Global Market Size, Forecast, and Trend Highlights Over 2025-2037

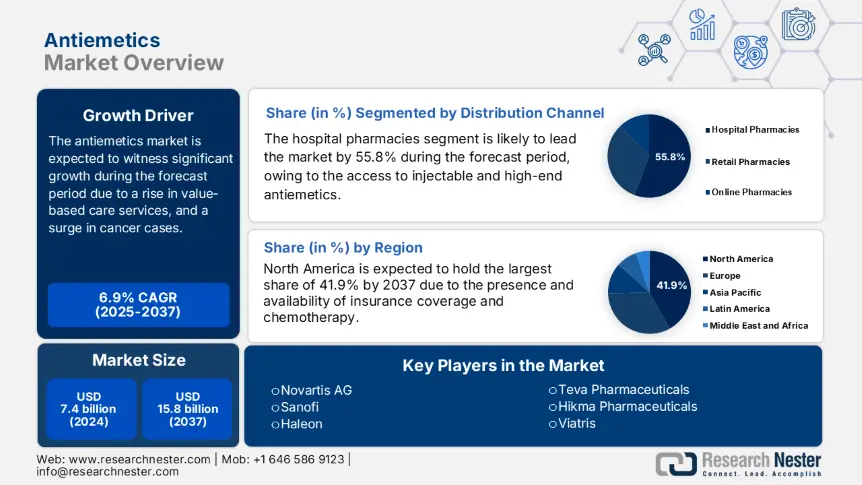

Antiemetics Market size was valued at USD 7.4 billion in 2024 and is expected to reach USD 15.8 billion by the end of 2037, growing at a CAGR of 6.9% during the forecast period from 2025-2037. In 2025, the industry size of antiemetics is estimated at USD 7.6 billion.

The market effectively caters to a significant patient pool, which is readily driven by motion sickness, postoperative cases, and chemotherapy-induced nausea and vomiting (CINV). According to a report published by the World Health Organization (WHO) in 2023, more than 21 million latest cancer cases are diagnosed yearly, out of which 75% to 85% of chemotherapy patients need antiemetic therapy. In addition, an estimated 35% of surgical patients experienced postoperative nausea and vomiting (PONV), thus enhancing the worldwide utilization of antiemetics. Besides, the supply chain aspect for antiemetic medications depends on sourced active pharmaceutical ingredients (APIs), especially from Europe, India, and China, thereby positively impacting the market growth.

Furthermore, the producer price index is readily influenced by geopolitical trade dynamics and raw material scarcity. For instance, the U.S. Bureau of Labor Statistics (BLS) reported a 4.5% yearly increase in pharmaceutical preparation expenses. Meanwhile, the consumer price index has also surged by 5.2% year-over-year (YoY), which reflects an increase in logistics, along with research and development expenses. Besides, the 2023 World Trade Organization (WTO) data report denoted that China constitutes 37% of API exports, while the EU and the U.S. dominate shipments related to finished drugs, thus creating a prolific opportunity for the market expansion across different nations.

Antiemetics Sector: Growth Drivers and Challenges

Growth Drivers

- Improvement in health quality and interventions: The demand for value-specific care services has made the market a pivotal point in the medical quality improvement. As stated in the 2022 AHRQ clinical study, standardized antiemetic protocols have been demonstrated that are intended to diminish preventable hospitalizations by an estimated 18.5%, resulting in USD 1.3 billion in savings within two years. Therefore, these protocols stratify patients by risk and deploy 5-HT3/NK1 antagonists preemptively by reducing hospital accommodation by 2.2 days, thus suitable for market upliftment.

- Personal and government spending: The global market comprises public healthcare budgets, with the U.S. Medicare Part D spending surging to USD 3.9 billion in 2023, a 9.5% YoY increase, highly facilitated by oral NK1 antagonists. Medicare usually covers 85% of antiemetic costs for beneficiaries, of which the average out-of-pocket expenses cater to USD 46 per prescription, thus leading to adherence gaps for 11% of patients. Besides, the Inflation Reduction Act's USD 36 per month Part D is intended to ease this burden in 2025, particularly enhancing the utilization by 13% to 16%, thus catering to market upliftment.

Historical Patient Growth and Its Impact on Antiemetics Market Expansion

The worldwide market has been fundamentally reshaped by expansion in the patient pool between 2014 and 2024, which is attributed to improved diagnostic rates for gastrointestinal disorders, surgical volumes, and chemotherapy implementation. For instance, in the U.S., oncology guideline updates and Medicare Part D have fueled a 9.5% growth rate in antiemetics users, while the aging population in Germany has put forward the demand for postoperative nausea treatments, thus increasing by 6.7% yearly. Besides, developing markets, including China and India, witnessed steeper growth, ranging between 14% to 18%, owing to improved health accessibility.

Historical Patient Growth (2014–2024)

|

Country |

2014 |

2019 |

2024 |

CAGR (2014–2024) |

|

U.S. |

8.3 |

10.2 |

13.8 |

5.7% |

|

Germany |

3.2 |

3.6 |

4.3 |

3.9% |

|

France |

2.4 |

2.7 |

3.4 |

4.9% |

|

Spain |

1.5 |

1.9 |

2.5 |

5.7% |

|

Australia |

0.8 |

1.1 |

1.6 |

5.6% |

|

Japan |

3.9 |

4.4 |

5.1 |

2.8% |

|

India |

5.7 |

9.2 |

14.3 |

9.9% |

|

China |

9.4 |

15.2 |

22.5 |

9.4% |

Manufacturer Strategies Reshaping the Antiemetics Market

The international market comprises notable manufacturers that are readily deploying strategies to dominate the global market. This is possible by implementing strategies, such as artificial intelligence-driven commercialization, tactical partnerships for emerging markets, and novel formulations for premium economies. For instance, in 2023, Pfizer launched a next-generation NK1 antagonist and captured 8.5% of the overall market share and generated USD 620.5 million in revenue. Besides, in India, Cipla entered into a partnership with local hospital facilities and expanded its accessibility to low-cost ondansetron, which has boosted volumes by approximately 25%, thus suitable for market expansion.

Revenue Opportunities for Manufacturers (2024–2027)

|

Strategy |

Example |

Revenue Impact |

Market |

|

Novel NK1 Antagonists |

Pfizer’s CINV drug (2023) |

+USD 620.5 million |

U.S., EU |

|

Emerging Market Biosimilars |

Cipla’s India expansion |

+USD 288 million |

India, SEA |

|

AI-Driven Prescribing |

Merck’s EHR integration |

+USD 455 million |

U.S. |

|

OTC Motion Sickness |

GSK’s transdermal patch (2024) |

+USD 905 million |

Global |

Challenges

- Barrier in government price control: The presence of price caps forces manufacturers to sell antiemetics at abrupt discounts, often ranging between 45% to 65% below the U.S. pricing strategies, leading to a hindrance in the antiemetics market. For instance, the AMNOG law in Germany requires manufacturers to cater to premium pricing, which results in delayed launches. However, in 2023, Helsinn combated this situation by connecting reimbursements to practical outcomes in Italy. This eventually demonstrated a 17% reduction in CINV-based hospitalizations in the country.

- Medicaid coverage gaps in the U.S.: There has been a rise in the demand for chemotherapy, despite which Medicaid covers only 57% of branded antiemetics, owing to constraints in budget. According to the 2023 CDC report, an estimated 29.5% of low-income CINV patients receive doses, which increases ER visits by 23%. However, Pfizer addressed this challenge by implementing a notable co-pay assistance program, which has diminished out-of-pocket expenses to USD 5 per month for more than 350,000 patients. Despite this solution, almost 16 states still impose authorization constraints, which delay treatment procedures by 4 to 6 days, thus hampering the overall market.

Antiemetics Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

6.9% |

|

Base Year Market Size (2024) |

USD 7.4 billion |

|

Forecast Year Market Size (2037) |

USD 15.8 billion |

|

Regional Scope |

|

Antiemetics Segmentation

Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)

Based on the distribution channel, the hospital pharmacies segment is anticipated to hold the largest share of 55.8% in the antiemetics market by the end of 2037. The segment’s growth readily originates from the demand for immediate accessibility to high-efficacy and injectable antiemetics for postoperative nausea (PONV) and chemotherapy-induced nausea (CINV) patients. As per the FDA report, more than 75% of infused antiemetics are managed in hospitals, especially for surgical and cancer cases. Besides, the NIH has demonstrated that hospitals tend to mandate first-dose antiemetic administration for almost 91% of chemotherapy patients, thus positively impacting the segment.

Route of Administration (Oral, Injectable, Transdermal)

Based on route of administration, the oral segment is projected to hold the second-largest share of 49.2% in the antiemetics market during the forecast timeline. This growth is possible with its expanded utilization in home care and outpatient settings, cost-effectiveness, along with convenience. As stated in a report published by the FDA, oral NK1 and 5-HT3 receptor antagonists are currently prescribed for almost 85% of chemotherapy patients, owing to reduced clinical visits and improved bioavailability. Besides, the WHO has highlighted oral drugs as essential for low-resource markets, wherein an estimated 65% of antiemetic regimens depend on syrups and tablets.

Our in-depth analysis of the global antiemetics market includes the following segments:

|

Distribution Channel |

|

|

Route of Administration |

|

|

Application |

|

|

Patient Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antiemetics Industry - Regional Synopsis

North America Market Analysis

North America in the antiemetics market is projected to account for the highest share of 41.9%, along with a 5.4% growth rate by the end of 2037. The market’s growth in the region is highly driven by the U.S.’s dominance, which caters to 35% of the international market, further supported by an increase in chemotherapy utilization and insurance coverage facilities. Besides, innovation leadership, policy support, and expanded oncology care services are other factors that positively impact the market growth in the region. Meanwhile, Canada caters to 6.5% of the regional market, thereby becoming another factor driving the market development.

The antiemetics market in the U.S. readily dominates the region, owing to an expansion in Medicare services, along with a rise in chemotherapy. For instance, the NIH has reported more than 2.5 million CINV cases every year, and the CMS data report has demonstrated USD 1.2 billion antiemetic spending in 2024. Besides, as per the 2024 HRSA report, an estimated 27% of hospitals effectively leverage discounts for antiemetics, which positively impacts the market in the country. In addition, the 2025 reimbursement model of the CMS readily ties antiemetic utilization to 15% fewer readmissions, thus another factor for market development.

The market in Canada is projected to grow at 4.9% during the forecast period, which is readily fueled by provincial healthcare reforms. The aspect of government funding, focus on pediatric, and generic adoption are other factors positively uplifting the market in the country. For instance, Ontario initiated an investment of USD 222 million, which covered 92% of CINV drugs, particularly for cancer patients. Besides, approximately 17.5% of antiemetic budgets in the country readily target child oncology, which denotes a prolific opportunity for market growth.

Europe Regional Market Size & Growth

Europe in the antiemetics market is expected to hold a considerable share of 32.7% during the forecast period. This growth is highly driven by a rise in the aging population and a huge demand for chemotherapy. Germany eventually dominates the region with 33% revenue share, followed by France with 24%, and the UK with 19%. Besides, focus on oncology, cost containment, and the presence of the EU Health Data Space are other factors readily driving the market in the region. For instance, the allocation of €2.6 billion to conduct antiemetics research and development readily accelerates novel NK1 antagonist acceptance.

The antiemetics market in Germany is significantly growing with the presence of a strict value-specific pricing system and a robust oncology care facility. The country has readily spent €4.5 billion on antiemetics in 2024, with the demand accelerated by more than 655,000 chemotherapy patients every year. Besides, the country comprises AMNOG health technology assessments that require antiemetics to display 27% superior efficacy in comparison to comparable for reimbursements. The availability of local producers, such as Bayer tentatively supply 46% of the EU’s NK1 antagonists, which benefits from €805 million in administrative subsidies.

The antiemetics market in France is continuously uplifting by grabbing 27% of the region’s market share, accounting for €2.2 billion since 2023. The country has displayed exclusive strengths in pediatric formulations, wherein 33% of antiemetic budgets target childhood cancer patients, further constituting a growth of 6% every year. Besides, the 2024 telemedicine reforms in the country have successfully boosted CINV treatments, of which 42% of prescriptions are currently provided in digital format. The market is effectively transitioning from 56% of generics to premium medications, thus denoting a positive impact on the market.

Companies Dominating the Antiemetics Landscape

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international market is effectively consolidated with the existence of organizations, including Merck, GSK, and Pfizer, collectively accounting for 45% of the overall market share through patented NK1/5-HT3 antagonists. These companies have implemented certain strategies to maintain their positions in the market, such as investments, service expansion, product innovation, and partnerships. For instance, Cipla and Dr. Reddy’s have readily captured 11% of share in the market share through the provision of low-cost ODTs. Likewise, Novartis AG initiated an investment of USD 550 million for next-generation CINV combinations, thereby suitable for market upliftment across different nations.

Here is a list of key players operating in the global market:

|

Company Name (Country) |

Industry Focus |

Market Share (2024) |

|

Pfizer Inc. (U.S.) |

Leading producer of NK1 antagonists (e.g., Emend) for CINV & PONV. |

19.2% |

|

GlaxoSmithKline (UK) |

Markets Zofran (ondansetron), dominant in 5-HT3 antagonists. |

13.1% |

|

Merck & Co. (U.S.) |

Key player in Emend (aprepitant) and combo therapies. |

11.3% |

|

Novartis AG (Switzerland) |

Produces Akynzeo (netupitant/palonosetron) for chemotherapy-induced nausea. |

9.4% |

|

Sanofi (France) |

Focus on Aloxi (palonosetron) and generics. |

7.3% |

|

Haleon (UK) |

OTC motion sickness drugs (e.g., Dramamine®). |

xx% |

|

Teva Pharmaceuticals (Israel) |

Major generic antiemetics supplier (ondansetron, metoclopramide). |

xx% |

|

Hikma Pharmaceuticals (UK) |

Specializes in injectable antiemetics for hospitals. |

xx% |

|

Viatris (U.S.) |

Supplies affordable generics in emerging markets. |

xx% |

|

Dr. Reddy’s (India) |

Low-cost APIs & generics (e.g., ondansetron ODT). |

xx% |

|

Cipla (India) |

Pediatric antiemetics & emerging-market expansion. |

xx% |

|

Aspen Pharmacare (South Africa) |

Leading supplier in Africa & Latin America. |

xx% |

|

Mayne Pharma (Australia) |

Focus on transdermal scopolamine for motion sickness. |

xx% |

|

Yuhan Corporation (South Korea) |

Developing novel NK1 antagonists for Asian markets. |

xx% |

|

Pharmaniaga (Malaysia) |

Government-backed supplier of affordable antiemetics in ASEAN. |

xx% |

Below are the areas covered for each company under the top global manufacturers:

Recent Developments

- In May 2024, Merck & Co. Inc. successfully unveiled a next-generation NK1 antagonist and rolapitant-SC, especially in Europe the following the EMA acceptance, displaying 45% rapid onset in severe CINV cases.

- In March 2024, GlaxoSmithKline plc strategically entered into a partnership with the Mayo Clinic to create AI-driven predictive models for assessing postoperative nausea risk by investing £120.5 million in the 5-year initiative.

- Report ID: 7721

- Published Date: Jun 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antiemetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert