Automotive Engine Oil Market Outlook:

Automotive Engine Oil Market size was valued at USD 41.6 billion in 2025 and is projected to reach USD 57.1 billion by the end of 2035, rising at a CAGR of 3.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive engine oil is evaluated at USD 43.1 billion.

The global market is primarily driven by the increasing demand for internal combustion engine vehicles in operation and spare parts maintenance cycles, which directly associates with engine oil consumption for service and replacement. In this context, the U.S. Highway Statistics 2023 report showcased the continued prevalence and usage of internal combustion engine vehicles, highlighting the heightened demand for automotive engine oil. It also mentioned that there has been a total of 284.6 million registered vehicles in 2023, which included 197.1 million light-duty vehicles and more than 11.5 million buses and trucks. The operational fleet sustains high maintenance needs. Moreover, the average travel per vehicle was 11,408 miles, which indicates that substantial ongoing engine utilization driving routine lubrication requirements.

U.S. Highway Vehicle and Fuel Consumption Statistics, 2023

|

Category |

Registered Vehicles |

Average Miles per Vehicle |

Fuel Consumed (thousand gallons) |

Average MPG |

|

Light Duty Vehicles |

197,134,299 |

11,026 |

88,145,179 |

24.7 |

|

Motorcycles |

9,516,910 |

2,121 |

459,065 |

44.0 |

|

Buses |

967,525 |

18,295 |

2,396,495 |

7.4 |

|

Single-Unit Trucks |

62,103,995 |

11,360 |

39,334,720 |

17.9 |

|

Combination Trucks |

3,324,112 |

58,890 |

29,296,989 |

6.7 |

|

Total All Motor Vehicles |

284,614,269 |

11,408 |

176,795,288 |

18.4 |

Source: FHWA

Furthermore, the article published by ARF in September 2023 reported that in a span of one year, India’s oil imports from Russia surged from 1% to 40% of its total crude imports, the government saving approximately USD 3.6 billion in FY 2022‑23, whereas private refiners saved USD 7.6 billion. It also mentioned that India-based firms exported 3.8 million tons of processed Russian crude to Europe, thereby generating USD 20 billion in revenues for Russia and supporting its foreign exchange reserves. Meanwhile, investments in Russian energy projects have faced temporary operational halts owing to Western sanctions, but India continues to benefit from discounted crude prices and strengthened energy security. Hence, the bilateral energy partnership remains a strategic cornerstone, balancing geopolitical shifts and Western-imposed price caps thereby fostering long-term economic collaboration, stimulating progress in the market. Also, imports of lube oil are supporting the growth of the market by providing high-quality base stocks for lubricant production.

Monthly Imports of Lube Oil (LOBS) in India 2025-2026 (‘000 Metric Tonnes)

|

Month |

LOBS / Lube Oil Imports ('000 MT) |

|

April 2025 |

296 |

|

May 2025 |

243 |

|

June 2025 |

259 |

|

July 2025 |

261 |

|

August 2025 |

243 |

|

September 2025 |

298 |

|

October 2025 |

242 |

|

November 2025 |

232 |

|

Total |

2,073 |

Source: PPAC

Key Automotive Engine Oil Market Insights Summary:

Regional Highlights:

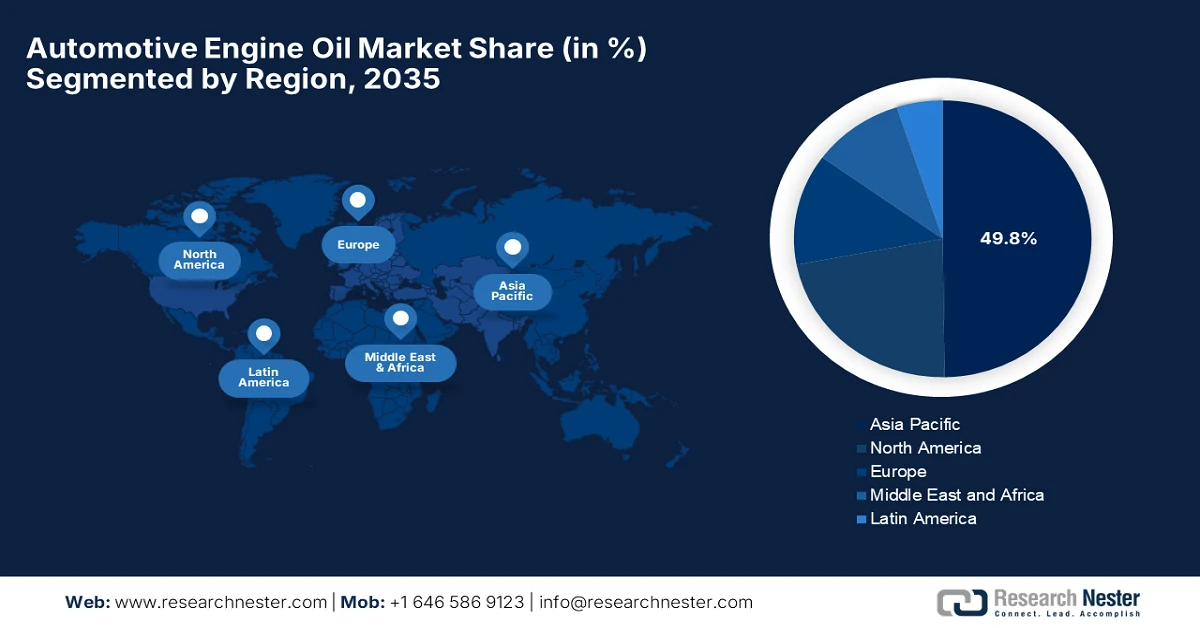

- Asia Pacific is expected to command the leading position with a 49.8% revenue share by 2035 in the automotive engine oil market, reinforced by strategic capacity expansions and portfolio strengthening initiatives by major lubricant manufacturers across key economies

- China is witnessing accelerated market expansion through 2035, supported by surging passenger and commercial vehicle demand alongside collaborative product innovation and localized technology development

Segment Insights:

- Passenger cars are projected to account for a dominant 55.5% revenue share by 2035 in the automotive engine oil market, supported by the escalating consumer inclination toward passenger vehicles and their recurring engine maintenance requirements

- 10W-60 oil is anticipated to expand at a notable pace over the 2026–2035 forecast period, stimulated by rising adoption in high-performance engines operating under extreme load and temperature conditions

Key Growth Trends:

- Demand for high-performance & premium lubricants

- Stringent emission regulations & fuel-efficiency standards

Major Challenges:

- Transition to electric vehicles

- Extended oil drain intervals

Key Players: ExxonMobil (Mobil 1) (U.S.), Chevron (Havoline) (U.S.), Valvoline Inc. (U.S.), Advance Auto Parts (ARGOS) (U.S.), Royal Dutch Shell (Shell Helix) (Netherlands / UK), BP / Castrol (UK), TotalEnergies (Total Quartz) (France), Fuchs Petrolub SE (Germany), Petronas Lubricants International (Malaysia), Idemitsu Kosan Co., Ltd. (Japan), JX Nippon Oil & Energy Corporation (Japan), Liqui Moly GmbH (Germany), GS Caltex (South Korea), Gulf Oil Lubricants India Ltd. (India), Penrite Oil Company (Australia), MOBIL Industrial Lubricants (ExxonMobil) (U.S.), Kixx Lubricants (GS Caltex) (South Korea), Indian Oil Corporation Ltd. (Servo) (India), Eni S.p.A. (Agip/Eni i-Sint) (Italy), Repsol Lubricants (Spain).

Global Automotive Engine Oil Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 41.6 billion

- 2026 Market Size: USD 43.1 billion

- Projected Market Size: USD 57.1 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.8% Share by 2035)

- Fastest Growing Region: China

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: India, China, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Automotive Engine Oil Market - Growth Drivers and Challenges

Growth Drivers

- Demand for high-performance & premium lubricants: Rising consumer awareness about engine maintenance, and growing disposable incomes, especially in emerging markets, are increasing demand for high-quality synthetic and semi-synthetic oils that extend engine life and improve performance. In this regard, Castrol India Limited in June 2024 reported that it has unveiled an expanded Castrol EDGE range of premium high-performance engine oils for passenger cars. The launch introduced three new synthetic variants, i.e., EDGE hybrid, EDGE euro car, and EDGE SUV, which are engineered to exceed the highest industry standards and deliver at least 30% improved performance. It is backed by a high-visibility national campaign wherein Castrol explicitly linked product innovation with India’s increasing preference for premium, high-quality engine oils, hence benefiting the automotive engine oil market.

- Stringent emission regulations & fuel-efficiency standards: Administrative bodies across the globe are pushing manufacturers to adopt low-viscosity and low-friction oils that help reduce emissions and meet fuel-economy driving business in the market. Testifying to this, the American Petroleum Institute illustrates how stringent emission and fuel-efficiency standards are shaping lubricant requirements through the introduction of API SQ in March 2025, which aligns with ILSAC GF-7A and emphasizes improved fuel economy, enhanced emission-control system protection, and low-temperature pumpability. Besides, the API SQ and earlier progressive categories, such as SP, SN, and others, show a clear regulatory-driven evolution toward low-viscosity, low-friction oils which are designed for modern engines, ethanol-containing fuels (up to E85), and tighter emissions compliance.

- Engine technology advancements: The aspect of modern engines, such as turbocharged, direct-injection engines have the capability to operate at higher pressures and temperatures. This, in turn, necessitate formulations to reduce friction and enhance fuel efficiency. In this regard, in August 2025, TotalEnergies Marketing India Pvt Ltd announced that it has launched the new Quartz engine oil range in India, which is certified to the latest API SQ and ILSAC GF‑7 standards, especially designed for modern engines, such as turbocharged and gasoline direct injection systems. Besides, the company also notes that these advanced lubricants are engineered to operate under higher pressures and temperatures, thereby providing up to 40% improved LSPI protection, better timing chain wear, enhanced piston cleanliness, and up to 16% improved fuel efficiency. It is also compatible with older engines, hence benefiting the automotive engine oil market.

Challenges

- Transition to electric vehicles: The increasing adoption of electric vehicles is hampering growth in the market since EVs do not require engine oil. Governments across the world are promoting EV adoption through suitable subsidies, emission regulations, and a ban on internal combustion engine (ICE) vehicles. Therefore, this shift reduces the demand for engine oils, which are used in passenger cars and commercial vehicles. In addition, automotive manufacturers are continuously making investments in the EV platforms, in turn causing obstacles to the ICE vehicle production. Further, as EV penetration increases, engine oil manufacturers must diversify into alternative lubricants, such as transmission fluids and thermal management oils, to sustain long-term growth.

- Extended oil drain intervals: Advancements in terms of engine technology and lubricant formulations increased the oil drain intervals, reducing the frequency of oil changes. Besides the modern synthetic and semi-synthetic engine oils, which report superior thermal stability, oxidation resistance, and wear protection, allowing vehicles to operate longer between oil replacements. In this context, automotive manufacturers currently recommend extended service intervals, sometimes exceeding 15,000 kilometers, which directly lowers overall oil consumption per vehicle. This trend is especially visible in developed markets where newer vehicles dominate the fleet. Meanwhile, this aspect of extended drain intervals might benefit consumers, but it’s a major challenge for manufacturers in the automotive engine oil market, who must compensate through premium pricing or value-added products.

Automotive Engine Oil Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 41.6 billion |

|

Forecast Year Market Size (2035) |

USD 57.1 billion |

|

Regional Scope |

|

Automotive Engine Oil Market Segmentation:

Application Segment Analysis

The passenger car will lead, capturing the largest revenue share of 55.5% in the automotive engine oil market over the forecasted years. The ever-increasing consumer preference for passenger cars is the key driving factor behind this dominance. Besides the rising sales of passenger vehicles, coupled with the need for regular maintenance to keep engines in optimal condition, continue to boost the demand. In this context, FRED reported that in March 2022, India registered approximately 167,309 passenger cars in retail trade, according to seasonally adjusted monthly data for car registrations. This figure reflects ongoing consumer demand for passenger vehicles in one of the world’s largest automotive sectors, which directly supports sustained growth in automotive engine oil consumption due to the maintenance needs of this expanding vehicle fleet, hence denoting a wider segment scope.

Product Segment Analysis

In the product segment, 10W-60 oil is expected to grow at a considerable rate in the market during the discussed timeframe. The growth of the subtype is due to its engineering to deliver excellent engine protection and performance under very harsh conditions. In September 2025, MANNOL reported that it had launched its 4-Takt Motorbike 10W‑60, which is a high-performance, ester-based engine oil especially designed for demanding sport and off-road four-stroke engines. In addition, the fully synthetic formulation ensures stable lubrication under extreme loads and temperatures, supports wet-clutch performance, and maintains engine cleanliness and longevity across a wide temperature range. Hence, this launch highlights growing demand for specialized 10W‑60 oils that protect modern high-stress engines in motorcycles, quads, and other light vehicles, reflecting broader trends in high-performance engine maintenance.

Performance Standard Segment Analysis

By the conclusion of 2035, the API/ILSAC-certified oils segment is expected to capture a significant revenue share in the automotive engine oil market. These are the current certified performance frameworks for automotive engine oils, which are used in gasoline engines, setting the benchmarks that most new oils must meet. They ensure optimal engine protection, improved fuel efficiency, and reduced emissions, aligning with the international regulatory requirements. In addition, the widespread consumer awareness and manufacturer recommendations continue to drive the adoption of certified oils, reinforcing their prominent position in this field. As engine technologies evolve, these standards guide the development of advanced formulations, which also include synthetic and high-performance oils that meet the demands of modern vehicles. Furthermore, the certified oils support the longevity and reliability of engines, making them a preferred choice for both OEMs and end-users across the globe.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Product |

|

|

Performance Standard |

|

|

Sales Channel |

|

|

Base Oil Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Engine Oil Market - Regional Analysis

APAC Market Insights

The Asia Pacific automotive engine oil market is predicted to dominate the entire global landscape, capturing the largest revenue stake of 49.8% by the end of 2035. The region’s dominance in this field is mainly fueled by the presence of major pioneers, each with distinct developmental strategies. In July 2025, Shell Lubricants reported that it had completed its acquisition of Raj Petro Specialities Pvt. Ltd., enhancing its lubricants portfolio and expanding its customer base in India, which is a key growth market. Therefore, this acquisition strengthens Shell’s presence across sectors such as automotive, power transmission, and pharmaceutical, while enabling new synergies and economies of scale within the lubricants value chain. In addition, Shell aims to leverage this complementary product range to drive further growth and maximize value in line with its strategic focus on performance and simplification.

China market is growing at a rapid pace on account of heightened demand for passenger and commercial vehicles. The country’s market also benefits from strict government regulations and the continuously rising vehicle population. In this regard, Tuhu and FUCHS China in March 2025 reported that they have signed a strategic cooperation agreement to jointly develop and launch the PENTOSIN series of engine and transmission oils that are suitable for the country’s market. The collaboration emphasizes product innovation, technology R&D, and service upgrades, introducing the precision oil change concept that provides car owners with customized maintenance plans and high-quality service guarantees. Additionally, the partnership launched the HYLUBS standard for hybrid vehicles to make sure that oils meet strict requirements for environmental protection, durability, and compatibility.

India automotive engine oil market has gained increased exposure over recent times owing to the strong economic expansion and shifting demographic trends. Additionally, increasing urbanization and a rising population with a growing preference for motorcycles, cars, SUVs, and other passenger vehicles are also fueling demand in the country. In this context, the Ministry of Commerce & Industry, in March 2025, reported that India’s automobile sector contributed approximately 6% to the national GDP, with vehicle production growing from 2 million in 1991-92 to 28 million in 2023-24. The report also underscored that passenger vehicles and two-wheelers contributed to production, wherein the exports reached 4.5 million units in 2023-24. It also noted that 4.4 million electric vehicles were registered, achieving 6.6% market penetration, supported by government schemes such as PLI & PM E-DRIVE.

Automotive Production and Component Statistics Driving India’s Automotive Engine Oil Sector (FY 2023-24 to 2026)

|

Parameter |

Value / Statistic |

|

Vehicle production (FY 2023-24) |

28 million units |

|

Passenger vehicles produced |

6.72 million units |

|

Two-wheelers produced |

3.45 million units |

|

FDI inflow in the auto sector (past 4 years) |

USD 36 billion |

|

Auto component sector turnover (FY24) |

₹6.14 lakh crore (USD 74.1 billion) |

|

Auto component exports (FY24) |

USD 21.2 billion (projected USD 30 billion by 2026) |

|

Jobs supported by the auto industry |

30 million (Direct: 4.2 million, Indirect: 26.5 million) |

Source: Ministry of Commerce & Industry

North America Market Insights

The North America market is anticipated to experience significant growth since it caters to diverse vehicle types such as passenger cars, light-duty trucks, heavy-duty vehicles, and off-road bikes, reflecting the varied maintenance needs in the region. In October 2025, LIQUI MOLY announced that it had begun local motor oil production in the U.S., marking a significant step in serving the U.S. aftermarket more efficiently. Besides, the new facility produces formulations that are suitable for heavy-duty vehicles as well as passenger cars, initially supplied in bulk containers with plans for smaller consumer packaging. This initiative has allowed the company to reduce delivery times, lower transportation costs, and respond more flexibly to local demand, all while maintaining the high German-quality standards that LIQUI MOLY is known for globally. Furthermore, the move also strengthens LIQUI MOLY’s footprint in North America and enhances its ability to support workshops and distributors with suitable solutions.

The U.S. automotive engine oil market is a major contributor for the regional growth influenced by continued technological advancements and innovations. The country’s market also benefits from the operational expansions, rise of high-performance engines, turbocharged systems which are requiring specialized oil formulations is driving demand and supporting overall market growth. In March 2023, Saudi Aramco reported that it completed the USD 2.65 billion acquisition of Valvoline Inc.’s global products business - Valvoline Global Operations, which is headquartered in Kentucky, U.S. This acquisition enables Aramco to expand its lubricants business internationally, leveraging its base oil production and R&D capabilities, whereas Valvoline Inc. continues to focus on its retail services business. The deal strengthens Aramco’s global footprint in automotive and industrial lubricants, enhances relationships with OEMs, and positions Valvoline Global operations as a key multinational lubricant brand under Aramco ownership.

Canada is growing in the automotive engine oil market on account of harsh climatic conditions, requiring oils that perform reliably across a wide temperature range. The increasing focus on fuel efficiency and adherence to environmental regulations promotes the adoption of advanced low-viscosity oils. TotalEnergies Marketing Canada Inc. in August 2025, announced the launch of Quartz 0W-12, which is a engine oil for the latest BMW engines. This very low viscosity formulation reduces internal friction, optimizes fuel consumption, and prolongs engine life, particularly in hybrid and electric vehicles. This product supports TotalEnergies’ broader strategy for sustainable mobility and carbon neutrality by the end of 2050, offering high performance under extreme operating conditions while remaining compatible with hybrid technologies, hence making it suitable for standard market growth.

Europe Market Insights

Europe automotive engine oil market has gained momentum positively influenced by strict emission regulations and fuel efficiency standards. Consumers and fleet operators in this region prefer premium and fully synthetic oils that ensure engine durability and comply with regulatory requirements. In July 2024, TotalEnergies reported that it had acquired Tecoil, which is a Finnish specialist in re-refined base oils, thereby enhancing its circular economy approach for lubricants in Europe. Tecoil’s facility in Hamina produces 50,000 tons of high-quality RRBOs on a yearly basis through an efficient used oil regeneration process, supplying sustainable base oils that reduce the carbon footprint of lubricants while also maintaining performance standards. Thus, this acquisition enables TotalEnergies to accelerate the integration of recycled base oils into its high-end lubricants, meeting growing customer demand for environmentally friendly products and advancing sustainability goals.

Germany automotive engine oil market is mainly driven by strong automotive manufacturing sector and high-performance vehicle ownership. OEMs and service networks in the country promote certified oils that support turbocharged and direct-injection engines. In November 2025, FUCHS SE announced that it has launched TITAN GT1 FLEX DE SAE 5W‑30, which an engine oil especially designed to meet the specifications of major German-based OEMs which includes BMW, Mercedes‑Benz, Opel, and Volkswagen. It also mentioned that the oil is universally applicable for both diesel and petrol engines, offering excellent cold-start performance, fuel efficiency, and protection for exhaust aftertreatment systems. In addition, it also supports selected hybrid vehicles, making it ideal for workshops servicing multiple Germany’s automotive brands, hence denoting a positive market outlook.

The UK automotive engine oil market has gained immense exposure over recent years, owing to both domestic passenger vehicle ownership and commercial transportation needs. The country’s market also benefits from growing awareness of engine maintenance and environmental sustainability, which drives heightened demand for fully synthetic and high-performance lubricants. In this regard, in June 2025, Castrol UK, in partnership with its distributor The Race Group, showcased its complete range of automotive lubricants and workshop services at Automechanika Birmingham by highlighting products for petrol, diesel, and hybrid vehicles, which includes the Castrol ON EV product line for electric vehicles. Furthermore, the event emphasized engine protection, fuel efficiency, and environmental sustainability, thereby offering technical guidance, digital solutions, and training opportunities to workshops across the UK.

Key Automotive Engine Oil Market Players:

- ExxonMobil (Mobil 1) (U.S.)

- Chevron (Havoline) (U.S.)

- Valvoline Inc. (U.S.)

- Advance Auto Parts (ARGOS) (U.S.)

- Royal Dutch Shell (Shell Helix) (Netherlands / UK)

- BP / Castrol (UK)

- TotalEnergies (Total Quartz) (France)

- Fuchs Petrolub SE (Germany)

- Petronas Lubricants International (Malaysia)

- Idemitsu Kosan Co., Ltd. (Japan)

- JX Nippon Oil & Energy Corporation (Japan)

- Liqui Moly GmbH (Germany)

- GS Caltex (South Korea)

- Gulf Oil Lubricants India Ltd. (India)

- Penrite Oil Company (Australia)

- MOBIL Industrial Lubricants (ExxonMobil) (U.S.)

- Kixx Lubricants (GS Caltex) (South Korea)

- Indian Oil Corporation Ltd. (Servo) (India)

- Eni S.p.A. (Agip/Eni i-Sint) (Italy)

- Repsol Lubricants (Spain)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil is a leading global oil and gas company and the creator of Mobil 1, which is one of the world’s most recognized synthetic engine oils. The company is focused on research and development, producing advanced lubricants that improve fuel efficiency, reduce engine wear, and extend oil drain intervals. In addition, ExxonMobil strongly emphasizes international distribution, technological innovation, and aftermarket penetration by also exploring sustainable and lower-carbon lubricants as part of its long-term corporate strategy.

- Chevron, through its Havoline brand, is a major player in this field, which offers mineral, synthetic blend, and fully synthetic oils for passenger cars and commercial vehicles. Besides, the company leverages proprietary additive technologies, such as Techron, to enhance engine cleanliness and performance. Chevron also makes investments in terms of brand marketing, OEM collaborations, and performance testing, strengthening customer trust and loyalty.

- Valvoline Inc. is based in the U.S. and is a lubricant manufacturer with a strong focus on consumer and professional automotive sectors. The company is best known for high-performance synthetic oils, and it integrates field research, professional technician insights, and rigorous testing into product development. Besides, the company operates both in retail and commercial service channels, which include quick-lube stores and partnerships with automotive workshops.

- Advance Auto Parts is a central player that has recently entered the market with its ARGOS brand, targeting the U.S. aftermarket with affordable, reliable oils for DIYers and professional technicians. ARGOS is focused mainly on customer-driven product development, responding to the growing demand for maintenance solutions in an aging U.S. vehicle fleet, positioning ARGOS as a cost-competitive alternative to established premium brands.

- Royal Dutch Shell is based in Europe and is identified as a frontrunner in automotive engine oils by offering products from conventional mineral oils to advanced fully synthetic formulations. The company mainly concentrates on technological innovation, OEM partnerships, and sustainability, wherein oils are especially designed for enhanced engine power, fuel efficiency, and reduced emissions. In addition, Shell Helix leverages international marketing campaigns, innovative packaging, and digital engagement to strengthen consumer awareness.

Below is the list of some prominent players operating in the global automotive engine oil market:

The global automotive engine oil market is fiercely competitive, which is hosting major multinationals and strong regional players who are constantly vying for both retail and professional segments. Leading companies are leveraging advanced synthetic and semi-synthetic formulations, fuel efficiency, and extended service intervals, alongside OEM partnerships. In this context, AMSOIL Inc., in May 2023, announced that it had acquired Benz Oil, which is a Milwaukee-based industrial and metalworking fluids company, expanding its AMSOIL Industrial business unit. Besides, the acquisition adds cutting and grinding fluids, process fluids, and specialty oils to AMSOIL’s existing portfolio of turbine, hydraulic, gear, and engine oils. Furthermore, Benz facilities and team will continue operations under the AMSOIL brand, strengthening expertise, consultative customer service, and industrial market presence by preserving the legacy and values of the 125-year-old family-owned business.

Corporate Landscape of the Automotive Engine Oil Market:

Recent Developments

- In January 2026, Advance Auto Parts announced that it had launched ARGOS, which is a new privately owned oil and fluids brand aimed at providing affordable, reliable, and high-performance automotive products for both DIY enthusiasts and professional technicians.

- In September 2025, BOSS Lubricants announced that it had acquired the CAMOil brand, which is best known for engine oils formulated for flat-bottom lifter engines in classic cars. The oils, blended by BOSS, combine last-century quality with today’s technology and serve the market of classic enthusiasts.

- In May 2025, Shell Helix unveiled new packaging and launched its global campaign unleash the power within for Shell Helix Ultra engine oil, which features drivers Charles Leclerc and Lewis Hamilton. The refreshed design emphasizes performance, convenience, and clear product information, reinforcing Shell Helix’s 75-year partnership with Scuderia Ferrari.

- In May 2025, Lubrizol announced that its heavy-duty diesel engine oil, Lubrizol CV1150, successfully met China’s GB D1 national specification, demonstrating long-term hardware protection and cost-efficiency over a 100,000-kilometer extended oil drain test.

- Report ID: 288

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Engine Oil Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.