Aquaponics Market Outlook:

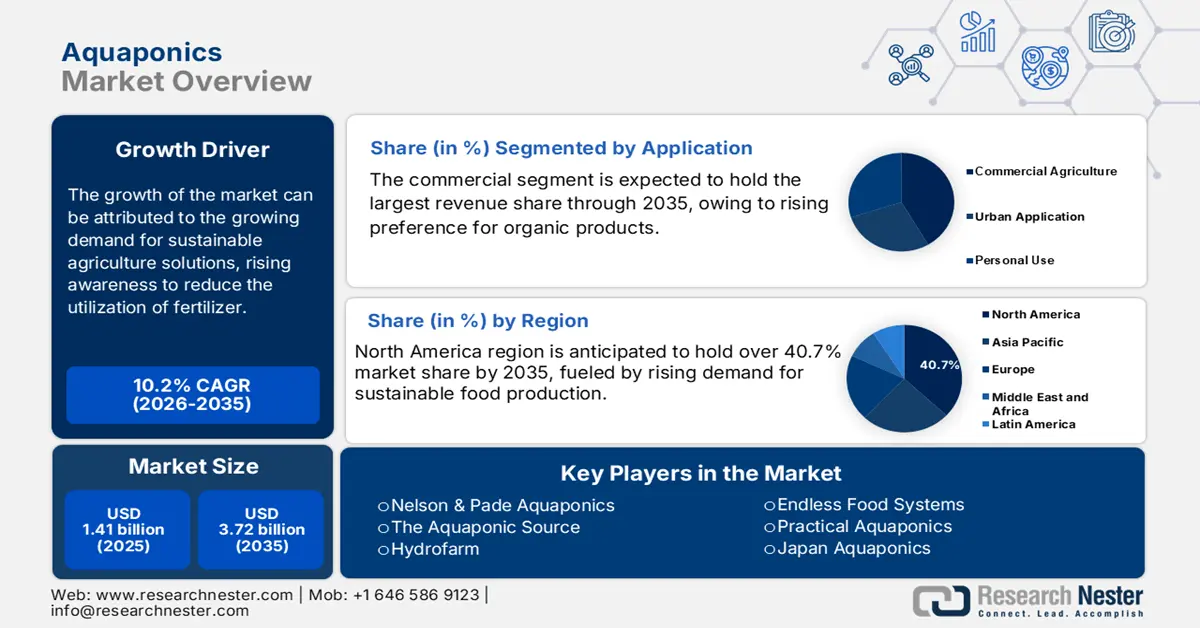

Aquaponics Market size was over USD 1.41 billion in 2025 and is poised to exceed USD 3.72 billion by 2035, growing at over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aquaponics is estimated at USD 1.54 billion.

The market growth can be ascribed to the growing demand for sustainable agriculture solutions. According to the UN World Water Development Report 2022, on average, agricultural farms across the world account for 70% of all water that is consumed annually. Also, 40% is lost to the environment due to evaporation, poor irrigation systems, and overall poor water management. While aquaponics utilizes up to 90% less water than traditional agriculture. The aquaponics industry epitomizes sustainable agriculture practices by lessening the environmental impact.

Additionally, rising awareness to reduce the utilization of fertilizer is acting as a catalyst for the market growth. There has been a rise in hypoxic and eutrophic events due to intensive agricultural practices, particularly by using fertilizers. According to data published by the World Resources Institute, almost 50% of the global population lives within a range of 60 kilometers of the coast. This means a major population is vulnerable to the consequences of eutrophication in their local ecosystem. Global governments are acknowledging this issue and promoting aquaponics as an efficient option to control eutrophication.

Key Aquaponics Market Insights Summary:

Regional Highlights:

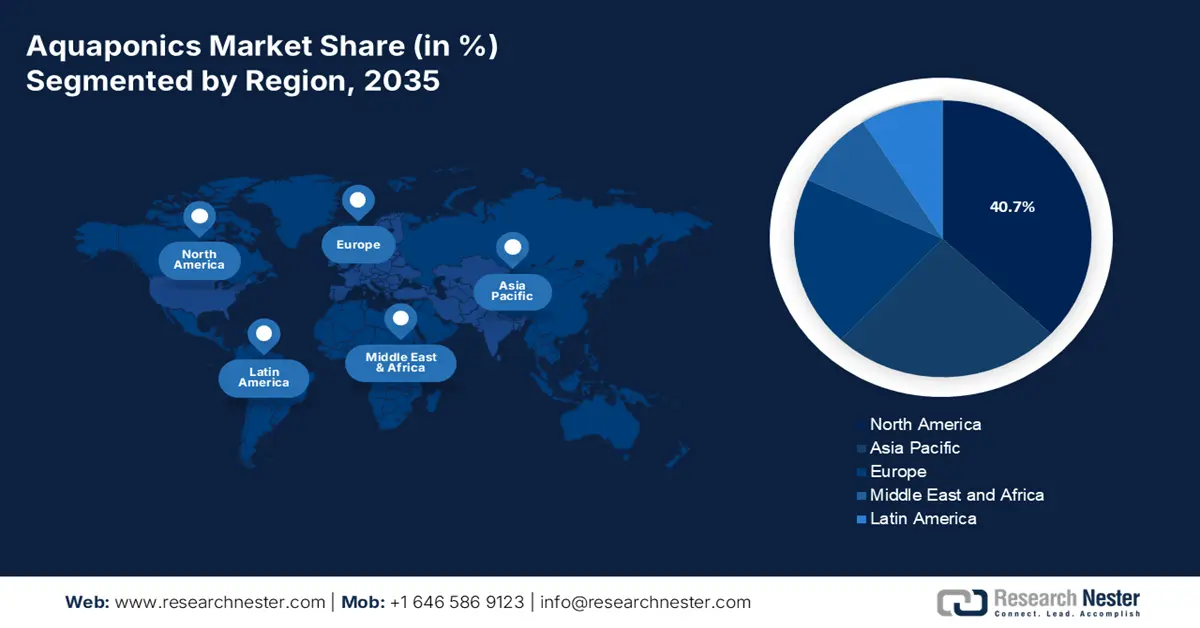

- North America aquaponics market will dominate over 40.7% share by 2035, driven by rising demand for sustainable food production.

- Asia Pacific market will register remarkable growth share of 23% during the forecast timeline, driven by government efforts to ensure food security and promote aquaponics.

Segment Insights:

- The commercial segment in the aquaponics market is expected to hold the maximum share by 2035, driven by rising demand for organic products and sustainable farming methods.

- The poly or glass greenhouse segment in the aquaponics market is expected to maintain a dominant share by 2035, propelled by its environmental control and durability.

Key Growth Trends:

- Rising demand for organic fruits and vegetables

- Increasing emphasis on food security

Major Challenges:

- Limited selection of plants

Key Players: Pentair Aquatic Eco-Systems, Nelson & Pade Aquaponics, The Aquaponic Source, Hydrofarm Endless Food Systems, Practical Aquaponics, Japan Aquaponics, ECF Farm System, Pontis Water Lentils, Pentair Aquatic Economy.

Global Aquaponics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.41 billion

- 2026 Market Size: USD 1.54 billion

- Projected Market Size: USD 3.72 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, Australia

- Emerging Countries: China, Japan, India, Australia, Thailand

Last updated on : 8 September, 2025

Aquaponics Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for organic fruits and vegetables: In the last few years, there has been increasing demand for organic produce from all across the globe. For instance, according to data published by the Economic Research Service in 2021, the U.S. organic retail sales rose by an average of 8% per year, and sales reached USD 52 billion. Aquaponics produces organic vegetables by recycling nutrients obtained from the aquaculture. The practice encourages organic and sustainable farming by eradicating the need for chemicals and pesticides.

- Increasing emphasis on food security: Many innovative food production methods have evolved due to reduced agricultural land, limited water availability, and concerns over food security. The World Bank stated in September 2023 that up to 783 million people faced hunger in 2022, and projections reveal that by 2030, over 600 million will struggle to get food. Aquaponics is emerging as an efficient method to improve food security in developing countries. Aquaponics utilizes the biomimetic natural system to lessen the generation of waste and inputs.

- Growing efforts for soil conservation: In August 2024, UNESCO warned that 90% of the Earth’s land surface could be degraded by 2050, posing immense risks for biodiversity. The United Nations also commemorates World Soil Day annually on December 5 to draw attention to the importance of healthy soil. Aquaponics is a circular method of farming that eliminates the need for soil and reduces soil erosion, pesticide use, and risk of nutrient runoff. These factors are bolstering the growth of the market in the assessed time frame.

Challenges

- High competition from conventionally produced products: The aquaponics market faces severe challenges as there are higher operational costs than those of soil culture. Aquaponics also requires skills and knowledge different from traditional farming methods.

- Limited selection of plants: Not all plants are suited for aquaponics farming, as various plants struggle to grow in the water environment and have specific soil needs. Also, sometimes aquaponics does not provide enough nutrients required for the plants to remain healthy.

Aquaponics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.41 billion |

|

Forecast Year Market Size (2035) |

USD 3.72 billion |

|

Regional Scope |

|

Aquaponics Market Segmentation:

Application Segment Analysis

The commercial segment is projected to register the maximum market share in the coming period. The growth of the market can be attributed to the rising preference for organic products. According to the World Economic Forum in 2022, the indoor vertical farming sector garnered remarkable funding of USD 2.4 billion. Investors are realizing the huge benefits of aquaponics, such as water efficiency, no usage of pesticides, flexibility with locations, and flexibility with locations. Researchers also suggest that starting an aquaponics business costs significantly less than a traditional farm. Additionally, entrepreneurs are finding aquaponics appealing as these systems are designed for continuous vegetable production.

Facility Type Segment Analysis

The poly or glass greenhouse segment dominates the global aquaponics market due to its durability and other environmental benefits. Glass greenhouses offer the highest light transmission for plants, which is necessary for optimal growth. In April 2021, the World Economic Forum reported that a large urban rooftop farm in Montreal, Canada, had been established and was producing more than 11,000 kg of food per week. Aquaponics greenhouses offer superior environmental control capabilities and are helpful in maintaining optimal conditions. It also reduces production risks as it prevents crops from damage from the extreme climate-related events. Other than this, plants in an aquaponics arrangement grow faster and vigorously, which leads to higher crop yields and fewer growth cycles. This will help eliminate the alarming issue of crop wastage. According to the Food and Agriculture Organization, about USD 3.8 trillion worth of crops and livestock production has been lost in the last 3 decades. Farmers are widely adopting the glass greenhouses practice to overcome crop wastage, acting as a prominent growth-promoting factor.

Our in-depth analysis of the global aquaponics market includes the following segments:

|

Equipment |

|

|

Facility Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aquaponics Market Regional Analysis:

North America Market Insights

North America region is anticipated to hold over 40.7% market share by 2035. This can be attributed to the rising demand for sustainable food production in the region. For instance, in the U.S., according to the National Sustainable Agriculture Coalition in 2022, 2,125 farms were transitioning acreage into certified organic production. The other reason for the growth of the market in the U.S. is the rising consumption of seafood. Economic Research Service stated in April 2021 that residents in the country consumed an average of 20.5 pounds of seafood, particularly finfish and shellfish. In an aquaponics ecosystem, fish play a crucial role as they generate natural fertilizers required by the plants to thrive. In Canada, commercial utilization of aquaponics is becoming popular, leading to further development of the deep-water system, resulting in faster-growing crops.

Asia Pacific Market Insights

Asia Pacific is also projected to register remarkable growth share of 23% during the forecasted period 2035, owing to rising efforts to ensure food security. According to the Food and Agriculture Organization, in June 2024, there were 370.7 million undernourished people present and registered as half of the globe’s severe food insecurity. Governments are embracing modern methods such as aquaponics to provide food supply to the maximum population. In India, according to the Press Bureau of India in August 2024, the Fisheries and Aquaculture Infrastructure Development Fund (FIDF) was implemented with a total fund size of 75 billion to support aquaculture farmers. Also, there is a target of increasing fish production to 22 million metric tons in 2025. The rising fish production and aquaculture are augmenting the market in the country.

Aquaponics Market Players:

- Pentair Aquatic Eco-Systems

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nelson & Pade Aquaponics

- The Aquaponic Source

- Hydrofarm

- Endless Food Systems

- Practical Aquaponics

- Japan Aquaponics

- ECF Farm System

- Pontis Water Lentils

- Pentair Aquatic Economy

The competitive landscape of the aquaponics market is rapidly evolving as established key players, agricultural giants, and new entrants are investing in modern technologies. Key players in the market are focused on developing new methods and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In 2024, Terrascope proposes developing in multi-functional aquaponics research exhibition on the MIT campus. This aims to promote the viability of the potential application within widespread commercial agriculture. The research exhibition will enhance reliance on campus-grown produce through an innovative waste heat recovery system.

- In February 2022, the Government of Sikkim in India launched modern technology of Hydroponics, Aquaponics, and Rooftop farming. The technology will support enhancing financial benefits for the farmers.

- Report ID: 1071

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aquaponics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.