Anti-money Laundering Solution Market Outlook:

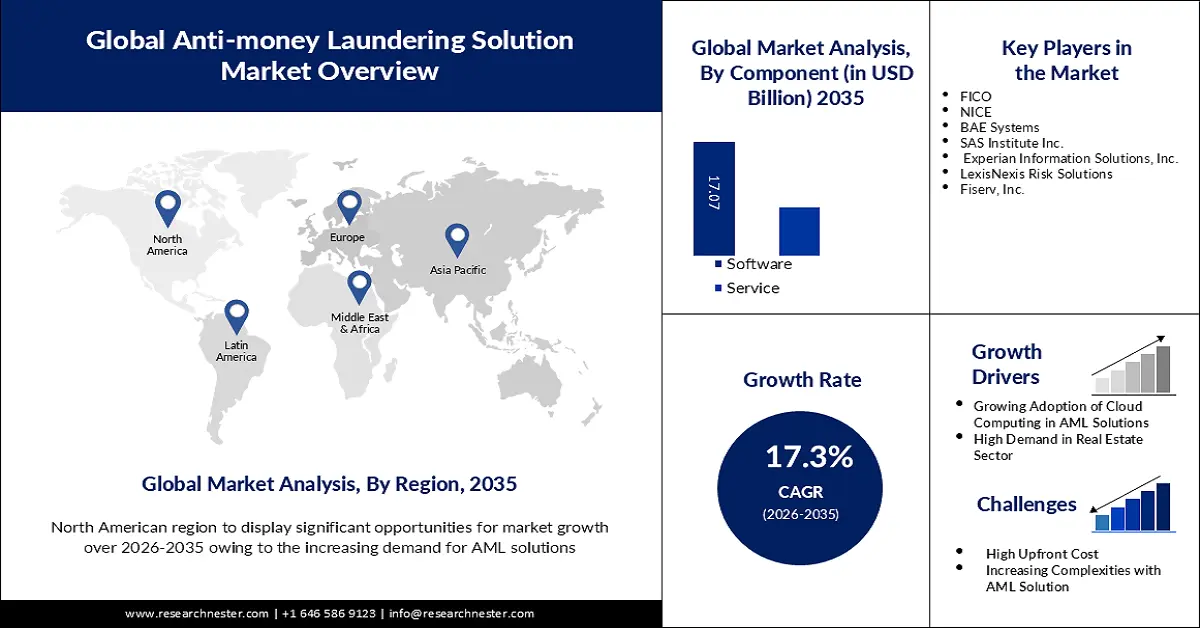

Anti-money Laundering Solution Market size was valued at USD 2.85 billion in 2025 and is set to exceed USD 14.05 billion by 2035, registering over 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-money laundering solution is estimated at USD 3.29 billion.

Money laundering is one of the most significant threats to global security and can be used for a variety of purposes, including drug trafficking and terrorist financing. Compliance with anti-money laundering standards can provide a safety net for businesses in the face of financial losses and damage to their reputation. According to United Nations Office on Drugs and Crime, it estimates that between 2% and 5% of global GDP is laundered each year, which would amount to around 715 billion dollars and 1.87 trillion.

Users using digital banking on tablets, computers, or phones can continue their activities by logging in with the details of their digital profile. When user log in to a financial institution account, the system allows real users to conceal their identity. Moreover, it can conduct this procedure anywhere on Earth.

The system enables the actual user to conceal their identity when logging on to a financial institution account, and it's capable of doing this from anywhere in the world. In addition, due to the growth of electronic payments and Internet banking solutions, there has been a high demand for anti-money laundering solution market

Key Anti-money Laundering (AML) Solution Market Insights Summary:

Regional Highlights:

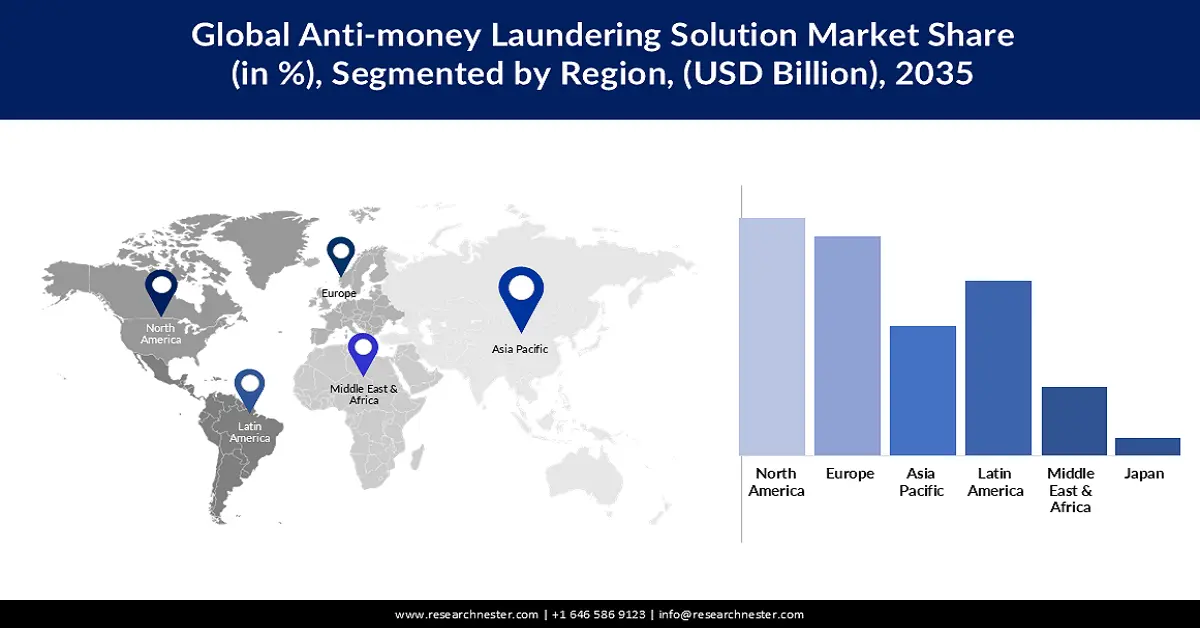

- North America anti-money laundering solution market will hold more than 28% share by 2035, attributed to the vast size of the US financial system, vulnerabilities in multiple domains, and increasing AML events per capita.

Segment Insights:

- The software segment in the anti-money laundering solution market is poised for majority share by 2035, driven by the rise in sophisticated financial criminal activities and digital payments.

- The bfsi segment in the anti-money laundering solution market is poised to maintain the largest share by 2035, attributed to the high volume of financial transactions handled regularly by the BFSI industry.

Key Growth Trends:

- Integration of cloud-based AML solutions

- Growing use of AML in the real estate sector

Major Challenges:

- Growing complexities of money laundering methods are predicted to hinder anti-money laundering solution market growth in the forecast period

- Changes in the regulatory landscape are expected to hamper the AML solution market share by the end of 2035.

Key Players: FICO, NICE, BAE Systems, SAS Institute Inc., Experian Information Solutions, Inc., LexisNexis Risk Solutions, Fiserv, Inc., and other.

Global Anti-money Laundering (AML) Solution Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.85 billion

- 2026 Market Size: USD 3.29 billion

- Projected Market Size: USD 14.05 billion by 2035

- Growth Forecasts: 17.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (28% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, Japan

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 17 September, 2025

Anti-money Laundering Solution Market Growth Drivers and Challenges:

Growth Drivers

- Integration of cloud-based AML solutions - To analyze transaction patterns and identify anomalies that could indicate the existence of money laundering activities, cloud-based AML solutions may use data analytics and machine learning algorithms. Training these algorithms to detect new trends and changes in modern times could increase the effectiveness of initiatives against money laundering.

To assess transaction patterns and detect anomalies that could indicate money laundering, cloud-based AML solutions can use data analytics and machine learning algorithms. Training these algorithms to recognize new patterns and adapting them to changing money laundering strategies can increase the effectiveness of anti-money laundering programs.

Companies are introducing cloud-based AML solutions expected to impact positively on anti-money laundering solution market expansion. Such as the Oracle Financial Services Compliance Agent was introduced by Oracle Financial Services. Banks may conduct low-cost, hypothetical scenario testing using the AI-powered cloud service AML solution to modify thresholds and controls to better filter through transactions, spot suspicious behavior, and comply with regulatory requirements. - Growing use of AML in the real estate sector - There is a high risk of money laundering due to the nature of real estate transactions. If substantial amounts of money are involved in property transactions, there is a possibility that illicit cash can become part of the lawfully functioning economy.

Since criminals can use real estate transactions as a cover for the source of their illegal proceeds, professionals in the real estate market need to remain cautious. A Global Financial Integrity research claims that between 2015 and 2021, U.S. real estate was used to launder more than USD 2.3 billion.

Challenges

- Integration complexity - Integration in anti-money laundering solutions creates barriers to the industry's growth as it increases operating costs and hinders the effectiveness of compliance processes.

- Growing complexities of money laundering methods are predicted to hinder anti-money laundering solution market growth in the forecast period

- Changes in the regulatory landscape are expected to hamper the AML solution market share by the end of 2035.

Anti-money Laundering Solution Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.3% |

|

Base Year Market Size (2025) |

USD 2.85 billion |

|

Forecast Year Market Size (2035) |

USD 14.05 billion |

|

Regional Scope |

|

Anti-money Laundering Solution Market Segmentation:

Component (Software, Service)

Software segment is set to dominate majority anti-money laundering solution market share by the end of 2035. The need for sophisticated anti-money laundering systems that can identify and block suspicious transactions in real time has risen due to the rise in sophisticated financial criminal activities such as fraud, cybercrime, and money laundering.

The amount and complexity of financial transactions are growing, as is the use of anti-money laundering software, due to the quick expansion of digital payment channels such as online and mobile banking and cryptocurrencies. NICE Actimize introduced SAM-10, a new anti-laundering program, in April 2023. It uses artificial intelligence (AI) and multilayered analytics to improve the identification of suspicious behavior while lowering false positives.

End Use Industry (BFSI, Defense and Government, Gaming and Gambling)

In anti-money laundering solution market, BFSI segment will account for largest share by 2035. Because the BFSI industry handles so many financial transactions regularly, it is vulnerable to money laundering schemes. Robust AML processes and an increasing volume of transactions help identify and shield consumers from financial crime.

Furthermore, information exchange and coordinated efforts to prevent financial crimes are facilitated by collaboration between BFSI institutions, regulatory bodies, law enforcement, and industry groups. The European Banking Authority introduced EuReCA, the EU's primary database for combating the funding of terrorism and money laundering, in January 2022. This database will function as a reporting mechanism for banks. The EBA will utilize this information to assess ML/TF threats in the EU financial sectors.

Our in-depth analysis of the global anti-money laundering solution market includes the following segments:

|

Component |

|

|

Type |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-money Laundering Solution Market Regional Analysis:

North American Forecasts

North America industry is anticipated to hold largest revenue share of 28% by 2035. The US is especially vulnerable to all forms of illicit money because of the scale of the US financial system and the significance of the US dollar in the payment system that supports worldwide trade.

Criminals and professional money launderers still locate, transport, and try to hide illicit earnings using a variety of strategies, including time-tested ones. Some examples are using cash for traditional transactions, making pricey or high-end investments, and keeping up with the quickly evolving world of virtual assets and related service providers such as decentralized finance and the growing use of technologies that increase anonymity. The US was found to have the highest number of AML events per capita in the world. The US accounts for 84 % of the total, of the top 10 countries with the highest incidence of AML per capita.

Money laundering is a significant and concerning matter in the United States. The region is appealing aim for money laundering owing to its vast size and vulnerabilities in multiple domains. Therefore, the demand for AML solutions in the region is at a high peak as a result driving the anti-money laundering solution market growth.

The government in Canada has introduced various regulatory standards to put a stop to the escalating money laundering cases in the region. In Canada's AML regime, the Criminal Code and the Proceeds of Crime and Terrorist Financing Act play an active role.

European Market Statistics

Europe anti-money laundering solution market is estimated to witness significant growth till 2035. Criminals in this region are frequently launder money using a variety of means, such as creating fictitious identities, using shell companies and trusts, and orchestrating transactions to avoid discovery. In addition, the money laundering cases are high in the Europe region. According to a study in the United Kingdom, approximately 112 billion are laundered every year. It is estimated that 3% of global GDP is laundered every year around the world. The amount of laundered money in the United Kingdom amounts to around 4.3% of GDP each year.

Credit bureaus keep an eye out for any unusual behavior and draw attention to any unexpected or contradicting information found on credit reports. This helps to identify and stop money laundering. For instance, TransUnion, a worldwide information and analytics supplier, became one of SmartSearch's identity-check providers for its digital anti-money laundering solution in April 2023. SmartSearch now offers a 'triple-bureau' electronic verification and digital compliant platform, leveraging global data partners Experian, Equifax, and TransUnion to give regulated firms a match and pass rate.

The United Kingdom has strict and advanced legislation in place to prevent financial crimes. Money laundering offenses have been highlighted in the United Kingdom's Anti Money Laundering Regulations, which have made it clear that money laundering should be avoided. The UK is also a member of the Financial Action Task Force. In line with FATF guidelines and EU directives on Money Laundering, the United Kingdom's anti-money laundering legislation is in line with them.

Germany is currently significant hub for money laundering and crime. To protect the integrity of the financial system and maintain investor confidence, this has led to a focus on strengthening anti money laundering safeguards. Germany has increased its investment in cybersecurity and fraud detection tools, as well as efforts to increase public awareness of the risk of fraud, due to the advent of digital financial services.

The growth of the AML solution market in France can be propelled by the increasing integration of AML solutions in the financial institutions.

Anti-money Laundering Solution Market Players:

- ACTICO GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kroll, LLC.

- FICO

- NICE

- BAE Systems

- SAS Institute Inc.

- Experian Information Solutions, Inc.

- LexisNexis Risk Solutions

- Fiserv, Inc.

- WorkFusion, Inc.

Recent Developments

- A strategic agreement between Lucinity and Experian was launched in April 2023 to improve KYB and compliance risk assessments. Data from transaction monitoring, risk screening, and KYC will all be integrated into this partnership.

- SAM-10, with AI-based transaction monitoring and multidimensional analytics, was added to NICE Actimize's Anti-Money Laundering Solutions in April 2023. Enhancing the identification of suspicious behavior, lowering false positives, and integrating with other AML systems are the goals of SAM-10.

- Report ID: 6064

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-money Laundering (AML) Solution Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.