Artificial Intelligence (AI) in Medical Diagnostics Market Outlook:

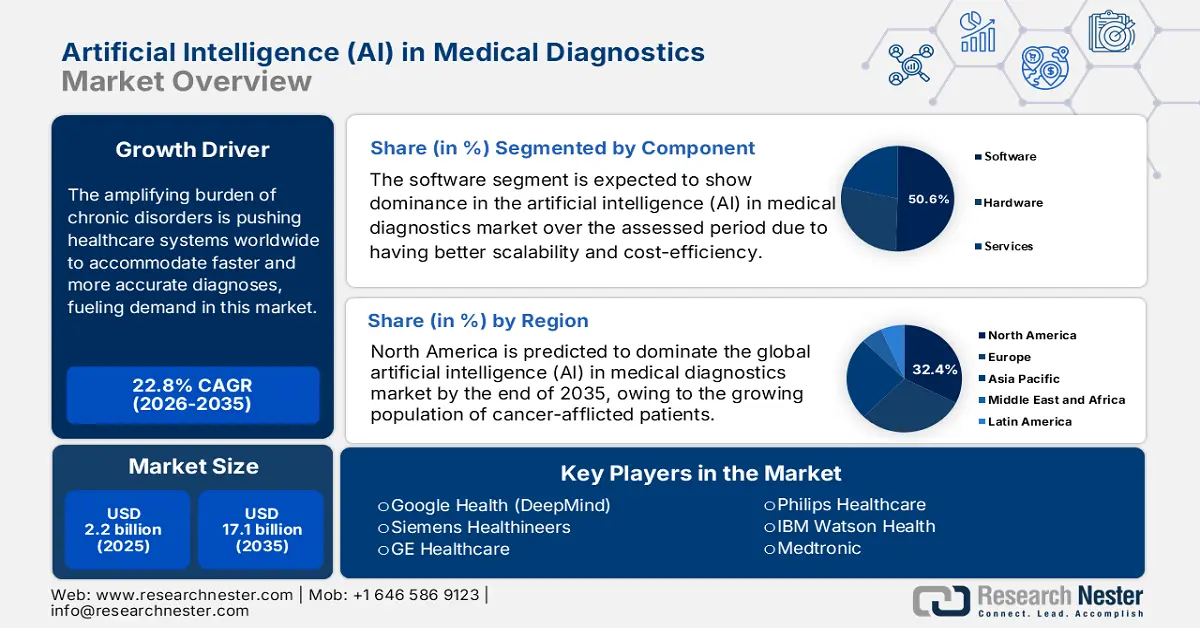

Artificial Intelligence (AI) in Medical Diagnostics Market size was valued at USD 2.2 billion in 2025 and is projected to reach USD 17.1 billion by the end of 2035, rising at a CAGR of 22.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of artificial intelligence (AI) in medical diagnostics is estimated at USD 2.7 billion.

The amplifying burden of chronic disorders is pushing healthcare systems worldwide to accommodate faster and more accurate diagnoses, fueling demand for artificial intelligence (AI) in the medical diagnostics market. According to the WHO report published in December 2024, 75% of the mortalities around the globe originated from non-communicable diseases (NCDs). Further WHO report in July 2025 states that 19.8 million people died from cardiovascular disease (CVD) in 2022. This demography testifies to the growing need for next-generation diagnostic methods and tools, such as AI-powered solutions, to enable early intervention for better outcomes.

The artificial intelligence (AI) in medical diagnostics market often presents notable economic pressure for payers, following recent trends in payers' pricing. As per the AHA report published in 2025, the U.S. has imported over $14.9 billion in medical equipment as of 2024, which encompasses items like MRI apparatus. The data reflects ongoing high demand and reliance on foreign medical equipment imports with the latest technology. Moreover, the heightening cost and resistance to AI implementation are limiting the optimum reach and adoption in this sector. On the other hand, the collective efforts from governing bodies and authorized insurers to increase public access to advanced diagnostics are minimizing this disparity.

Key Artificial Intelligence (AI) in Medical Diagnostics Market Insights Summary:

Regional Highlights:

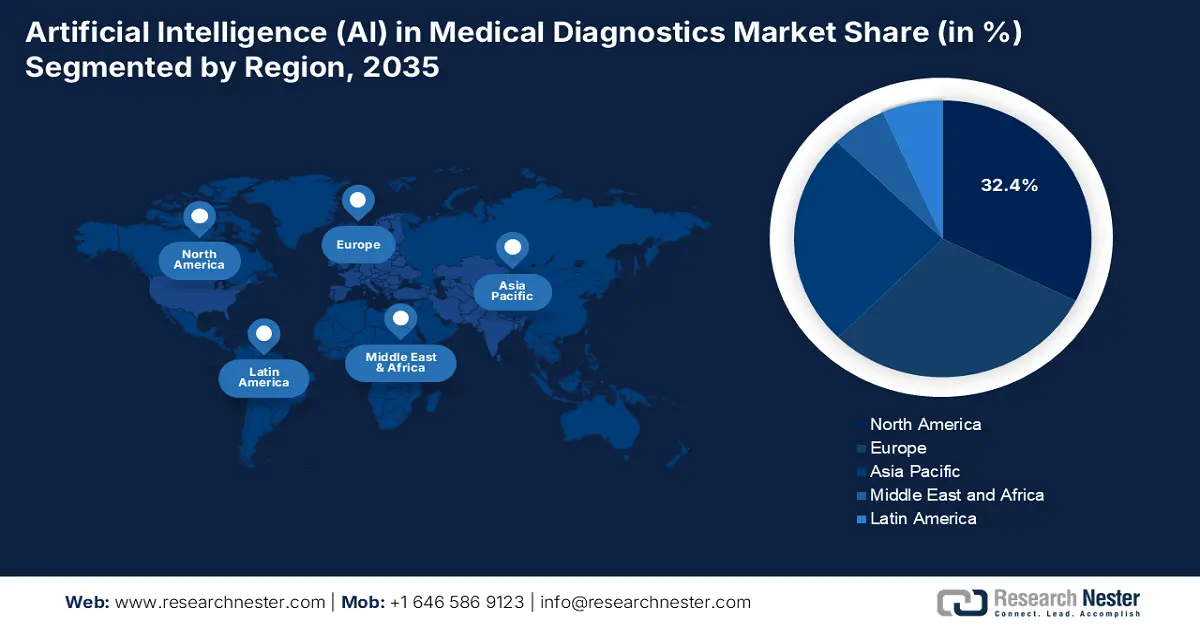

- North America is projected to lead the artificial intelligence (AI) in medical diagnostics market with a 32.4% share by 2035, owing to the expanding cancer patient population and continuous advancements in oncology.

- Europe is anticipated to maintain a substantial share by 2035, attributed to its strong regulatory framework and increasing adoption of AI for disease diagnosis.

Segment Insights:

- The software segment is anticipated to account for 50.6% share by 2035 in the artificial intelligence (AI) in medical diagnostics market, propelled by the growing adoption of scalable and cost-efficient AI-as-a-Service (AIaaS) models.

- The hospitals segment is projected to secure a substantial share by 2035, impelled by increasing patient volumes, robust imaging infrastructure, and the pursuit of greater operational efficiency.

Key Growth Trends:

- Magnifying government support and investments

- Clinical advantages in integrating AI

Major Challenges:

- Resistive tendency toward automation

Key Players: IBM Watson Health (Merative), Google Health (Alphabet Inc.), Microsoft Healthcare (Nuance AI), Siemens Healthineers, GE HealthCare, Philips Healthcare, Roche Diagnostics, Canon Medical Systems, Fujifilm Holdings, Hitachi Healthcare, NEC Corporation, Shimadzu Corporation, PathAI, Tempus AI, Zebra Medical Vision (Nanox AI), Lunit, Aidoc, Qure.ai, Behold.ai, Arterys (Tempus acquired)

Global Artificial Intelligence (AI) in Medical Diagnostics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.7 billion

- Projected Market Size: USD 17.1 billion by 2035

- Growth Forecasts: 22.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 2 September, 2025

Artificial Intelligence (AI) in Medical Diagnostics Market - Growth Drivers and Challenges

Growth Drivers

-

Magnifying government support and investments: The escalating adoption in the AI in medical diagnostics market is highly attributable to the trend of digitalization and modernization in the healthcare industry. The proactive participation of governing bodies from across the globe, particularly in emerging economies, is fueling this cohort with steady capital engagement. According to the Congress.gov report released in 2025, the overall NIH budget was roughly USD 47.3 billion in 2023, with slight variations in subsequent years, including allocations toward AI and ML projects within their broader research funding. Moreover, the regulatory frameworks are also promoting the wide adoption of advanced technologies in mainstream workflow to improve efficiency and patient outcomes.

-

Clinical advantages in integrating AI: Various research and evidence are cultivated through studies and trials, the validation of offerings from the artificial intelligence (AI) in medical diagnostics market solidifies. The NLM report in September 2024 mentions that the AI system was highly sensitive at 87.5% and specific at 66.2% in diabetic retinopathy detection and leading to efficient screening and lower costs. In addition, clinical evidence of reducing initial expenditures boosted uptake, even for smaller clinics.

-

Personal out-of-pocket expenses: The patients' own expenditures are reshaping AI adoption. The KFF report issued in May 2024 indicates the out-of-pocket expenses during 2022 totaled USD 1,425 per individual, making it a substantial burden for some. Although long-term costs are projected to be reduced by AI tools through efficiency, the existing reimbursement deficits compel some of the cost onto patients. AI adoption is largely made possible by national insurance programs, which lower direct costs.

Challenges

-

Resistive tendency toward automation: Despite offering a wide range of advantages, including better accuracy and scalability, many legacy medical service providers and physicians refrain from adopting commodities from the artificial intelligence (AI) in medical diagnostics market. The trust issue further escalates to patients, which may slow the expansion of the consumer base in this sector. For instance, in 2023, a survey conducted by the American Medical Association revealed that U.S. doctors lack faith in AI diagnostics. However, the government and private initiatives to train and teach selected healthcare professionals have shown promising improvement in combating this skepticism.

Artificial Intelligence (AI) in Medical Diagnostics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

22.8% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 17.1 billion |

|

Regional Scope |

|

Artificial Intelligence (AI) in Medical Diagnostics Market Segmentation:

Component Segment Analysis

The software segment is expected to show dominance in the artificial intelligence in medical diagnostics market with a share of 50.6% over the assessed period. Having better scalability and cost-efficiency compared to services and hardware, AI-as-a-Service (AIaaS) models have become the most preferred choice in this sector. According to the NLM report in April 2025, FDA has approved 434 AI driven medical devices in the U.S. with advanced AI/ML algorithms to enhance the accuracy and effectiveness in diagnosis. Moreover, the expedited surge in flexible and value-based diagnostic solutions is democratizing access to advanced medical services, which is propelling cash inflow in this sector.

End user Segment Analysis

Hospitals are leading the end user segment in the artificial intelligence in medical diagnostics market and are expected to hold a considerable share value by 2035. The segment is driven by the large patient volumes, extensive imaging infrastructure, and need for operational efficiency. They are the first adopters of integrated AI diagnostic solutions to decrease diagnostic mistakes, accelerate time-to-treatment, and control increasing healthcare expenditures. Government incentive programs and investments, including grants by the Centers for Disease Control and Prevention (CDC) for health IT modernization within clinical environments, enable hospitals to invest in these technologies, making them the largest market segment.

Technology Segment Analysis

Machine Learning, deep learning in particular, is the central technology that can enhance the capacity for learning from huge amounts of medical images and electronic health records to classify and predict. Its dominance is driven by public-private collaborations and grants from institutions such as the NIH financing research on the creation of strong ML algorithms to use for diagnosis to perpetuate technological development and verification. The NIH Common Fund's Bridge to Artificial Intelligence (Bridge2AI) program is a notable initiative, announced with an investment of around $130 million to accelerate the AI adoption in biomedical and behavioral research.

Our in-depth analysis of the AI in medical diagnostics market includes the following segments:

|

Segment |

Subsegment |

|

Component |

|

|

Diagnosis |

|

|

Technology |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Intelligence (AI) in Medical Diagnostics Market - Regional Analysis

North America Market Insights

North America is predicted to dominate the global artificial intelligence in medical diagnostics market by capturing 32.4% by the end of 2035. Its proprietorship is highly pledged to the growing population of cancer-afflicted patients and ongoing advancements in oncology. According to the Intuition Labs report in July 2025, nearly 18.7% of the hospitals in the U.S. have adopted AI to improve diagnosis. Further, well-established healthcare infrastructure, the presence of internationally recognized AI pioneers, constant regulatory support, and enhanced reimbursement coverage are accumulatively amplifying growth in the North America landscape.

The projections display the dominance of the U.S. over the regional artificial intelligence in medical diagnostics market by 2035, generating a considerable revenue. The NIH is actively interested in AI studies, with the National Cancer Institute investing more in AI oncology diagnostic-related research. According to the Breast Cancer report of July 2024, AI has minimized the false positives of breast cancer by 6% in the U.S. The key trend related to AI applications in medical imaging is transforming the radiology and pathology domains to address the limitations in the diagnostic bottlenecks and enhance accuracy.

Approvals for AI Enabled Medical Devices (2015-2023)

|

Year |

Number of FDA approvals for AI/ML-enabled medical devices |

Licensed for children (percentage relative to total FDA approvals %) |

|

2015 |

5 |

1 (20.0) |

|

2016 |

19 |

0 (0.0) |

|

2017 |

26 |

1 (3.8) |

|

2018 |

63 |

7 (11.1) |

|

2019 |

76 |

4 (5.3) |

|

2020 |

108 |

13 (12.0) |

|

2021 |

123 |

10 (8.1) |

|

2022 |

139 |

24 (17.3) |

|

2023 |

108 |

9 (8.3) |

Source: NLM, October 2024

APAC Market Insights

The Asia Pacific AI in medical diagnostics market is anticipated to exhibit the highest CAGR over the discussed tenure. Its pace of propagation is accelerated with rapid aging, digitalization, and modernization. Particularly, the proactive governments in emerging economies, such as China and India, are participating in this transformation, fueling adoption in this sector. For instance, in 2024, the Ministry of Health and Family Welfare, Government of India, has depicted that the total teleconsultations under eSanjeevani were 21.60 crore, enhancing the health services with the latest technology and accessible to every individual in the society. This is further attracting both domestic and foreign AI pioneers to invest.

China leads the AI in medical diagnostics market in the Asia Pacific region through regulatory backing and the growing medical device sector. According to the NLM report in September 2024, almost 59 AI medical devices were approved in China, shaping the medical device and diagnosis practice gradually. This growth highlights the growing innovation and proactive regulatory landscape, changing the diagnostic practices and speeding the adoption of AI-driven solutions. The approvals make China the leading region in the adoption of AI applications in healthcare.

Europe Market Insights

Europe is the second-largest region in artificial intelligence in medical diagnostics market, and is expected to hold a considerable share by 2035. The region is driven by the solid regulatory framework, government digital health portfolio expansion, and the urgent need to improve efficiency in healthcare. The September 2024 Frontiers report has clearly stated that almost 42% of hospitals in the EU have already adopted AI for disease diagnosis, indicating a desire to adopt new and innovative solutions. Supportive regulations from the EMA for software as a medical device (SaMD) are also streamlining market entry for innovative AI solutions.

UK is dominating artificial intelligence in medical diagnostics market in Europe and fueling the demand for AI diagnostics to overcome the challenges of the workforce shortages and backlogs. According to the the National AI Strategy report in September 2021, £250 million is allocated develop the NHS AI Lab at NHSX to surge the safe adoption of AI in health and care. Furthermore, the UK’s unique centralized health data from the NHS provides an unparalleled resource for training and validating diagnostic algorithms, attracting significant investment from global AI developers and securing its strong market position.

Key Artificial Intelligence (AI) in Medical Diagnostics Market Players:

- IBM Watson Health (Merative)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google Health (Alphabet Inc.)

- Microsoft Healthcare (Nuance AI)

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Roche Diagnostics

- Canon Medical Systems

- Fujifilm Holdings

- Hitachi Healthcare

- NEC Corporation

- Shimadzu Corporation

- PathAI

- Tempus AI

- Zebra Medical Vision (Nanox AI)

- Lunit

- Aidoc

- Qure.ai

- Behold.ai

- Arterys (Tempus acquired)

The artificial intelligence in medical diagnostics market features intense competency among tech giants and specialized healthcare firms, such as IBM Watson Health and Google Health. Individual leaders are opting for indifferent strategies to advance their existing pipelines and commercial territories. Following the same pathway, Qure.ai and Lunit Inc. are establishing a strong foundation for AI in cancer detection by delivering more accurate and faster outcomes. Simultaneously, Siemens Healthineers and GE Healthcare are more focused on developing dedicated solutions for radiology.

Below is the list of some prominent players operating in the global artificial intelligence in medical diagnostics market:

Recent Developments

- In July 2025, Forte Diagnostics partnered with Health Vectors, together launched AI powered medical diagnostics and health data visualization platform. This launch represents advancements in technology related to patient centric innovation.

- In June 2025, PathAI announced the 510(k) clearance from FDA on AISight Dx(Novo). The launch is aimed for the continuous innovation and PathAI’s commitment to delivering enhanced capabilities as the product evolves.

- Report ID: 3731

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Intelligence (AI) in Medical Diagnostics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.