Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Autologous Cell Therapy Market size was over USD 4.5 billion in 2024 and is estimated to reach USD 19.2 billion by the end of 2037, expanding at a CAGR of 16.1% during the forecast timeline, i.e., 2025-2037. In 2025, the industry size of autologous cell therapy is assessed at USD 5.2 billion.

The rising worldwide burden of chronic ailments, such as cancer, cardiovascular disease (CVD), end-stage kidney disorders (ESKD), and diabetes, are the primary growth engines in the market. According to the WHO predictions, the number of afflicted patients around the globe, eligible for CAR-T and stem cell therapies, is poised to reach 2.2 million by the end of 2025, which is further expected to surpass 4.6 million by 2037. Similarly, as per a report from the Robert Koch Institute (RKI), Germany alone consisted of a significantly enlarging patient pool till 2025, accounting for 450,010, which showcased a rise of 60.3% from 2018. These demographic trends highlight the growing demand for regenerative treatments, including autologous cell therapy (ACT).

Despite the enormous surge, the market still faces notable payers' pricing disparities, which require global attention and investments to be mitigated. This financial pressure can be displayed through the upstream flow of inflation in key economic indicators. As evidence, in 2024, the Bureau of Labor Statistics (BLS) indicated an 8.4% year-over-year (YoY) hike in the producer price index (PPI) for cell therapy goods, as a result of consistent cost increases in production and transportation. This further stimulated the consumer price index (CPI) by 22.4% for autologous treatments, during the timeline from 2020 to 2024. In response, healthcare systems and authorities are strategizing their approach to procuring and cultivating innovative options to minimize affordability issues.

Autologous Cell Therapy Sector: Growth Drivers and Challenges

Growth Drivers

- Amplifying cash inflow from public and personal spending: Considering the clinical benefits of offerings from the autologous cell therapy market, both public and private payers are prioritizing the improvement of accessibility. This, coupled with the subsidiary policies, ensures greater cash inflow in this sector and hence attracts more organizations to invest and participate. Testifying this, the Centers for Medicare & Medicaid Services (CMS) underscored a 40.3% YoY rise in reimbursement coverage for this category, which totaled USD 2.9 billion in 2023. The increasing out-of-pocket spending and willingness to pay for these advanced therapeutics among patients are also indicators of substantial growth in this field.

- Innovation-based solutions to enhance outputs: Extensive research and development cohorts are another significant driver behind the progress of the autologous cell therapy market. This is propelled by continuous investment and engagement in R&D. Testifying this, the National Institute of Health (NIH) calculated the net public and private funding in research, development, and deployment (RDD) to be USD 3.7 in 2024. In addition, the integration of next-generation technologies in large-scale production is also improving accessibility in this sector by mitigating supply channel disruptions. In this regard, the Food and Drug Administration (FDA) suggested modular facilities to bring average lead times of 14–21 days per batch down to a minimum threshold.

Historical Patient Growth and Its Impact on Market Expansion

The dramatic transformation in the patient pool from 2010 to 2020 translated to a phase of remarkable growth in the autologous cell therapy market. Particularly, the introduction of CAR-T and stem cell technologies as breakthroughs in the discipline of oncology and other life-threatening non-communicable diseases evolved the dynamics of targeted therapy. The same tenure also witnessed an immunosuppressing pandemic, which raised the volume of high-risk populations. As a result, this era marked a fundamental shift toward accepting regenerative medicine solutions in mainstream practices. Furthermore, the demographic changes throughout this period pushed authorities for regulatory and healthcare reinforcements, widening the scope of business in this sector.

Historical Patient Growth (2010-2020)

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010-2020) |

|

U.S. |

0.13 |

0.86 |

21.6% |

|

Germany |

0.06 |

0.43 |

23.9% |

|

France |

0.04 |

0.32 |

26.0% |

|

Spain |

0.03 |

0.19 |

24.4% |

|

Australia |

0.02 |

0.13 |

27.7% |

|

Japan |

0.09 |

0.56 |

21.0% |

|

India |

0.006 |

0.10 |

33.2% |

|

China |

0.05 |

0.49 |

28.5% |

Feasible Expansion Models Shaping the Market

The strategic pathways implemented by key players in the autologous cell therapy market are transforming the approach to commercial operations. They established a strong foundation for tailored business models for acquiring optimum profit margins in this sector. For instance, between 2022 and 2024, suppliers in India solidified their position by forming alliances with local hospitals, enabling a 12.3% revenue boost. On the other hand, the penetration of value-based pricing in Germany helped pioneers garner an 18.4% increase in adoption rate. These strategies are proving their effectiveness by securing greater financial success and guiding new entrants for sustainable market expansion.

Feasibility Models for Market Expansion (2020-2024)

|

Model |

Region |

Impact |

|

Hospital Partnerships |

India |

12.3% revenue growth (2022–2024) |

|

Value-Based Pricing |

Germany |

18.4% patient uptake increase |

|

Medicare Coverage |

U.S. |

$2.9 billion spending (2023), +40.1% YoY |

|

Fast-Track Approvals |

Japan |

20.3% cost reduction for therapies |

Challenge

- Limitations in worldwide adoption: Despite public and private efforts, the market still faces accessibility and acceptability issues due to budget and infrastructural constraints. This can be displayed through the lack of apheresis centers in 40.2% of medical systems across Europe, which is causing treatment delays, as per the European Centre for Disease Prevention and Control (ECDC). However, the recent initiatives taken by government institutions and dedicated companies are promoting the deployment of decentralized healthcare models to ensure equitable access to advanced cell therapies, even in rural areas. For instance, mobile CAR-T units, introduced by MD Anderson, showcased a 15.4% improvement in rural patient access.

Autologous Cell Therapy Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

16.1% |

|

Base Year Market Size (2024) |

USD 4.5 billion |

|

Forecast Year Market Size (2037) |

USD 19.2 billion |

|

Regional Scope |

|

Autologous Cell Therapy Segmentation

Application (Oncology, Cardiovascular Diseases, Orthopedic Disorders, Neurological Disorders, Autoimmune Diseases)

Based on applications, the oncology segment is predicted to hold the highest share of 48.5% in the autologous cell therapy market over the discussed timeline. Being one of the highest mortality causes worldwide, this medical discipline has become a priority for every healthcare authority and institution. Thus, after gaining international recognition as a breakthrough therapeutic with remarkable clinical success, these cell-based therapies are becoming the first-line option for people seeking safer alternatives to harsh treatments, such as chemotherapy. In addition, this validation has accelerated the momentum of the regulatory compliance process, increasing acceptability among major medical settings and cancer-afflicted patients. Moreover, the segment's leadership is also reflected by its captivity over 65.1% of the total R&D investment.

Therapy Type (CAR-T Cell Therapy, Stem Cell Therapy, Dendritic Cell Therapy, NK Cell Therapy)

In terms of therapy type, the stem cell therapy segment is expected to dominate the autologous cell therapy market with a share of 28.5% throughout the analyzed period. These curative solutions have a broad range of applications, including musculoskeletal diseases, making it a preferred category. Additionally, the presence of sufficient clinical evidence, demonstrating significant improvement in managing the symptoms and preventing the progress of osteoarthritis, helped this segment gain priority for non-invasive orthopedic treatments. Furthermore, with substantial R&D investments, based on its cost-effectiveness, this segment secured prosperous growth in the upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Therapy Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

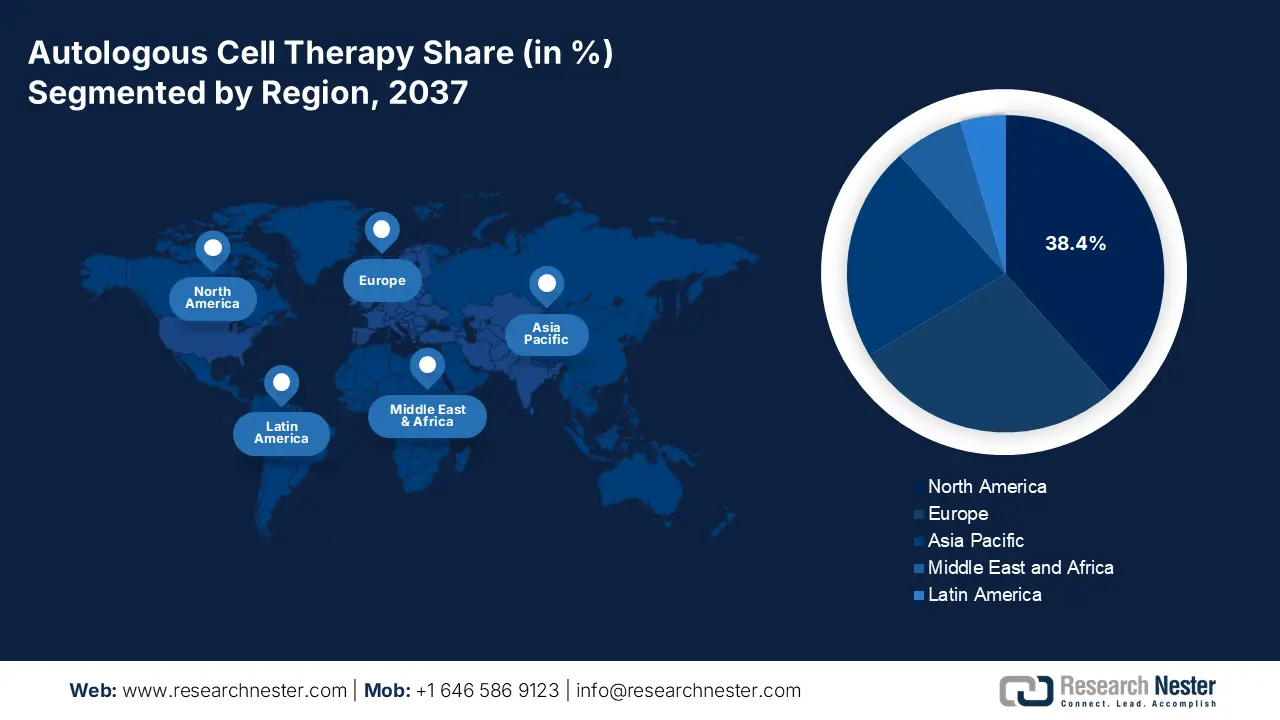

Autologous Cell Therapy Industry - Regional Synopsis

North America Market Analysis

North America is poised to attain the largest revenue share of 38.4% in the autologous cell therapy market by the end of 2037. The proprietorship is highly attributable to the increasing cases and financial burden of malignancies. Testifying this, the CDC reported that every year, approximately 2.0 million citizens from across the region are diagnosed with cancer. This secured a 35.1% captivity of North America over the global demand. In response, authorized insurers and the Federal government are allocating significant capital in this category, amplifying cash inflow in this landscape. Furthermore, the predominant advances in biopharmaceutical R&D and discoveries are widening the scope of garnering greater revenue in this field.

The U.S. is augmenting regional leadership in the market with wide utilization of associated treatment in various medical disciplines, such as oncology and orthopedics. Additionally, the USD 5.2 billion investment from the Federal government in 2023, coupled with reimbursement coverage expansion, is also fueling progress in this landscape. Testifying this, NIH reports a 20.4% annual rise in clinical trials in this category since 2020, where BIO alone highlighted more than 501 active trials in 2024. Furthermore, support from the regulatory framework with accelerated approvals is propelling this nationwide cohort of innovation in this sector.

Till the end of 2023, the Federal government invested USD 3.3 billion in research, development, and deployment of cell-based therapies in Canada. On the other hand, from 2020 to 2024, the volume of related therapy users across the country grew by 15.4%, reflecting the widening range of adoption in the market. Moreover, government investments and initiatives to establish a nationwide network of biotechnological R&D and collaborations between academia and industry leaders are propelling the pace and scale of commercialization of this merchandise. This ambitious goal of becoming a hub of regenerative medicine production for North America is further elevated by local participation.

APAC Market Statistics

The Asia Pacific autologous cell therapy market is estimated to follow the highest CAGR during the timeline between 2025 and 2037. The expanding territory of the biotechnology industry in emerging economies, such as China, India, and Malaysia, is magnifying the overall financial and commercial output from this landscape. This pace of progress is further pledged to continuous public and private investments in producing cost-effective cell-based therapeutics. For instance, from 2013 to 2023, funding for localized development of cutting-edge therapies rose by 20.3%. On the other hand, South Korea and Japan are accelerating adoption with ongoing clinical findings and innovations.

China is propagating the market with dominant control over the majority of global API supply and regional revenue generation. The country has a large consumer base, backed by the increasing prevalence and mortality of cancer, osteoarthritis, CVD, and ESKD. This subsequently constricted a patient pool of 1.6 million eligible citizens in 2023. In the same year, the government of China dedicated USD 3.6 billion as funding in this category, exhibiting a 15.2% yearly rise. Furthermore, the nation is also solidifying its position in this merchandise with the potential to lead the global clinical trial industry.

India is emerging as a global biotech innovation and manufacturing hub, which is subsequently benefiting the domestic autologous cell therapy market. Besides, the country has a large cancer, CVD, and diabetic population, creating a sustainable demand for localized development in this sector. Testifying this, the Indian Council of Medical Research (ICMR) identified more than 2.5 patients, who are eligible to undergo cell-based therapies. This is dragging the focus of both governing bodies and foreign investors to engage their resources in this cohort. In this regard, in 2023, the net funding in this category from the government of India totaled USD 1.9 billion.

Companies Dominating the Autologous Cell Therapy Landscape

- Vericel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pharmicell Co., Inc.

- Holostem Terapie Avanzate S.r.l.

- Lineage Cell Therapeutics, Inc.

- Opexa Therapeutics

- BrainStorm Cell Therapeutics

- Sangamo Therapeutics

- Bayer AG

- Novartis AG

- Mesoblast Limited

- Samsung Biologics

- United Surgical Industries

- Malaysia Healthcare Innovations

- Eli Lilly & Co.

- AstraZeneca

- Amgen Inc.

Current dynamics in the autologous cell therapy market are characterized by intense competency among key players, research institutions, and emerging biotech firms. Some of them are investing heavily in R&D to develop next-generation therapies, whereas others are forming strategic partnerships to extend their manufacturing capabilities and product reach. The landscape is further stimulated by technological integrations, focusing on improving production efficiency, scalability, and treatment accessibility.

Top key players in this merchandise include:

Recent Developments

- In May 2024, Gilead Sciences expanded access to its autologous CAR-T therapy Tecartus (brexucabtagene autoleucel) for mantle cell lymphoma (MCL) patients in Germany and France. This strategic market expansion drove a 15.4% increase in European sales during the 2nd quarter of 2024.

- In March 2024, Bristol-Myers Squibb secured FDA approval for Breyanzi (lisocabtagene maraleucel) as a second-line treatment for relapsed/refractory large B-cell lymphoma (LBCL). This expanded indication drove a 9.5% revenue increase in 2nd quarter of 2024, demonstrating strong market adoption.

- Report ID: 7739

- Published Date: Jun 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autologous Cell Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert