Antiepileptic Drugs Market Outlook:

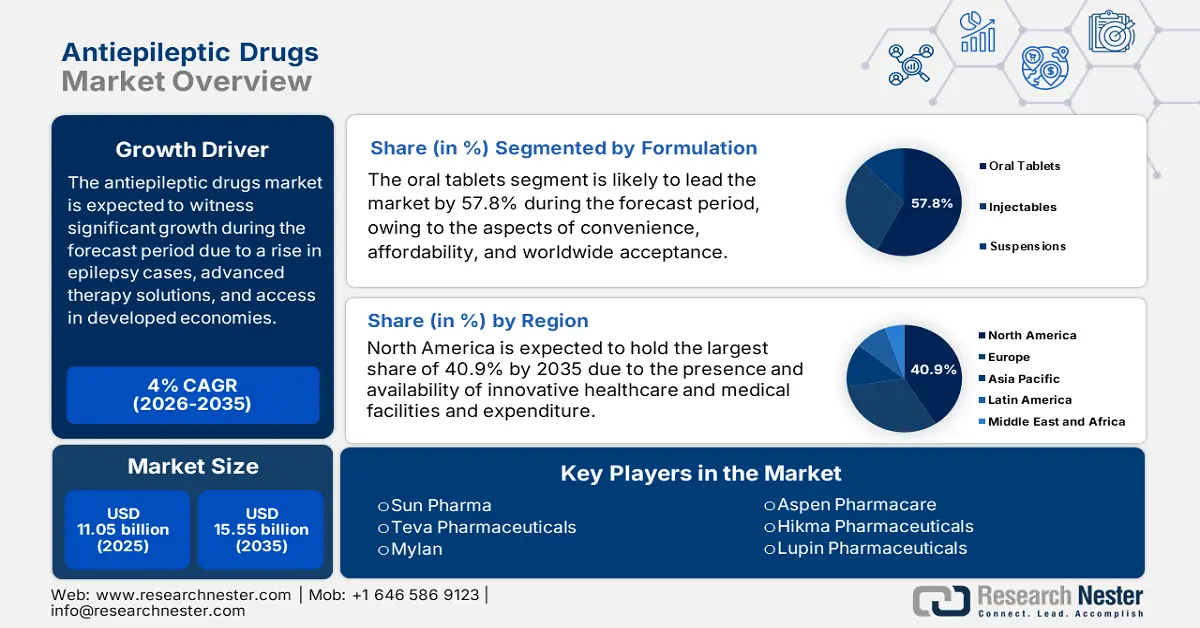

Antiepileptic Drugs Market size was valued at USD 11.05 billion in 2025 and is projected to reach USD 15.55 billion by the end of 2035, rising at a CAGR of 4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of antiepileptic drugs is evaluated at USD 12 billion.

The market for neuroprotective drugs (AEDs) is undergoing substantial changes as a result of innovative drug development, increasing demand for individualized therapy, and changing ranges of healthcare preparedness. Historically, most of the newer AEDs, such as levetiracetam and lacosamide, are desirable because of their efficacy and safety. The retail pharmacy channel is the most competitive line of distribution channels available, likely due to the detail of consistent price and accessibility. Hospital pharmacy channels are expected to show faster growth than retail pharmacies. Additionally, the market is gaining increased significance, owing to the presence of the patient pool. According to the Center for Advancing Health (CFAH), approximately 2.75 million people in the U.S. readily rely on AEDs, thus driving the market growth. Besides, the supply chain facility highly depends on pharmaceutical ingredient (API) production, particularly in China and India. In addition, finished formulations are usually manufactured in Japan, the U.S., and the EU, wherein administrative compliance ensures quality control.

Furthermore, the consumer price index for epilepsy drugs has surged, which has effectively outpaced usual inflation, owing to patent protections on the latest therapies. Meanwhile, the producer price index for AED formulations has equally increased, which has reflected an increase in logistics and API expenses. Besides, even research, development, and deployment-based investments for epilepsy therapies have increased, thereby suitable for uplifting the market.

Key Antiepileptic Drugs Market Insights Summary:

Regional Highlights:

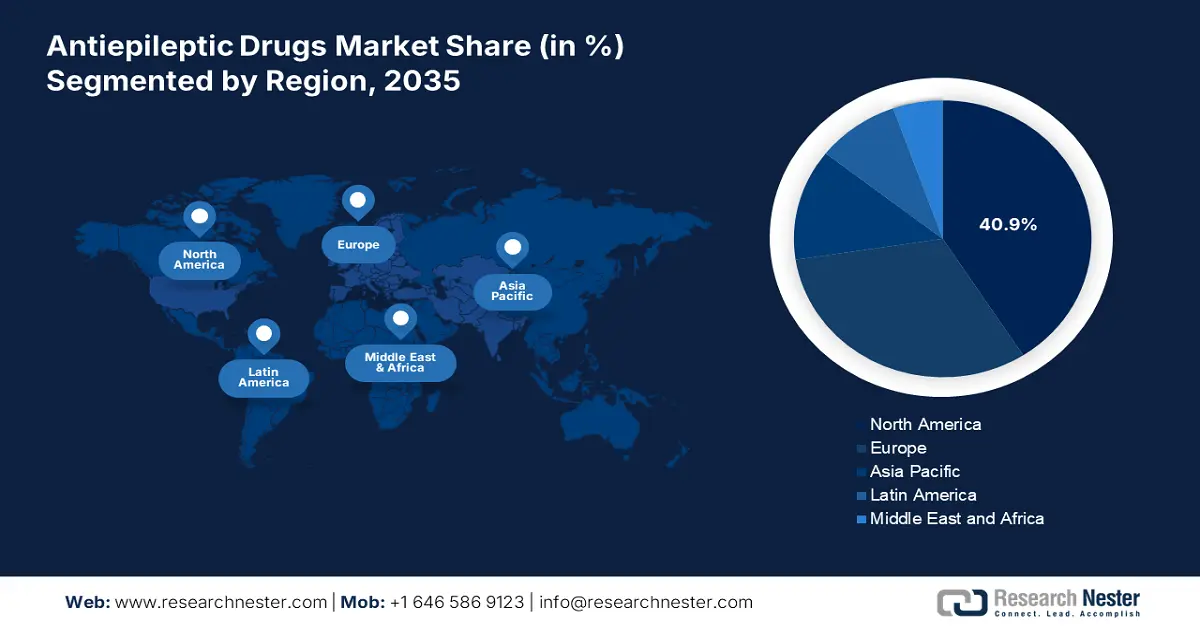

- North America in the antiepileptic drugs market is on track to command a 40.9% share by 2035, supported by rising health expenditure and the accelerated adoption of innovative treatments.

- Europe is projected to capture a 31.7% share by 2035, underpinned by the growing use of precision drugs and an expanding aging population.

Segment Insights:

- The oral tablets segment is expected to attain a 57.8% share by 2035 in the antiepileptic drugs market, fueled by its broad acceptance, cost-effectiveness, and long-term therapy suitability.

- The third-generation AEDs segment is anticipated to hold a 43.5% share by 2035, strengthened by its superior efficacy and favorable safety profile.

Key Growth Trends:

- Cost effectiveness and interventions in health quality

- Administrative spending on AEDs

Major Challenges:

- Complexities and delays in administrative approvals

- Poor out-of-pocket expenses

Key Players: UCB Pharma, Pfizer, Novartis, GlaxoSmithKline (GSK), Eisai, Sanofi, Sun Pharma, Teva Pharmaceuticals, Mylan, Hikma Pharmaceuticals, Lupin Pharmaceuticals, Aspen Pharmacare, CSL Limited, Celltrion, Pharmaniaga.

Global Antiepileptic Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.05 billion

- 2026 Market Size: USD 12 billion

- Projected Market Size: USD 15.55 billion by 2035

- Growth Forecasts: 4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 13 August, 2025

Antiepileptic Drugs Market - Growth Drivers and Challenges

Growth Drivers

- Cost effectiveness and interventions in health quality: The demand for value-specific care to provide epilepsy treatment is gradually reshaping the global market. This has readily underscored clinical as well as economic benefits for optimized dosing and drug selection, particularly for refractory epilepsy, thereby suitable for the market. At the same time, an increased focus on improving health outcomes, particularly in connection with public health and policy, has been recognized. There are a variety of organizations and agencies that are working to improve the early identification of and access to timely treatment for epilepsy. In addition, health technology assessments and pharmacoeconomic evaluations are increasingly helping to promote new AEDs within national formularies. Collectively, these factors are providing the impetus for the continued growth of the market in developed and emerging markets.

- Administrative spending on AEDs: The aspect of public healthcare expenses is a crucial driver for boosting the market globally. Additionally, these solutions eliminate logistical barriers, lower medication costs, and improve long-term medication adherence. In many parts of the world, these administrative costs are responsible for collaboration and bulk acquisition of AEDs with negotiated deposits. As healthcare systems continue to prioritize chronic disease prevention and management and value-based care, administrative spending on AEDs is part of the larger trend of expanding and modernizing the antiepileptic drug market.

- Growing focus on mental health and neurological care: According to a 2024 report by the American Brain Foundation, neurological diseases are currently the main cause of illness and disability worldwide, affecting more than one in three people. With mental health and neurological disorders being increasingly recognized as public health concerns, epilepsy is seeing more focus and funding than ever. Holistic long-term pharmacological approaches to treatment will become increasingly prevalent as the focus of care. In other words, access to anti-epileptic drugs will increase if the story of epilepsy as a long-term, chronic condition becomes intrinsic in the system.

Challenges

- Complexities and delays in administrative approvals: The presence of diversified international regulatory pathways creates expensive bottlenecks for developers in the antiepileptic drugs market. However, organizations are deliberately overcoming these challenges; for instance, the ANVISA initiative in Brazil currently requires Portuguese-language labeling for almost all trial materials. Besides, Sun Pharma has escalated the cenobamate approval in India by submitting EMA data through the 505(b)(2) pathway.

- Poor out-of-pocket expenses: The aspect of prohibitive pricing techniques results in treatment barriers, which negatively impact the market internationally. In addition, insurance barriers also exist, for example, the Seguro Popular in Mexico covers only 5 first-generation of AEDs, thus causing a hindrance in the market expansion.

Antiepileptic Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4% |

|

Base Year Market Size (2025) |

USD 11.05 billion |

|

Forecast Year Market Size (2035) |

USD 15.55 billion |

|

Regional Scope |

|

Antiepileptic Drugs Market Segmentation:

Formulation Segment Analysis

Based on formulation, the oral tablets segment is projected to hold the largest share of 57.8% in the antiepileptic drugs industry by the end of 2035. The segment’s growth is highly driven by its widespread acceptance, cost-effectiveness, and convenience. Tablets, in general, provide precise dosage, ease of administration, and stability for chronic epilepsy management, making them suitable for long-term therapy. Besides, key trends, such as UCB Pharma’s Keppra have reinforced tablet dominance through expanded release formulations that tend to enhance compliance, thereby suitable for the segment’s upliftment.

Drug Class Segment Analysis

Based on drug class, the third-generation AEDs segment is projected to hold the second-largest share of 43.5% in the antiepileptic drugs market during the forecast timeline. The segment has emerged as the dominant drug class, owing to its safety profile for aiding refractory epilepsy and superior efficacy. These particular AEDs, including brivaracetam (Briviact) and cenobamate (Xcopri), are found to have few drug interactions and side effects. In addition, the segment comprises targeted mechanisms, such as selective sodium channel blockade and SV2A modulation, which make them effective for treatment-specific cases, thus driving the segment’s growth.

Distribution Channel Segment Analysis

The hospital pharmacies segment is poised to dominate the antiepileptic drugs market. Hospitals will be important because they are responsible for the diagnosis, treatment, and ongoing management of epilepsy. Moreover, hospital pharmacy services will be the first point of access for many AED therapies. Typically, hospitals will manage inpatient and/or outpatient neurology departments, as well as epilepsy monitoring units (EMUs) and specialized care programs. Hospitals function under public, private, and drug benefit schemes, and thus have access to bulk purchase contracts, capable logistics, and other provisions in their pharmacy systems.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Formulation |

|

|

Drug Class |

|

|

Seizure Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antiepileptic Drugs Market - Regional Analysis

North America Market Insights

North America in the antiepileptic drugs industry is anticipated to dominate with the highest share of 40.9% by the end of 2035, along with a 4.7% growth rate. The U.S. readily drives this development, which is further supported by an increase in health expenditure and innovative treatment implementation. Besides, Canada also contributes to the regional demand, thereby creating a prolific opportunity for the market in the region.

The market in the U.S. is leading the international scenario, owing to the aspects of innovation and high healthcare spending. In addition, the National Institute of Neurological Disorders and Stroke (NINDS), a division of the National Institutes of Health (NIH), estimates that in 2024, federal funding for epilepsy research was around USD 242 million. Moreover, there are many major pharmaceutical companies in the U.S., creating competition and accelerating commercialization and market entry. Lastly, growing awareness of epilepsy and the importance of taking epilepsy medications will continue to sustain demand for antiepileptics. Overall, the U.S. is a dominant market in the global AED market.

The market in Canada is significantly growing fueled by biosimilar and universal medical adoption. Besides, Ontario Health Teams (OHTs) are being created to offer more integrated and patient-centered care. Epilepsy Ontario is joining these teams to support integrated care for individuals with epilepsy. The Government of Canada and Ontario signed a bilateral agreement on January 24, 2025, under the National Strategy for Drugs for Rare Diseases, committing to invest over USD 535 million over three years to improve access to new and existing drugs for rare diseases and to assist in improving access to early diagnosis. Meanwhile, tele-epilepsy programs have increased their accessibility to rural patients.

Europe Market Insights

Europe in the antiepileptic drugs market is projected to account for 31.7% by the end of the forecast period. This market upliftment in the region is highly facilitated by the implementation of precision drugs, along with a surge in the aging population. Biosimilar competition, EU-based initiatives, and cost containment are a few trends that are also positively influencing the market growth in the region. Additionally, Europe has a large burden of epilepsy, with millions of patients on lifelong therapy. The healthcare infrastructure in the region is firmly established with universal health coverage in most countries. This allows for access to medications that include newer and more advanced AED therapies. Moreover, strict regulatory environments and diligent health care policies in European countries promote the adoption of newer and safer antiepileptic medications. Governments and healthcare authorities heavily invest in clinical trials and public health programs to maximize epilepsy treatment.

The market in Germany is leading the region’s share, owing to its increased focus on refractory epilepsy and medical spending. In addition, the adoption of artificial intelligence in domestic clinic facilities has diminished misdiagnosis rates, all of which positively contributes to uplifting the market in the country. Germany has a high rate of epilepsy and neurological disorders which makes a strong demand for efficient antiepileptic therapies. Germany's well-developed healthcare system and established national health insurance make AEDs broadly accessible to patients across all income tiers. The region is also a leader in pharmaceutical development and research and is home to numerous global and regional pharmaceutical companies that develop and manufacture some of the most advanced AEDs on the market.

The antiepileptic drugs market in the UK is equally thriving with the presence of the NHS’s centralized procurement. Additionally, the post-Brexit aspect has accelerated approvals in the country through the MHRA’s Innovative Licensing Pathway. Therefore, all these factors denote a positive impact on the market development in the country. The UK government is dedicated to supporting research into and treatment for epilepsy through several initiatives. Moreover, the high prevalence of the disease, a strong healthcare infrastructure, past regulatory support of innovation, and government research expenditures uniquely position the UK for continued leadership in the AEDs market.

APAC Market Insights

The Asia Pacific antiepileptic drugs (AEDs) market is growing rapidly due in large part to several contributing factors. The considerable diversity of the population results in a very high portion of the population having the condition of epilepsy. In addition, countries such as China and India have begun to recognize the importance of epilepsy. Furthermore, populated sections of Japan have also identified the increased burden of epilepsy across the older patient population. Importantly, with better education of treating neurologists and the growth of new AED formulations, medical research has created improved AEDs. Newly dedicated to epilepsy and the increase in demand for AEDs from government frameworks and structures has also improved overall care. These factors have come together to assist the rapid growth of AEDs in the Asia Pacific region.

The antiepileptic drugs market in India is set to boom by 2035, driven by several key factors. With India's large population, its high prevalence of epilepsy creates demand for treatment. Moreover, government initiatives will help citizens obtain affordable or free high-quality generic medicines. Additionally, India is the largest supplier of generic medicines in the world by volume, aiding in the consistent availability of antiepileptic drugs. The growth of innovation of medicines research makes it possible to improve the development of new formulations of antiepileptic drugs. India represents a rapidly growing market for antiepileptic drugs.

China's antiepileptic drug (AED) market is projected to rise between 2026 and 2035. With a large population, China has a relatively high prevalence of epilepsy. This leads to an increased demand for effective treatments. In addition, more funding from the Chinese Government to healthcare has led to better collective access to medications and the overall treatment of patient populations that suffer from epilepsy. Furthermore, Government spending towards improved care and treatment of epilepsy further enables growth in numerous aspects of the market. Increased spending on health by Governments and individuals enables the AED market to grow. Advancements in technologies related to targeted drug delivery and innovative formulations of drugs contribute to overall improved performance and ease of use in AED therapy.

Key Antiepileptic Drugs Market Players:

- UCB Pharma

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer

- Novartis

- GlaxoSmithKline (GSK)

- Eisai

- Sanofi

- Sun Pharma

- Teva Pharmaceuticals

- Mylan

- Hikma Pharmaceuticals

- Lupin Pharmaceuticals

- Aspen Pharmacare

- CSL Limited

- Celltrion

- Pharmaniaga

The global market is considered oligopolistic with the presence of renowned organizations, such as Novartis, Pfizer, and UCB, jointly controlling 45% of the overall market revenue. These companies have readily adopted certain strategies, including gene therapy services, establishment focus on emerging markets, generics expansion, and precision medicines. For instance, UCB has introduced artificial intelligence-driven Briviact trials, which have reduced trial facilities by almost 35%. Besides, Sun Pharma’s cenobamate biosimilar has aimed to reduce brand cut by almost 75%. Likewise, Sanofi’s Depakine has successfully reached more than 5.5 million patients, particularly in Africa through WHO partnerships, thus creating a positive impact on the market internationally.

Here is a list of key players operating in the global market:

Recent Developments

- In March 2024, Pfizer Inc. announced the receipt of the EMA acceptance for LYRICA, which is a pregabalin that has been approved for treating refractory epilepsy, comprising real-world evidence from over 15,500 patient records.

- In August 2021, UCB Pharma announced that the FDA had approved BRIVIACT, particularly to cater to pediatric focal seizures, which has been supported by Phase III trials that showcased a 39% in seizures.

- Report ID: 920

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antiepileptic Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.