Animal Genetics Market Outlook:

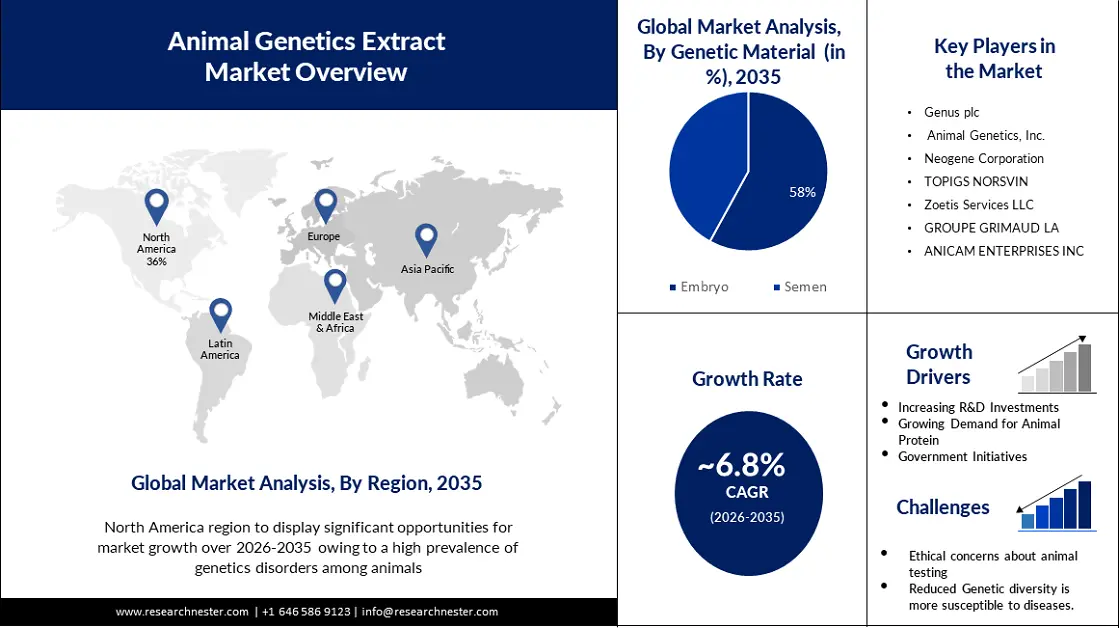

Animal Genetics Market size was over USD 7.59 Billion in 2025 and is poised to exceed USD 14.65 Billion by 2035, growing at over 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of animal genetics is estimated at USD 8.05 Billion.

The surge in worldwide demand for animal-based protein products, including meat, milk, and eggs, has created an increased need for the development of genetically superior livestock breeds and aquaculture species. The FAO estimates that 136 million tonnes of poultry will be consumed globally in 2022. This is primarily due to the ever-increasing consumption of these products, which has put a strain on the available resources and necessitated the need for more efficient and productive methods of production. By utilizing advanced genetic technologies and breeding programs, the agricultural industry can meet the demand for animal protein products while also ensuring the sustainability and welfare of the animals involved.

In light of this, the market is predicted to witness growth during the projection period. Additionally, the market is estimated to account for growth owing to the rising funding for animal genetics research, growing implementation of animal welfare, and advancements in genetic technologies.

Key Animal Genetics Market Insights Summary:

Regional Highlights:

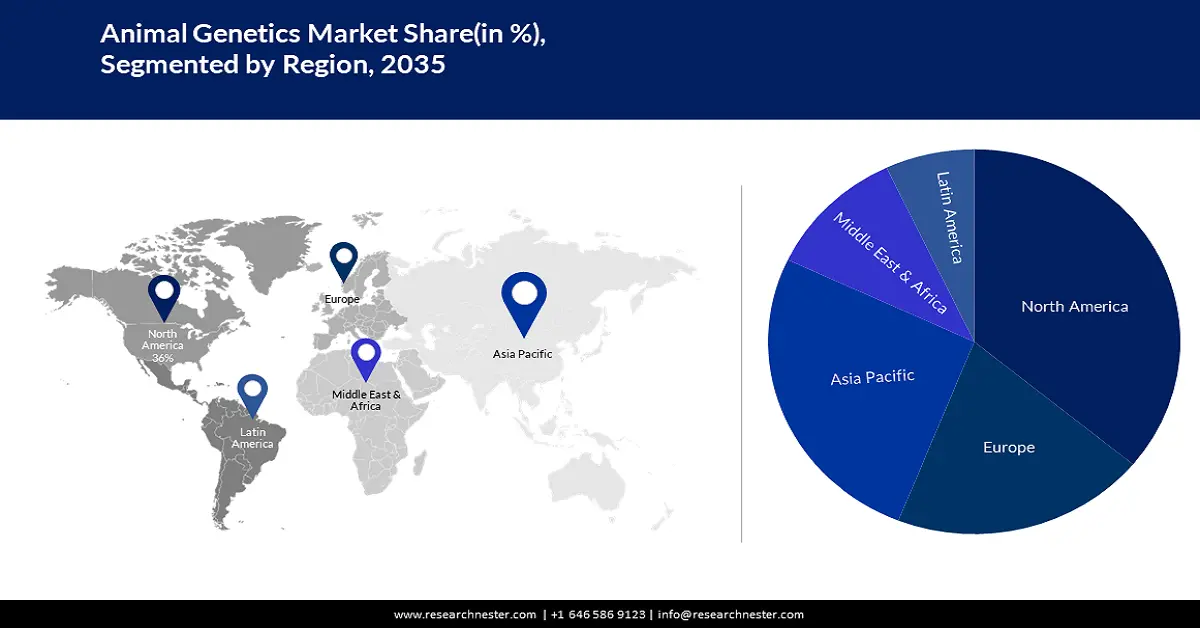

- North America’s animal genetics market will dominate over 36% share by 2035, fueled by high prevalence of genetic disorders among animals, strong market presence, and R&D in breeding practices.

- Asia Pacific market will achieve significant revenue share by 2035, attributed to rising awareness of animal health, a large animal population, and increasing spending on animal healthcare.

Segment Insights:

- The embryo segment in the animal genetics market is forecasted to achieve a dominant 58% share by 2035, influenced by the growing popularity of embryo transfer in livestock and advancements in genetics and IVF technology.

- The animal type segment in the animal genetics market is expected to capture a significant share by 2035, driven by increased consumption of animal protein and supporting government initiatives.

Key Growth Trends:

- Increased R&D Investments

- Emergence of precision livestock Farming

Major Challenges:

- Increased R&D Investments

- Emergence of precision livestock Farming

Key Players: Genus plc, Animal Genetics, Inc., Neogen Corporation, TOPIGS NORSVIN, Zoetis Services LLC, GROUPE GRIMAUD LA, ANICAM ENTERPRISES INC, Trans Ova Genetics., GenEra, HOKKO CHEMICAL INDUSTRY CO., LTD..

Global Animal Genetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.59 Billion

- 2026 Market Size: USD 8.05 Billion

- Projected Market Size: USD 14.65 Billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Netherlands, Brazil

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Animal Genetics Market Growth Drivers and Challenges:

Growth Drivers

- Increased R&D Investments- The field of animal genetics has been witnessing a surge in investments from both biotech companies and research institutions, which is driving innovation and spurring new product development. This trend has been fueled by the growing demand for improved livestock health and productivity, as well as the need to address environmental challenges and meet the evolving needs of consumers. As a result, there has been a considerable focus on genetic research and development, with a particular emphasis on identifying and selecting traits that can enhance animal performance, health, and well-being. This has led to the development of new breeding techniques, advanced gene editing technologies, and innovative genetic tools and tests that are helping to advance the field of animal genetics and contribute to the sustainable growth of the livestock industry.

- Emergence of precision livestock Farming - Using precision farming techniques like genetics, sensors, and data analytics can help farmers improve animal production efficiency, lower costs, and make informed decisions about resource allocation and treatment plans. It also enhances feed and water usage, reduces waste, and minimizes environmental impacts, leading to a more sustainable and profitable operation. As per analytical data, in the next 15 years, the demand for meat, milk, and other animal products may rise by 40% globally. This will have a positive impact on the animal genetics market.

- Changing Consumer Preferences - Consumer preferences have shifted towards animal products that meet specific criteria. They increasingly demand high-quality products that align with ethical and sustainable practices. To fulfill these expectations, animal agriculture has turned to genetic improvement. This involves selectively breeding animals to exhibit desired traits, such as improved meat quality, higher yields, and reduced environmental impact. By genetically improving livestock and aquaculture, the industry can meet consumer demands for products that are not only of superior quality but also produced ethically and sustainably. This shift benefits both the agriculture sector and the consumers who access healthier and more conscientiously sourced products that adapt to evolving market trends.

Challenges

- Sustainability of the economy in regional breeds- Large financial commitments are needed to carry out genetic improvement initiatives for regional breeds. Large sums of money must be spent to build the infrastructure that is lacking in places where native breeds are prevalent. These investments are frequently regarded as having little value because of their results and economic viability. For example, because of economies of scale, artificial insemination in small local animal breed populations costs more per dosage of semen than it does in big animal populations. In many situations, the cost-benefit analysis produces inferior or negative results when compared to numerous necessary investments. Given this situation, one of the primary challenges in the market is the increasing need to increase the productivity of local breeds and to increase the affordability and viability of genetic development programs for these breeds.

- Developing superior animal breeds requires extensive R&D investments.

- Managing and interpreting vast genetic datasets can be complex and require advanced computational resources.

Animal Genetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 7.59 Billion |

|

Forecast Year Market Size (2035) |

USD 14.65 Billion |

|

Regional Scope |

|

Animal Genetics Market Segmentation:

Genetic Material Segment Analysis

The embryo segment in the animal genetics market is anticipated to hold the largest segment over the forecast period, accounting for 58%. Mostly utilized on cattle, sheep, goats, and pigs, embryo transfer technology is also utilized to a lesser degree on buffaloes and camels. In recent years, there has been a notable increase in the transfer of bovine embryos. Recently, seed stock and beef producers have shown a significant increase in popularity for embryo transfer in the bovine business. It has benefited from advances in genetics, ultrasonography, and IVF. Embryo transfer programs are used by producers to expand the flock size of genetically superior animals.

Product & Service Segment Analysis

Animal genetics market from the animal type segment is expected to witness a significant revenue share by 2035. The consumption of animal protein has experienced a noticeable uptick in recent times. This trend is expected to continue over the forecast period, owing to various factors such as governmental initiatives aimed at mitigating environmental impact and increasing global awareness. As a result, the demand for animal protein is expected to grow significantly, leading to market growth in this segment.

Our in-depth analysis of the global market includes the following segments:

|

Genetic Material |

|

|

Product & Service |

|

|

Animal Type |

|

|

Testing Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Animal Genetics Market Regional Analysis:

North American Market Insights

North America animal genetics market is anticipated to account for 36% of the revenue share during the forecast period. This is mainly due to the high prevalence of genetic disorders among animals and the presence of key market players in the region. The market is expected to witness significant growth owing to extensive research & development activities aimed at improving breeding practices. This, in turn, will lead to the production of healthier animals that can effectively utilize nutrients for growth and reproduction purposes. Overall, the market outlook is quite promising, with several exciting opportunities likely to emerge in the foreseeable future.

APAC Market Statistics Insights

Asia Pacific animal genetics market is expected to hold a significant revenue share. This can be attributed to the growing awareness of animal health among the general populace in the region. Additionally, the region boasts a significant animal population base, which is expected to further drive growth in the market. As a result, there has been a noticeable increase in spending on animal healthcare in the region, which is expected to contribute significantly to the market's growth in the coming years.

Animal Genetics Market Players:

- Hendrix Genetics BV

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Genus plc

- Animal Genetics, Inc.

- Neogen Corporation

- TOPIGS NORSVIN

- Zoetis Services LLC

- GROUPE GRIMAUD LA

- ANICAM ENTERPRISES INC

- Trans Ova Genetics.

- GenEra

Recent Developments

- May 2022- The official launch of InfiniSEEKTM, an innovative, economical solution for whole genome sequencing and targeted SNP analysis, was announced by Neogen® Corporation and Gencove, the industry-leading low-pass whole genome sequencing and analysis software firm.

- June 2022- Basepaws is a privately held petcare genetics firm that offers pet owners genetic tests, analytics, and early health risk assessments. Zoetis Inc. announced the completion of its acquisition of Basepaws. A pet's risk for the disease can be better understood by pet owners and doctors with the help of genetic insights from Basepaws. This can result in more meaningful interactions and improve the chances of early disease identification and treatment. The acquisition was first disclosed on June 7th, but the financial details of the deal were not made public.

- Report ID: 4390

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Animal Genetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.