Atomic Layer Deposition Market Outlook:

Atomic Layer Deposition Market size was valued at USD 3.28 billion in 2025 and is expected to reach USD 9.74 billion by 2035, expanding at around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of atomic layer deposition is assessed at USD 3.62 billion.

Atomic layer deposition (ALD) is finding high applications in low-power memory chips, semiconductor manufacturing, nanotechnology, organic light-emitting diodes, and lithium-ion batteries, offering larger gains to key atomic layer deposition market players. The demand for atomic layer deposition products is anticipated to exhibit a high growth in the coming years. The continuous innovations in automobile manufacturing are poised to propel the demand for atomic layer deposition solutions. The electric vehicle (EV) trend coupled with increasing applications of lithium-ion batteries is set to offer high growth opportunities for atomic layer deposition product manufacturers.

The U.S. Department of Energy (DOE) states that all-electric and plug-in hybrid electric vehicles (PHEV) utilize lithium-ion batteries. The rise in adoption of zero-emission vehicles, particularly those with batteries is set to offer huge gains to atomic layer deposition product manufacturers. The International Energy Agency (IEA) discloses that in 2022, the demand for automotive lithium-ion (Li-ion) batteries expanded by 65% to 550 GWh from 330 GWh in 2021. This was majorly driven by the electric passenger car sales hitting 55.0% of new registrations. Further, the Li battery demand amounted to 140 kt in 2023 owing to a 10.0% rise in lithium supply.

China leads the lithium-ion batteries trade with 417.97 GWh, followed by Europe (99.16 GWh), North America (57.94 GWh), Japan (12.54 GWh), Rest of the World (5.73 GWh). The installed battery cell manufacturing capacity stood over 45.0% in 2023, in both China and the U.S., parallel to the previous year, while 250% in the EU. Following the current trades supported by the U.S. Inflation Reduction Act (IRA) policies is estimated to uplift the U.S. position in the coming years. Thus, the booming production and registrations of electric vehicles are poised to drive battery sales and ultimately the ADL techniques.

Key Atomic Layer Deposition Market Insights Summary:

Regional Highlights:

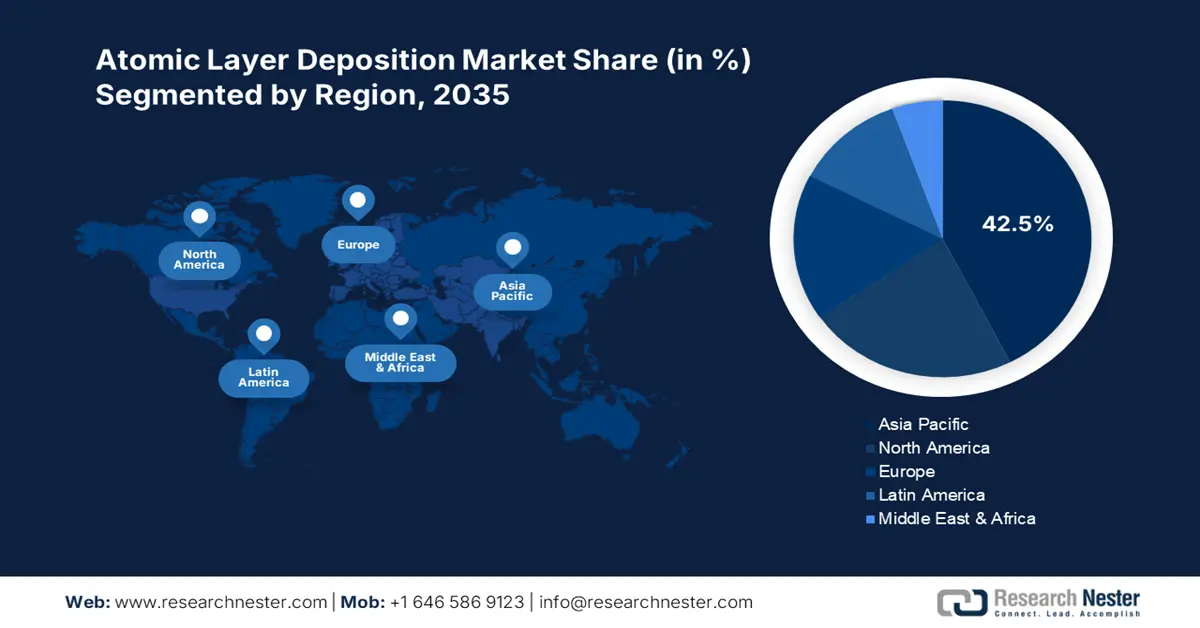

- Asia Pacific atomic layer deposition market will dominate over 42.50% share by 2035, driven by semiconductor production and investments in renewable energy.

- North America market will exhibit the fastest growth during the forecast timeline, driven by investments in semiconductors and renewable energy innovations.

Segment Insights:

- The electronics & semiconductors segment in the atomic layer deposition market is forecasted to capture a 46.80% share by 2035, driven by increasing demand for smaller, smarter electronic devices.

- The thermal ald segment in the atomic layer deposition market is expected to capture a 37.80% share by 2035, fueled by the miniaturization trend in electronics and solid-state battery adoption.

Key Growth Trends:

- Rise in renewable energy applications

- Emerging role in the development of advanced medical devices

Major Challenges:

- High capex challenging market entry

- Slower reaction times

Key Players: ASM International, Applied Materials, Inc., Veeco Instruments Inc., CVD Equipment Corporation, SkyWater Technology, and ACM Research, Inc.

Global Atomic Layer Deposition Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.28 billion

- 2026 Market Size: USD 3.62 billion

- Projected Market Size: USD 9.74 billion by 2035

- Growth Forecasts: 11.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Taiwan, South Korea, Japan

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 8 September, 2025

Atomic Layer Deposition Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in renewable energy applications: The increasing use of atomic layer deposition in solar cell production particularly high-efficiency thin film photovoltaic materials is set to drive overall atomic layer deposition market growth in the years ahead. The fueling demand for innovative materials and substances for uniform and high-quality thickness for the effectiveness of renewable energy technologies is set to double the profits of atomic layer deposition product producers. The Solar Energy Industries Association (SEIA) disclosed that in the past decade, solar installation costs lowered by nearly 40.0%. As per the IEA findings, by 2030 the solar technology is anticipated to account for 80.0% of the global renewable capacity growth.

-

Emerging role in the development of advanced medical devices: The miniaturization trend in the device manufacturing sector is driving a high demand for advanced deposition techniques including atomic layer deposition. The ALD’s thin and uniform deposition properties are increasing their use in the development of medical devices such as diagnostic technologies, sensors, and drug delivery systems.

Challenges

-

High capex challenging market entry: The high initial investment required for the installation of advanced atomic layer deposition equipment and process complexity are barriers to small-scale industries. The high initial investment costs are a major challenge for end industries with limited budgets, particularly price-sensitive markets. Furthermore, new companies entering the atomic layer deposition market are estimated to invest heavily to sustain their position in the competitive landscape.

-

Slower reaction times: The slow reaction time of the atomic layer deposition leads to poor precision compared to other methods. The slow deposition rates limit its use in high-volume manufacturing processes, where speed is premium such as large-scale semiconductor manufacturing and consumer electronics production. Leading companies are investing heavily in research and development activities to enhance the reaction times of ADL and attract a wider consumer base.

Atomic Layer Deposition Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 3.28 billion |

|

Forecast Year Market Size (2035) |

USD 9.74 billion |

|

Regional Scope |

|

Atomic Layer Deposition Market Segmentation:

Application

Electronics & semiconductors segment is predicted to hold more than 46.8% atomic layer deposition market share by 2035. The propelling demand for faster, smarter, and smaller electronic devices worldwide is creating a lucrative environment for atomic layer deposition applications. The semiconductor used in electronic technologies requires advanced thin film materials for precision and efficiency. Thus, the ideal and versatile capabilities of ADL are fueling their use in the semiconductor and electronics industries. Government funding in semiconductor component manufacturing is also playing a major role in expanding the sales of atomic layer deposition solutions. For instance, in July 2024, the U.S. Department of Commerce (DOC) revealed that it entered into a strategic agreement with GlobalWafers America, LLC, and MEMC LLC to fund around USD 400 million to increase silicon wafer manufacturing in the country.

Product

By 2035, thermal ALD segment is anticipated to dominate over 37.8% atomic layer deposition market share. The miniaturization trend in the electronics sector majorly driving the sales of thermal atomic layer deposition technologies. The growing popularity of next-gen solid-state batteries is also backing the demand for thermal ALD for enhanced protective layers and solid electrolytes. Several sectors such as automotive, aerospace, and renewable energy are driving a high demand for advanced coating technologies, which is opening profitable doors for thermal atomic layer deposition technique producers. Thermal coatings aid in protecting engines, high-performance turbine blades, and critical components of automobile and aerospace applications.

Our in-depth analysis of the global atomic layer deposition market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Atomic Layer Deposition Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in atomic layer deposition market is predicted to account for around 42.5% revenue share by 2035. The robust production of semiconductor and electronic solutions is set to push the demand for atomic layer deposition technologies. The increasing investments in renewable energy solutions are expected to offer a double-digit percent revenue growth for key atomic layer deposition market players. The positive foreign direct investments and continuous technological advancements are estimated to propel the atomic layer deposition product demand in China, India, South Korea, and Japan.

China being the semiconductor hub is poised to offer high gains to atomic layer deposition market players. The advancing semiconductor chip-producing regulations and supportive investments by the government are anticipated to push the trade of atomic layer deposition technologies. The strong end user base is also backing the atomic layer deposition product sales growth. For instance, the Foreign Policy Research Institute (FPRI) unveiled that the latest industrial policy is focusing to cross domestic chip manufacturing from 40.0% in 2020 to 70.0% by 2025. The growth in the domestic production of semiconductor technologies is positively contributing to the demand for atomic layer deposition techniques.

The boasting trade of renewable energy technologies and electric vehicles in India is likely to increase the demand for atomic layer deposition solutions. The India Brand Equity Foundation (IBEF) report highlights that in September 2024, the 2-, 3-wheeler, and quadricycle production amounted to 27,73,039 units. The same source also projects that India is expected to lead the electric vehicle sales by 2030. Furthermore, IBEF discloses that the installed renewable energy capacity of the country is expected to rise from 136.57 GW in 2023 to 170 GW by 2025. The rising public investments to expand power infrastructure to meet an estimated 458 GW demand by 2032 are driving investments of about USD 109.50 billion.

North America Market Insights

The North America atomic layer deposition market is projected to increase at the fastest CAGR throughout the forecast period. The robust automotive, electronics, and medical device sectors are uplifting the atomic layer deposition product trade. Continuous innovations in solar and other renewable energy technologies are creating high-earning opportunities for atomic layer deposition technology producers. Positive public funding in semiconductor manufacturing is likely to propel the overall atomic layer deposition trade in the coming years.

In the U.S., the expanding investments in improved semiconductor chip production are propelling the demand for atomic layer deposition solutions. In February 2025, the Office of the Texas Governor disclosed that the government announced the grant of USD 23.25 million for Silicon Laboratories, Inc. under the third Texas Semiconductor Innovation Fund (TSIF). Through this grant, the company aims to drive around USD 80.0 million in capital investment for new R&D activities in Austin. Thus, supportive government policies for semiconductor production in the form of investments are set to fuel the demand for atomic layer deposition products in the coming years.

Canada’s rising automobile registration particularly energy-efficient vehicles is expected to push the sales of atomic layer deposition solutions. Statistique Canada discloses that the zero-emission vehicle registrations reached 75,636 in the third quarter of 2024. The advancements in energy storage batteries and growing demand for solid-state batteries are poised to uplift the need for atomic layer deposition techniques. Furthermore, increasing investments in renewable energy technologies are likely to offer high gains to atomic layer deposition technology manufacturers.

Atomic Layer Deposition Market Players:

- Forge Nano Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Beneq Group

- Oxford Instruments Plc

- The Kurt J. Lesker Company

- Pico sun Oy

- SENTECH Instruments GmbH

- Arradiance, LLC

- Lam Research Corporation

- ASM International

- Applied Materials, Inc.

- Veeco Instruments Inc.

- CVD Equipment Corporation

- SkyWater Technology

- ACM Research, Inc.

The key players in the atomic layer deposition market are employing several organic and inorganic strategies to earn high profits and reach a wider consumer base. Some of the tactics are new product launches, technological innovations, mergers & acquisitions, collaborations & partnerships, and regional expansions. Collaborations with other players are adding leading companies to double their revenue shares and customer base. The majority of players are investing in new and improved product launches to uplift their atomic layer deposition market position and earn double-digit revenue growth.

Some of the key players include:

Recent Developments

- In December 2024, ACM Research, Inc. announced the qualification of its Ultra Fn a plasma-enhanced atomic layer deposition (PEALD) furnace tool. The tool is now set for high-volume 300mm semiconductor manufacturing.

- In September 2023, SkyWater Technology revealed the launch of a new semiconductor processing tool for atomic layer deposition (ALD), the Applied Picosun Morpher. The ALD tool is set to be utilized to fabricate ultra-thin, highly uniform, and conformal material layers for new and emerging customer applications

- Report ID: 1519

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Atomic Layer Deposition Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.