Automotive Control Cable Market Outlook:

Automotive Control Cable Market size was valued at USD 5.9 billion in 2025 and is projected to reach USD 8.6 billion by the end of 2035, rising at a CAGR of 3.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive control cable is assessed at USD 6.1 billion.

The demand for the automotive control cable market is shaped by the production volumes across the automotive industry and regulatory requirements, which influence the vehicle reliability and safety. The OICA 2025 data depicts that the global motor vehicle production reached 10,562,188 units in 2024, reflecting a rise YoY and reinstating pre-pandemic output levels, an indicator directly correlated with the OEM level demand for mechanical control cables across the brake, clutch, throttle, and transmission systems. The increased investment in domestic manufacturing under the federal mobility and supply chain programs also aids higher production of locally tiered automotive components, including cables. Further, the vehicle parc expansion continues to support the aftermarket cable replacement segment. This strong production foundation ensures a steady baseline demand for the control cables, even as their specific applications and technical specifications are based on the new vehicle architectures.

Motor Vehicle Production 2024

|

Country |

Units |

|

China |

31 281 592 |

|

Poland |

555 346 |

|

Austria |

71 785 |

|

Algeria |

30 10 |

Source: OICA 2025

The regulatory policies around the durability, emissions, and vehicle safety are also influencing procurement and specification patterns for automotive control cables, mainly in commercial vehicle manufacturing. The data from the ACEA in 2025 has indicated that the EU’s commercial vehicle sales increased by 14.3% to 1 million units in the first three quarters of 2023, contributing to increased installation of high-durability mechanical cabling assemblies. Similarly, Japan’s automotive production also increased in the same year, driven by the strong export demand, suggesting a sustained purchasing requirement from the cable suppliers, aiding Japan's OEMs. Further, the electrification trends also maintain indirect relevance, although EVs reduce certain cable volumes, they retain mechanical cable applications in HVAC, door, seat, and latch systems. On the other hand, the government-backed vocational and manufacturing programs such as the U.S. Manufacturing Extension Partnership and EU industrial policy frameworks continue to report increased investments aimed at strengthening domestic automotive supply chains, aiding stable control cable sourcing and vendor qualification activity.

Key Automotive Control Cable Market Insights Summary:

Regional Highlights:

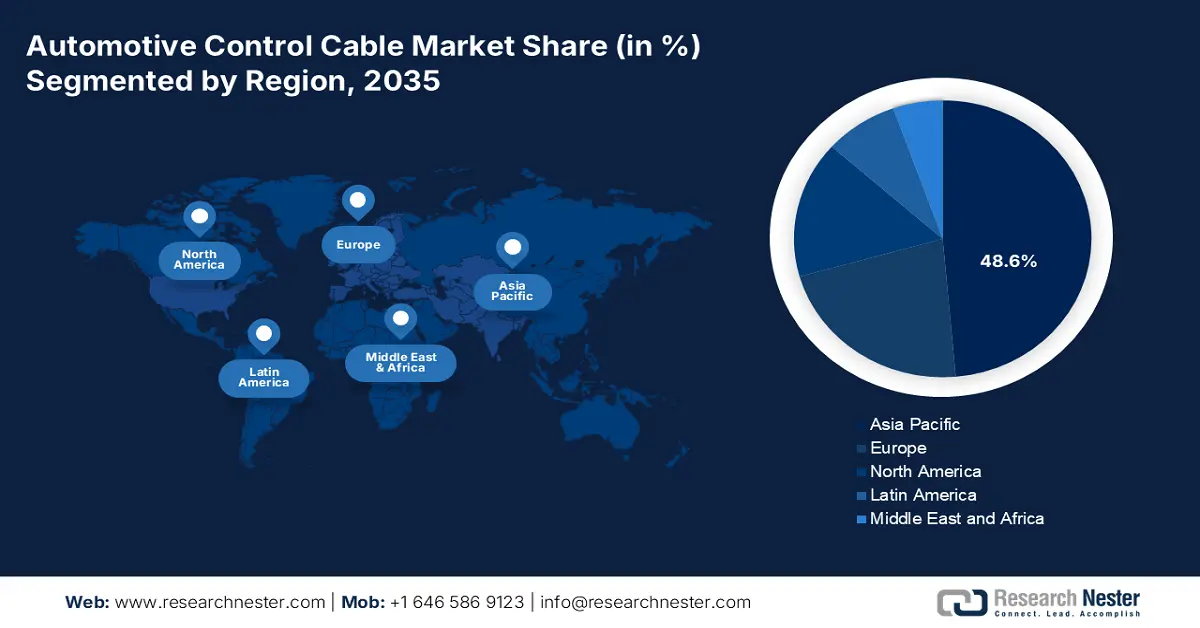

- By 2035, the Asia Pacific region in the automotive control cable market is expected to command a 48.6% revenue share, underpinned by its dominant vehicle production base and accelerating shift toward electric mobility.

- Europe is set to expand at a 4.1% CAGR from 2026-2035, propelled by stringent regulations and rapid EV-platform adoption that elevate demand for advanced control-cable systems.

Segment Insights:

- The passenger cars segment of the automotive control cable market is forecast to hold a 68.4% share by 2035, bolstered by expanding global vehicle production and rising consumer demand for comfort-enhancing cable-dependent systems.

- By 2035, the battery electric vehicles segment is positioned to capture a considerable share, reinforced by the development of innovative control-cable solutions tailored to BEV-specific architectures.

Key Growth Trends:

- Global expansion of electric vehicle production

- Government investment in EV charging infrastructure

Major Challenges:

- High R&D and capital investment

- Long and rigorous OEM qualification cycles

Key Players: Dura Automotive Systems (U.S.), Cable Manufacturing & Assembly Co. (U.S.), AGS Company (U.S.), Kongsberg Automotive (Norway), Ficosa Internacional SA (Spain), AB Elektronik Sachsen GmbH (Germany), Küster Holding GmbH (Germany), KISAB (Sweden), Magura (Germany), Aisin Seiki Co., Ltd. (Japan), Hi-Lex Corporation (Japan), Fujikura Ltd. (Japan), Yazaki Corporation (Japan), Daekyung Co., Ltd. (South Korea), NK Co., Ltd. (South Korea), Laxmi Associates (India), Makcute Cables Private Limited (India), SMT Cables Sdn Bhd (Malaysia), Robert Bosch GmbH (Germany), LEONI AG (Germany).

Global Automotive Control Cable Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.1 billion

- Projected Market Size: USD 8.6 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Thailand, Indonesia

Last updated on : 1 December, 2025

Automotive Control Cable Market - Growth Drivers and Challenges

Growth Drivers

- Global expansion of electric vehicle production: Governments' mandates the consumer incentives are stimulating the adoption of EVs, directly shaping the control cable demand. While the EVs eliminate some of the traditional cables, they create new high-value opportunities in electric shift by wire systems, thermal management controls, and battery disconnect units. The U.S. Energy Information Administration data in March 2024 states that the percentage of Battery EV share in the U.S. in 2023 was 1.07%, indicating a rapidly diversifying and growing automotive control cable market that requires specialized cable solutions. This growth line highlights a long-term shift in product mix away from purely mechanical components. The manufacturers must invest in developing high-durability and lightweight cables that are capable of handling electronic signals and harsh under-hood environments to remain competitive.

Battery Electric Vehicles Percentage Share in the U.S.

|

Year |

Percentage |

|

2020 |

0.37 |

|

2021 |

0.54 |

|

2022 |

0.80 |

|

2023 |

1.07 |

|

2024 |

1.36 |

|

2025 |

1.70 |

Source: EIA March 2024

- Government investment in EV charging infrastructure: A substantial public funding for charging networks is a vital driver in the automotive control cable market. Reliable infrastructure boosts the EV consumer confidence, increasing the sales and the demand for the EV-specific components. The report from the U.S. Department of Energy in February 2022 highlights that the DOE and DOT have announced USD 5 billion over five years for the National EV Charging Network. This initiative focuses on creating a convenient and reliable national network of DC fast chargers. The expansion of this infrastructure directly surges the adoption of electric vehicles that utilize the advanced control cables for shift by wire and thermal management systems. This federal spending further surges the upstream demand for specialized high-value cable assemblies from the automotive suppliers.

- Demand for enhanced vehicle safety and reliability: A strong global regulation on the safety and reliability of vehicles is the prime driver for innovation in the automotive control cable market. The regulatory bodies are mandating more robust systems, directly increasing the performance requirements for control cables used in critical functions such as the electronic parking brakes, transmission shift interlock systems, and the hood releases. This regulatory focus on the fail-safe operations compels manufacturers to invest in advanced materials and engineering to produce cables with superior durability, exceptional corrosion resistance, and extended lifecycle performance. This shift moves the automotive control cable market away from commodity products and creates a distinct segment for premium value-engineered solutions.

Challenges

- High R&D and capital investment: Entering the automotive control cable market requires an immense upfront investment in R&D for lightweight, durable material and advanced manufacturing processes. Suppliers must develop prototypes to meet the robust OEM specifications before securing the contracts, a process costing millions. For example, Kongsberg Automotive invests heavily in developing by-wire-ready systems. The global automotive components market R&D spend often exceeds a certain percentage of the annual revenue, which is the key barrier for new entrants without established cash flow.

- Long and rigorous OEM qualification cycles: The sales cycle from initial contact to volume production can exceed significant years. Suppliers must pass multiple design validation and production part approval process stages. A company such as the Hi-Lex Corporation secures long-term contracts by engaging in co-engineering from a vehicle concept phase, a commitment of time and resources impossible for undercapitalized new players. This creates a significant barrier as manufacturers must sustain operational costs for years without any guaranteed return on the initial investment, effectively filtering out but the most resilient and well-funded suppliers.

Automotive Control Cable Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 8.6 billion |

|

Regional Scope |

|

Automotive Control Cable Market Segmentation:

Vehicle Type Segment Analysis

The passenger cars sub-segment dominates and is expected to hold the share value of 68.4% by 2035. The segment is driven by the global vehicle production and ownership. The high volume directly translates to the largest demand for the automotive control cables that are used in the application, from transmission and throttle to hood release mechanisms. A primary driver of the segment is the continuous consumer demand for enhanced comfort and convenience that fuels the adoption of automatic transmissions and advanced features that rely on precise cable systems. As per the Bureau of Transportation Statistics data, nearly 1,563K passenger cars were sold in 2021, highlighting the immense and sustained automotive control cable market size that underpins this segment’s leading revenue share.

Electric Vehicle Type Segment Analysis

The battery electric vehicles are leading the segment and are poised to hold a considerable share value by 2035. The segment is driven by innovative control cable solutions. Unlike the hybrid, the BEVs require a new cable architecture for systems such as regenerative braking, battery thermal management, and electronic shift-by-wire units, creating a high-value market. This segment’s growth is directly tied to the global government push for electrification. For instance, the U.S. Department of Energy data in July 2023 depicts that the public and private electric vehicle charging ports have doubled from 87,352 to 161,562 from 2019 to 2023. This rapid infrastructure expansion is critical for supporting the burgeoning BEV fleet and boosting its automotive control cable market dominance. Further, the cable manufacturers are also prioritizing the development of lightweight, high-durability cables mainly engineered for the unique demands of the BEV platform.

Type Segment Analysis

By 2035, the electronic control cables are forecasted to lead the type segment and witness the highest growth and revenue share within the cable types. This shift is driven by the automotive industry’s transition from purely mechanical systems to advanced electromechanical and by-wire technologies. These cables are vital for transmitting electronic signals to control the units for functions such as electronic power steering, throttle control, and advanced driver assistance systems that are becoming standard even in mid-range vehicles. The report from the National Safety Council data in 2025, approximately 57.3% of the vehicles produced were equipped with ADAS features such as rear view cameras, a system reliant on the electronic data transmission that defines the leading cable type. This evolution is critical for the development of autonomous driving capabilities, which depend on instantaneous and reliable electronic communication.

Our in-depth analysis of the automotive control cable market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Vehicle Type |

|

|

Application |

|

|

Electric Vehicle Type |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Control Cable Market - Regional Analysis

APAC Market Insights

The Asia Pacific is dominating the automotive control cable market and is expected to hold the revenue share of 48.6% by 2035. This leadership is driven by the region’s status as the world’s largest vehicle producer, massive domestic markets, and aggressive government-led transitions to electric mobility. China’s commanding position is fueled by its world-leading EV adoption rates and comprehensive supply chain, while emerging economies such as Southeast Asia and India contribute significant growth via rising vehicle production and ownership. Key regional trends include the rapid electrification of vehicle fleets that shifts the demand from traditional mechanical cables to electronic and high voltage variants and intense competition among local suppliers to meet the cost and innovation demands of both domestic and global OEMs.

Japan’s automotive control cable market is defined by its leading manufacturers pivot towards next gen vehicles mainly hybrids and solid-state battery EVs. The automotive control cable market demand is shifting from the high-volume standard cables to specialized, high-value electronic control cables for the advanced transmissions, brake-by-wire systems, and thermal management. According to International Council on Clean Transportation data from June 2023, Japan had 92,000 EV sales in 2022, a 109% increase over the previous year, indicating a fast acceleration in electrification. This transition is aided by the government green innovation funds, which push the domestic suppliers such as Aisin and Hi-Lex to innovate in lightweight materials and electronic integration to maintain their competitive edge in the global supply chain for domestic OEMs and international exports.

China dominates the automotive control cable market in the APAC and is the largest and most dynamically evolving market. The market is driven by the world’s most aggressive electric vehicle adoption. The market is defined by intense competition, rapid innovation cycles, and a complete domestic supply chain for EVs. According to the data from the IEA 2025, China's electric vehicle production in 2024 was 17.3 million, representing a YoY rise. This massive scale is fueled by the sustained government subsidies and purchase tax exemptions, creating an unparalleled demand for the EV-specific control cables for the battery disconnect units, electronic park brakes, while simultaneously causing a decline in the traditional clutch and throttle cable volumes.

China Motor Vehicle Production

|

Year |

Units |

|

2019 |

25 750 650 |

|

2021 |

26 121 712 |

|

2022 |

27 020 615 |

|

2023 |

30 160 966 |

|

2024 |

31 281 592 |

Source: OICA 2025

Europe Market Insights

Europe is growing rapidly in the automotive control cable market and is poised to grow at a CAGR of 4.1% during the forecast period, 2026 to 2035. The market is shaped by the strong regulatory environment and a rapid technology-driven transition to electric vehicles. The region is a leader in premium and luxury vehicle manufacturing that demands high-performance, durable control cables. The primary market driver is the European Union’s de facto ban on the new internal combustion engine car sales, stimulating OEM investments in the EV platforms. This shift is minimizing the demand for the traditional throttle and clutch cables but generating a significant growth for the electronic shift-by-wire systems, advanced brake controls, and thermal management cables. The market is also influenced by strong supply chain legislation and competition from low-cost Asian manufacturers, pushing European suppliers to compete on innovation, quality, and integration.

Germany is projected to hold the highest revenue share in Europe by 2035 and is driven by its position s the continent’s automotive manufacturing hub. The growth is fueled by the massive investment from the domestic OEMs, such as BMW and Volkswagen, into electrification. For example, Germany’s Federal Ministry for Economic Affairs and Climate Action reports that the share of electric vehicles in the new registrations is high in 2023. Further, the report from the European Environment Agency data in 2024, Germany holds the share of 13.9% of electric vehicle adoption in the region. This rapid adoption is supported by a dense network of Tier 1suppliers creating a concentrated demand for high-value electronic control cables. The key trends include the integration of control cables with the ADAS and automated driving features, requiring fail-safe performance and compliance with strict EU safety standards set by bodies such as the European Commission.

France is set to be a leader in the automotive control cable market in Europe, and the growth is anchored by the strong government industrial policy and a successful domestic EV manufacturing base, notably from Stellantis and Renault. The French government’s France 2030 plan includes €4 billion to decarbonize industry, directly supports the production of EVs and their components, as per the IEA January 2024 report. Further, the policy-driven market expansion ensures a sustained demand for the control cables. A major trend focuses on a vertically integrated European battery supply chain that necessitates compatible, high-performance cable systems for battery management and vehicle safety, aligning with the EU's strategic autonomy goals.

North America Market Insights

The North America automotive control cable market is projected to hold a significant revenue share by 2035. The market is driven by the technologically advanced automotive sector. The key drivers include a robust U.S. fuel economy standard, compelling lightweight cable solutions, and the rapid electrification of the vehicle fleet that demands specialized control cables for battery disconnect and thermal management systems. The reshoring of automotive manufacturing, supported by policies such as the U.S. Inflation Reduction Act and the complementary Canadian incentives, strengthens the regional supply chain. Further, the high consumer demand for feature-rich vehicles with advanced transmissions and safety systems ensures a steady demand for the high-value durable control cables, offering lower volume growth.

The automotive control cable market in the U.S. is driven by the strategic pivot to electric vehicle production and stringent regulatory standards. The Environmental Protection Agency’s revised Multi Pollutant Emissions Standards for 2027 to 2032 are surging the transition, pushing automakers to electrify and lightweight their fleet, thereby increasing the demand for electronic and composite control cables. According to the IEA data in 2024, the U.S. has sold over 1.4 million EVs in 2023, and the need for specialized cables for battery management and shift-by-wire systems is escalating. Furthermore, the Bipartisan Infrastructure Law's support for national EV charging infrastructure is a critical demand catalyst, boosting consumer confidence and long-term EV adoption that secures the market for advanced control cable solutions. This regulatory and investment landscape is compelling suppliers to localize production and form strategic partnerships with domestic EV manufacturers.

Electric Car Sales Share in the U.S.

|

Year |

Share Percentage |

|

2018 |

2 |

|

2019 |

2 |

|

2020 |

2 |

|

2021 |

5 |

|

2022 |

7 |

|

2023 |

10 |

Source: IEA 2024

Canada’s automotive control cable market is shaped by its federal zero-emission vehicle mandate requiring 100% light-duty vehicle sales to be ZEVs by 2035. This policy is detailed by the Environment and Climate Change Canada, creates a guaranteed long-term demand pipeline for EV-specific control cables. As per the government of Canada data in November 2023, the iZEV program, which has allocated an additional CAD 1.7 billion via budget in 2022 nd has already supported over 200,000 ZEV incentive claims, which continues to shape the country’s vehicle production mix. With ZEV reaching 9.5% of new registrations by the third quarter in 20233, OEMs and Tier 1 suppliers are adjusting the control cable specifications for non-powertrain applications, maintaining a stable procurement despite reduced use in traditional combustion systems. Canada’s strategic focus on its critical mineral supply chain, essential for EV batteries, further integrates its automotive sector with the North America production, ensuring domestic control of cable suppliers is anchored to a resilient future-oriented manufacturing ecosystem.

Key Automotive Control Cable Market Players:

- Dura Automotive Systems (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cable Manufacturing & Assembly Co. (U.S.)

- AGS Company (U.S.)

- Kongsberg Automotive (Norway)

- Ficosa Internacional SA (Spain)

- AB Elektronik Sachsen GmbH (Germany)

- Küster Holding GmbH (Germany)

- KISAB (Sweden)

- Magura (Germany)

- Aisin Seiki Co., Ltd. (Japan)

- Hi-Lex Corporation (Japan)

- Fujikura Ltd. (Japan)

- Yazaki Corporation (Japan)

- Daekyung Co., Ltd. (South Korea)

- NK Co., Ltd. (South Korea)

- Laxmi Associates (India)

- Makcute Cables Private Limited (India)

- SMT Cables Sdn Bhd (Malaysia)

- Robert Bosch GmbH (Germany)

- LEONI AG (Germany)

- Dura Automotive Systems is a dominant force in the automotive control cable market is using its expertise in mechatronic systems to provide critical solutions for gear shift, parking brake, and hood latch applications. The company advances its market position by aiming for strategic initiatives to develop lightweight and high-strength cable assemblies directly supporting the automotive industry's shift towards electric vehicles.

- Cable Manufacturing & Assembly Co. secures its role in the automotive control cable market as a key supplier by specializing in highly engineered custom assemblies for demanding automotive applications. The company’s strategy is based on vertical integration and rigorous testing protocols, ensuring superior reliability for transmission, clutch controls, which helps the global OEMs to meet the standards.

- AGS Company strengthens its standing in the automotive control cable market by offering integrated cable and component solutions for vehicle access, sealing, and powertrain systems. Its prime strategic initiatives involve the co-engineering of products with major automakers, aiming at the miniaturization of the components and the development of the silent, low-effort control mechanisms to enhance the user experience.

- Kongsberg Automotive enhances its leadership in the automotive control cable market via its advanced pedal and gearshift systems that are essential for both electric and conventional vehicles. A core strategic initiative involves the aggressive expansion of its product portfolio to include the by-wire-ready solutions and electronic control modules, enabling the industry’s transition towards automation and electrification. In Q3 2025, the company earned a revenue of MEUR 162.9 with a cash flow of 6.6 MEUR.

- Ficosa Internacional SA has strategically positioned itself in the automotive control cable market by integrating its cable systems with advanced electronic surveillance and actuator technologies for parking brake and transmission systems. The company’s key market advancement is fueled by the heavy investment in R&D for smart cable systems that interface seamlessly with ADAS and autonomous driving platforms, aiming to provide safer and dynamic control. In 2024, the company witnessed sales of 1,397 million euros.

Here is a list of key players operating in the global automotive control cable market:

The automotive control cable market is intensely competitive and is defined by global consolidation and technological innovation. The key players, such as Kongsberg, Aisin, and Hi Lex, are mainly aiming at strategic initiatives such as geographical expansion into high-growth markets, such as the Asia Pacific, and product diversification into electronic control systems and lightweight cables for electric vehicles. Mergers and acquisitions are long-term supply contracts with major OEMs are also critical strategies to enhance the market share, reduce costs, and develop integrated solutions to meet the evolving demands for safety, efficiency, and vehicle electrification. For instance, Suprajit has announced that it has acquired the Light Duty Cable (LDC) business unit from Kongsberg Automotive in October 2021 in Norway. Further, the push towards electric and autonomous vehicles further stimulates this trend.

Corporate Landscape of the Automotive Control Cable Market:

Recent Developments

- In June 2025, the ASK Automotive board has approved a joint venture with T.D. Holding GmbH for sunroof cable manufacturing. The new joint venture will focus on producing, marketing, and selling sunroof control and helix cables for passenger vehicles.

- In January 2025, V-Marc India Limited expanded to Kerala and launched innovative wire & cable products. This expansion introduces the latest range of advanced wire and cable solutions.

- Report ID: 923

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Control Cable Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.