Automotive Metal Die Casting Market Outlook:

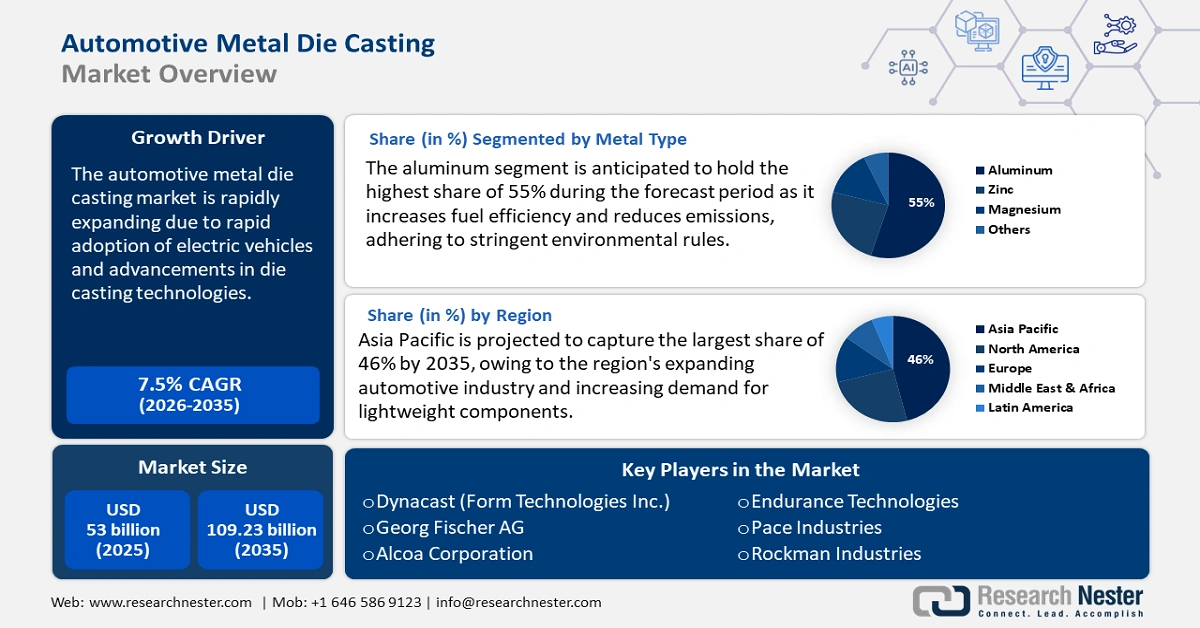

Automotive Metal Die Casting Market size was valued at USD 53 billion in 2025 and is likely to cross USD 109.23 billion by 2035, registering more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive metal die casting is assessed at USD 56.58 billion.

The rapid adoption of electric vehicles is one of the primary factors fueling the automotive metal die casting market. EVs require specialized components, such as motor enclosures and battery housings, which are effectively made by die casting techniques. For instance, in September 2023, Tesla used die casting technology for rear underbody assembly, reducing manufacturing costs by 40% and the weight of the vehicle body system by 10%. Thus, specialized parts for EVs, especially battery electric vehicles, include structural elements, thermal management systems, and aluminum die-cast battery pack housings. Hence, utilizing a die-casting machine known as the Giga Press, Tesla has expanded the usage of big aluminum die-cast parts, such as the Model Y's front and rear underbody.

Key Automotive Metal Die Casting Market Insights Summary:

Regional Highlights:

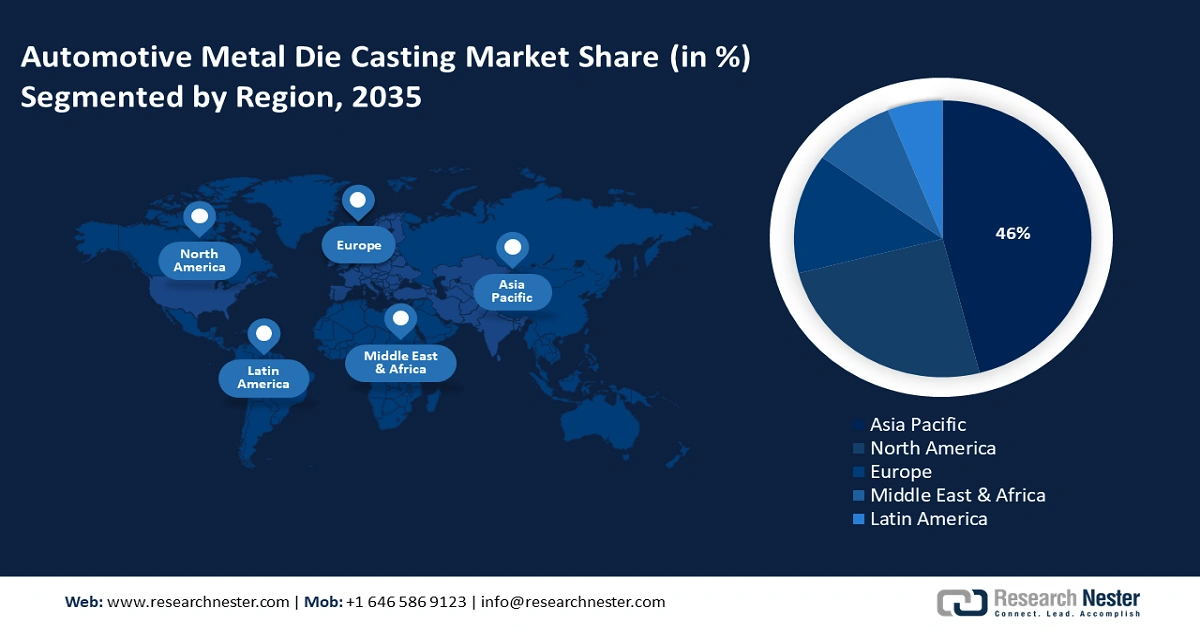

- Asia Pacific automotive metal die casting market will dominate over 46% share by 2035, fueled by the region’s growing automotive industry, rising demand for lightweight components, and increasing adoption of electric vehicles (EVs).

- North America market will achieve a 25% share by 2035, driven by investments in electric vehicle manufacturing, advanced production technologies, and a shift towards aluminum die casting.

Segment Insights:

- The high-pressure (process type) segment in the automotive metal die casting market is anticipated to achieve a 70% share by 2035, fueled by the need for lightweight and high-precision components in electric vehicles.

- The aluminum segment in the automotive metal die casting market is expected to achieve significant growth during 2026-2035, attributed to aluminum's lightweight properties that enhance fuel efficiency and meet environmental regulations.

Key Growth Trends:

- Advancements in die casting technologies

- Regulatory pressure for lightweight vehicles

Major Challenges:

- High production costs

Key Players: Dynacast (Form Technologies Inc.), Georg Fischer AG, Alcoa Corporation, Endurance Technologies, Pace Industries, Rockman Industries.

Global Automotive Metal Die Casting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 53 billion

- 2026 Market Size: USD 56.58 billion

- Projected Market Size: USD 109.23 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 September, 2025

Automotive Metal Die Casting Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in die casting technologies: Innovations such as high-pressure die casting (HPDC), vacuum die casting, and squeeze casting have enhanced the precision, strength, and quality of cast components. These developments expand the use of die casting in the automobile sector by making it possible to produce increasingly elaborate and sophisticated components. For instance, in January 2025, KUKA Robotics partnered with die-casting manufacturers to use robotics and AI-driven systems to identify casting quality in real-time, improving production by 30% and reducing defects by 20%. The integration of these automated technologies and AI in die casting processes lowers completion times, reduces manufacturing time, and limits interruptions.

- Regulatory pressure for lightweight vehicles: The introduction of strict fuel efficiency standards and emission rules keeps automotive manufacturers under pressure to reduce vehicle weight owing to fuel efficiency restrictions. For instance, using lightweight materials such as aluminum and magnesium in vehicle manufacturing has increased as the U.S. Environmental Protection Agency (EPA) announced to boost in the miles per gallon (mpg) regulations to 54.5 mpg by 2025. Thus, an effective technique for manufacturing these lightweight parts is die casting.

Challenges

- High production costs: The high production costs of the technology are one of the primary issues faced by the automotive metal die casting business. Die casting requires certain tools and molds, which are expensive to buy and maintain. Additionally, the cost of raw materials rises when premium materials are used to manufacture lightweight and long-lasting components, leading to a price hike. Thus, low-budget industries or those functioning with restricted access to resources may find this financial barrier difficult to overcome, which could result in lower profitability and higher final consumer pricing.

Complexity in achieving precision and quality control: Another major challenge in die casting is maintaining high precision and quality control. During the casting process, keeping exact control over temperature, pressure, and timing is necessary to produce components with complex geometries, such as thin walls or delicate designs. Even the smallest mistakes can cause holes, bending, or size problems. To avoid these issues, advanced technology and skilled workers are needed to monitor and adjust the process, which increases production costs. Thus, ensuring constant quality also becomes difficult as the demand for lightweight and high-performance automotive parts increases.

Automotive Metal Die Casting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 53 billion |

|

Forecast Year Market Size (2035) |

USD 109.23 billion |

|

Regional Scope |

|

Automotive Metal Die Casting Market Segmentation:

Metal Type Segment Analysis

The aluminum segment in the automotive metal die casting market is anticipated to hold the highest share of 55% during the forecast period as it increases fuel efficiency and reduces emissions, adhering to stringent environmental rules. For instance, using 100 kg of aluminum in a vehicle can save nearly 46 liters of fuel in a year, contributing to a notable decrease in CO₂ emissions. Furthermore, technological advancements in die casting, such as sophisticated pressure and vacuum die casting procedures, have increased the accuracy and efficiency of aluminum components in the automotive sector.

The need for aluminum die castings is also increasing due to the growing demand for EVs. Aluminum's strength-to-weight ratio and superior heat dissipation properties make it the perfect material for EV components, as they are strong and lightweight. The demand for this segment also depends on the automotive industry's efforts toward environmental responsibility, as companies are adopting sustainable manufacturing techniques. These include the utilization of recycled aluminum and energy-efficient production processes in manufacturing.

Process Type Segment Analysis

The high-pressure die casting type is anticipated to hold a 70% share of the automotive metal die casting market during the forecast period due to the industry's shift toward lightweight and high-performance components. HPDC enables the production of complex, thin-walled parts with high precision and smooth surfaces, reducing the need for secondary machining and assembly. This is beneficial for electric vehicles, where lightweight structures are essential to hold battery weight and enhance energy efficiency. The adoption of HPDC enables manufacturers to produce entire vehicle underbodies in a single casting, making the assembly processes simpler and cutting production costs.

Our in-depth analysis of the global automotive metal die casting market includes the following segments:

|

Metal Type |

|

|

Process Type |

|

|

Application |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Metal Die Casting Market Regional Analysis:

Asia Pacific Market Insights

The automotive metal die casting market in Asia Pacific is projected to hold the highest share of 46% by 2035, owing to the region's expanding automotive industry and increasing demand for lightweight components. This growth is further fueled by the increasing adoption of EVs, which demand lightweight materials, including aluminum, to optimize energy efficiency and reduce emissions. Additionally, advancements such as high-pressure die casting technology are helping in the production of complicated and precise automobile parts, expanding the market.

The automotive metal die casting market in China is witnessing significant growth due to the robust manufacturing potential, supportive government policies, and investments for EV production. According to a report, in 2022, China sold more than 6 million EVs, marking an 82.33% surge from 2021. This sudden surge in EV sales has escalated the demand for high-pressure castings, particularly in areas of transmission, powertrain, and battery housings. Manufacturers in China are investing in advanced die-casting machines to meet this demand, keeping the country a global leader in automotive metal die casting.

The automotive metal die casting market in India is predicted to hold a notable share due to the rising automotive production. The growth can be attributed to government initiatives such as the Production-Linked Incentive (PLI) scheme and rising demand for lightweight components in vehicles. The PLI scheme in India, with a budget of USD 3.5 billion, is targeted to promote domestic production of high-tech automotive products and attract investments to the industry. This supportive background is encouraging innovation and investment in the die-casting sector, increasing its competitive edge worldwide.

North America Market Insights

The automotive metal die casting market in North America is projected to hold a significant share of 25% by 2035, driven by rising investments in electric vehicle manufacturing and advanced production technologies. Industry players in North America are upgrading their facilities to meet the evolving vehicle efficiency regulations. Moreover, the shift to aluminum die casting type is helping automobile manufacturers to lower overall vehicle weight and reduce vehicle emissions, complying with environmental regulations.

In the U.S., the automotive metal die casting market is driven by strong government support for clean energy vehicles and domestic auto production. Initiatives such as the Inflation Reduction Act and EV tax credits in the country have boosted the demand for lightweight metal parts and pressure-cast metal parts. Thus, U.S. manufacturers are investing in high-pressure die casting to improve output and quality.

Canada automotive metal die casting market is expanding as automakers rely more on local sourcing of parts and work on building cleaner, more optimized vehicles. Moreover, support from the government’s zero-emission vehicle program increases demand for lightweight aluminum castings. This push is encouraging more innovation and automation in the die casting process.

Automotive Metal Die Casting Market Players:

- Dynacast (Form Technologies Inc.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Georg Fischer AG

- Alcoa Corporation

- Endurance Technologies

- Pace Industries

- Rockman Industries

- Idra Group

- KSM Castings Group

- Sunrise Metal

- Goebels Metallverarbeitung

- Zetwerk

The automotive metal die casting market is highly competitive, with major players like Nemak, Ryobi Die Casting, and Dynacast leading through strong manufacturing and new technology. In April 2024, Endurance Technologies expanded its aluminum die casting and machining operations for four-wheeler parts. Around the same time, Ryobi invested $50 million in its Mexico plant to increase production of EV parts. These actions show the industry’s efforts in shifting toward lightweight, high-performance components, especially for electric vehicles.

The table below consists of the top companies leading the automotive metal die casting market.

Recent Developments

- In April 2024, Endurance Technologies announced plans to enhance its aluminum die casting and machining capacities at its Chakan facility in Pune, India. The expansion involves installing new high-end technology machines to produce machined clutch and transmission housings for four-wheelers. The project, with an investment of INR 631 million, aims to increase production by 8,300 casting parts per month.

- In October 2023, L.K. Technology introduced a 16,000-ton super-large intelligent die casting machine, marking a significant advancement in clamping force capabilities. This machine is the largest of its kind globally and is designed to produce large integrated die-casting structural parts for new energy vehicles.

- Report ID: 4120

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Metal Die Casting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.