Global Market Size, Forecast, and Trend Highlights Over 2025-2037

Artificial Tendons and Ligaments Market size was over USD 1.5 billion in 2024 and is estimated to reach USD 4.1 billion by the end of 2037, expanding at a CAGR of 9.6% during the forecast timeline, i.e., 2025-2037. In 2025, the industry size of artificial tendons and ligaments is evaluated at USD 1.6 billion.

The rising cases of sports injuries, trauma cases, and degenerative joint disorders are creating a surge in the market. In this regard, the National Institute of Health (NIH) reported that the yearly number of these reconstructive procedures performed around the world till 2023 surpassed 1.2 million. The same was 300,010 in the U.S. each year. On the other hand, rapid aging is amplifying this demography, where the projected population of older residents, aged 60 and over, was calculated to be 2.2 billion by 2050, according to the WHO. Moreover, the heightened prevalence of osteoarthritis and rotator cuff tears among these citizens is propelling demand in this sector.

The volatility in the import values and supply chain disruptions often impose pricing pressure on payers, which may impact wide adoption in the market. The significant expenses of outsourcing essential materials, such as ultra-high-molecular-weight polyethylene (UHMWPE), polyester fibers, and bovine/xenogeneic collagen, are acting as the primary drivers behind the upstream inflation. As evidence, in 2023, the U.S. International Trade Commission recorded a 12.3% rise in producer prices for synthetic ligament components from 2021. However, the continuous improvement in insurance policies is resolving this disparity by offering extensive subsidies and reimbursement coverage for both manufacturers and patients.

Artificial Tendons and Ligaments Sector: Growth Drivers and Challenges

Growth Drivers

- Efforts to improve healthcare accessibility: Considering the notable rise in the population of afflicted individuals and the prevalence of high-risk comorbidities, governments are heavily investing in procuring essentials from the artificial tendons and ligaments market. In addition, authorized insurers are also expanding their coverage, which is acting as a financial cushion for patients undergoing associated treatment, enhancing public access to this sector. For instance, from 2021 to 2023, the expenditure on tendon and ligament repair devices by Medicare increased to USD 1.3 billion while exhibiting a 15.4% rise. Moreover, the support from regulatory frameworks is also accelerating the process of commercialization.

- Growing awareness about early detection and intervention: Several clinical studies have highlighted significant cost-effectiveness and enhanced patient outcomes by performing reconstruction at an early stage, establishing a strong foundation for the market. In this regard, the Agency for Healthcare Research and Quality published a study, which demonstrated a 30.2% reduction in the need for hospital admissions, saving USD 850.1 million for the U.S. healthcare system over 2 years. Such validations are helping this merchandise attract more residents and companies, even from underserved regions, to invest.

Historical Patient Growth (2010-2020) & Its Impact on Market Expansion

The rapid expansion of the patient pool from 2010 to 2020 underscored a transformative phase, which identified a sustainable demand for the artificial tendons and ligaments market. Moreover, the increase in cases of injuries, joint stress, and musculoskeletal deformities created a surge in orthopedic interventions, including reconstructive or corrective surgeries, across the globe. Subsequently, the decade-long continuation of this demographic growth pushed healthcare systems and institutions to accommodate components from this sector. Furthermore, the dramatic changes in this afflicted population also increased understanding of the patient-centric evolutions and helped draft projections of the future consumer base.

Historical Patient Growth (2010-2020) for Artificial Tendons & Ligaments

|

Country |

2010 Patients (Million) |

2020 Patients (Million) |

CAGR (2010-2020) |

Key Driver |

|

U.S. |

0.8 |

1.5 |

6.9% |

Sports injuries, Medicare coverage |

|

Germany |

0.4 |

0.7 |

7.9% |

Trauma care advancements |

|

France |

0.3 |

0.5 |

7.3% |

Aging population |

|

Spain |

0.2 |

0.4 |

7.6% |

Football (soccer) injuries |

|

Australia |

0.2 |

0.3 |

7.7% |

Rugby/outdoor sports |

|

Japan |

0.5 |

1.0 |

7.5% |

Elderly rotator cuff demand |

|

India |

0.2 |

0.6 |

10.8% |

Medical tourism, rising obesity |

|

China |

0.5 |

1.2 |

10.7% |

Expanding hospital networks |

Feasible Expansion Models Shaping the Future Market

The expediting dynamics of the artificial tendons and ligaments market are remarkably followed through the strategic commercial operations of key players. Their public-private partnership (PPP) formation, value-based pricing structure, product innovation, and optimized production are constructing a roadmap for new entrants and investors. For instance, in 2023, suppliers in India increased the accessibility of their pipelines by 30.4% cost reduction through collaborating with local hospitals. Simultaneously, in 2024, leaders in Germany diversified the range of options by enhancing the efficiency and compatibility of their offerings in alignment with the nationwide emergence of robotic surgery.

Revenue Feasibility Models (2022-2024)

|

Strategy |

Region |

Revenue Impact |

Key Driver |

|

Local Manufacturing |

India |

+12.2% (2022-2024) |

Reduced import tariffs |

|

Medicare ASC Partnerships |

U.S. |

+$220.4 million (2023) |

Outpatient shift |

|

Robotic Surgery Bundling |

Germany |

+18.5% per procedure |

Precision demand |

|

Tier-2 Hospital Expansion |

China |

+25.1% volume growth |

Infrastructure push |

Challenge

- Surgeon resistance toward transition: The shortage of skilled workforce is a major hurdle in gaining wide adoption in the market. The lack of knowledge of advanced surgical tools often creates resistance and hesitation among healthcare professionals in utilizing products from this sector. Testifying this, in 2024, the American Academy of Orthopaedic Surgeons revealed that more than 65.2% of the surgeons in the U.S. were favoring traditional methods due to familiarity. However, the ongoing initiatives from both public and private organizations to train associated individuals regarding this category are mitigating this gap.

Artificial Tendons and Ligaments Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

9.6% |

|

Base Year Market Size (2024) |

USD 1.5 billion |

|

Forecast Year Market Size (2037) |

USD 4.1 billion |

|

Regional Scope |

|

Artificial Tendons and Ligaments Segmentation

Application(Knee Reconstruction, Shoulder Repair, Foot & Ankle)

Based on applications, the knee reconstruction segment is poised to capture the largest share of 42.3% in the artificial tendons and ligaments market by the end of 2037. The predominant captivity of knee-related injuries over the net patient pool worldwide makes it a priority for both healthcare settings and dedicated companies. Technological advancements in this category are also significantly higher than other applications, which amplifies the segment's contribution to greater revenue generation. This is also displayed through the expansion of robotic-assisted knee surgeries exhibited a CAGR of 18.2%, as per a 2025 report from the American Academy of Orthopaedic Surgeons. Moreover, the greater procedural volume, coupled with favorable reimbursement policies, is solidifying its leadership in this sector.

Material (Polymer-Based, Biological)

In terms of material, the polymer-based segment is expected to garner a considerable share of 48.1% in the artificial tendons and ligaments market throughout the forecasted timeframe. Its augmentation can be testified by the majority use of UHMWPE-based solutions due to exceptional tensile strength and long-term efficacy. In this regard, in 2024, an NIH study revealed that polymer-based components can reduce the need for revision surgeries by 25.3%, in comparison to other alternatives. As a result of such performance and safety advantages, the use of this subtype accounts for approximately 50.2% of all implants and is considered the gold standard by regulatory bodies. Moreover, being the first choice for manufacturing high-load-bearing orthopedic applications, this segment represents a notable position in this field.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

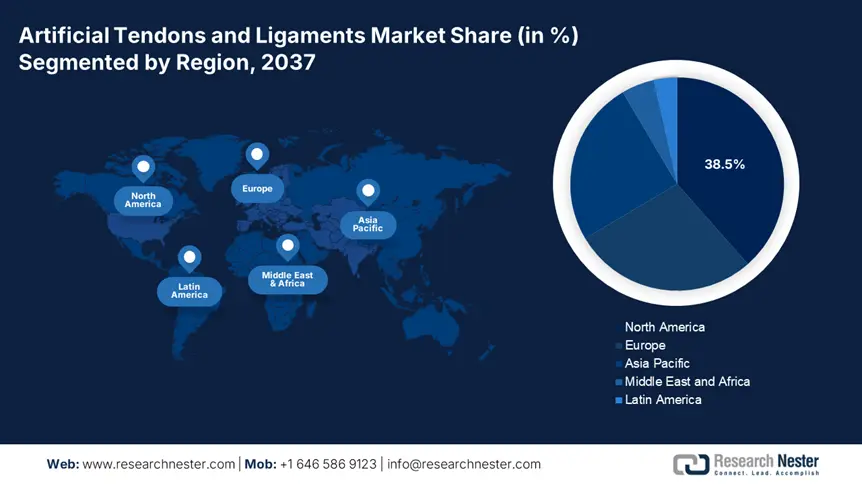

Artificial Tendons and Ligaments Industry - Regional Synopsis

North America Market Analysis

North America is projected to dominate the artificial tendons and ligaments market with a share of 38.5% over the discussed timeline. Its leadership is induced by the increasing prevalence of sports injuries, advanced healthcare infrastructure, and strong reimbursement policies. Particularly, in developed countries, such as the U.S. and Canada, the number of ACL procedures performed is remarkably high, which reflects the improved accessibility and wide adoption. Furthermore, the heavy utilization of innovative biomaterials and medical devices bolsters the volume of revenue generation in this landscape, making it a lucrative option for global leaders.

The U.S. is augmenting the artificial tendons and ligaments market with a regional dominance, gained through enlarging its consumer base and a steady cash inflow. Testifying this, the Centers for Medicare & Medicaid Services (CMS) revealed that 80.2% of the outpatient ACL repairing procedures were subsidized under Medicare coverage till 2024. Furthermore, the continuous capital influx from authorized investors to accelerate advancements is also escalating its expansion in this merchandise. For instance, from 2020 to 2024, the net NIH investments for extensive R&D on biomaterials totaled USD 250.4 million. On the other hand, the integration of 3D printing technology in medical instrument production, coupled with accelerated FDA approvals, the U.S. is underscoring a strong foundation in this sector.

The Canada artificial tendons and ligaments market is also following the region's pathway of progress with provincial healthcare investments and government initiatives. For instance, from 2021 to 2024, the funding from the governing body of Ontario increased by 18.2%. On the other hand, the robot-assisted surgery pilot program in Alberta enhanced public access by reducing costs by 15.1%. Moreover, the country's contribution to the demographic expansion is also a notable driver behind this sector's augmentation. In this regard, StatsCan published a projection for 2024, indicating an increase in the population of senior citizens, reaching 25.4% by 2030. It also mentioned that more than 200,004 tendon repairs were being performed nationwide every year till 2024.

APAC Market Statistics

Asia Pacific is poised to follow the highest CAGR in the global artificial tendons and ligaments market by 2037. The presence of multiple manufacturing and innovation powerhouses, such as China, India, Japan, and South Korea, is the major fast-propagating factor in this region. This is also fueled by government initiatives and investments. For instance, in 2024, the governing bodies of Japan dedicated 12.3% of the total healthcare budget, accounting for USD 3.2 billion, to advancing implants. Furthermore, the efforts to bring affordability in this sector are diversifying the pipelines, creating new business opportunities for both domestic and international pioneers.

China is predicted to dominate the APAC artificial tendons and ligaments market with an enlarging patient pool and amplifying government healthcare spending. For instance, till 2024, over 1.6 million reconstruction procedures were being performed every year nationwide, leading to a 15.1% rise in year-on-year expenditure, according to the National Medical Products Administration. Additionally, the country is highly adaptive to advanced technologies, propelling progress in this landscape. As evidence, in 2024, 3D-printed implants held around 30.2% of this merchandise in China. Thus, the collective influence of healthcare modernization, enlarging consumer base, and heavy capital influx are consolidating the nation's position at the forefront of regional territory.

India is emerging as an alternative manufacturing and innovation hub for the artificial tendons and ligaments market by following the current trend of infrastructural development. The country's propagation in this sector is also pledged to government efforts in improving public access to advanced healthcare. In addition, the expanding territory of the domestic medical tourism industry is contributing to 25.4% of the nation's demand, which is a result of the presence of international patients seeking high-quality treatment at an affordable rate. Besides, the country's progress in implementing equitable healthcare distribution is outstretching the field's reach toward rural areas, fostering greater revenue generation opportunities.

Companies Dominating the Artificial Tendons and Ligaments Landscape

The dominance of key players in the global market is affiliated with the commercial success of strategic initiatives. This is displayed by the collective captivity of Arthrex, Stryker, and Zimmer Biomet over 55.3% revenue share in this sector. The emergence of advanced designs and materials is procuring greater business value for these pioneers. For instance, Medtronic solidified its dominance in the U.S. landscape by attaining FDA approval for its next-generation hybrid implants, collagen-PEEK grafts. Following the same region-specific approach, Smith & Nephew utilized its strong partnerships with public organizations in India to secure lucrative profit margins. Such key players are:

|

Company Name |

Country |

Market Share |

Industry Focus |

|

Arthrex |

U.S. |

22.4% |

Leader in polymer-based ACL/PCL implants & minimally invasive surgical systems |

|

Stryker |

U.S. |

18.1% |

Robotic-assisted ligament reconstruction (Mako system) |

|

Zimmer Biomet |

U.S. |

15.2% |

3D-printed synthetic ligaments & revision surgery solutions |

|

Smith & Nephew |

UK |

12.1% |

Bioabsorbable collagen scaffolds for rotator cuff repairs |

|

Medtronic |

Ireland |

8.3% |

Hybrid (polymer + biologic) grafts for complex joint injuries |

|

Johnson & Johnson (DePuy Synthes) |

U.S. |

xx% |

Sports medicine-focused implants (LARS ligament) |

|

CONMED |

U.S. |

xx% |

Cost-effective synthetic tendons for emerging markets |

|

Wright Medical (part of Stryker) |

U.S. |

xx% |

Foot/ankle ligament solutions |

|

Össur |

Iceland |

xx% |

Smart ligament implants with IoT-enabled monitoring |

|

DJO Global |

U.S. |

xx% |

Rehabilitation-integrated tendon repair systems |

|

Lepu Medical |

China |

xx% |

Domestic market leader in China; low-cost polyester ligaments |

|

MicroPort Scientific |

China |

xx% |

Export-focused OEM supplier for APAC markets |

|

Mathys AG |

Switzerland |

xx% |

Precision-engineered knee ligament systems |

|

Corin Group |

UK |

xx% |

Customizable tendon implants for complex anatomies |

|

Surgival |

Spain |

xx% |

Bioactive ceramic-coated ligaments |

|

Orthomed (India) |

India |

xx% |

Affordable autograft alternatives for Indian hospitals |

|

Biometrix |

Australia |

xx% |

Marine collagen-based tendons (patented AquaTend technology) |

|

BioAlpha Holdings |

Malaysia |

xx% |

Halal-certified biologic grafts for Muslim-majority markets |

Recent Developments

- In May 2024, Smith & Nephew launched the first FDA-approved xenograft ligament for rotator cuff repairs, RegenaLig, derived from porcine collagen. The product delivered an immediate commercial impact by driving a 12.2% increase in the company’s 2nd quarter revenue volume.

- In March 2024, Arthrex developed a bioabsorbable synthetic ligament, BioTeno ACL implant, by blending UHMWPE fibers with collagen coating. This innovation captured 8.4% of the U.S. ACL reconstruction market within 3 months of its launch while addressing rejection risks and accelerating healing.

- Report ID: 7731

- Published Date: Jun 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert