Global Automotive Aftermarket Fuel Additive Market

- An Outline of the Global Automotive Aftermarket Fuel Additive Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Automotive Aftermarket Fuel Additive

- Recent News

- Regional Demand

- Global Automotive Aftermarket Fuel Additive by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Automotive Aftermarket Fuel Additive Demand Landscape

- Global Automotive Aftermarket Fuel Additive Demand Trends Driven by Maintenance of vehicles, Sustainability and Stringent Regulations (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Automotive Aftermarket Fuel Additive Porter Five Forces

- PESTLE

- Comparative Positioning

- Automotive Aftermarket Fuel Additive– Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- BASF

- Clariant

- DHALOP CHEMICALS

- Huntsman International LLC Kollmorgen

- LIQUI MOLY GmbH

- Qingdao IRO Surfactant Co., Ltd

- Rislone

- TIANJIN ZHONGXIN CHEMTECH CO., LTD. (ZX CHEMTECH)

- Business Profile of Key Enterprise

- Global Automotive Aftermarket Fuel Additive Market Outlook

- Market Overview

- Market Revenue by Value (USD Thousand), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Global Segmentation Automotive Aftermarket Fuel Additive Analysis (2026-2036)

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Thousand), 2026-2036

- North America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Market Overview

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- U.S. Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Overview

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- UK Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- China Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Overview

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Brazil Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- By Additive Type

- Deposit Control Additive, Market Value (USD Thousand), and CAGR, 2026-2036F

- Octane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cetane Improvers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel System Cleaners, Market Value (USD Thousand), and CAGR, 2026-2036F

- Fuel Stabilizers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Anti-Gelling Additives, Market Value (USD Thousand), and CAGR, 2026-2036F

- Corrosion Inhibitors, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Fuel Type

- Gasoline, Market Value (USD Thousand), and CAGR, 2026-2036F

- Diesel, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Distribution Channel

- E-commerce, Market Value (USD Thousand), and CAGR, 2026-2036F

- Big Retail Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- 4S Stores, Market Value (USD Thousand), and CAGR, 2026-2036F

- Unauthorized Spare Part Shop, Market Value (USD Thousand), and CAGR, 2026-2036F

- Independent Service Centers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Gas Stations, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Saudi Arabia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Additive Type

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

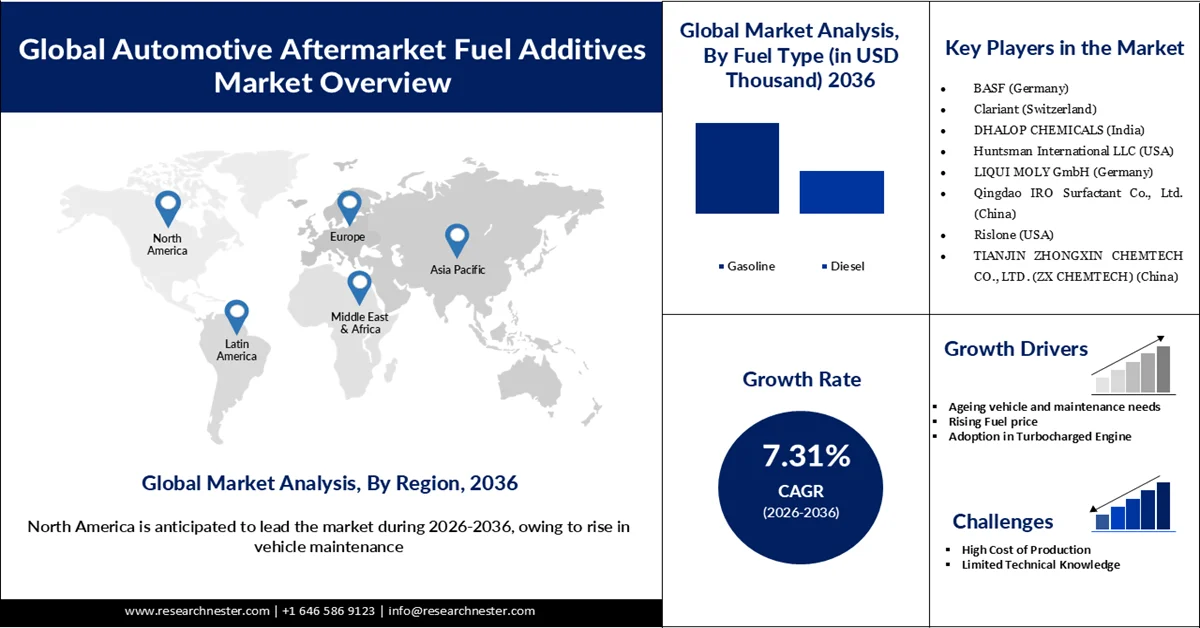

Automotive Aftermarket Fuel Additives Market Outlook:

Automotive Aftermarket Fuel Additives Market size is valued at USD 2.19 billion in 2025 and is forecasted to reach a valuation of USD 4.89 billion by the end of 2036, rising at a CAGR of 7.31% during the forecast period, i.e., 2026-2036. In 2026, the industry size of the automotive aftermarket fuel additive is estimated at USD 2.41 billion.

Rising emission norms across the regions have fuelled the adoption of the automotive aftermarket fuel additives market. Regional governments are pushing consumers to service their cars, which would reduce CO2 emissions and enhance environmental protection. Vehicles with time tend to deposit carbon content, which can increase fuel consumption and can increase emissions, leading to the usage of additives that can reduce emissions from the vehicles and can minimize damage to the environment. In August 2025, Afton Chemical introduced an advanced fuel additive that controls the deposit and enhances engine efficiency. The Euro 6 regulation in Europe and EPA regulations in the U.S. have significantly improved the scope of the automotive aftermarket fuel additives market, as these regulations pressure consumers to limit emissions by ensuring proper maintenance of engines.

Key Automotive Aftermarket Fuel Additives Market Insights Summary:

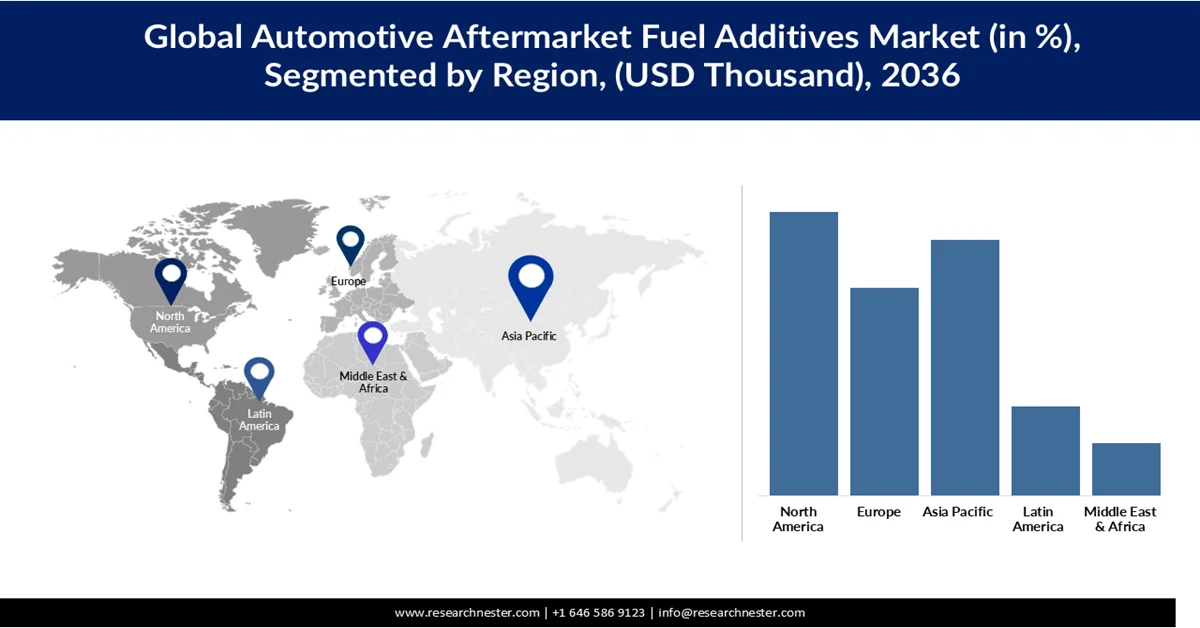

Regional Highlights:

- By 2036, Asia Pacific is anticipated to command a 31.9% share of the automotive aftermarket fuel additives market, driven by rising fuel prices and increasing reliance on gasoline and diesel additives to enhance mileage and engine longevity.

- North America is projected to secure a 28.8% share by 2036, supported by a growing vehicle population and stringent environmental regulations encouraging frequent engine maintenance and additive usage.

Segment Insights:

- By 2036, the deposit control additive system is expected to account for a 24.1% share in the automotive aftermarket fuel additives Market, driven by its extensive use in removing carbon deposits and enhancing fuel efficiency while meeting emission norms.

- By 2036, the gasoline segment is projected to dominate with a 67.7% share, propelled by its widespread application in improving engine health, protecting octane levels, and optimizing fuel system performance.

Key Growth Trends:

- Ageing vehicle and maintenance needs

- Rising fuel prices

Major Challenges:

- High cost of production

- Limited technical knowledge

Key Players: BASF (Germany), Clariant (Switzerland), DHALOP CHEMICALS (India), Huntsman International LLC (U.S.), LIQUI MOLY GmbH (Germany), Qingdao IRO Surfactant Co., Ltd. (China), Rislone (U.S.), TIANJIN ZHONGXIN CHEMTECH CO., LTD. (ZX CHEMTECH) (China)

Global Automotive Aftermarket Fuel Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.19 billion

- 2026 Market Size: USD 2.41 billion

- Projected Market Size: USD 4.89 billion by 2036

- Growth Forecasts: 7.31% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.9% Share by 2036)

- Fastest Growing Region: Europe

- Dominating Countries: Countries: United States, China, Germany, Japan, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Thailand

Last updated on : 16 February, 2026

Automotive Aftermarket Fuel Additives Market - Growth Drivers and Challenges

Growth Drivers

- Ageing vehicle and maintenance needs: Consumers use vehicles for a prolonged time, that demand for frequent maintenance to improve engine performance and enhance the longevity of the vehicle's operation. Fuel additives are added to the engine to protect the pistons and essential fast-moving components. Aftermarket polytheramine detergents support the expansion of the lifespan and restore the performance of the vehicles. In the U.S., average vehicle age increased from 12.6 years in 2024 to 12.8 years in 2025, demonstrating the rising improvement in maintenance in engines, enhancing the growth of the automotive aftermarket fuel additives market.

- Rising fuel prices: Globally, crude prices have increased, leading to massive price increases impacting the growth of the automotive aftermarket fuel additive that maximises fuel efficiency and minimises combustion carbon. Beaureu of Transportation Statistics claimed average prices for regular gasoline were USD 3.08 per gallon in January 2025, demonstrating rising prices of fuels, demanding the use of automotive aftermarket fuel additives to enhance vehicle efficiency and reduce cost. In the UK, the prices of petrol and diesel have increased by 2.8% and 4.3% in 2024, which again makes it challenging for consumers to afford, considering the average fuel efficiency of the economic cars. Fuel additives enhance average fuel efficiency by eliminating carbon, thus enhancing the growth of the automotive aftermarket fuel additives market.

- Adoption in turbocharged engine: Passenger vehicles are equipped with economical engines that are made to deliver minimal power and higher efficiency. However, modern SUVs and vans are equipped with direct injection and turbochargers that require frequent cleaning using synthetic additives, as carbon deposits on the injector valve can reduce power and performance significantly. As per the 2024 EPA reports, gasoline-based turbocharged engines accounted for more than 35% of all produced models in 2023, demonstrating the rising domination. Turbocharged engines have become crucial to maintain power efficiency and are used in passenger vehicles to manage drive terrains.

Challenges

- High cost of production: The production of PEA-based additives is expensive because of the complex compounds and chemistries. The product requires extensive research and development, which elevates the price further and limits the adoption of automotive aftermarket fuel additives.

- Limited technical knowledge: Many independent automotive workshops have limited technical knowledge of the benefits of PEA-based aftermarket fuel additives, which limits the growth of the automotive aftermarket fuel additives market, increasing the reliance on company-based fuel additives, which cost more and include separate labour charges, which further elevate the cost.

Automotive Aftermarket Fuel Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

7.31% |

|

Base Year Market Size (2025) |

USD 2.19 billion |

|

Forecast Year Market Size (2036) |

USD 4.89 billion |

|

Regional Scope |

|

Automotive Aftermarket Fuel Additives Market Segmentation:

Additive Type Segment Analysis

The deposit control additive system is expected to hold automotive aftermarket fuel additives market share of 24.1% owing to its wide usage in treating the carbon deposits from the injectors and the valves that are exposed to the continuous flow of oil and air. PEA-based fuel additives are commonly used to restore the vehicle's performance and eliminate carbon deposits. PEA is also proven to increase fuel efficiency and reduce emissions in order to keep commercial and private vehicles aligned with the emission norms of the government. Polybutenyl amine-based additives further enhance the deposit control additive segment because of their properties in reducing injector fouling and loss of power.

Fuel Type Segment Analysis

The gasoline segment will hold the largest share of 67.7% owing to its use in enhancing engine health, protecting octanes, and enhancing the vehicle fuel system. In August 2025, Afton Chemical launched the HiTEC 65522 series, approved by TOP TIER+ gasoline, which eliminates the deposit risks and enhances the engine performance. The diesel fuel additive will also hold a significant opportunity in the future because of its lubrication and system-cleaning potential. Diesel engines tend to have higher combustion, which leads to increased emissions. The additives can effectively mitigate the carbon deposit and extend the life of the engine.

Distribution Channel Segment Analysis

The 4S segment will hold a automotive aftermarket fuel additives market share of 31.9% due to the track of excellence in maintenance standards and consumer trust in the OEM-based additives and services. Customers can rest assured of the quality backed by a warranty. Furthermore, certified technicians and serving bundling further push the consumers toward authorized deal-based additives. Authorized dealers often recommend the correct additives depending upon the vehicle, which further improves the vehicle's engine health, expanding the market. The e-commerce segment will also hold a significant share owing to high availability, price comparison, and updated stocks that help vehicle owners to rely on the segment, expanding the market potential.

Our in-depth analysis of the global automotive aftermarket fuel additives market includes the following segments:

|

Segments |

Subsegments |

|

Additive Type |

|

|

Fuel Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Aftermarket Fuel Additives Market - Regional Analysis

North America Market Insights

The automotive aftermarket fuel additives market under the region is expected to hold a share of 31.9% by the end of 2036. The region is experiencing a rise in fuel prices, which is driving the use of gasoline and diesel-based additives to enhance the octane and increase the mileage of the vehicles. The region also experiences regular traffic congestions which leads to pressure on certain vehicle engine component leading to early decay. The use of PEA-based additives can enable longer operation of the vehicle and minimized decaying of the engine components. North America has also accelerated the use of turbocharger engines within the modern passenger vehicle, which increases efficiency, requiring thorough cleaning of the injector values leading to higher adoption of automotive aftermarket fuel additives.

The U.S. is aiming to minimize emissions and focus on enhancing sustainability to meet the rising pollution levels. The addition of fuel-based additives reduces emissions and enhances engine health, leading to widespread adoption of aftermarket fuel additives. OEM manufacturers have their own established authorized service stations. Further, Canada is experiencing expensive fuel prices, which are leading to a decline in vehicle usage. After-market additives help in increasing the average fuel efficiency, enhancing the scope of the market. The additives also ensure a cleaner system component that helps in enhancing the engine life and curbs the emissions that align with the goals of the government.

Asia Pacific Market Insights

The automotive aftermarket fuel additives market in the region is expected to hold a share of 28.8% by the end of 2036, owing to an increasing population with various vehicle types, which require frequent servicing, including engine maintenance that demands additives to minimize the environmental pollution from the cars. Certain countries within the region have laid strong policies and regulations that enhance the adoption of automotive aftermarket fuel additives. PEA-based additives are proven to minimize corrosion and enhance engine health. The presence of key players in the market is supporting the growth of innovation and product development, fuelling the growth of the automotive aftermarket fuel additives market.

China has seen a surge in population levels, which is propelling the growth of the market as the population use vehicle to commute to different destinations, demanding regular engine check-ups and the addition of engine oils and engine cetane to enhance the lubrication process, and increasing the health of the engine. The sudden spike in the population levels and the demand for vehicles has significantly fuelled the expansion of the automotive aftermarket fuel additive. India has witnessed a rise in disposable income, which is fueling the growth of vehicle ownership. India is a booming market for four and two-wheeler vehicles, which has raised the demand for additives. The growth of two-wheelers within the region has significantly fuelled the need for environmental protection measures that can be obtained by additives. The prices of fuel have also increased significantly over the past that demonstrates the need of additive to increase vehicle efficiency and reduce fuel consumption.

Europe Market Insights

The region is expected to hold a share of 23.4% because of the rising sustainability and emission control norms. Europe has laid strict regulations regarding vehicle maintenance in order to curb the emissions and pollution arising from non-service cars. OEM service centres are being pushed to enhance the sales of additives within the vehicle to minimise the impact on the environment. The European Union’s measures to control pollution have elevated the growth of fuel additives as they can effectively support in cleaning the carbon deposits and enhance the performance of the vehicles. Europe is also witnessing a rise in high-value cars, which require synthetic PEA-based additives to remove sustained carbon particles and enhance the oil filtration process to enable more power.

Germany holds a vast automotive market, which witnesses a large number of ageing vehicle that requires servicing and maintenance. The authorised service centres focus on engine performance and carbon deposits as a first step towards vehicle maintenance, where additives are often recommended to reduce carbon deposits and enhance engine health, leading to enhanced growth of the market. The UK has addressed sustainability, where it has urged manufacturers to employ efficient components that can limit environmental degradation while maintaining power. The use of turbochargers in vehicles has increased, leading to lower emissions and higher power management. The turbochargers demand frequent cleaning through PEA additives as they intake external air and combine with combustion to deliver higher power.

Key Automotive Aftermarket Fuel Additives Market Players:

- BASF (Germany)

- Clariant (Switzerland)

- DHALOP CHEMICALS (India)

- Huntsman International LLC (U.S.)

- LIQUI MOLY GmbH (Germany)

- Qingdao IRO Surfactant Co., Ltd. (China)

- Rislone (U.S.)

- TIANJIN ZHONGXIN CHEMTECH CO., LTD. (ZX CHEMTECH) (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF: The organization is one of the largest chemical production companies across the globe with a range of products including speciality chemicals and performance chemicals. The fuel additive of the company is believed to enhance engine performance and improve vehicle efficiency. The products are sustainable and are aimed towards reducing environmental degradation.

- Clariant: A global leader in manufacturing and speciality chemicals, with key areas of service that include automotive. It specializes in fuel additives and lubricants for automotive engines to eliminate carbon deposits and enhance vehicle performance. The business is highly engaged in innovation and sustainability, resulting in eco-friendly product manufacturing.

- DHALOP CHEMICALS: The business focuses on speciality chemicals and fuel additives for automotive applications. The products are aimed towards minimising engine corrosion and increasing fuel efficiency. The products manufactured by the business are a cost-effective solution for vehicle owners.

- Huntsman International LLC: A popular manufacturer of fuel additives and lubricants for automotive demands. The business has developed products keeping in mind the environmental sustainability and degradation-free products that enhance the additive significantly.

Below is the list of the key players operating in the automotive aftermarket fuel additives market:

The players operating in the global automotive aftermarket fuel additives market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the automotive aftermarket fuel additives market are significantly supported by the governments for research and innovation.

Corporate landscape of the global automotive aftermarket fuel additives market

Recent Developments

- In November 2025, ExxonMobil partnered with advanced methane pyrolysis for low-emission hydrogen production, which was demonstrated in a plant in Texas. The companies will collaborate with technology and innovation to codevelop the pyrolysis technology.

- In October 2025, Clariant completed the expansion of CHF 100 million at the Daya Bay facility in China with its Exolit OP flame retardant aimed towards the growth of electric mobility.

- Report ID: 390

- Published Date: Feb 16, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Aftermarket Fuel Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.