Angiography Imaging Systems Market Outlook:

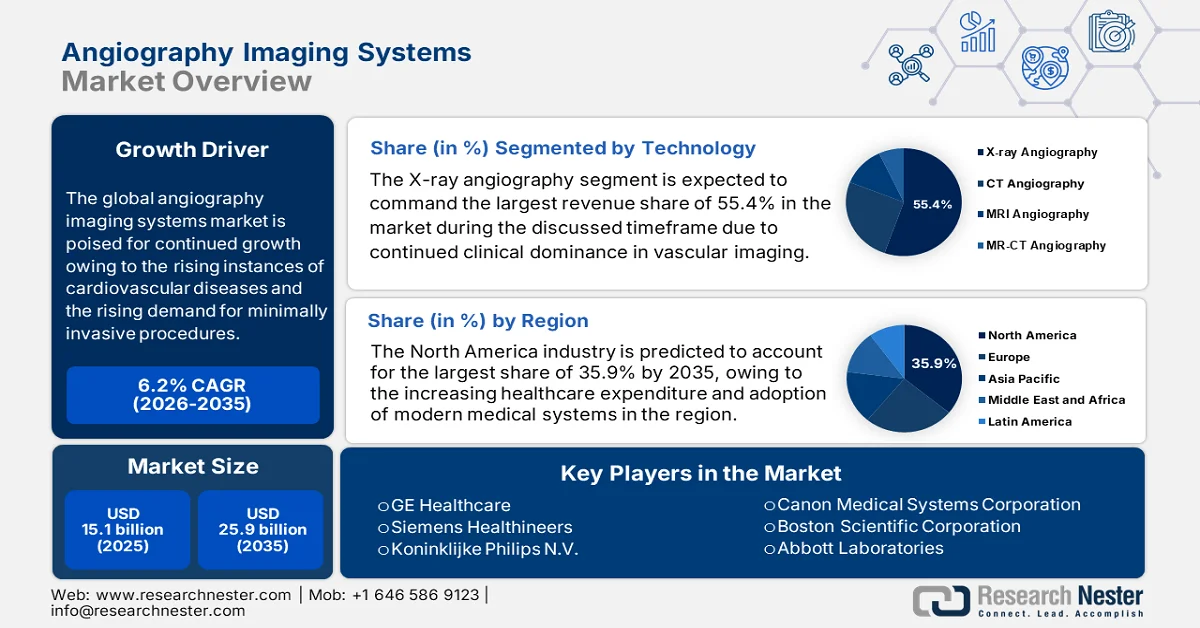

Angiography Imaging Systems Market size was valued at USD 15.1 billion in 2025 and is projected to reach USD 25.9 billion by the end of 2035, rising at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of angiography imaging systems is evaluated at USD 16 billion.

The global angiography imaging systems market is poised for continued growth owing to the rising instances of cardiovascular diseases and the growing demand for minimally invasive procedures. As per an article published by NIH in August 2023, cardiovascular diseases (CVD) are one of the leading causes of death in the U.S. and globally, accounting for nearly one in every four deaths in the U.S. and an estimated 17.7 million deaths worldwide in a year. It also stated that CVD represents the costliest disease burden, with indirect costs of about USD 237 billion on a yearly basis, and is projected to rise to USD 368 billion by 2035. Moreover, the lifetime risk of heart disease remains high at nearly 50% by age 45, elevating the angiography imaging systems market potential under this demographic. This growing prevalence is expected to drive the adoption of angiography solutions across hospitals and diagnostic centers worldwide.

Furthermore, the cost aspect stimulates consistent progress in the angiography imaging systems market, increasing competitiveness amongst national and international players and driving medical tourism. Asian Heart Institute in May 2024 reported that across India, the cost of an angiography is reported to be from ₹20,000 to ₹60,000, with an average cost being ₹25,000 to ₹42,000 (USD 300 to 500). The final expense depends on factors such as the type of angiography, hospital ownership, doctor’s expertise, city location, and insurance coverage. Moreover, India offers angiography at significantly lower costs compared to Western countries while maintaining high clinical expertise and advanced cardiac infrastructure. Hence, this aspect of affordability in emerging nations encourages hospital investments in terms of advanced angiography systems, strengthening equipment sales, and accelerating overall angiography imaging systems market growth.

Global Angiography Procedure Cost Comparison by Country (USD)

|

Country |

Approximate Cost (USD) |

|

India |

USD 300 |

|

U.S. |

USD 28,200 |

|

Thailand |

USD 4,200 |

|

Singapore |

USD 13,400 |

|

Malaysia |

USD 8,000 |

|

Turkey |

USD 4,800 |

|

South Korea |

USD 17,700 |

Source: Asian Heart Institute

Key Angiography Imaging Systems Market Insights Summary:

Regional Highlights:

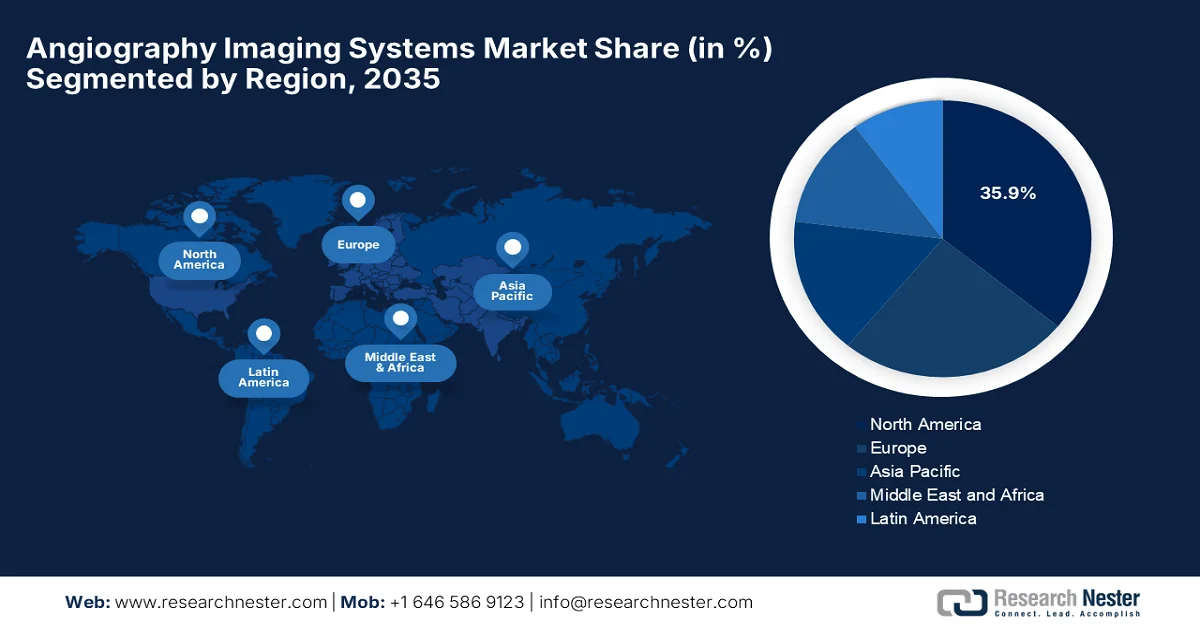

- North America in the angiography imaging systems market is projected to capture a 35.9% revenue share by 2035, reinforced by high healthcare spending, advanced medical infrastructure, and rapid uptake of innovative angiography technologies.

- Asia Pacific is expected to witness steady market expansion through 2035, supported by growing adoption of minimally invasive procedures, government-led healthcare modernization, and rising institutional procurement of advanced imaging systems.

Segment Insights:

- The X-ray angiography segment in the angiography imaging systems market is anticipated to secure a 55.4% revenue share by 2035, sustained by its clinical primacy in real-time vascular imaging and interventional guidance.

- The cardiology application segment is set to grow strongly by 2035, fueled by increasing minimally invasive cardiac interventions and heightened emphasis on early and accurate cardiovascular diagnosis.

Key Growth Trends:

- Rising disease burden

- Growth in minimally invasive and image-guided procedures

Major Challenges:

- Shortage of skilled professionals

- Regulatory and compliance barriers

Key Players: GE Healthcare (U.S.), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Boston Scientific Corporation (U.S.), Abbott Laboratories (U.S.), Medtronic plc (Ireland/U.S.), B. Braun Melsungen AG (Germany), Terumo Corporation (Japan), Cordis (a Cardinal Health company) (U.S.), AngioDynamics, Inc. (U.S.), Shimadzu Corporation (Japan), Hitachi Medical Systems (Japan), Toshiba Medical Systems (Japan), Carestream Health (U.S.), Ziehm Imaging GmbH (Germany), Samsung Medison Co., Ltd. (South Korea), Allengers Medical Systems Ltd. (India).

Global Angiography Imaging Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.1 billion

- 2026 Market Size: USD 16 billion

- Projected Market Size: USD 25.9 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, China, South Korea, Brazil, Saudi Arabia

Last updated on : 5 February, 2026

Angiography Imaging Systems Market - Growth Drivers and Challenges

Growth Drivers

- Rising disease burden: The growing burden of peripheral vascular diseases is the primary growth driver for the angiography imaging systems market. Factors such as aging populations, sedentary lifestyles, unhealthy diets, and rising incidence of diabetes and hypertension are contributing to higher diagnostic and interventional procedure volumes across the globe. In this context, the National Institute of Health in June 2023 revealed that peripheral vascular disease affects nearly 200 million people globally, including about 40 to 45 million individuals in the U.S. It also mentioned that the prevalence rises sharply with age, exceeding 20% in those over 80 years. In addition, significant racial disparities exist, wherein residents from Africa and America exhibit a two- to three-fold higher risk of PAD when compared to non-Hispanic whites, hence positively impacting market growth.

Peripheral Artery Disease (PAD) Epidemiology Statistics: Historic Data (2010-2015)

|

Parameter |

Statistic |

|

Global PAD prevalence |

200 million people |

|

PAD prevalence (U.S.) |

40–45 million |

|

PAD prevalence in the population >80 years |

>20% |

|

IC prevalence (men vs women) |

1.9% vs 0.8% |

|

ABI-based PAD prevalence (women vs men) |

20.5% vs 16.9% |

|

Risk in African Americans vs non-Hispanic whites |

OR 2.1–3.1 |

|

PAD risk with low socioeconomic status |

2× higher |

|

PAD risk with lower education |

OR 2.8 (95% CI 1.96–4.0) |

Source: National Institute of Health

- Growth in minimally invasive and image-guided procedures: There has been a major shift towards minimally invasive procedures, which is yet another key driver of the angiography imaging systems market. Simultaneously, the increasing patient preference for less invasive treatments, coupled with physician adoption of image-guided therapies, is encouraging investments in advanced angiography systems. Based on the government data from India, which was published by the Ministry of Defense in December 2025, the Army Hospital performed the country’s first-ever 3D flex aqueous angiography with iStent, by integrating advanced imaging with minimally invasive glaucoma surgery. It also notes that such instances enhance intraoperative imaging and patient outcomes. Hence, this rising adoption of advanced, image-guided procedures in India directly stimulates demand and growth for angiography imaging systems.

- Expansion of healthcare infrastructure and medical tourism: Rapid expansion in terms of healthcare infrastructure, particularly in emerging economies, is accelerating angiography imaging systems market growth. Countries such as India, China, and those in Southeast Asia are also benefiting from growing medical tourism, positively influenced by high-quality care at lower costs. As per the reports published by the Ministry of Tourism from India in August, 2025, India represented 131,856 foreign tourist arrivals for medical purposes until April 2025, which represents 4.1% of the total arrivals. Besides, the government is proactively promoting medical tourism through initiatives such as the Heal in India program, e-medical visas for 171 countries, and state-level collaborations such as Gujarat’s wellness retreats, hence encouraging participation in diagnostic and interventional technologies, bolstering the market growth.

Challenges

- Shortage of skilled professionals: Operating angiography imaging systems requires highly trained radiologists, cardiologists, and technicians with specialized expertise needed in terms of interventional procedures. Therefore, the worldwide shortage of skilled work professionals who are capable of handling these complex imaging workflows and interpreting results accurately poses a major hurdle for the angiography imaging systems market expansion. Since the training programs are limited, it discourages workforce expansion, whereas in developing countries, this ultimately delays adoption despite the availability of equipment. Furthermore, this absence of skilled personnel also increases the risk of diagnostic errors, impacting patient outcomes and limiting widespread adoption in this field.

- Regulatory and compliance barriers: Angiography imaging systems are mostly subject to stringent regulatory approvals influenced by their invasive nature and direct impact on patient safety. In this context, obtaining certifications from administrative agencies involves very lengthy processes, extensive clinical trials, and even high costs. This, in turn, leads to manufacturers facing delays in product launches, limiting innovation cycles, and ultimately slowing the angiography imaging systems market’s expansion. In addition, the rapidly evolving standards around radiation safety, data privacy, and interoperability demand continuous adaptation. This makes it challenging for firms from emerging nations to reduce competitive diversity, hinder timely adoption, and restrict global angiography imaging systems market growth.

Angiography Imaging Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 15.1 billion |

|

Forecast Year Market Size (2035) |

USD 25.9 billion |

|

Regional Scope |

|

Angiography Imaging Systems Market Segmentation:

Technology Segment Analysis

The X-ray angiography segment is expected to command a revenue share of 55.4% in the angiography imaging systems market during the discussed timeframe. The leadership of the segment is mainly propelled by the continued clinical dominance in real-time vascular imaging and interventional guidance. It is widely used for both diagnostics and minimally invasive procedures, and improvements in flat‑panel detectors and dose optimization sustain its high usage. In December 2025, WeMed Medical announced that it had launched its Taikon medical angiography X-ray system, which marks the company’s official entry into the global angiography imaging systems market, followed by the CE certification. It also mentioned that the system offers enhanced imaging accuracy and superior clinical performance, reflecting a significant technological advancement in the angiography sector, hence denoting a wider segment scope.

Application Segment Analysis

In the angiography imaging systems market, the cardiology application will grow at a considerable rate over the forecasted years. Angiography systems are highly essential for diagnosing and treating heart conditions such as blockages, MI, and structural abnormalities. The worldwide campaigns for early diagnosis of coronary artery disease, myocardial infarction, and structural heart abnormalities with high precision are encouraging widespread adoption in this field. There has been increasing adoption of minimally invasive procedures such as percutaneous coronary interventions, which is driving demand for advanced angiography systems. Innovations in terms of high-definition imaging, 3D reconstruction, and AI-assisted diagnostics are enhancing procedural accuracy and patient safety. Furthermore, government initiatives for heart disease screening programs are boosting the utilization of cardiology-focused angiography systems.

End user Segment Analysis

By the conclusion of 2035, the hospitals are projected to grow with a significant share in the end-user segment. This growth of the sub-segment is mainly driven by the high concentration of advanced cardiac catheterization labs, interventional radiology suites, and specialized cardiology departments. Hospitals are also considered to be primary referral centers for complex cases, creating consistent demand for angiography equipment. In August 2025, Apollo Specialty Hospitals in Chennai announced that it had inaugurated a cath lab consisting of advanced 3D imaging, stent motion visualization, neurovascular support, and low-dose radiation systems to support minimally invasive procedures in cardiology, neurology, and oncology in Teynampet. The facility enhances real-time navigation for precise treatment of heart attacks, strokes, and vascular blockages, improving diagnostic accuracy and patient recovery times, positively impacting the angiography imaging systems market’s growth and adoption.

Our in-depth analysis of the angiography imaging systems market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Application |

|

|

End user |

|

|

Product |

|

|

Procedure |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Angiography Imaging Systems Market - Regional Analysis

North America Market Insights

The North America angiography imaging systems market is forecasted to emerge as the dominating landscape with a share of 35.9% by 2035. The region’s leadership in this region is mainly propelled by increasing healthcare expenditure, advanced medical infrastructure, and increasing adoption of modern medical systems. Favorable regulatory procedures and continued innovations from industry players are also prompting a profitable business environment in the region. In October 2025, the U.S. FDA reported that it cleared Spectrawave Inc.’s X1-FFR device, an X-ray angiographic imaging–based coronary vascular simulation software, under 510(k) number K251355. The device is classified under QHA and LLZ codes and was determined to be substantially equivalent (SESE) and falls under the radiology medical specialty. X1-FFR supports non-invasive coronary flow assessment and procedural planning, aiding clinicians in diagnosing and managing coronary artery disease, hence bolstering the angiography imaging systems market growth.

The U.S. angiography imaging systems market is the key contributor for region’s growth and is mainly driven by strong R&D, insurance, and continued healthcare investments by both public and private organizations. For instance, as per the industry-validated analysis by the AHA Journals Organization published in October 2025, it analyzed how insurance coverage in the U.S. aligns with guidelines and landmark trials for invasive coronary angiography and percutaneous coronary intervention in stable coronary artery disease. Among 33 major payers, 55% of ICA and 42% of PCI policies were publicly available, revealing significant variability in adherence to professional society guidelines and trials such as ORBITA and ISCHEMIA. Therefore, this suggests that the variability and partial coverage of ICA and PCI procedures in the country could drive demand for advanced angiography systems as providers seek efficient, guideline-aligned solutions to optimize patient care and reimbursement.

The angiography imaging systems market in Canada is also significantly growing owing to the presence of rapidly aging populations, growing cardiovascular disease burden. The strong government backing and a strong focus on AI-based diagnostics and improved image quality are also driving consistent revenue in the country’s market. As per the article published by NIH, the Canadian Medical Imaging Inventory 2022-2023 report highlights that most imaging equipment in Canada is over 5 years old, with a significant portion exceeding 10 years, and the country lags behind OECD averages in units per population for CT, MRI, and PET-CT. It also stated that publicly funded hospitals dominate the imaging landscape, concentrated mainly in urban areas. Hence, this denotes the urgent need for advanced technologies in Canada, driving demand for modern angiography imaging systems, and boosting market growth.

APAC Market Insights

The Asia Pacific angiography imaging systems market is set to represent consistent growth owing to the increasing adoption of minimally invasive procedures and expanding healthcare infrastructure. Key trends witnessed by the region’s market include growing awareness of early diagnosis, government initiatives to improve healthcare access, and rising investments in imaging technologies. In April 2024, the National University Corporation of Tokyo published a notice for the procurement of one cardiovascular-specific angiography system. The system is required to be a biplane unit with interventional radiology capabilities, image-processing workstations, ablation treatment functions, and integration with the hospital’s network for patient data and image management. Therefore, the presence of institutional procurements in the region creates high-value demand and encourages pioneers to supply advanced angiography systems through contracts.

China angiography imaging systems market is progressing due to the increasing investments in terms of hospital infrastructure and ongoing innovations. Besides, the domestic manufacturers and international players are making investments in terms of research, distribution, and training, creating new revenue streams and enhancing competitiveness in the market. In this context, the National Medical Products Administration (NMPA) reported that it approved Shanghai United Imaging Healthcare Co., Ltd.’s medical angiography X-ray machine for marketing, consisting of advanced components such as a high-voltage generator, flat panel detector, 3D images processing workstation, and robotic 9-axis DSA system. The system enables full-abdomen and chest cone beam imaging, addressing the limited field of view in traditional cone beam CT. Therefore, with such continued innovations, the country’s market is set to evolve at a rapid pace in the years ahead.

Government initiatives to improve healthcare access and modernize medical facilities are the major driving factors for the growth of the angiography imaging systems market in India. The country’s market is also driven by increasing cath lab installations and skilled interventional cardiologists across public and private hospitals. Simultaneously, the domestic manufacturing initiatives and procurements from public organizations enhance both technology access and uptake nationwide. National University Corporation AIIMS New Delhi, in August 2025, reported a government eProcurement notice seeking submission of materials for the purchase of one angiography system for cardiovascular examination and interventional radiology. The requirements included a biplane angiographic unit with a treatment support workstation, ablation capability, and connectivity to the hospital network for patient data and image storage. Hence, such instances directly stimulate demand for angiography imaging systems, encouraging more players to establish their footprint in the country.

Europe Market Insights

The angiography imaging systems market in Europe is being propelled by a strong focus on enhancing interventional cardiology and vascular care infrastructure. Besides, healthcare policymakers in the region are prioritizing the modernization of medical imaging facilities, such as replacing outdated systems with advanced digital angiography suites that efficiently support 3D imaging and proper procedure guidance. In this context, Philips in June 2025 announced that it has launched the CE-marked SmartCT intelligent 3D imaging solution across Europe, integrated with the Azurion neuro biplane system to enhance real-time visualization during neurovascular procedures. This innovation streamlines stroke care by eliminating the need for separate CT scans, enabling faster, more confident treatment decisions and image clarity directly in the angiography suite; hence, such developments imply the market’s increased exposure in Europe.

Officially Reported Cardiovascular Disease Burden in the EU: Mortality, Prevalence, and Socio-Economic Impact (2022)

|

Category |

Statistic / Value |

Notes |

|

Total deaths due to CVD (2022) |

1.7 million |

Accounts for 1 in 3 deaths in the EU |

|

People affected by CVD (2022) |

62 million |

Includes all ages, both genders |

|

Premature mortality reduction (2012–2022) |

20% in males, 23% in females |

Average EU-wide reduction, varied by country |

|

Male vs Female mortality |

43% higher in men |

Age-adjusted mortality ratio across EU countries |

|

Working days lost due to illness/disability (2021) |

256 million days |

Impact on workforce productivity |

|

Working years lost due to premature deaths |

1.3 million years |

Economic and social impact |

|

Total workforce impact |

€47 billion |

Includes lost productivity from premature mortality and illness |

|

Years of life lost (under 75) |

1,301.9 per 100,000 |

EU average due to premature CVD deaths |

|

Total societal cost of CVD (2021) |

> €282 billion |

Includes direct healthcare costs, productivity losses, and long-term disability care |

Source: OECD

In Germany, the angiography imaging systems market is positively influenced by the emerging hospital network and an urgent need for a well-established diagnostic imaging culture. Regional funding programs for hospital equipment upgrades are encouraging institutions to adopt hybrid interventional suites that integrate CT and angiography capabilities. In this context, NIH in May 2025 revealed that the GEDA study in Germany made an analysis of the 10-year risk of cardiovascular disease among 3,271 adults who were aged 35 to 69 without having any prior heart attack or stroke instances. It found that 19% of participants had an increased or high test-based risk, whereas nearly half of them underestimated their risk, often due to lower education, good mental health, physically active. Therefore, these findings reflect the urgent need for targeted cardiovascular prevention strategies for populations who misperceive their risk.

The UK angiography imaging systems market is being primarily shaped by national healthcare priorities, which are aimed at reducing procedural wait times and increasing access to minimally invasive diagnostics. Public health campaigns that are targeting early detection of vascular diseases are driving greater demand for diagnostic imaging access. In May 2025, NHS England announced that it has rollout of AI-driven HeartFlow 3D heart scans across 56 hospitals, enabling faster, more accurate diagnosis of coronary heart disease across the nation. It also notes that this technology creates personalized 3D models of patients’ coronary arteries, guiding treatment planning and improving clinical efficiency. Furthermore, early adoption has helped many patients, cut unnecessary tests, and demonstrated the impact of these imaging systems on patient care and healthcare resource optimization.

Key Angiography Imaging Systems Market Players:

- GE Healthcare (U.S.)

- Siemens Healthineers (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- Boston Scientific Corporation (U.S.)

- Abbott Laboratories (U.S.)

- Medtronic plc (Ireland/U.S.)

- B. Braun Melsungen AG (Germany)

- Terumo Corporation (Japan)

- Cordis (a Cardinal Health company) (U.S.)

- AngioDynamics, Inc. (U.S.)

- Shimadzu Corporation (Japan)

- Hitachi Medical Systems (Japan)

- Toshiba Medical Systems (Japan)

- Carestream Health (U.S.)

- Ziehm Imaging GmbH (Germany)

- Samsung Medison Co., Ltd. (South Korea)

- Allengers Medical Systems Ltd. (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare is one of the most prominent players based in the U.S. and is best known for its broad portfolio of angiography and interventional imaging systems. The firm deliberately emphasizes innovation in high-resolution imaging, dose‑reduction technologies, and AI-enabled analytics to improve diagnostic performance across cardiology, neurology, and vascular applications.

- Siemens Healthineers is a frontrunner in this field and is a major competitor in angiography imaging, which is known for advanced digital systems and integrated workflow solutions. The company’s main focus is to make strategic R&D investments, partnerships with healthcare institutions, and global reach, which underpin its strength and ongoing expansion in the market.

- Koninklijke Philips N.V. is mainly focused on user-centric imaging systems and smart procedural workflows. Besides, the company integrates sophisticated software, interoperability features, and cloud-based data tools to enhance angiography diagnostics and interventional procedures, which efficiently strengthen its position across global healthcare settings.

- Canon Medical Systems Corporation is a central player in this field and competes by delivering high-quality imaging solutions with a prime focus on image clarity, low radiation exposure, and robust system integration. Furthermore, Canon also combines organic growth with partnerships and clinical collaborations to extend its international footprint, especially in Asia.

- Boston Scientific Corporation extends its presence in the angiography imaging ecosystem by combining its expertise in terms of interventional cardiology and vascular intervention devices that also have complementary imaging solutions. Besides, the company leverages cross‑portfolio integration to provide procedural tools that support minimally invasive therapies and enhance clinical effectiveness, bolstering its influence in global markets.

Below is the list of some prominent players operating in the global angiography imaging systems market:

The angiography imaging systems market is dominated by large multinational imaging and medtech companies, which are continuously making investments in R&D, AI integration, and hybrid imaging solutions. Similarly, the U.S. and Europe-specific players are focused on advanced X-ray and interventional suites with digital enhancements, whereas firms from emerging nations are expanding through cost-effective innovations. Acquisitions, platform integration, and service ecosystem expansion to strengthen clinical adoption and global footprint are the tactical strategies opted by these players to strengthen their market positions. In July 2025, Teleflex Incorporated reported that it had completed its acquisition of BIOTRONIK’s Vascular Intervention business, adding a comprehensive portfolio of coronary and peripheral intervention products to its interventional access offerings. The deal was valued at €760 million (approximately USD 830 million), enhancing Teleflex’s global presence in cath labs and positioning it in the fast-growing peripheral intervention sector, hence creating an optimistic market opportunity.

Corporate Landscape of the Angiography Imaging Systems Market:

Recent Developments

- In December 2025, Philips announced that it had acquired SpectraWAVE Inc., gaining next-generation coronary imaging and AI-enabled angiography-based physiology technologies, such as the HyperVue Imaging System and X1-FFR.

- In November 2025, Canon Medical Systems announced the launch of the Alphenix 4D CT with Aquilion ONE / INSIGHT Edition, which is an Angio-CT hybrid suite approved by the U.S. FDA, combining high-definition angiography with AI-assisted, wide-area CT imaging for interventional procedures.

- Report ID: 4138

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Angiography Imaging Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.