Anisole Market Outlook:

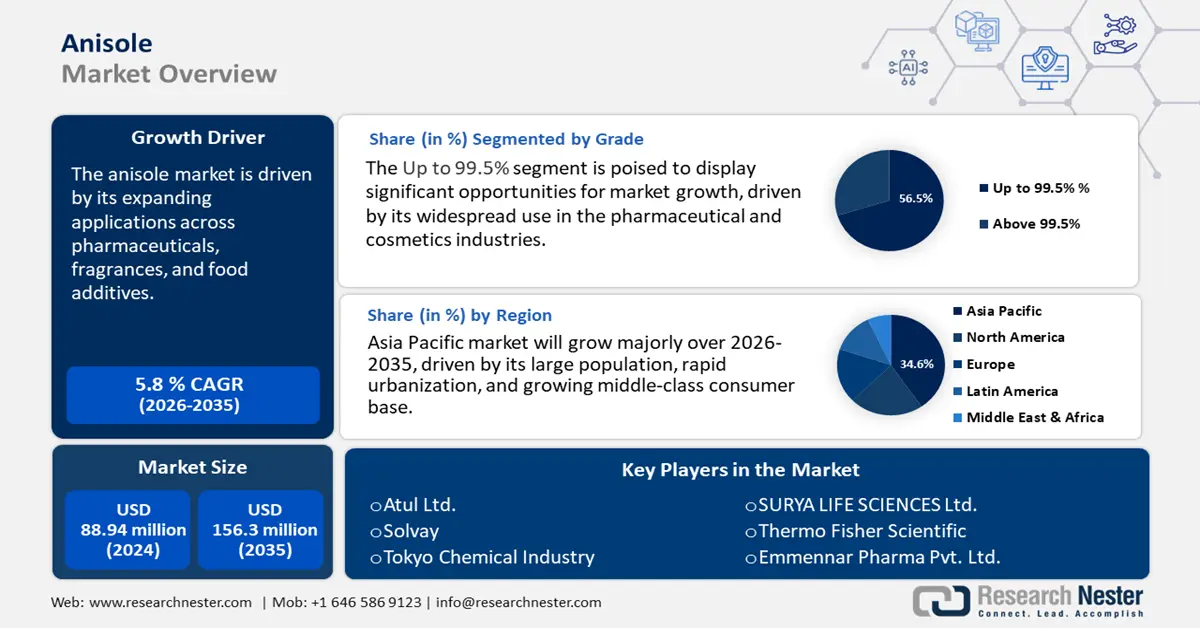

Anisole Market size was valued at USD 88.94 million in 2025 and is set to exceed USD 156.3 million by 2035, registering over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anisole is estimated at USD 93.58 million.

The anisole market is experiencing robust growth, driven by its expanding applications across pharmaceuticals, fragrances, and food additives. Anisole, known for its sweet, floral scent and chemical stability, serves as a key intermediate in the synthesis of various pharmaceutical compounds. Its role in the formulation of medications has significantly boosted demand from the healthcare sector. Additionally, the fragrance and flavor industry continues to adopt anisole due to its aromatic properties, making it a preferred ingredient in perfumes, cosmetics, and food products.

A major driver in the current market landscape is the growing emphasis on sustainable and environmentally friendly chemical production. As anisole can be derived from renewable feedstocks, it aligns well with global initiatives aimed at reducing carbon emissions and promoting green chemistry. This has opened new opportunities for manufacturers to innovate and differentiate their offerings in a sustainability-focused market. Recent trends also highlight a shift towards high-purity anisole, particularly for applications in pharmaceuticals and the electronics industry.

The demand for ultra-high-purity anisole is fueled by stringent regulatory and performance standards, especially in sensitive use cases. Advancements in distillation and purification technologies have enabled producers to meet these standards effectively. Tokyo Chemical Industry Co., Ltd., a leading Japanese chemical manufacturer, offers high-purity anisole variants tailored for laboratory and industrial applications. TCI’s commitment to quality and innovation exemplifies how key players are responding to evolving market needs through technological advancement and product diversification. As demand diversifies and quality expectations rise, the market is poised for sustained growth in the year ahead.

Key Anisole Market Insights Summary:

Regional Highlights:

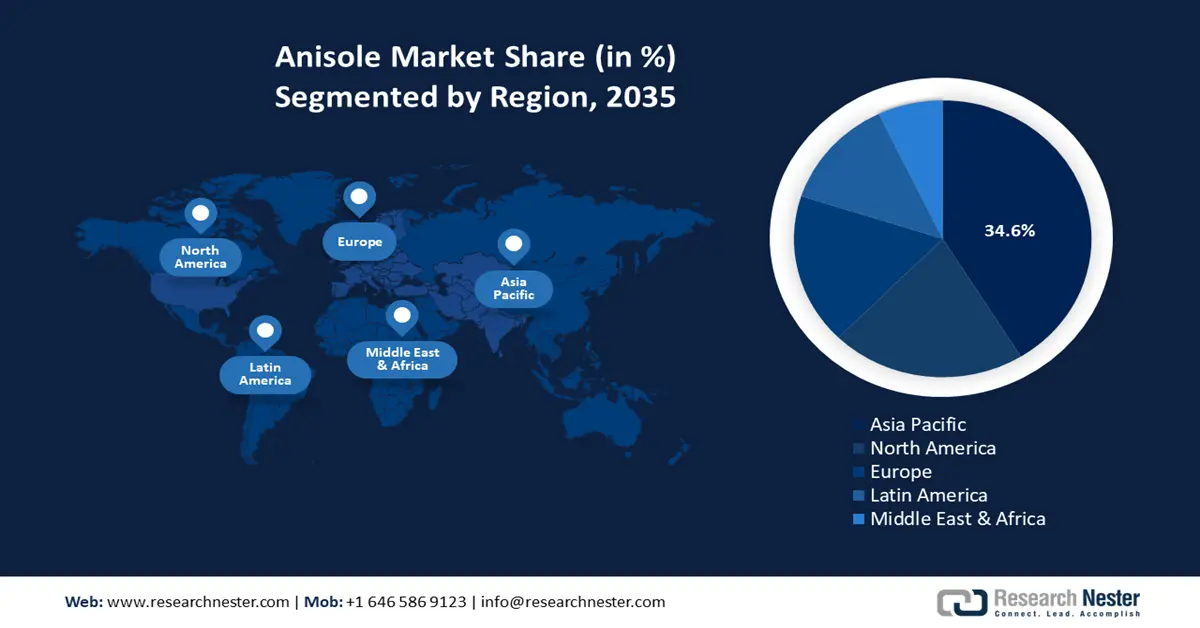

- Asia Pacific anisole market will secure around 34.60% share by 2035, driven by rising demand for cosmetics and green chemistry adoption.

- Europe market demonstrates notable growth during the forecast timeline, driven by increasing demand in pharmaceutical and fragrance sectors.

Segment Insights:

- The up to 99.5% grade segment in the anisole market is expected to capture a significant 56.50% share by 2035, fueled by its cost efficiency and extensive use in pharmaceuticals and cosmetics.

- The perfume segment in the anisole market is expected to hold a significant share by 2035, driven by the rising demand for unique, long-lasting fragrances and the expanding personal care sector.

Key Growth Trends:

- Increasing need from the pharmaceutical industry

- The growing utilization in the fragrance and flavor industry

Major Challenges:

- Regulatory compliance costs

- Dependence on petrochemical feedstocks

Key Players: Atul Ltd, Solvay, Tokyo Chemical Industry Co., Ltd., SURYA LIFE SCIENCES LTD., Thermo Fisher Scientific, Emmennar Pharma Pvt. Ltd., Benzo Chem Industries Pvt. Ltd., Merck KGaA, Camlin Fine Sciences Ltd..

Global Anisole Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 88.94 million

- 2026 Market Size: USD 93.58 million

- Projected Market Size: USD 156.3 million by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 September, 2025

Anisole Market Growth Drivers and Challenges:

Growth Drivers

- Increasing need from the pharmaceutical industry: The primary key driver of the anisole market is the pharmaceutical industry, due to anisole’s role as an essential intermediate in the synthesis of various drugs. Its application spans across therapeutic categories, including anti-inflammatory agents, analgesics, and antipyretics. As the prevalence of chronic diseases continues to rise and global populations age, the demand for these medications is accelerating, consequently boosting the need for anisole. According to the Pharmaceutical Research and Manufacturers of America (PhRMA), the global pharmaceutical market was projected to reach USD 2.82 trillion by 2023, propelled by increased healthcare needs, innovative drug development, and advancements in biotechnology.

The expanding pharmaceutical pipeline, particularly in emerging markets, further supports this upward trajectory. Companies like Merck KGaA exemplify the strategic importance of anisole in pharmaceutical manufacturing. With a strong focus on specialty chemicals and drug intermediates, Merck utilizes anisole derivatives in several synthesis processes, reflecting its integral role in modern drug production. As pharmaceutical innovation progresses, the demand for high-quality anisole is expected to remain strong and steadily grow.

- The growing utilization in the fragrance and flavor industry: Anisole is a vital chemical compound that is gaining recognition in the flavor and fragrance sector, alongside its established applications in pharmaceuticals. Its growing demand is attributed to the rising popularity of perfumes, cosmetics, household cleaners, soaps, and laundry detergents. According to the International Fragrance Association (IFRA), the global fragrance market was projected to reach USD 53.2 billion by 2023, driven by the expansion of luxury goods, rapid growth of e-commerce, and increased incorporation of essential oils in aromatherapy and cosmetic formulations.

Anisole’s versatility and pleasant aroma make it a preferred ingredient across a wide range of fragrant products. As consumer preferences shift toward premium and aromatic offerings, manufacturers are ramping up production and application of anisole in various formats. For instance, Givaudan, a leading global fragrance and flavor company, leverages anisole in its formulations to develop signature scents for luxury perfumes and personal care products. The growing demand for high-end fragrances continues to push the supply and innovation around anisole in the global market.

Challenges

- Regulatory compliance costs: The market faces increasing regulatory compliance costs due to stringent environmental, health, and safety standards imposed by global frameworks such as REACH in the EU and OSHA in the U.S. Manufacturers must invest heavily in monitoring, documentation, employee training, and safety measures to meet these requirements. Furthermore, regular audits, chemical analyses, and compliance with labeling regulations contribute to the operational workload. This compliance demand not only increases production costs but also presents barriers to entry for smaller players, influencing overall market competitiveness and supply chain dynamics.

- Dependence on petrochemical feedstocks: The anisole market is highly dependent on petroleum-based feedstocks, particularly methanol and phenol, which are derived from crude oil. This reliance makes the production of anisole vulnerable to fluctuations in the oil process, which can significantly impact production costs. An increase in oil prices results in a rise in the cost of raw materials, consequently elevating manufacturing costs. Additionally, supply chain disruption in the petrochemical industry, such as geopolitical tensions or natural disasters, can further affect the availability and cost of these essential inputs, thereby creating instability in the market and reducing overall profitability.

Anisole Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 88.94 million |

|

Forecast Year Market Size (2035) |

USD 156.3 million |

|

Regional Scope |

|

Anisole Market Segmentation:

Grade Analysis

The up to 99.5% segment is anticipated to dominate the anisole market, with the largest revenue share of 56.5% in 2035. The expansion of this sector is largely fueled by its extensive application in the pharmaceutical and cosmetics sectors, where both cost efficiency and adequate purity are crucial for a range of formulations. Manufacturers favor this grade for its balance of affordability and compliance with industry purity standards, making it ideal for mass-market personal care products, soaps, and medications. The increasing demand for affordable yet high-performance ingredients in these sectors has significantly contributed to the consumption of anisole in this grade range.

A leading instance of a company utilizing anisole in this grade is Kraton Polymers, a global supplier of high-performance materials. Kraton leverages anisole in the formulation of personal care products and adhesives, where up to 99.5% grade anisole provides the necessary balance between cost and performance. As the market increasingly emphasizes cost-effective and efficient ingredients, the segment with a grade of up to 99.5% is anticipated to retain its leading position in the anisole industry. This dominance is projected to persist, fueled by the rising demand for economic solutions in the personal care and pharmaceutical sectors.

End use

The perfume segment will dominate the global anisole market, maintaining a significant share throughout the forecast period of 2035. This growth is primarily driven by the increasing consumer demand for unique, personalized, and long-lasting fragrances. Anisole’s sweet, pleasant, and slightly floral aroma makes it a highly sought-after ingredient in both luxury and mass-market perfume formulations. Its ability to enhance scent complexity and stability makes it a preferred choice among fragrance manufacturers.

The growth of this segment is additionally bolstered by the worldwide increase in disposable incomes and the expanding impact of the cosmetics and personal care sectors. Consumers are increasingly investing in premium fragrances, boosting the demand for aromatic compounds like anisole. A notable instance is Firmenich, one of the world’s leading fragrance and flavor companies, which utilizes anisole in creating bespoke perfume blends. Firmenich’s focus on innovation and olfactory sophistication underscores anisole’s critical role in modern fragrance development and its sustained market relevance.

Our in-depth analysis of the market includes the following segments:

Grade |

|

|

End use |

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anisole Market Regional Analysis:

Asia Pacific Market Insights

The Asia Pacific anisole market is poised to hold a 34.6% share by the end of 2035, driven by its large population, rapid urbanization, and growing middle-class consumer base. The rising demand for cosmetics and personal care products has fueled the need for aromatic ingredients like anisole, especially in premium and branded fragrance formulations. Chinese consumers are increasingly focused on product quality, brand reputation, and personal grooming, leading to a surge in high-purity anisole consumption. Additionally, government support for sustainable and green chemistry practices is promoting the adoption of bio-based and environmentally friendly chemicals, further strengthening anisole’s market potential in the region.

India, another high-growth market, is witnessing a similar trend with increasing disposable incomes, a youthful population, and heightened awareness around personal care and hygiene. The rapid expansion of the beauty and wellness sector is encouraging local manufacturers to incorporate anisole in perfumes, soaps, and skincare products. S.H. Kelkar (Keva) utilizes anisole in its fragrance compositions, addressing the growing demand for personal care and scented products as disposable incomes increase and consumer preferences change..

Europe Market Insights

The Europe region is anticipated to experience notable growth, driven by the demand from UK and Germany’s pharmaceutical and fragrance sectors. In the UK, the rising focus on sustainable and innovative personal care products is fueling demand for aromatic compounds like anisole. British consumers are increasingly inclined toward eco-friendly and high-performance products, which encourages manufacturers to explore bio-based and synthetic fragrance components.

Germany, with its advanced chemical manufacturing infrastructure and emphasis on precision and quality, plays a central role in the regional anisole market. High-purity anisole is widely used in drug synthesis and premium fragrance formulations, supported by Germany’s strict compliance with EU pharmaceutical and environmental standards. A prominent instance is BASF, which produces and supplies high-grade anisole for applications in both flavor and fine fragrances. BASF’s commitment to a sustainability focus reinforces its position as a key contributor to Europe’s market expansion.

Anisole Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atul Ltd

- Solvay

- Tokyo Chemical Industry Co., Ltd.

- SURYA LIFE SCIENCES LTD.

- Thermo Fisher Scientific

- Emmennar Pharma Pvt. Ltd.

- Benzo Chem Industries Pvt. Ltd.

- Merck KGaA

- Camlin Fine Sciences Ltd.

Key players in the anisole market leverage advanced purification technologies, sustainable synthesis methods, and continuous research & development to ensure high-quality, eco-friendly anisole production. Their focus on innovation, regulatory compliance, and customized formulation capabilities helps them maintain a competitive edge in diverse end-use applications.

Recent Developments

- In October 2024, Syensqo is pleased to announce its collaboration with the Jean-Marie Lehn Foundation. This strategic alliance will enable Syensqo, foundation members, and chemists from the University of Strasbourg and the CNRS to jointly engage in three research initiatives aimed at developing sustainable and ecological materials, as well as synthesizing renewable and multifunctional building blocks. This partnership underscores Syensqo's dedication to fostering innovation and sustainability within the materials sector.

- In May 2024, UPL declared the formation of a joint venture (JV) with Aarti Industries (AIL), in which both parties hold an equal stake of 50%. This collaboration is focused on the production and marketing of specialty chemicals used in diverse downstream industries. UPL plays a significant role in the specialty chemicals sector, while AIL is acknowledged as a key player in the domain of specialty chemical intermediates.

- Report ID: 1137

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anisole Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.