Atraumatic Occlusion Market Outlook:

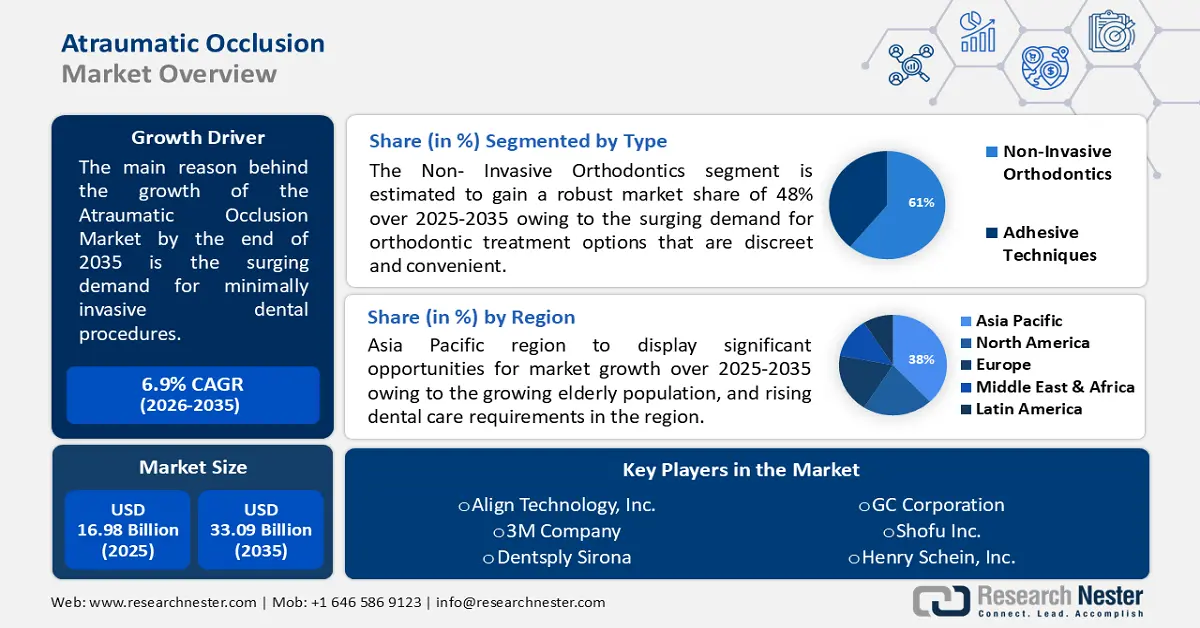

Atraumatic Occlusion Market size was valued at USD 16.98 billion in 2025 and is likely to cross USD 33.09 billion by 2035, expanding at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atraumatic occlusion is assessed at USD 18.03 billion.

The primary factor propelling the market growth is the increasing need for minimally invasive dental procedures. The increase in demand for minimally invasive dental procedures can be ascribed to a change in patient preferences for procedures that guarantee a more comfortable and unobtrusive experience in addition to effectively addressing oral health concerns. The demand for minimally invasive dental procedures is expected to grow robustly by 6.8% globally between 2022 and 2027, according to a report.

In order to achieve the intended treatment outcomes, the atraumatic occlusion approach seeks to preserve as much of the natural tooth structure as possible. The market is seeing an expansion of product offerings and solutions tailored to the particular needs of dental professionals as the demand for atraumatic occlusion rises.

Key Atraumatic Occlusion Market Insights Summary:

Regional Insights:

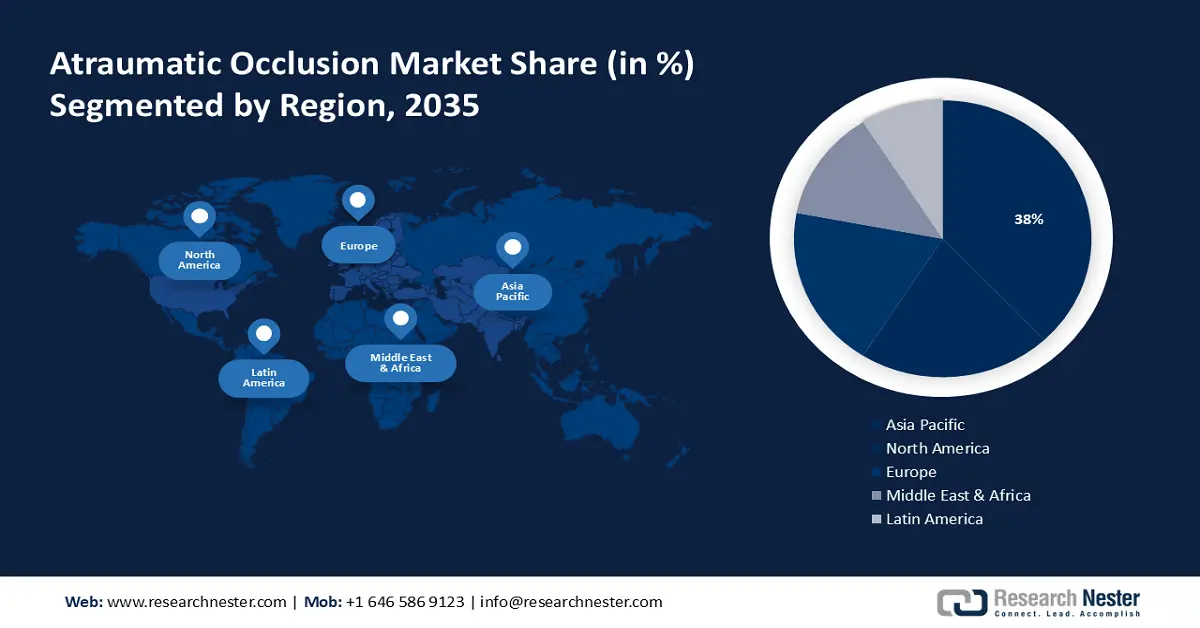

- The Asia Pacific region is projected to secure a 38% share by 2035 in the atraumatic occlusion market, propelled by the escalating dental care needs in the region.

- North America is anticipated to command the second-largest share through 2035, supported by the rising adoption of minimally invasive dentistry procedures.

Segment Insights:

- The non-invasive orthodontics segment is forecasted to capture over 61% share by 2035 in the atraumatic occlusion market, driven by the expanding demand for discreet and convenient adult orthodontic solutions.

- The hospitals segment is expected to accumulate a substantial share by 2035, bolstered by continuous research initiatives and clinical training programs enhancing atraumatic occlusion practices.

Key Growth Trends:

- Technological advancements driving innovation in atraumatic occlusion solutions

- Regulatory initiatives supporting minimally invasive dental practices

Major Challenges:

- Limited awareness and education

- Resistance to change

Key Players: Straumann Group, Dentsply Sirona, Zimmer Biomet Holdings, Inc., Ivoclar Vivadent AG, GC Corporation, Danaher Corporation (Ormco).

Global Atraumatic Occlusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.98 billion

- 2026 Market Size: USD 18.03 billion

- Projected Market Size: USD 33.09 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 26 November, 2025

Atraumatic Occlusion Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements driving innovation in atraumatic occlusion solutions - Continuous technological advancements in the dental industry are driving a significant growth surge in the atraumatic occlusion market. Dentists now have advanced tools to adopt atraumatic occlusion with never-before-seen accuracy and effectiveness due to advancements in materials science, imaging technology, and therapeutic modalities.

Digital imaging innovations like intraoral scanners and 3D imaging have completely changed the ways in which treatment planning and diagnosis are carried out. A more precise and individualized approach to atraumatic occlusion interventions is made possible by these technologies, which give practitioners the ability to visualize the oral environment in unprecedented detail. - Regulatory initiatives supporting minimally invasive dental practices - Regulations that support and promote minimally invasive dental procedures are advantageous to the industry. As dental procedures have a minimal environmental impact, government agencies and dental associations are realizing the value of atraumatic occlusion in achieving the best possible oral health outcomes.

Through the establishment of standards and guidelines that encourage the adoption of minimally invasive dental practices, regulatory initiatives like the EU MDR have a significant impact on the atraumatic occlusion market. - Integration of atraumatic occlusion in comprehensive treatment planning - The dental market is thriving as more practitioners are incorporating atraumatic occlusion into their treatment planning to provide comprehensive care. By recognizing the advantages of a holistic approach to oral health, these practitioners are making atraumatic occlusion a key element in patient care.

This integration involves a detailed evaluation of the patient's oral health, functional requirements, and cosmetic objectives. By incorporating atraumatic occlusion principles early on in treatment planning, practitioners can create tailored interventions that prioritize the preservation of natural teeth and encourage lasting oral health.

Challenges

- Limited awareness and education - The lack of knowledge and instruction regarding atraumatic occlusion techniques among dental professionals and the general public is one of the main obstacles. Patients may not be aware of the advantages of atraumatic occlusion, and many dental professionals may not be up to date on the latest developments. Atraumatic occlusion may not be widely used in dental offices due to a lack of awareness. Market expansion may be restricted by dental professionals' propensity to adhere to traditional techniques and patients' lack of proactive search for atraumatic occlusion solutions.

- Resistance to change

- Cost considerations

Atraumatic Occlusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 16.98 billion |

|

Forecast Year Market Size (2035) |

USD 33.09 billion |

|

Regional Scope |

|

Atraumatic Occlusion Market Segmentation:

Type Segment Analysis

In atraumatic occlusion market, non-invasive orthodontics segment is likely to hold over 61% share by the end of 2035. This segment’s growth is due to the growing market for adult orthodontics. There's a growing demand for options that are both discreet and convenient as more adults seek orthodontic treatment.

Adult orthodontic treatment seekers increased by 62 percent in the US and Canada, according to the American Association of Orthodontists. Among adults who might be reluctant to undergo traditional orthodontic treatments with visible braces, non-invasive orthodontics like clear aligners have grown in popularity.

End User Segment Analysis

The hospitals segment in the atraumatic occlusion is expected to garner a significant share in the year 2035. Hospitals, as centers for research and education, contribute to the growth of atraumatic occlusion techniques by providing research opportunities and training programs. Ongoing research initiatives and educational programs within hospitals foster advancements in atraumatic occlusion.

A survey found that hospital-based dental residency programs have seen a 22% increase in research productivity over the past decade. This statistic underscores the importance of hospitals as hubs for dental research and education. Hospital settings provide an environment conducive to research and training, allowing dental professionals to explore and refine atraumatic occlusion techniques.

Our in-depth analysis of the global atraumatic occlusion market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atraumatic Occlusion Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 38% by 2035, impelled by surge in dental care needs in the region.. The Asia Pacific area's growing elderly population and rising dental care requirements are major factors propelling the market for atraumatic occlusion in that region. The need for dental solutions that put oral health preservation first is rising as the number of older people increases.

According to the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), the Asia-Pacific region's share of the population 65 years of age and older is predicted to rise to 18.3% by 2050.

North American Market Insights

The atraumatic occlusion market in the North America region is set to hold the second largest share through 2035. The market in North America is primarily driven by the increasing use of minimally invasive dentistry procedures.

Based on a study, dental professionals in North America have been using minimally invasive procedures more frequently; the adoption rate has increased by 20% year over year. Because it emphasizes conservative approaches to dental interventions, minimally invasive dentistry is consistent with the principles of atraumatic occlusion. The atraumatic occlusion market in North America is largely driven by advancements in technology and the integration of digital dentistry. Cutting-edge technologies help to seamlessly integrate atraumatic occlusion techniques, improve diagnostics, and increase treatment precision.

Atraumatic Occlusion Market Players:

- Straumann Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dentsply Sirona

- Zimmer Biomet Holdings, Inc.

- Ivoclar Vivadent AG

- GC Corporation

- Danaher Corporation (Ormco)

- 3M Company

- Henry Schein, Inc.

- Align Technology, Inc.

- Kuraray Noritake Dental Inc.

Recent Developments

- Dentsply Sirona acquired Byte, a leading direct-to-consumer, doctor-directed clear aligner company, for USD 1 billion. This move solidified Dentsply Sirona's position in the growing clear aligner market and expanded its reach to younger customers.

- Dentsply Sirona announced the acquisition of MIS Implants Technologies Ltd., a leading manufacturer of dental implants, for an undisclosed sum. This acquisition enhances Dentsply Sirona's dental implant portfolio and strengthens its competitiveness in the implant market.

- Report ID: 5479

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atraumatic Occlusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.