Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Automotive-Over-The-Air Updates (OTA) Market size was valued at USD 4.4 billion in 2024 and is poised to reach USD 33 billion by the end of 2037, expanding at a CAGR of 16.5% throughout the anticipated timeline from 2025 to 2037. In 2025, the industry size of automotive OTA is evaluated at USD 5.2 billion.

A major factor in the automotive OTA update market’s expansion is the trends encapsulating the broader automotive sector, where there has been a sustained shift towards software-defined vehicles (SDVs). SDVs require remote software improvements to maintain performance whilst ensuring compliance with mandates. As of early 2025, the electric vehicle (EV) sales worldwide have increased. In the first four months of 2025, EV sales reportedly increased by 29.3%, with April alone accounting for over 1.5 million sales. The leading markets of EV sales during this period were China and Europe.

The producer price index (PPI) of the automotive OTA is a vital economic indicator to understand the market’s dynamics. In January 2025, the PPI for final demand increased by 0.5%, highlighting a surge in the selling prices received by domestic producers. Additionally, in the transportation equipment sector, a 1.5% increase in prices was observed between January 2024 to January 2025. Now, transportation equipment includes automotive components, and hence, the increase has a direct impact on the automotive OTA updates market. The rising prices also indicate a potential surge in the production costs of OTA systems.

Another vital economic indicator of the automotive OTA sector is the Consumer Price Index (CPI). As per its analysis, the CPI rose by 2.3% from March 2024 to March 2025. The CPI encapsulates a multitude of goods and services, but a significant contribution is from the vehicle-related expenses of the transportation sector. Fluctuations in the CPI influence the consumer demand for vehicles with new and advanced technologies. Overall, the market is slated to maintain its CAGR by the end of 2037, by leveraging a robust supply chain and benefiting from the widespread deployment of 5 G.

Automotive Over-The-Air Updates Sector: Growth Drivers and Challenges

Growth Drivers

- Integration of predictive maintenance systems: The global automotive industry is impacted by the widespread adoption of predictive maintenance technologies, which rely heavily on real-time data analytics. Predictive maintenance ensures that any potential issues in a vehicle are anticipated early. A vital feature of this approach is the frequent updates delivered via OTA Mechanisms. Amidst recent trends, in April 2025, FreightWaves reported that leading fleet operators in North America, APAC, Europe, and the Middle East are transitioning from scheduled to condition-based maintenance. Additionally, this shift has been successful in ushering in an increase of over 40% in OTA-delivered diagnostic patches, which in turn bodes well for the future of the sector.

- Expansion of 5G-enabled connected vehicle ecosystems: The widespread deployment of 5G has created a feasible ecosystem for the automotive OTA updates sector. Due to the proliferation of 5G, the capabilities of connected vehicles have improved. For instance, in the U.S. alone, the sales of connected cars with 5G represented 1.6% of the total vehicle sales in 2022, with industry projections estimating a whopping increase to over 50% by the end of 2027. The expansion is also expected to drive a surge in the demand for components associated with OTA updates.

For instance, in February 2025, J.D. Power’s U.S. Vehicle Dependability Study 2025 found that more than 35% of 2022 model owners performed at least one OTA update within the first three years of vehicle ownership, with 27% in 2023. The table below highlights the impact of 5G on the automotive OTA updates and manufacturing efficiency.

|

Metric |

Improvement (%) |

|

Reduction in defective products |

27.0% |

|

Faster production of prototypes |

7.0% |

|

Reduction in production costs |

29.4% |

|

Increase in network capacity and efficiency |

100x |

|

Average 5G download speeds in the U.S. |

186.3 Mbps |

|

Average 5G download speeds in South Korea |

432 Mbps |

Major Technological Advancements in the Automotive OTA Updates Market

The automotive over-the-air updates market is positively reinforced by the technological advancements in the sector. For instance, the 5G Standalone networks have been instrumental in providing low-latency channels for secure OTA payloads, vital for the application of infotainment updates. Additionally, the manufacturing sector has embraced remote feature delivery, evident from China’s rapid OTA installation between January to September 2024. The technological advancements bode well for the future of the automotive OTA market, with the table below highlighting key metrics:

|

Trend |

Industry |

Metric & Period |

Example & Result |

|

5G SA OTA Channels |

Telecom |

60 operators with 5G SA networks as of Dec 2024 |

Enables ultra-fast, low-latency OTA updates |

|

OTA Installation Rate |

Manufacturing |

11.083 M cars with OTA; 71.7% install rate (Jan–Sep 2024) |

China’s passenger vehicles; project to >90% by 2030 |

|

Edge‑Computing for OTA |

Telecom/Auto |

AECC published 4 use‑case requirements on Mar 3, 2025 |

Demonstrated CAMARA APIs at MWC 2025 for intelligent driving |

|

AI-Driven Cockpit Personalization |

Auto Luxury |

Voyah Courage launched in October 2024 with an OLED sliding screen |

2.5K resolution, 201 PPI for dynamic, software-driven interfaces |

|

OTA Performance Tuning |

Manufacturing |

Fast‑charging time reduced by 4–6 min in Mar 2025 |

Ford F-150 Lightning Q1 2025 OTA update |

The Impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Automotive OTA Updates Market

The convergence of AI and ML has transformed the global automotive over-the-air updates market by bolstering predictive analytics as well as improving the personalization of updates. The advent of AI & ML in product development is critical as OEMs shift toward software-defined vehicles. The table below highlights the successful use case of AI and ML by the major players of the automotive OTA updates market:

|

Company |

Integration of AI & ML |

Outcome |

|

Tesla |

AI-driven OTA platform using behavioral data and simulations for autonomous software updates |

Reduced time-to-market by 29% via real-time update testing and deployment |

|

Volkswagen AG |

Used AI for predictive maintenance and OTA quality control via the Cariad unit |

Improved product reliability by 21% and reduced downtime by 24% |

|

BMW Group |

ML-based customer usage analysis to tailor OTA feature rollouts |

Enhanced OTA feature engagement rate by 17% |

|

Ford Motor Co. |

Integrated AI-based simulations to accelerate infotainment system updates |

Cut infotainment development costs by 14% and time-to-deploy by 21% |

Challenges

- Vulnerabilities associated with cybersecurity: With vehicles becoming more connected, the threat surface of cyberattacks has expanded. In January 2023, security researchers identified vulnerabilities in vehicles from 16 manufacturers, including major players such as BMW, Toyota, and Ford. These findings highlight the requirement for secure measures in OTA systems. In addition, manufacturers may have to navigate complex regulatory mandates. For instance, in August 2024, China released draft regulations to boost supervision of OTA software upgrades, requiring manufacturers to report incidents that involve the remote control of vehicles, and constraints in meeting these requirements may limit automotive over-the-air (OTA) updates market access for certain players.

Automotive Over-The-Air (OTA) Updates Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

16.5% |

|

Base Year Market Size (2024) |

USD 4.4 billion |

|

Forecast Year Market Size (2037) |

USD 33 billion |

|

Regional Scope |

|

Automotive Over-The-Air (OTA) Updates Segmentation

Update Type (Software Updates, Firmware Updates, Map Updates, Security Patches)

The software updates segment of automotive over-the-air (OTA) updates market is poised to hold a leading revenue share of 65.2% throughout the forecast timeline. A major driver of the segment is the surging demand for continuous improvements in navigation, vehicle performance, and infotainment. With a greater number of connected vehicles on the roads, the demand for regular software updates is exponential across the market. Major players in the market, such as Tesla, have reportedly released software updates every four weeks, while Volkswagen seeks to release OTA updates for its ID series vehicles every 12 weeks.

Technology (Cellular, Wi-Fi, Bluetooth)

The cellular segment of the automotive over-the-air updates market is slated to hold around 60.6% revenue share by the end of 2037. The widespread cellular coverage facilitating high-speed data transmission bolsters the segment’s growth. The automotive industry is exhibiting a heightened shift towards autonomous vehicles, and cellular networks are vital to deliver timely OTA updates, positioning itself as a vital component of the shift. Companies, including Vodafone, are at the forefront by connecting more than 55 million cars worldwide by the second quarter of 2024.

Our in-depth analysis of the global automotive over-the-air updates market includes the following segments:

|

Update Type |

|

|

Technology |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

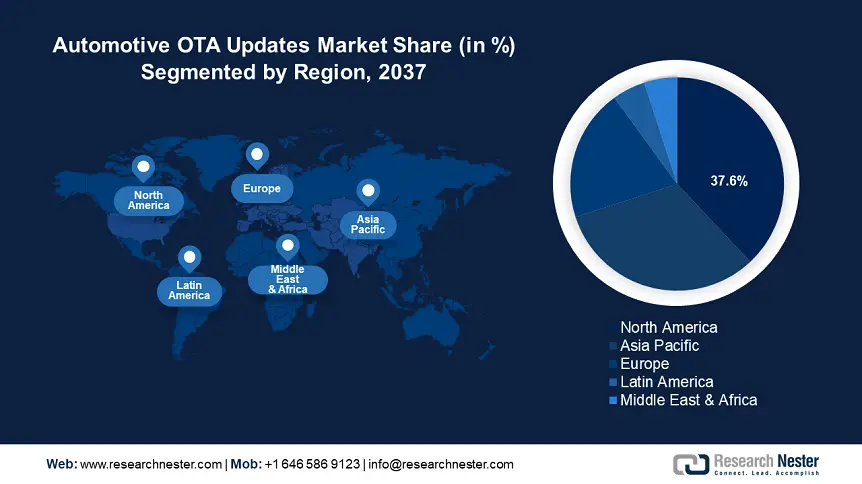

Automotive OTA Updates Industry - Regional Scope

North America Market Forecast

The North America automotive OTA updates market is estimated to maintain a leading revenue share of 37.6% throughout the forecast timeline. The presence of major OEMs along with strict regulatory standards has created a favorable environment for the implementation of OTA solutions. A significant factor in the regional market’s growth curve is also the rapid adoption of EVs across the U.S. and Canada, which require regular software updates.

The U.S. automotive over-the-air updates market is projected to maintain its leading share in North America. The surging adoption of EVs and hybrid vehicles is a major factor facilitating the growth curve. The U.S. has invested substantially to improve the charging infrastructure across the region, creating favorable opportunities for the application of OTA updates in the next-generation vehicle solutions. Opportunities are rife in the U.S. market through potential collaborations between tech giants and leading automotive manufacturers.

The Canada OTA updates market is estimated to expand during the forecast period. A vital factor contributing to the expansion of the market is the surge in demand for connected vehicles, along with the government initiatives promoting the use of hybrid and electric vehicles. Additionally, Canada is pushing for decarbonization initiatives, which tie with the broader trends within the automotive industry moving towards electrification. This creates a greater possibility of a surge in connected vehicles on the roads, creating lucrative opportunities for the deployment of OTA updates.

Asia Pacific Market Forecast

The APAC automotive over-the-air updates market is poised to register the fastest expansion, at a CAGR of 19.3% throughout the forecast timeline. The regional market’s growth is attributed to the rise in vehicle connectivity, along with the surging demand for infotainment systems. APAC has one of the largest vehicle densities across the world, and the rising disposable income in emerging APAC economies has ensured a greater percentage of vehicle ownership. The proliferation of ride-share companies in the region is another factor contributing to the rising scope of application of OTA updates in connected vehicles across the region.

The China automotive over-the-air updates market is expected to maintain a leading revenue share in APAC. A major driver of the market is the country’s push for EVs and surging investments in smart transportation. Additionally, China leads in EV deployment globally. For instance, the leading manufacturers such as BYD reported more than 4 million EV sales in 2024. With EVs relying on software for core functions, such as autonomous driving and infotainment, there is a continuous requirement for remote updates. This is for the global automotive over-the-air updates market.

Companies Dominating the Automotive Over-The-Air Updates Landscape

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global automotive over-the-air updates market is projected to remain competitive, with automotive suppliers and technology conglomerates seeking to bolster vehicle connectivity. Leading firms such as Harman International, Bosch Mobility, etc., hold leading market share in the sector. Additionally, the integration of advanced technologies, bolstered by expanding 5G deployed, is poised to ensure the continued opportunities in the market. The table below highlights the major players of the automotive over-the-air updates market:

|

Company Name |

Country of Origin |

2024 Revenue Share (%) |

|

Harman International |

USA |

14.9% |

|

Bosch Mobility |

Germany |

13.2% |

|

Infineon Technologies |

Germany |

10.6% |

|

Continental AG |

Germany |

9.1% |

|

Qualcomm Technologies |

USA |

8.4% |

|

BlackBerry QNX |

Canada |

XX |

|

NXP Semiconductors |

Netherlands |

XX |

|

Airbiquity Inc. |

USA |

XX |

|

Garmin Ltd. |

USA |

XX |

|

Thales Group |

France |

XX |

|

Digi International |

USA |

XX |

|

CDK Global |

USA |

XX |

|

Sierra Wireless |

Canada |

XX |

|

ZF Friedrichshafen AG |

Germany |

XX |

|

TomTom N.V. |

Netherlands |

XX |

Below are the areas covered for each company that is a key player in the automotive over-the-air updates market:

Recent Developments

- In July 2024, HARMAN International announced the introduction of OTA 12.0, i.e., a major improvement to its over-the-air update platform. Key features include distributed onboard OTA orchestration along with improved cybersecurity measures.

- In January 2024, Aurora Labs and Infineon Technologies announced a partnership to boost automotive safety via OTA solutions supported by AI. This collaboration combines the Line-of-Code Intelligence (LOCI) technology of Aurora Labs with the 32-bit TriCore of Infineon to improve the safety of vehicle components via real-time monitoring.

- Report ID: 3766

- Published Date: May 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert