, citing budget restraints. This coverage hurdle can leave over 3 million individuals in the U.S. untreated, making it a challenging proposition.

Bariatric Surgery Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.9% |

|

Base Year Market Size (2024) |

USD 3.1 billion |

|

Forecast Year Market Size (2037) |

USD 8.3 billion |

|

Regional Scope |

|

Bariatric Surgery Segmentation

Procedure Type (Sleeve Gastrectomy, Gastric Bypass, Adjustable Gastric Band, Biliopancreatic Diversion with Duodenal Switch)

Based on procedure type, the sleeve gastrectomy segment is expected to garner the highest share of 48.2% in the bariatric surgery market by the end of 2037. The dominance of the segment is facilitated by its low complication rates, 5.8% when compared to gastric bypass, which is 9.8%. Besides, the U.S. FDA approved robotic-assisted sleeves in 2023 that significantly boosted adoption by 26%. Furthermore, CMS states that Medicare covers over 88% of sleeve procedures, thus providing an optimistic outlook for the segment’s dominance.

End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics)

Based on end user, the ambulatory surgical centers segment is anticipated to grow at a considerable rate, with a share of 42.5% in the bariatric surgery market during the forecast timeline. The growth in the segment is subject to its affordability when compared to hospitals offering a 42% cost reduction. Besides the UnitedHealthcare-imposed mandates, ASCs for bariatric surgery thereby increased procedural volumes by 35%. Further, it offers a reduced recovery timeframe when compared to hospitals, hence effectively contributing to the segment’s growth.

Our in-depth analysis of the global market includes the following segments:

|

Procedure type |

|

|

Device Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

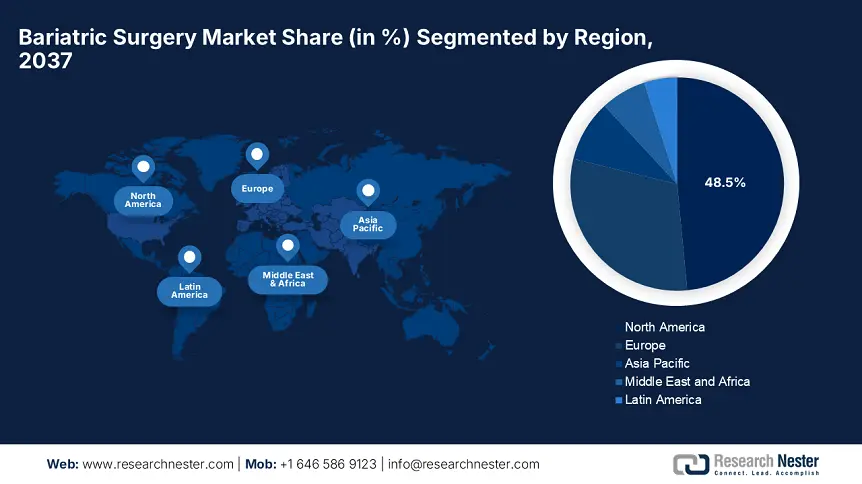

Bariatric Surgery Industry - Regional Synopsis

North America Market Analysis

North America is projected to hold the largest share of 48.5% in the bariatric surgery market during the forecast timeline. The leadership of the region is attributable to the rising obesity rates and the expanding insurance coverage. The market grows at 8.4% CAGR, driven by unique developmental approaches undertaken by the U.S. and Canada. CDC study underscores that there are 42.5% adult obesity rates, due to which the Medicare spending is expected to increase by USD 1.3 billion in 2024. Furthermore, 28 states in the region are granting coverage, hence providing an optimistic opportunity for the region’s market.

The U.S. is set to dominate the global bariatric surgery market, comprising a considerable share with a surge in chronic conditions and provision of public healthcare investments. As stated by AHRQ in 2023, robotic-assisted procedures grew by 27%, which is a 14% increase from 2020, reflecting a widespread adoption. Also, the outpatient adoption witnessed an expanded adoption in 40% of cases, further propelling growth in the country. Therefore, the combination of all of these factors significantly enables the prolific opportunity for market development.

There is a tremendous opportunity for the bariatric surgery market in Canada, driven by the enhanced procedural volumes and robust healthcare investments. Ontario extended its support with the allocation of USD 124 million in 2024 to reduce long wait periods, whereas Alberta expanded its coverage to BMI to over 30 with comorbidities. The Canada Institute for Health Information (CIHI) states that the future growth of the sector relies on provincial funding and telemedicine adoption for post-surgical care.

Asia Pacific Market Statistics

Asia Pacific’s bariatric surgery market is poised for the fastest growth, rising at a CAGR of 11.5%, owing to the robust healthcare infrastructure. Each country in the region makes a unique contribution towards the upliftment of the market, thereby positioning Asia Pacific as a critical player in the global merchandise. The growing burden of metabolic disorders, medical tourism, and regulatory support propels business in the sector. Besides the aspect of universal health coverage, and stringent BMI threshold also fosters a favorable business environment in the region.

China dominates the regional bariatric surgery market with 46.7% of the share in the Asia Pacific. The domination of the country caters to the government funding and domestic manufacturing initiatives. As stated by the National Medical Products Administration, over 500,000 bariatric procedures were performed in 2024 and are expected to double by the end of 2037 due to improved healthcare access. Further, the medical tourism contributes to a USD 1.3 billion growth in the private sector, and minimally invasive techniques now account for over 70% of surgeries, supporting market integration in the country.

The India bariatric surgery market is gaining immense exposure with expanded demand and healthcare reforms. It is reported that 1.5 million bariatric procedures were performed in 2024, which is a 300% up from the past few years, reflecting a heightened demand. On the other hand, the government funding reached USD 4.5 billion with a collective focus on tier-2 city hospitals to reduce negative outcomes. Therefore, all of these factors appreciably drive business in this sector, with medical tourism offering 30% of the revenue in the country.

Companies Dominating the Bariatric Surgery Landscape

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide bariatric surgery market is readily dominated by the organizations present in the U.S., such as Medtronic, Johnson & Johnson, and Intuitive, which have emphasized robotics and minimally invasive technologies. Besides the Europe-based firms, such as Karl Storz and B. Braun, focus on laparoscopy. Revolutionary strategies shaping the global market include the incorporation of AI and affordable disposables, coupled with partnerships in medical tourism, as opted by China and India.

Here is a list of key players operating in the bariatric surgery market:

|

Company |

Country |

Market Share (2024) |

Industry Focus |

|

Medtronic |

U.S. |

24.3% |

Surgical staplers, energy devices, and robotic-assisted bariatric systems. |

|

Johnson & Johnson (Ethicon) |

U.S. |

12.3% |

Advanced stapling, sealing devices, and minimally invasive bariatric tools. |

|

Intuitive Surgical |

U.S. |

16.2% |

Da Vinci robotic systems for precision bariatric surgeries. |

|

Stryker |

U.S. |

10.4% |

Laparoscopic instruments and advanced surgical visualization systems. |

|

Boston Scientific |

U.S. |

8.5% |

Endoscopic suturing devices and metabolic intervention technologies. |

|

Olympus Corporation |

Japan |

xx% |

Endoscopic and laparoscopic equipment for bariatric procedures. |

|

Karl Storz |

Germany |

xx% |

High-definition laparoscopy systems for bariatric surgery. |

|

B. Braun Melsungen |

Germany |

xx% |

Surgical sutures, staplers, and obesity management solutions. |

|

Smith & Nephew |

UK |

xx% |

Minimally invasive surgical tools and wound closure devices. |

|

Teleflex |

U.S. |

xx% |

Specialty surgical instruments for bariatric interventions. |

|

ConMed |

U.S. |

xx% |

Electrosurgical devices and trocars for laparoscopic bariatric surgery. |

|

Microline Surgical |

U.S. |

xx% |

Robotic and laparoscopic instruments for bariatric procedures. |

|

Applied Medical |

U.S. |

xx% |

Trocar systems and advanced energy devices for metabolic surgery. |

|

Frankenman International |

China |

xx% |

Disposable laparoscopic instruments for bariatric surgery. |

|

TransEnterix (Asensus Surgical) |

U.S. |

xx% |

AI-driven robotic platforms for precision bariatric operations. |

Below are the areas covered for each company under the top 15 global manufacturers:

Recent Developments

- In January 2024, Intuitive Surgical introduced an AI-Powered Preoperative Planning Tool called Da Vinci 5 now integrates AI-driven 3D patient anatomy mapping, optimizing surgical approaches for obesity comorbidities.

- In May 2024, Johnson & Johnson launched Ethicon Echelon 3000 Stapler, the next-gen stapler that features adaptive compression tech, reducing leaks and bleeding risks in bariatric surgeries.

- Report ID: 4115

- Published Date: Jun 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bariatric Surgery Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert