Sustainable Aviation Fuel Market Outlook:

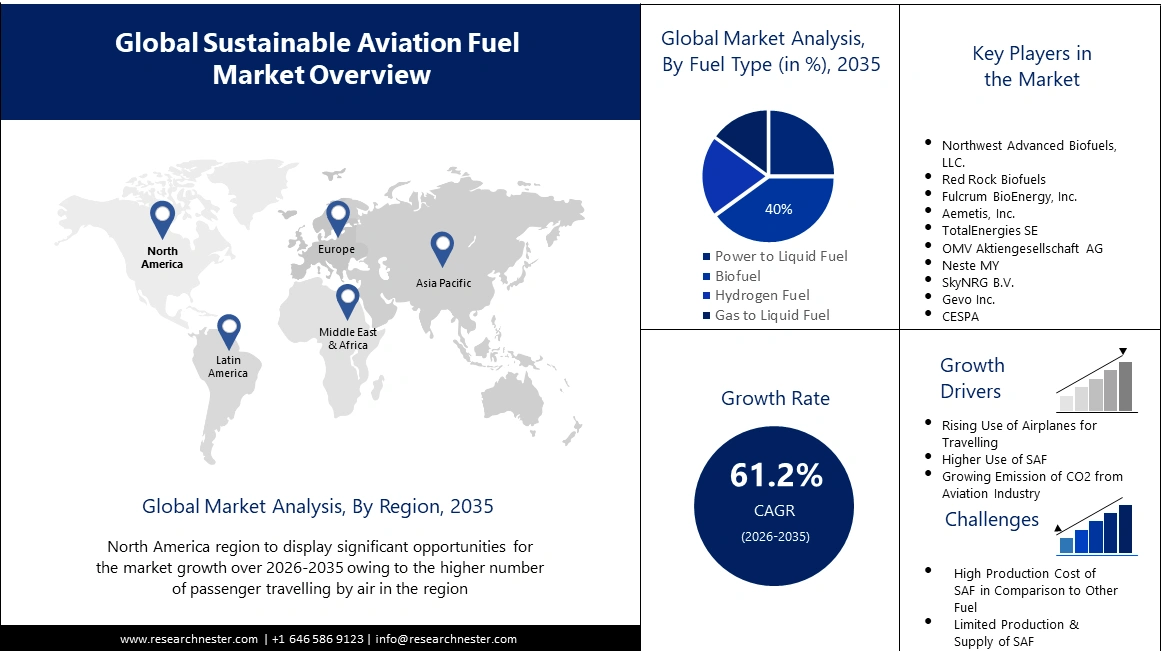

Sustainable Aviation Fuel Market size was valued at USD 1.98 billion in 2025 and is expected to reach USD 234.59 billion by 2035, registering around 61.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sustainable aviation fuel is evaluated at USD 3.07 billion.

The growth of the market can be attributed to the increased traffic in airlines. With increasing air passenger traffic, the need for reducing carbon emission has become crucial which in turn has increased the adoption of sustainable aviation fuel (SAF). In 1960, there were 100 million air passengers and by 2019, the overall yearly global passenger count had reached 4.56 billion. Moreover, according to the International Air Transport Association statistics of the Asia-Pacific airlines increased full-year foreign traffic by around 363.3% in 2022 compared to 2021, keeping the highest year-over-year growth among the regions. The capacity increased by 129.9%

In addition to these, factors that are believed to fuel the market growth of sustainable aviation fuel include the rising pollution caused by the aviation industry. Despite substantial improvements in aircraft and flight operations efficiency over the last 60 years. However, passenger air travel was responsible for the largest and fastest growth in individual emissions. According to the International Council on Clean Transportation (ICCT), commercial aviation produced 707 million tons of CO2 globally in 2013. Moreover, in 2019, that value has risen by nearly 30% in six years to 920 million tons. In addition to this, in a round-trip flight from London to San Francisco around 6 tons of CO2 equivalent (CO2e) per passenger is generated, which is more than twice the emissions produced by a family car in a year and roughly half of the average carbon footprint of a British citizen. Even a return flight from London to Berlin generates about 0.6 tonnes CO2e, which is three times the amount of CO2e saved by recycling for a year.

Key Sustainable Aviation Fuel Market Insights Summary:

Regional Highlights:

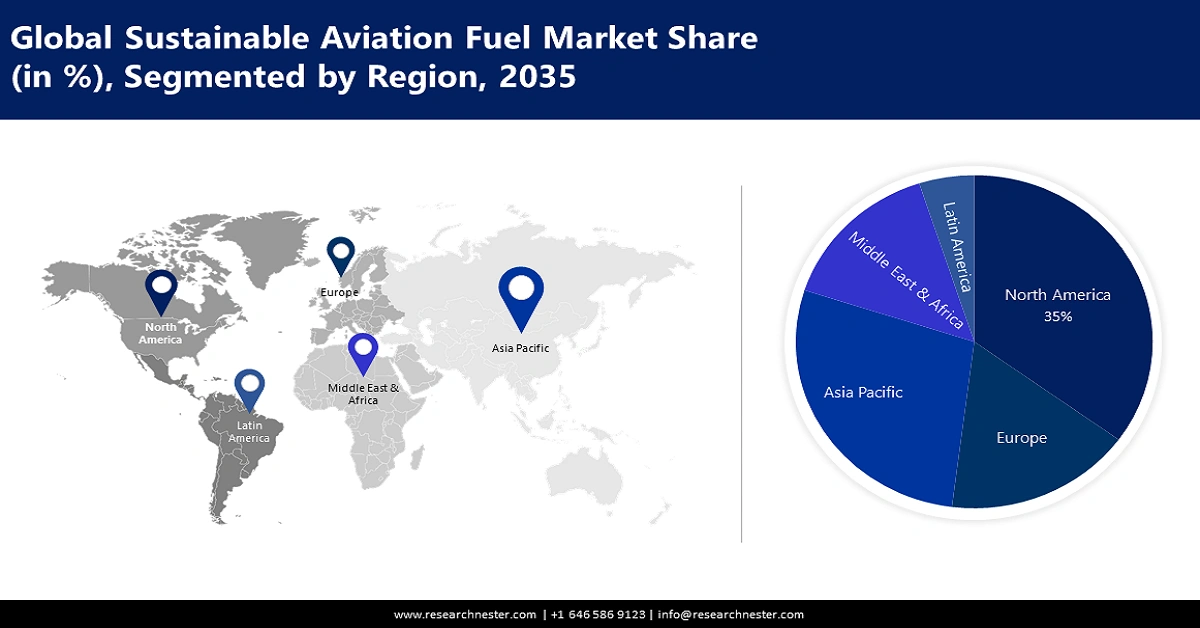

- North America sustainable aviation fuel market will secure around 35% share by 2035, driven by increased air travel, higher CO₂ emissions from aviation, and adoption of sustainable aviation fuel.

- Asia Pacific market will capture a 28% share by 2035, driven by rising military exercises and initiatives by private aviation companies to expand aircraft deployment.

Segment Insights:

- The biofuel (fuel type) segment in the sustainable aviation fuel market is projected to capture a 40% share by 2035, driven by increasing popularity and production of aviation biofuels and airport initiatives.

- The military aviation segment in the sustainable aviation fuel market is expected to achieve a 39% share by 2035, attributed to rising investments in military aviation, including major defense industry spending.

Key Growth Trends:

- Growing Number of Passenger Taking Flights

- Rising Pollution Caused by Aircraft

Major Challenges:

- Limited supply of SAF

- The production cost of SAF in comparison to traditional fuels

Key Players: Northwest Advanced Biofuels, LLC., Red Rock Biofuels, Fulcrum BioEnergy, Inc., Aemetis, Inc., TotalEnergies SE, OMV Aktiengesellschaft AG, Neste MY, SkyNRG B.V., Gevo Inc., CESPA.

Global Sustainable Aviation Fuel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.98 billion

- 2026 Market Size: USD 3.07 billion

- Projected Market Size: USD 234.59 billion by 2035

- Growth Forecasts: 61.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Netherlands, Singapore

- Emerging Countries: Germany, France, United Kingdom, Netherlands, Sweden

Last updated on : 10 September, 2025

Sustainable Aviation Fuel Market Growth Drivers and Challenges:

Growth Drivers

- Growing Number of Passenger Taking Flights –Rising use of aircrafts for traveling is expected to drive the need for fuel and is likely to more opportunities for incorporating sustainable aviation fuel. According to the International Air Transport Association, global air passenger traffic recovered significantly in 2022, rising from 41.7% of 2019 revenue passenger kilometers (RPKs) in 2021 to 68.5% in 2022.

- Rising Pollution Caused by Aircraft –Higher pollution by aircraft has prompted airlines and the government to use sustainable fuels. Aviation accounts for around 2% of worldwide CO2 emissions. The industry, collectively with other gases and water vapor trails produced by airplanes, is accountable for around 5% of global warming.

- Increasing Investment in New Aircrafts – Rising deployment of new aircraft for sufficing the need for growing air traffic is also expected to drive market growth. In 2021, Rakesh Jhunjhunwala, a billionaire investor in India, intended to launch a new airline with 70 aircraft within four years by spending USD 35 million in 2021.

- Lower CO2 Emission by Sustainable Fuel–The rising benefits of sustainable fuel have increased its adoption across the aviation industry. SAF reduces carbon emissions by up to 80% over the lifecycle of the fuel when compared to traditional jet fuel. However, it is dependent on the feedstock used, production process and supply chain to the airport.

- Rising Military Aviation Exercises– The majority of SAFs authorized for civil aviation use have also been examined and approved for use in the majority of fighter aircraft. Arctic Forge 23, a US Army (Europe-Africa) led umbrella exercise, was held from February 16 to March 17, 2023. It comprised the Defense Exercise North in Finland and the Joint Viking Exercise in Norway. These exercises are undertaken on a yearly basis to strengthen military capabilities and cooperation among participating countries.

Challenges

- Limited supply of SAF- The production capacity of sustainable aviation fuel is currently limited also there are not enough suppliers of the fuel. This can make it difficult for airlines to procure enough SAF to meet the needs of the aviation industry and is likely to hamper market growth.

- The production cost of SAF in comparison to traditional fuels

- Lack of consistent government policies and incentives

Sustainable Aviation Fuel Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

61.2% |

|

Base Year Market Size (2025) |

USD 1.98 billion |

|

Forecast Year Market Size (2035) |

USD 234.59 billion |

|

Regional Scope |

|

Sustainable Aviation Fuel Market Segmentation:

Fuel Type Segment Analysis

The global sustainable aviation fuel market is segmented and analyzed for demand and supply by fuel type into biofuel, power to liquid fuel, hydrogen fuel, and gas to liquid fuel. Out of the four types of fuels used in aviation, the biofuel segment is estimated to gain the largest market share of about 40% in the year 2035. The growth of the segment can be attributed to the increasing popularity of aviation biofuels. According to the International Energy Agency, the first flight utilizing mixed biofuel occurred in 2008. After that, biofuels have been used on over 150,000 flights all across the world. In 2018, around 15 million liters of aviation biofuel were produced. Moreover, initiatives taken by airports to supply biofuels are also expected to drive the growth of the segment. Only five airports currently have regular biofuel distribution (Bergen, Brisbane, Los Angeles, Oslo, and Stockholm), with others receiving it on an as-needed basis. However, owing less than 5% of all airports handle 90% of international flights, aviation fueling is centralized. These now cover around 6 billion liters of petroleum.

Aircraft Type Segment Analysis

The global sustainable aviation fuel market is also segmented and analyzed for demand and supply by aircraft type into commercial, regional transport aircraft, military aviation, business & general aviation, and unmanned aerial vehicles. Amongst these five segments, the military aviation segment is expected to garner a significant share of around 39% in the year 2035. The growth of the segment is primarily attributed to the rising investment in military. Saudi Arabia intends to invest more than USD 20 billion in its domestic defense industry over the next decade as part of its efforts to increase domestic military spending. Over the next decade, the government intends to invest more than $10 billion on Saudi Arabia's defense industry, as well as equivalent sums in research and development.

Our in-depth analysis of the global market includes the following segments:

|

By Fuel Type |

|

|

By Technology |

|

|

By Aircraft Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sustainable Aviation Fuel Market Regional Analysis:

North American Market Insights

The market share of sustainable aviation fuel in North America, amongst the market in all the other regions, is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the increased number of a passenger taking air routes for traveling. In 2021, US airlines carried 674 million passengers (not seasonally adjusted), an increase of 82.5% over 2020 (369 million, unadjusted). Moreover, according to the Bureau of Transportation Statistics, US airlines carried 68.1 million systemwide including both domestic and international scheduled service passengers in December 2021, seasonally adjusted. Besides this, the rising emission of CO2 from the aviation sector and higher adoption of SAF is also expected to drive North America’s market growth. The United States is the world's top source of aviation emissions. In 2019, commercial passenger flights departing from the United States produced 179 million metric tons of carbon dioxide emissions, with domestic flights emitting the vast majority. Furthermore, The Biden Administration has also prioritized SAF, with a production goal of 3 billion gallons per year by 2030 a significant increase from the 10-20 million gallons produced in the United States currently.

APAC Market Insights

The Asia Pacific sustainable aviation fuel market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the rise in the number of military exercises. To strengthen bilateral air defense cooperation, India and Japan held the 'Veer Guardian-2023' joint air exercise comprising the Indian Air Force and the Japan Air Self Defence Force (JASDF) at Hyakuri Air Base in Japan from January 12 to January 26, 2023. The Indian presence featured four Su-30 MKI, two C-17, and one IL-78 aircraft, while the Japanese contribution included four F-2 and four F-15 aircraft. On the other hand, the rising initiative taken by private aviation companies to deploy more aircraft is also expected to drive market growth in Asia Pacific.

Europe Market Insights

Europe region is projected to observe substantial growth through 2035. The growth of the market can be attributed majorly to the rising initiatives put in by European Union to minimize greenhouse gas emissions. The EU has set a goal to achieve net-zero emissions by 2050, and aviation is a significant contributor to emissions in the transportation sector. In addition to this, the European Union has introduced incentives and policies to promote the use of SAF, it includes mandatory use of sustainable fuels in some amount and tax exemption for SAF manufacturers.

Sustainable Aviation Fuel Market Players:

- Northwest Advanced Biofuels, LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Red Rock Biofuels

- Fulcrum BioEnergy, Inc.

- Aemetis, Inc.

- TotalEnergies SE

- OMV Aktiengesellschaft AG

- Neste MY

- SkyNRG B.V.

- Gevo Inc.

- CESPA

Recent Developments

- CESPA came in alliance with Iberia Group Seal to reduce the carbon emission in air transport at a large scale. They intend to create and generate substantial quantities of sustainable aviation biofuels (SAF) using waste, recovered used oils, and other sustainable plant-based feedstocks.

- Neste Corporation announced the strategic collaboration with DHL Express to make one of the largest-ever deal in the aviation industry of sustainable aviation fuels. Neste is going to supply DHL with roughly 320,000 tons (400 million liters) of Neste MY Sustainable Aviation FuelTM over the next five years.

- Report ID: 4881

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sustainable Aviation Fuel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.