Azulene Market Outlook:

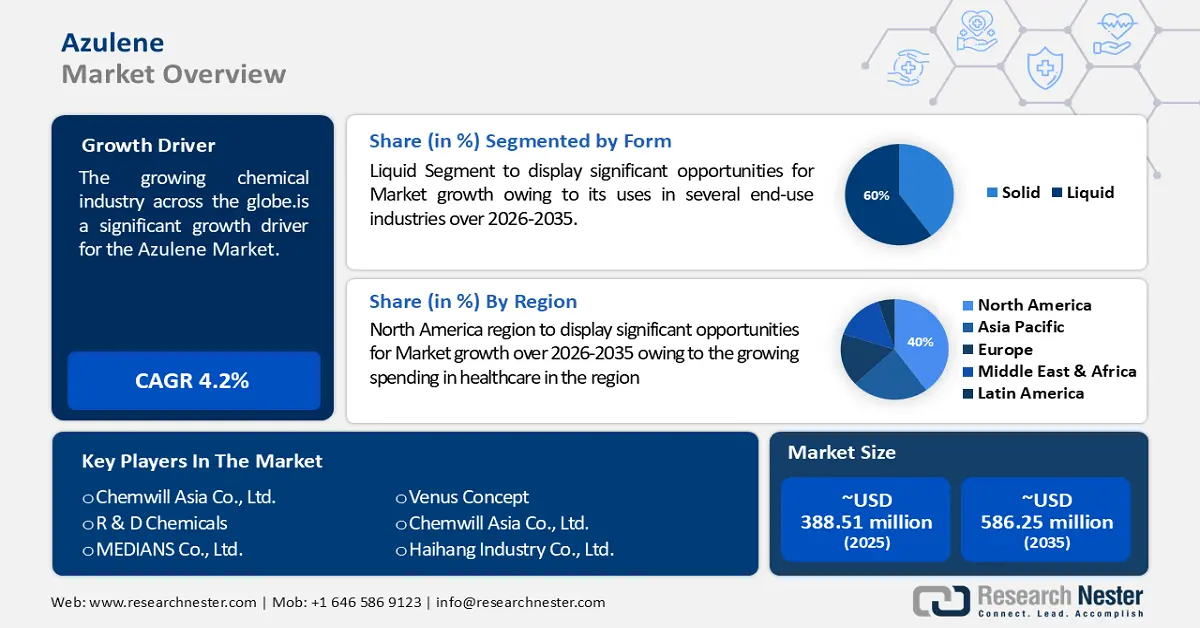

Azulene Market size was over USD 388.51 million in 2025 and is projected to reach USD 586.25 million by 2035, growing at around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of azulene is evaluated at USD 403.2 million.

The reason behind the growth is due to the growing chemical industry across the globe. The chemical industry worldwide has seen significant expansion in several areas since chemical producers are making significant global investments in research and development (R&D). For instance, the global chemical industry generated over USD 5 trillion in revenue in 2022.

The growing consumption of naphthalene is believed to fuel the azulene market growth. Azulene is an isomer of naphthalene, which is an aromatic chemical molecule that is produced from coal tar or crude oil often used in the manufacture of mothballs, repellents, and deodorizers. For instance, the average annual growth rate of the world's naphthalene consumption is predicted to be around 2% between 2020 and 25.

Key Azulene Market Insights Summary:

Regional Highlights:

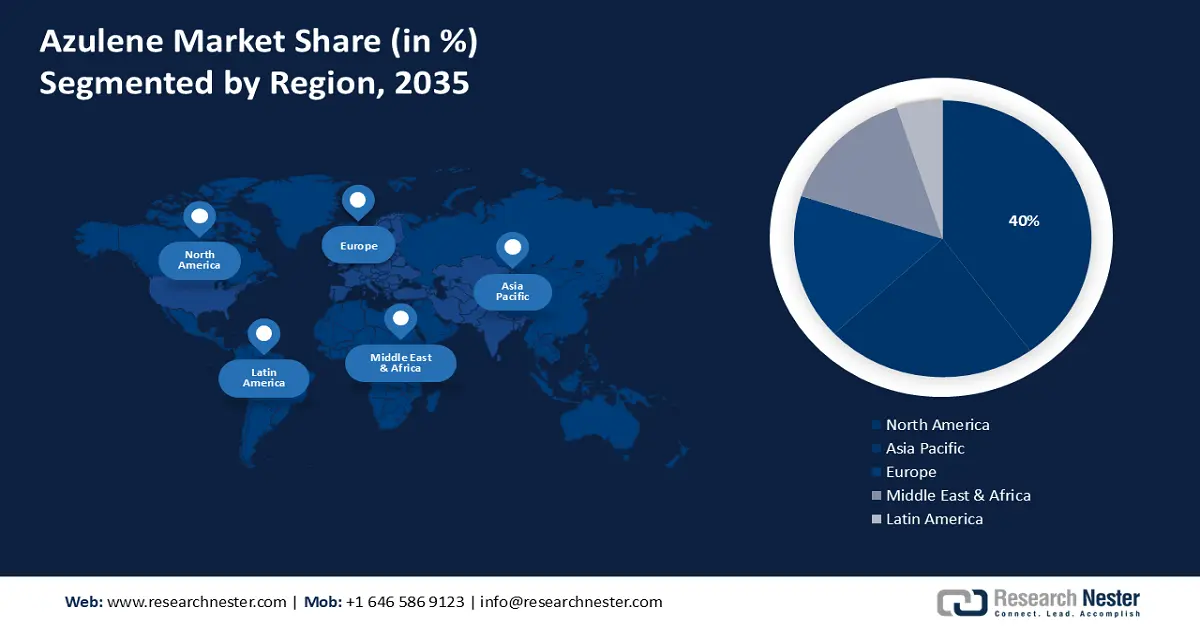

- North America is poised to hold a 40% share by 2035 in the azulene market, underpinned by rising healthcare spending and expanding demand for pharmaceutical and cosmetic products due to the growing spending in healthcare.

- The Asia Pacific region is expected to secure the second-largest share by 2035, supported by rising personal disposable incomes and increasing consumption of skincare and haircare items owing to the growing personal disposable income.

Segment Insights:

- The liquid segment in the azulene market is projected to secure a 60% share by 2035, supported by its wide-ranging medicinal applications and preference for natural product formulations owing to its uses in several end-use industries.

- The cosmetics and personal care segment is anticipated to capture a notable share by 2035, bolstered by its extensive incorporation in moisturizers, serums, and hair treatments impelled by its potent anti-inflammatory qualities.

Key Growth Trends:

- Rising Need for Organic Materials

- Growing Production of Electronics

Major Challenges:

- Lack of raw materials

- Higher production costs may limit the production of azulene

Key Players: Chemwill Asia Co., Ltd., R & D Chemicals, MEDIANS Co., Ltd., Venus Concept, Chemwill Asia Co., Ltd., Haihang Industry Co., Ltd., Guangzhou Fourto Sanitary Products Co., Ltd., HONG KONG YASHA Bio-technology Company Ltd., Mainchem Co., Ltd., Hubei Xin Bonus Chemical Co. LTD.

Global Azulene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 388.51 million

- 2026 Market Size: USD 403.2 million

- Projected Market Size: USD 586.25 million by 2035

- Growth Forecasts: 4.2%

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 28 November, 2025

Azulene Market - Growth Drivers and Challenges

Growth Drivers

- Rising Need for Organic Materials – Advanced materials with an aromatic nature, such as azulene, have shown considerable promise in the development of improved organic materials, which are employed in many sectors of human society, including food.

- Growing Production of Electronics- Azulene, a non-alternant aromatic calixarene made up of four azulene chromophores, is frequently utilized in organic optoelectronic devices' charge transfer components such as encompassing organic light-emitting diodes (OLEDs), organic field-effect transistors (OFETs), and organic photovoltaics (OPVs).

- Increasing Pharmaceutical Industry- A naturally occurring substance with an intriguing chemical structure and biological characteristics, azulene is found in Achillea millefolium, Anthemis cretica, and other organisms, which is mostly utilized in pharmaceuticals, and its derivatives can also be employed as a structural theme in medicinal chemistry to create anti-inflammatory and anti-cancer drugs.

Challenges

- Lack of raw materials – Azulene-the most significant component of known as chamomile-forms during the distillation process. is among the oldest recognized therapeutic herbs to humans the scarcity of which can make it difficult for the producers to maintain a standard price. Moreover, the cost of chamomile essential oil depends on factors including seasonal availability which may hamper the production process.

- Higher production costs may limit the production of azulene

- Regulatory hurdles owing to its usage in cosmetics and pharmaceuticals may limit its adoption

Azulene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 388.51 million |

|

Forecast Year Market Size (2035) |

USD 586.25 million |

|

Regional Scope |

|

Azulene Market Segmentation:

Form Segment Analysis

The liquid segment in the azulene market is estimated to gain a robust revenue share of 60% in the coming years owing to its uses in several end-use industries. The essential oil of chamomile is the source of liquid azulene, which has important medicinal uses, owing to its anti-inflammatory, anti-allergic, and antibacterial qualities properties which makes it useful in formulations for a range of medical issues. Moreover, it can relieve skin irritation, lower inflammation, and accelerate the healing of wounds. Besides this, customers are looking for product formulations devoid of harsh chemicals, therefore liquid azulene is in line with consumers' increasing desire for unadulterated and natural products which is often incorporated into skincare, haircare, and personal care products.

End-User Segment Analysis

The cosmetics and personal care segment in the azulene market is set to garner a notable share shortly. Numerous cosmetic items, such as soaps, cleansers, and moisturizers, contain azulene since it has potent anti-inflammatory qualities. One of the most popular components in skin care products for sensitive skin types is azulene, which is also present in hair care treatments and products, such as hair dyes, and conditioners, and also used in permanent hair straightening and permanent hair extensions. Additionally, moisturizers and skin care treatment serums, creams, and lotions include azulene since it aids in reducing the redness caused by imperfections, hastening the healing of the skin.

It has the power to minimize the signs of aging skin, and lessen the chance of fine lines and wrinkles, and can also help prevent cellular damage and is known to revitalize skin cells, which can help repair already-occurring cellular damage. It is capable of soothing skin; therefore, it is added to goods such as aftershave cream and wax oil.

Besides this, sunburn sufferers might also benefit from using azulene oil as it lessens redness, and is also applied by experts to avoid infection following skin procedures such as microneedling, laser hair removal, and other cosmetic procedures.

Our in-depth analysis of the global azulene market includes the following segments:

|

Application |

|

|

End-User |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Azulene Market - Regional Analysis

North American Market Insights

North America industry is poised to account for largest revenue share of 40% by 2035impelled by the growing spending in healthcare. This may raise the demand for pharmaceutical products such as anti-inflammatory cancer drugs which necessitate the use of azulene. For instance, the expense of healthcare is currently rising in the United States by around 1% faster than the GDP each year, and by 2028 the country is expected to spend over USD 6 trillion on healthcare. In addition, American women spend over USD 3750 per year on cosmetics and services. It has been found in a survey that each year, Americans spend more than USD 720 on skincare and cosmetics on average. This is expected to drive azulene market growth in the region.

APAC Market Insights

The Asia Pacific azulene market is estimated to the second largest, during the forecast period led by the growing personal disposable income. As a result, the demand for cosmetics, such as skincare, makeup, and hair care products, is rising, leading to a higher demand for azulene in the region. According to estimates, by 2027, India's household expenditure will surpass USD 2 trillion driven by a compound annual growth in disposable income of around 14%.

Azulene Market Players:

- Shanghai Zheyan Biotech Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chemwill Asia Co., Ltd.

- R & D Chemicals

- Calibre Chemicals,

- MEDIANS Co., Ltd.

- Venus Concept

- Sephora

- Chemwill Asia Co., Ltd.

- Haihang Industry Co., Ltd.

- Guangzhou Fourto Sanitary Products Co., Ltd.

- HONG KONG YASHA Bio-technology Company Ltd.

- Mainchem Co., Ltd.

- Hubei Xin Bonus Chemical Co. LTD

Recent Developments

- Calibre Chemicals announced the acquisition of Tina's laboratory to expand the scope of its Custom Development and Manufacturing (CDMO) Service offerings and provide customers with superior service with their experience and understanding in organic synthesis, electrochemistry, process development, and excellence in manufacturing.

- Sephora announced a partnership with Reliance Retail Ventures to use RRVL's vast retail network to sell premium brands and merchandise and increase Sephora's visibility in India through a variety of platforms.

- Report ID: 5893

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Azulene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.