Angiogenesis Inhibitor and Simulator Market Outlook:

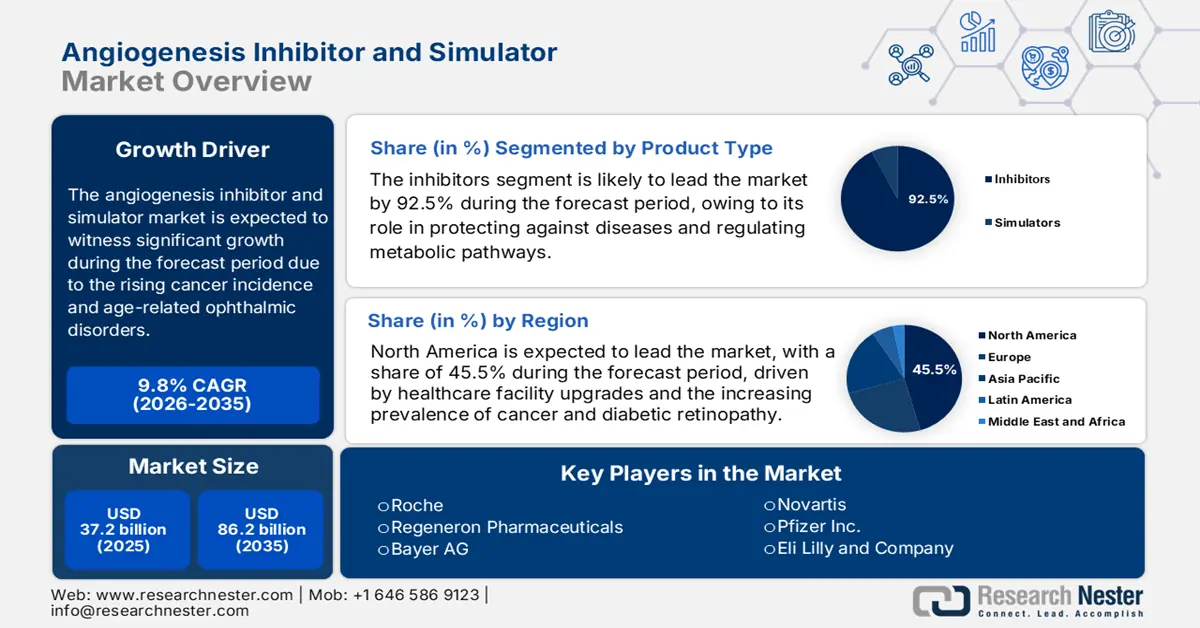

Angiogenesis Inhibitor and Simulator Market size was over USD 37.2 billion in 2025 and is estimated to reach USD 86.2 billion by the end of 2035, expanding at a CAGR of 9.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of angiogenesis inhibitor and simulator is assessed at USD 40.8 billion.

The worldwide patient cases in the market are continuously rising, with an upsurge in age-based ophthalmic diseases and cancer cases. According to an article published by the World Health Organization (WHO) in February 2024, 20 million cancer cases, along with 9.7 million deaths, were estimated in 2022. In addition, 53.5 million people were alive following a 5-year cancer diagnosis. Besides, 1 in 5 people developed cancer in their overall lifetime, with approximately 1 in 12 women and 1 in 9 men dying from the disorder. Therefore, with this surge in cancer, there is a huge demand and growth opportunity for the market across different nations.

Moreover, the effective trend of uplifting the market is the transition from monotherapy to combination regimens, expansion in biosimilars and biologics, technological convergence in simulators, and a tactical focus on notable targets and beyond VEGF. According to the June 2024 NLM article, 39 biosimilars have been cleared by the U.S. Food and Drug Administration (FDA), and a few of these products are commercially available. Besides, the median medical spending for biologic-based disease-modifying antirheumatic drugs in the U.S. has been estimated to be USD 26,217, with out-of-pocket expenses accounting for USD 1,484. Additionally, traditional DMARDs constituted an average spending of USD 5,389, with an out-of-pocket cost of USD 396 per person.

Key Angiogenesis Inhibitor and Simulator Market Insights Summary:

Regional Highlights:

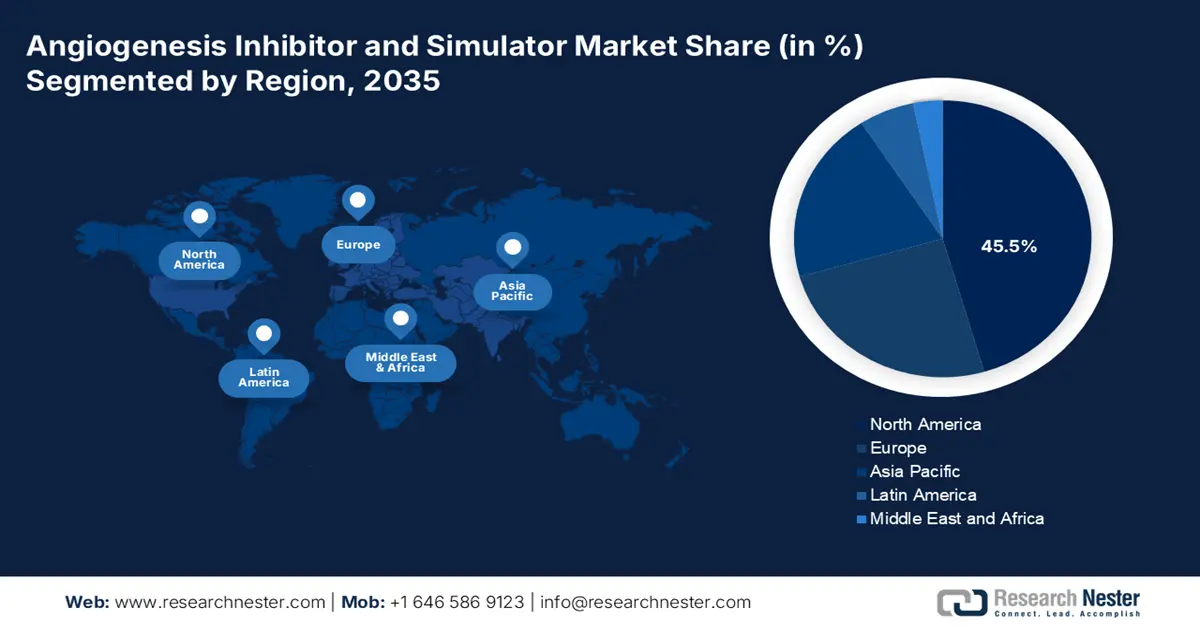

- North America in the angiogenesis inhibitor and simulator market is forecasted to hold the highest 45.5% share by 2035, driven by the rising disease burden, growing elderly population, and expanding healthcare expenditure.

- Asia Pacific is anticipated to be the fastest-growing region through 2026-2035, fueled by the increasing prevalence of diabetes and cancer-related eye disorders along with improved healthcare accessibility.

Segment Insights:

- The Inhibitors segment in the angiogenesis inhibitor and simulator market is projected to capture the largest 92.5% share by 2035, fueled by its crucial role in disease protection, metabolic pathway regulation, and reaction control.

- The hospital pharmacies segment is estimated to secure the second-largest share by 2035, propelled by its integral position in the regulatory and clinical administration of angiogenesis inhibitor therapies.

Key Growth Trends:

- Expansion in Ophthalmic Indications

- Rise in immunotherapy

Major Challenges:

- Acquired and innate drug resistance

- Adverse event management and complicated safety profile

Key Players: Roche (Switzerland), Regeneron Pharmaceuticals (U.S.), Bayer AG (Germany), Novartis (Switzerland), Pfizer Inc. (U.S.), Eli Lilly and Company (U.S.), Bristol Myers Squibb (U.S.), Sanofi (France), AstraZeneca (UK/Sweden), Merck & Co. (U.S.), Johnson & Johnson (U.S.), Takeda Pharmaceutical (Japan), Astellas Pharma (Japan), CSL (Australia), Samsung Bioepis (South Korea), Celltrion Inc. (South Korea), Dr. Reddy's Laboratories (India), Biocon Ltd. (India), Hetero (India), Hovid Berhad (Malaysia).

Global Angiogenesis Inhibitor and Simulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.2 billion

- 2026 Market Size: USD 40.8 billion

- Projected Market Size: USD 86.2 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: South Korea, Brazil, Australia, Mexico, Indonesia

Last updated on : 20 October, 2025

Angiogenesis Inhibitor and Simulator Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in Ophthalmic Indications: The angiogenesis inhibitor and simulator market is propelling beyond oncology, owing to growth in the geriatric population, effectively susceptible to sight-based disorders. The incidence of age-based macular degeneration as well as diabetic retinopathy is surging significantly, readily sustaining the need for anti-VEGF therapy. According to an article published by NLM in June 2025, an estimated 94 million individuals aged more than 50 years witness visual impairment and blindness, owing to cataract. For instance, in Sweden, cataract surgeries increased from 3,700 to 12,800, thereby driving the market’s demand globally.

- Rise in immunotherapy: This has emerged as the latest standard in cancer, which is positively impacting the market internationally. Immunotherapy has the capability to harness the patients’ immune system to fight disorders and provide a potentially less and targeted alternative to conventional treatments. As stated in the June 2025 NLM article, there has been an increase in cancer by 400% across low-income nations, by amounting USD 1,145 per capita, and 168% across middle-income countries, with USD 1,146 to USD 14,005 income per capita. This has readily uplifted the need for immunotherapy, which in turn is bolstering the market internationally.

- Suitable regulatory and reimbursement pathways: The presence of administrative organizations, such as EMA and FDA, has successfully established expedited pathways, including priority review and breakthrough therapy. These pathways have been extremely suitable for orphan and oncology-based medications, which is escalating the market entry for notable antiangiogenic agents. Besides, the existence of string reimbursement frameworks in certain economies, including Europe and the U.S., has ensured patient accessibility, along with commercial visibility, which is also bolstering the angiogenesis inhibitor and simulator market.

Different Cancer Types Driving the Angiogenesis Inhibitor and Simulator Market (2022)

|

Cancer Type |

Incidence |

Death |

|

Lung Cancer |

2.5 million (12.4%) |

1.8 million (18.75) |

|

Female Breast Cancer |

2.3 million (11.6%) |

670,000 (6.9%) |

|

Colorectal Cancer |

1.9 million (9.6%) |

900,000 (9.3%) |

|

Prostate Cancer |

1.5 million (7.3%) |

- |

|

Stomach Cancer |

970,000 (4.9%) |

660,000 (6.8%) |

|

Liver Cancer |

- |

760,000 (7.8%) |

Source: WHO

Biosimilar Price Reduction Boosting the Angiogenesis Inhibitor and Simulator Market (2024)

|

Biosimilar Type |

Decrease in Pricing |

|

Trastuzumab |

USD 438 |

|

Infliximab |

USD 112 |

|

Bevacizumab |

USD 110 |

|

Adalimumab |

USD 49 |

|

Filgrastim |

USD 290 |

|

Infliximab |

USD 21 |

Source: NLM

Challenges

- Acquired and innate drug resistance: A vital and scientific challenge in the angiogenesis inhibitor and simulator market is the development of confrontation to antiangiogenetic treatment. Tumors tend to activate alternative pathways to bypass VEGF inhibition, resulting in disease progression and restored blood vessel advancement. This acquired and innate resistance eventually limits the long-lasting efficiency of these agents, frequently covering utility to certain months of progression-based survival. However, to combat this, the development of next-generation rational combination or multi-targeted inhibitors is essential, which in turn enhances R&D cost, complexity, and clinical trial risk.

- Adverse event management and complicated safety profile: Angiogenesis inhibitors are significantly related to a particular class and frequent side-effect profile, which has caused a hindrance in the market. These include impaired wound healing, gastrointestinal perforation, bleeding, arterial thromboembolic events, and hypertension. Therefore, managing these toxicities requires treatment discontinuation, dosage modifications, and severe patient monitoring that impacts patients’ quality of life as well as complicates clinical management. Besides, the safety profile can readily deter physicians from suggesting or maintaining treatment, especially among comorbid and older patients.

Angiogenesis Inhibitor and Simulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 37.2 billion |

|

Forecast Year Market Size (2035) |

USD 86.2 billion |

|

Regional Scope |

|

Angiogenesis Inhibitor and Simulator Market Segmentation:

Product Type Segment Analysis

Inhibitors segment in the market is anticipated to account for the largest share of 92.5% by the end of 2035. The segment’s growth is highly driven by its importance for protecting against disease, regulating metabolic pathways, and controlling reactions. According to an article published by Pharmacological Research in June 2025, over 400 orally effective and atypical protein kinase inhibitors are under clinical trials globally. In addition, there exist 85 FDA-cleared drugs that effectively target almost a dozen types of mutant protein kinases, thereby suitable for bolstering the segment’s growth.

Distribution Channel Segment Analysis

The hospital pharmacies segment is predicted to garner the second-largest market share during the forecast timeline. The segment’s importance is propelled by the aspect of fundamental root in the regulatory and clinical profile of angiogenesis inhibitors. In addition, the majority of these therapies, especially intravenous biologics, such as monoclonal antibodies, are readily classified as specialty medications. Their management demands rigorous monitoring for acute events, complicated oversight, and manageable infusion facilities, thereby denoting an optimistic outlook for the overall segment.

Application Segment Analysis

Oncology segment in the market is expected to garner the third-largest share by the end of the projected duration. The segment’s upliftment is effectively fueled by its provision of wide-ranging cancer care through early diagnosis, detection, and different treatments, such as targeted therapy, immunotherapy, and chemotherapy. As per an article published by NLM in May 2025, almost 18.6 million people in the U.S. constituted cancer cases, which is projected to increase at 22 million by the end of 2035. An estimated 51% have been diagnosed in the past 10 years, and almost 79% were elderly patients, thus driving the segment’s exposure.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

Application |

|

|

Drug Class |

|

|

Mechanism of Action |

|

|

End user |

|

|

Simulator Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Angiogenesis Inhibitor and Simulator Market - Regional Analysis

North America Market Insights

North America in the market is projected to garner the highest share of 45.5% by the end of 2035. The market’s exposure in the region is effectively driven by an increase in disease burden, aging demographics, a surge in healthcare spending, the presence of innovative diagnostic facilities, and the existence of technological convergence. According to an article published by Nucleic acids in March 2023, the aspect of developing and discovering drugs usually takes USD 2.8 billion and approximately 15 years. Therefore, with the application of artificial intelligence to ensure biological data analysis has readily attracted the region’s pharmaceutical sector.

U.S. market is growing significantly, owing to the increasing prevalence of cancer, progression in healthcare infrastructure, and strong private and federal R&D investment. In addition, the rapid adoption of simulators and AI is readily supported by the NIH funding, particularly for computational biology, which is also driving the market in the country. As stated in the 2025 U.S. Embassy Government data report, the NIH has initiated generous funding for medical research, with a yearly budget of almost USD 32.3 billion to ensure biomedical research, which creates an optimistic outlook for the overall market.

The angiogenesis inhibitor and simulator market in Canada is also growing due to the presence of a publicly and universally funded healthcare system that readily governs market accessibility. Additionally, the transition by provincial payers, such as Ontario’s Ministry of Health, to balanced budget constraints and entry agreement management is also resulting in innovation and development in the market. For instance, in the February 2025 Government of Canada article, Toronto Innovation Acceleration Partners achieved USD 3.5 million to operate with research and academic institutions to develop, grow, and upscale life science ventures, thereby suitable for bolstering the market in the country.

Present Healthcare Spending in North America Boosting the Market (2022)

|

Countries |

% of GDP |

|

Overall North America |

16.0 |

|

Canada |

11.2 |

|

Guatemala |

7.4 |

|

Panama |

8.4 |

|

U.S. |

16.5 |

|

Jamaica |

7.7 |

Source: World Bank Organization

APAC Market Insights

Asia Pacific in the market is expected to emerge as the fastest-growing region during the forecast timeline. The market’s exposure in the region is effectively fueled by a huge aging population, a rise in the incidence of diabetes and cancer-based eye disorders, along with rapid optimization in healthcare accessibility. Moreover, other factors, such as suitable government investments in health facilities, as well as a tactical push for universal health coverage in nations such as India and China, are readily extending patient accessibility to innovative therapy. Besides, the region is emerging as a vital center for conducting clinical trials by providing cost and speed benefits, which escalates localized market entry for the latest drugs.

China market is gaining increased traction, owing to the existence of the NMPA to accelerate clearances for regional angiogenesis inhibitors with the newest molecular entities. Additionally, the aspect of government expenditure on medical therapies has also increased as a part of the Healthy China 2030 strategy, with the intention of optimizing cancer care results. For instance, in January 2024, HUTCHMED received marketing clearance for its ELUNATE by the Pharmacy and Poisons Board of Hong Kong after gaining the NMPA approval, thereby denoting a suitable contribution towards the market.

The angiogenesis inhibitor and simulator market in India is also developing due to the presence of the National Health Mission increasingly providing funds for cost-effective cancer care. Additionally, regional production of Bevacizumab, which is a biosimilar, has also driven reduced expenses, thus making treatment easily accessible to a massive patient pool. As per an article published by NLM in July 2025, approximately 2.5 million people in the country are presently residing with cancer, with almost 700,000 new cases annually. By the end of 2025, the country’s cancer burden is projected to surge to 29.8 million, thus denoting an optimistic outlook for the overall market.

Europe Market Insights

Europe market is projected to grow steadily by the end of the forecast duration. The market’s development in the region is highly attributed to a surge in the aging population, which is coupled with robust government and region-based support for pharmaceutical advancement. For instance, in July 2024, Roche declared that the Europe Commission has successfully cleared Vabysmo, which is suitable for aiding visual impairment, owing to macular edema secondary to retinal vein occlusion. Therefore, with the existence of such regulatory bodies, there is a huge growth opportunity for the overall market to gain increased importance in the region.

The angiogenesis inhibitor and simulator market in Germany is gaining increased exposure, owing to the aspect of strong healthcare spending, along with streamlined processes for market accessibility. This is further complemented by robust investment in research, with the Federal Ministry of Education and Research allocating funds to oncology research networks. According to the 2025 World Bank Organization data report, the current healthcare spending in the country caters to 11.8% of its gross domestic product (GDP), which denotes an optimistic outlook for the market to grow.

The angiogenesis inhibitor and simulator market in France is also growing due to the presence of wide-ranging cancer plans, as well as effective pricing negotiations. In addition, the 2021-2030 Decade of Cancer strategy has readily focused on enhancing access to advanced treatments, which directly bolsters the market in the country. Besides, as stated in the September 2024 OECD Organization article, the majority of clinical trials for oncology take place in the overall region, with 2,344 trials in the country. Therefore, this denotes a huge scope for the market’s growth, with an increase in oncology treatment solutions.

Key Angiogenesis Inhibitor and Simulator Market Players:

- Roche (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Regeneron Pharmaceuticals (U.S.)

- Bayer AG (Germany)

- Novartis (Switzerland)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Bristol Myers Squibb (U.S.)

- Sanofi (France)

- AstraZeneca (UK/Sweden)

- Merck & Co. (U.S.)

- Johnson & Johnson (U.S.)

- Takeda Pharmaceutical (Japan)

- Astellas Pharma (Japan)

- CSL (Australia)

- Samsung Bioepis (South Korea)

- Celltrion Inc. (South Korea)

- Dr. Reddy's Laboratories (India)

- Biocon Ltd. (India)

- Hetero (India)

- Hovid Berhad (Malaysia)

- Roche is one of the market leaders through its outstanding drug, Bevacizumab, which readily became suitable for foundational therapy pertaining to ophthalmology and oncology. Besides, according to its 2024 annual report, the organization expanded its partnership across 15 cities, 74% of its drugs received approval, in comparison to 68% in 2023, and 30 billion diagnostic tests have been provided to customers globally.

- Regeneron Pharmaceuticals is considered a vital player that jointly developed Aflibercept, which is a notable VEGF Trap-Eye that readily dominates the ophthalmology segment. Besides, according to its 2024 annual report, its fourth quarter sales for EYLEA and EYELEA HD surged by 2% from USD 1.5 billion in 2023. This also includes USD 305 million, particularly from EYELEA HD.

- Bayer AG is the co-marketing partner for Regeneron’s Aflibercept, and has leveraged its extended commercial approach to grab a generous portion of the ophthalmology angiogenesis market. The organization has readily complemented this with continuous research into suitable antiangiogenic compounds.

- Novartis is one of the key contributors through Ranibizumab, which is a monoclonal antibody, especially designed for intraocular utilization, thus making it the ultimate competitor in the retinal disease field. Additionally, the company has also invested in progressive simulation, along with data analytics, to improve clinical development.

- Pfizer Inc. accounts for a significant stake in the oncology segment with Axitinib, which is a small molecule inhibitor, readily utilized for innovative renal cell carcinoma. The organization has proactively explored the role of angiogenesis inhibition within its targeted therapy portfolios and wide-ranging immune-oncology.

Here is a list of key players operating in the global market:

The international angiogenesis inhibitor and simulator market is readily dominated by Japan and West-based organizations, such as Bayer, Regenron, and Roche, which effectively control outstanding patented medications. Besides, a potent competitive risk that originates from India and South Korea-driven manufacturers, including Dr. Reddy’s and Samsung Bioepis, is significantly driving the biosimilar wave. For instance, in August 2024, Biocon Biologics Ltd, declared that it has signed a license and settlement-based deal with Johnson & Johnson, Janssen Science Ireland, and Janssen Biotech Inc. The purpose is to successfully commercialize Bmab 1200 in Japan, Canada, Europe, and the UK, thereby creating a positive impact on the market internationally.

Corporate Landscape of the market:

Recent Developments

- In December 2024, Merck declared the closing of the significant international license deal for LM-299, which is a notable investigational PD-1/VEGF bispecific antibody, and successfully developed, manufactured, and commercialized it.

- In November 2024, Kura Oncology received an upfront payment of USD 330 million, along with an overall milestone payment of USD 1.2 billion, which also includes USD 420 million in opt-in rights for solid tumors and near-term milestone payments.

- In June 2023, MIMETAS notified that it has extended its continuous partnership with Astellas, with the intention of including application and automation support to readily device notable immune-oncology therapies.

- Report ID: 7746

- Published Date: Oct 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Angiogenesis Inhibitor and Simulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.