Automotive Operating System Market Outlook:

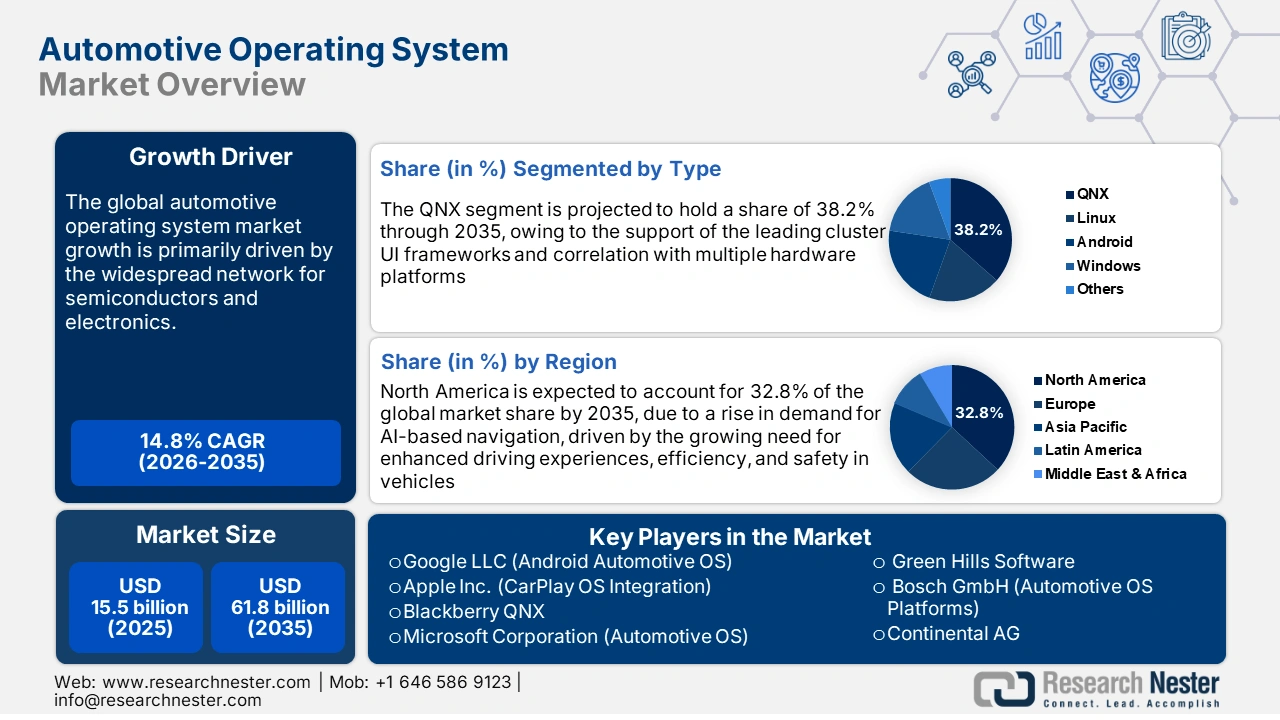

Automotive Operating System Market was valued at USD 15.5 billion in 2025 and is projected to reach USD 61.8 billion by the end of 2035, rising at a CAGR of 14.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive operating systems is assessed at USD 17.8 billion.

The supply chain for the automotive operating system market is closely tied to a widespread network for semiconductors and electronics. Raw materials, including rare earth elements, silicon, and copper, are sourced from various countries in South America and the Asia Pacific. AOS platforms are integrated with chipsets and ECUs, whose production relies primarily on rare earth metals from China. Companies and governments are also active in the production of rare earth materials, contributing to mitigating supply chain disruptions in the production of the automotive operation system. As reported by the Center for Strategic and International Studies (CSIS), a U.S.-based company, MP Materials produced a record 1,300 tons of neodymium-praseodymium (NdPr) oxide in 2024. A projected 300,000 tons of NdFeB magnets were produced in China in the same financial year.

Semiconductors are the backbone of automotive operating systems, as several modern automotive OS rely on advanced semiconductor chips such as SoCs, MCUs, GPUs, and AI accelerators. In July 2025, the U.S. Bureau of Labor Statistics (BLS) disclosed a 6.1% surge in the Producer Price Index for the manufacturing of semiconductors over the period of the last 3 years, from December 2021 to December 2024. The rise was seen due to constant disruptions in the supply chain and persistent geopolitical tensions.

U.S. Semiconductor Industry Import/Export Price Trends

|

Categories Of Trends |

Surge Or Decline In 2022 |

Surge Or Decline In 2023 |

Surge Or Decline In 2024 |

|

Annual change in the Producer Price Index for semiconductor manufacturing |

+3.9% |

-0.1% |

+2.2% |

|

Annual changes in the export price index |

+1.4% |

-4.7% |

-0.2% |

|

Annual changes in the import price index |

+2.4% |

-3.8% |

0.0% |

Source: BLS

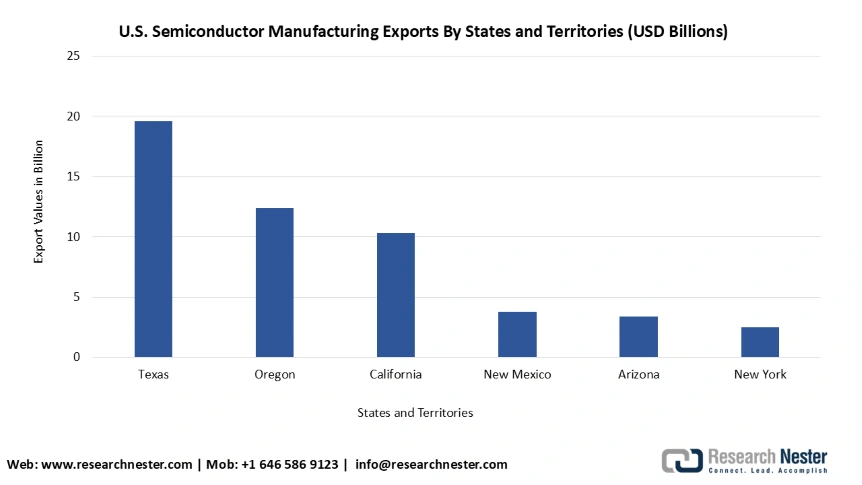

As per the same report, in 2024, North America established itself as the leader in the global chip supply chain, and more than 70% of the U.S. semiconductor exports took place in Texas, Oregon, California, New Mexico, Arizona, and New York.

Top Six Exporting U.S. States and Territories for Semiconductor Manufacturing In 2024

Source: BLS

Moreover, the United States International Trade Commission revealed in November 2024 that automotive parts imports from China increased from USD 2.0 billion in 2013 to USD 5.3 billion in 023 in Mexico. As evidence of continuous investment in creating cutting-edge mobility infrastructure, an investment of USD 54 million was announced by the U.S Department of Transportation for 34 projects taking place in the final round of the SMART Stage 1 Grants across 21 states.

Key Automotive Operating Systems Market Insights Summary:

Regional Highlights:

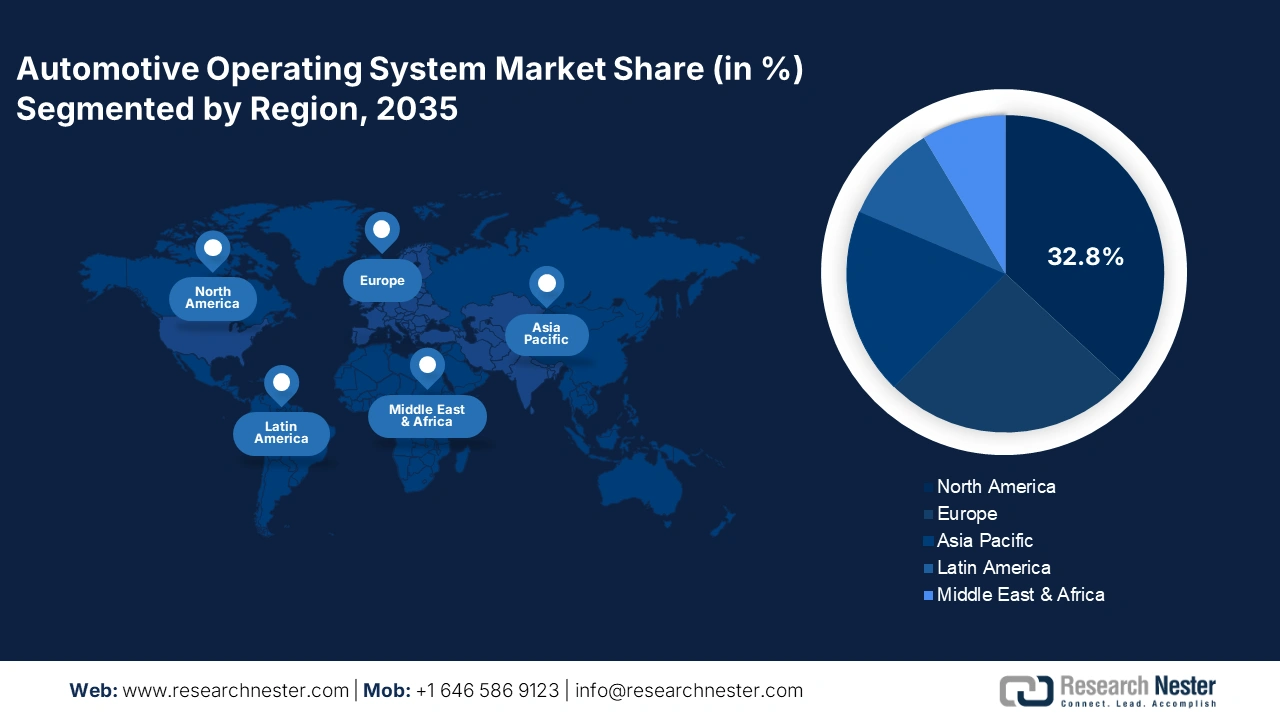

- North America is projected to hold a 32.8% share by 2035, impelled by rising demand for AI-based navigation enhancing driving experience, efficiency, and safety.

- Asia Pacific is expected to register substantial revenue share by 2035, stimulated by growing demand for vehicles integrated with AI and 5G-enabled high-bandwidth environments.

Segment Insights:

- QNX segment is anticipated to account for 38.2% share by 2035, driven by support of leading cluster UI frameworks and compatibility with multiple hardware platforms in automotive operating system market.

- Passenger cars segment is expected to register rapid growth by 2035, owing to increasing demand for advanced features in EVs and ADAS.

Key Growth Trends:

- Surge in sales of connected and autonomous vehicles

- Rising investment in Mobility-as-a-Service

Major Challenges:

- Strict laws for data protection

- Lack of harmonized global standards

Key Players: Apple Inc. (CarPlay OS Integration), Blackberry QNX, Microsoft Corporation (Automotive OS), Green Hills Software, Bosch GmbH (Automotive OS Platforms), Continental AG, Panasonic Automotive Systems, Renesas Electronics Corporation, Hyundai AutoEver, Tata Elxsi, KPIT Technologies, Wind River Systems, NNG LLC, Middleware Malaysia.

Global Automotive Operating Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.5 billion

- 2026 Market Size: USD 17.8 billion

- Projected Market Size: USD 61.8 billion by 2035

- Growth Forecasts: 14.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (significant revenue share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 29 September, 2025

Automotive Operating System Market - Growth Drivers and Challenges

Growth Drivers

- Surge in sales of connected and autonomous vehicles: As the automotive industry is becoming more software-defined, there has been a rising demand for ultra-modern OS platforms with the expansion of the sector. As reported by the International Energy Agency in July 2025, EV sales in the first quarter of 2025 increased by 35% compared to the first quarter of the previous financial year. There has been a surge in intricacies in modern driver assistance systems, over-the-air updates, and infotainment. Prominent companies launched the Automotive OS, that are widely adopted by end users operating across different sectors. Also, automotive giants Volkswagen and Bosch are infusing money into automotive OS for level 4 autonomy.

- Rising investment in Mobility-as-a-Service: The automotive operating system market growth can be attributed to the surge in MaaS services such as Ola, Uber, and Didi. Through the New Energy Vehicle Development Plan, the governments are supporting automotive organizations with subsidies for accumulating robotaxis and MaaS. Companies are also taking strategic initiatives for the development of Mobility-as-a-Service. For instance, in May 2023, DiDi Autonomous Driving unveiled its joint venture with GAC AION New Energy Automobile Co., Ltd. for the mass production of electric robotaxi under the joint project, AIDI. These factors influence a surge in demand for AOS.

- Regulatory push for vehicle electrification: According to data published by the International Energy Agency (IEA), global penetration of EVs is projected to hit 65% of car sales by 2030. An advanced automotive OS is needed to operate the electric vehicle battery systems, connectivity, and powertrains. As reported by the State Council in June 2023, the purchase tax exception for NEVs borrowed in 2024 and 2025 in China was around USD 4,178.5 thousand. Also, countries in Europe are aiming for real-time energy management OS, fueling the market growth during the coming decade.

Challenges

- Strict laws for data protection: The stringent data protection laws from various countries lead to a rise in compliance costs and slow down the software deployment time. General Data Protection Regulation (GDPR) in the EU obstructs the flow of crucial updates across the border. Similarly, in August 2023, the government of India introduced a new version of the Digital Personal Data Protection Act, 2023 (DPDP Act).

- Lack of harmonized global standards: The uneven regulatory frameworks and the presence of fragmented global standards for OS are restraining the market growth and causing increasing development costs. GDPR in the EU, CCPA in the U.S., and PIPL in China have different mandates for the development of operating systems.

Automotive Operating System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.8% |

|

Base Year Market Size (2025) |

USD 15.5 billion |

|

Forecast Year Market Size (2035) |

USD 61.8 billion |

|

Regional Scope |

|

Automotive Operating System Market Segmentation:

Type Segment Analysis

The QNX segment is anticipated to account for a automotive operating system market share of 38.2% by the end of 2035, owing to the support of the leading cluster UI frameworks and correlation with multiple hardware platforms. The use of the QNX operating system in severe applications, including cockpit controllers, in-vehicle infotainment, and ADAS features, is also bolstering the market growth. Different user-friendly and safety features, such as navigation, smartphone connectivity, and voice recognition, are also offered by the operating system, contributing to its market popularity. Companies are also initiating strategic collaborations to expand applications for the OS. In August 2025, QNX unveiled its role as a key ecosystem and integration partner in the development of the new NVIDIA DRIVE AGX Thor development kit. The OS was integrated in the vehicles for safety 8 and to enable the capacity of delivering cutting-edge AI performance, scalability, and safety features.

Vehicle Type Segment Analysis

By 2035, the passenger cars segment is anticipated to register rapid growth, on account of the rising demand for advanced features in EVs and ADAS. Automotive companies are also taking measures to make passenger cars more personalized and improve user experiences. For example, in February 2025, Stellantis N.V. announced its first in-house-developed ADS, STLA AutoDrive 1.0. The technology is compatible with STLA Brain and STLA Smart Cockpit, enabling 60 km/h (37 mph) automated driving speed.

Application Segment Analysis

The ADAS and safety system is poised to hold a high market share by the end of 2035, owing to growing concern among potential users for safety, and stringent government regulations obligating safety enhancement in vehicles. For example, as per the UN Regulation No. 155, automotive manufacturers in Europe needed to have a valid Certificate of Compliance for the Cyber Security Management System based on their vehicle types manufactured after July 2024. Rapid developments of ADAS by companies through technological innovation is also expected to influence the dominance of the segment in the near future.

Our in-depth analysis of the global automotive operating system market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Vehicle Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Operating System Market - Regional Analysis

North America Market Insights

The North America market is predicted to have robust growth, accounting for 32.8% of the revenue share by 2035 due to a rise in demand for AI-based navigation, driven by the growing need for enhanced driving experiences, efficiency, and safety in vehicles. Technology companies across the region are investing in relevant technological research and development. Automotive manufacturers are also consistently taking measures to strengthen OS capabilities in their vehicles. For instance, in January 2023, Hyundai Motor Group revealed its strategic collaboration with NVIDIA to boost AI development to drive future mobility. Enhancing the application of intelligence to the core mobility products, including software-defined vehicles and robotics, was the aim of the automotive business.

The exponentially surging penetration of connected vehicles fuels the automotive operating system market in the U.S. As reported by the Alliance for Automotive Innovation in June 2025, the automotive company sold 374,841 connected electric vehicles in the U.S., which accounts for 9.6% of the sold light-duty vehicles. In addition, growing concerns about cybersecurity among the users of connected vehicles are fuelling the need for automotive operating systems associated with robust security frameworks. Companies based in the U.S. are also taking measures to enhance the security of automotive operating systems. In April 2025, Intel unveiled the second-generation Intel AI-enhanced software-defined vehicle (SDV) system-on-chip (SoC) at Auto Shanghai 2025. The SoC offers scalable performance, optimized cost-efficacy, and advanced AI capabilities to the automakers so that they can fulfil the rising demands for intelligent and connected vehicles.

In Canada, the automotive operating system market is expected to experience remarkable expansion, owing to rising government support to strengthen the adoption of connected and automated vehicles, expected to fuel the demand for automotive operating systems. In February 2025, Transport Canada unveiled its efforts to modernize the transportation system across the country. The government also works actively to establish a regulatory environment supporting the integration of new and merging connected and automated vehicles. National and international regulations in Canada are also pushing automotive companies in Canada to invest in the development of robust automotive operating systems.

Asia Pacific Market Insights

The Asia Pacific is anticipated to account for a significant revenue share by 2035 due to rising demand for vehicles integrated with AI. The growth in the region can be ascribed to the 5G rollouts in various nations and the presence of a robust OEM base. As reported by the Global System for Mobile Communications Association in July 2023, China, South Korea, and Japan lead in 5G deployment, and with the continued rollout of the networks in other regional areas, the Asia Pacific is expected to emerge as the largest 5G market worldwide. This is expected to allow the automobile manufacturers to make the operating systems in the vehicles function in an environment of high bandwidth and low latency. With the rapid integration of AI and ML into vehicles, the demand for sophisticated automotive operating systems increases.

China is projected to hold the largest share in the Asia Pacific AOS market due to rapid electrification and large-scale government subsidies for the adoption of EVs, increasing the scope of integrating sophisticated operating systems into vehicles. As disclosed by the Information Technology & Innovation Foundation in July 2024, in the development and launch of new car models, EV companies in China are faster compared to companies based in Europe, America, and Japan. China has also launched programs highly dependent on the AOS, including the National Smart Vehicle Innovation Development Strategy.

Japan is expected to register a rapid CAGR during the forecast timeline, as a consequence of rising government spending in research and development activities, fuelling the scope of enabling new features in automotive operating systems. As revealed by the Institute of Geoeconomics in July 2025, the government raised USD 7.4 billion of funding in research and development on next-generation semiconductor and quantum computing. The growing focus of the automobile sector on vehicle safety, reliability, and quality is expected to boost the demand for automotive operating systems.

Europe Market Insights

Europe automotive operating system market is anticipated to account for a lucrative revenue share by the end of 2035, due to stricter environmental regulations obligating emissions reduction in vehicles. The regulations are pushing the population to adopt electric and software-defined vehicles, boosting the demand for automotive operating systems. For instance, amendments to Regulation (EU) 2019/1242 were initiated as part of the 'Fit for 55' legislative package. The revised regulation came into force in Jun 2024 and obligated emissions reduction in heavy-duty vehicles, including lorries, city buses, trailers, and coaches. The fueling demand for personalized in-car experiences across the region is anticipated to accelerate the deployment of automotive operating systems into vehicles.

Germany is anticipated to register a significant CAGR during the forecast period, on account of the government incentives, including pilot project funding and tax breaks in the production and promotion of autonomous vehicles. As reported by the World Economic Forum in April 2025, the government incentivized severe AV programs, which included a funding of USD 342.2 million distributed across 70 AV projects. Companies in Germany are focusing on innovation in the ways of using automotive operating systems. In March 2023, BMW revealed its milestone in the latest development of the iDrive system. The operating system was integrated with a new home screen, allowing the vehicle users to get wider ease of utilization on the Curved Display.

The automotive operating system market in France is poised to expand at a high CAGR between 2026 and 2035, attributed to the rising popularity of ADAS. This is expected to increase the need for appropriate, real-time, and standardized vehicle data, which can fuel the demand for automotive OS. The involvement of the France-based companies in producing software-defined vehicles also accelerates the use of the AOS. For example, in April 2024, the joint venture between Renault Group and Volvo Group received regulatory approval for the creation of a new company, Flexis SAS. The company is involved in the production of the next generation of completely electric vans that were developed adhering to a Software Defined Vehicle (SDV) platform and its dedicated services.

Key Automotive Operating System Market Players:

- Google LLC (Android Automotive OS)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc. (CarPlay OS Integration)

- Blackberry QNX

- Microsoft Corporation (Automotive OS)

- Green Hills Software

- Bosch GmbH (Automotive OS Platforms)

- Continental AG

- Panasonic Automotive Systems

- Renesas Electronics Corporation

- Hyundai AutoEver

- Tata Elxsi

- KPIT Technologies

- Wind River Systems

- NNG LLC

- Middleware Malaysia

The competitive landscape of the market is rapidly evolving as established key players, automotive giants, and new entrants are investing in electrification. Key players in the market are focused on developing new technologies and products that cater to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Here are some key players operating in the automotive operating system market:

Recent Developments

- In May 2025, Volvo Cars unveiled its partnership with Google to deliver the latest Android automated operating system innovations to consumers who own Volvo models with Google built in, including Google Gemini. This led to the incorporation of the latest conversational AI technology in BMW cars.

- In May 2025, Tata Elxsi joined hands with Mercedes-Benz, aiming to enhance Research and Development in India on vehicle software engineering and accelerate the development of software-defined vehicles (SDVs). This collaboration aims to leverage Tata Elxsi's expertise in automotive software to advance SDV technologies.

- In March 2025, BMW China collaborated with Huawei for the integration of its own digital ecosystem with HarmonyOS. The company took the initiative to offer consumers with BMW Digital Key, My BMW App, and HUAWEI HiCar.

- Report ID: 4717

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Operating Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.