Amifampridine Market Outlook:

Amifampridine Market size was valued at USD 162 million in 2025 and is projected to reach USD 349.7 million by the end of 2035, rising at a CAGR of 8% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of amifampridine is assessed at USD 174.9 million.

The global amifampridine market is experiencing significant transformations due to its rising adoption in Lambert-Eaton Myasthenic Syndrome (LEMS) treatment and expanding orphan drug approvals. LEMS can be typically bifurcated into autoimmune (A-LEMS) and paraneoplastic (P-LEMS) subtypes. Roughly 50% of all LEMS cases have underlying malignancy, specifically small-cell lung cancer (SCLC). In the context of the disease burden, studies suggest that LEMS occurs in about 3% of SCLC patients, and conversely, around 40-70% of individuals diagnosed with LEMS consequently have SCLC. Although the worldwide LEMS incidence and prevalence rates are uncertain, a population-based study published by Frontiers in August 2025 provided some insight. The Netherlands recorded a prevalence of 2.3 per million and an incidence rate of 0.5, whereas the U.S. has reported a 2.6 per million prevalence rate. Globally, the estimated LEMS prevalence is 2.8 per million, thereby classifying it as a rare disease.

Türkiye: LEMS Patient Pool Epidemiological Summary (2015-2024)

|

Parameter |

Reported Data |

|

Confirmed LEMS cases (2015-2024) |

159 |

|

National population (2024) |

85,664,944 |

|

Median age at diagnosis |

60 years (range 16-88) |

|

Mean age ± SD |

58.1 ± 14.9 years |

|

Sex distribution |

Female: 55.3% (n = 88); Male: 44.7% (n = 71) |

|

P-LEMS cases |

59.7% (n = 95) |

|

A-LEMS cases |

40.3% (n = 64) |

|

SCLC association (within P-LEMS) |

55.8% (n = 53) |

|

Annual incidence (2015–2024) |

0.09-0.30 per million (0.27/million in 2024) |

|

Overall prevalence (2024) |

1.11 per million |

|

A-LEMS prevalence (2024) |

0.60 per million |

|

P-LEMS prevalence (2024) |

0.51 per million |

|

Mortality |

A-LEMS: 23.4%; P-LEMS: 58.9% |

|

Drug utilization (Prescription) |

Pyridostigmine: 65.4%; Amifampridine: 24.5% |

|

Geographic distribution |

Highest in Black Sea, Aegean, Central Anatolia |

Source: Turkish Statistical Institute, Frontiers

Clinical Trial Summarization

Clinical trials have proven the efficacy of 3,4-diaminopyridine (3,4-DAP) or Amifampridine in fostering neuromuscular transmission and muscle strength. Several studies have showcased improvements in patient report scores in comparison to placebo. This has led to supportive regulatory approvals by governing bodies such as the U.S. FDA and EMA. Amifampridine has emerged as the gold-standard therapy for LEMS, in addition to current studies exploring optimized formulations and broader neuromuscular applications. Its development represents a significant milestone in rare disease pharmacotherapy, offering improved functionality and quality of life for patients with debilitating neuromuscular transmission disorders.

1. Amifampridine Phosphate for the Treatment of Congenital Myasthenic Syndromes

|

Field |

Details |

|

ClinicalTrials.gov ID |

NCT02562066 |

|

Summary Description |

Randomized, double-blind, controlled, outpatient two-period, two-treatment crossover study to evaluate efficacy and safety of amifampridine phosphate in patients (ages ≥2) with certain genetic subtypes of CMS who demonstrated open-label (amifampridine phosphate) or history of sustained benefit. |

|

Recruitment Status |

Completed |

|

Conditions / Indication |

Myasthenic Syndromes, Congenital |

|

Intervention(s) |

Drug: amifampridine phosphate (oral) - continuation vs. Placebo (blinded during crossover periods) |

|

Phase |

Phase 3 |

|

Study Type |

Interventional |

|

Age Range (eligible) |

Minimum: 2 Years; Maximum: 70 Years |

|

Enrollment / Sample Size |

Not provided in excerpt |

|

Key Run-in Requirement |

Open-label unblinded drug escalation/treatment run-in phase up to 4 weeks until stable dose/frequency achieved for 7 days prior to randomization. |

|

Primary Objective / Endpoint (implicit) |

Evaluate efficacy and safety of amifampridine phosphate vs. placebo in CMS. (Exact primary endpoint text not supplied in excerpt.) |

|

Exclusion Criteria |

1. CMS subtypes: acetylcholinesterase deficiency, slow-channel syndrome, LRP4 deficiency, plectin deficiency. 2. Cardiac conduction defects on Screening ECG. 3. Seizure disorder. 4. Abnormal liver function tests at Screening. 5. Abnormal kidney function tests at Screening. 6. Abnormal electrolyte values at Screening. 7. Pregnancy/breastfeeding or planning pregnancy. 8. Any clinically significant systemic infection untreated. 9. Treatment with another investigational drug/device/biologic within 30 days prior to Screening. 10. Any other medical condition that might interfere or add risk per investigator. 11. History of allergy to pyridine-containing substances or study excipients. |

|

Primary Contact / Location |

Boston Children’s Hospital |

|

Download / Record Date |

2021-04-02 |

Source: Boston Children’s Hospital

2. Amifampridine Phosphate

|

Section |

Details |

|

NOC date |

July 31, 2020 |

|

Sponsor |

KYE Pharmaceuticals Inc. |

|

Health Canada approval status |

NOC |

|

Health Canada review pathway |

Priority review |

|

Comparator |

Placebo (withdrawal studies) |

|

Therapeutic Goal |

Improvement in health-related quality of life (HRQoL) and functional activities of daily living (ADL) |

|

Assessment Methods (per CADTH clinical expert) |

Patient’s subjective response; objective neurologic exam; 3TUG (Triple Timed-Up-and-Go) or QMGS; electrophysiological study (CMAP amplitude pre/post maximum voluntary contraction). |

|

Pivotal Trials Included |

1. LMS-002 2. LMS-003 |

|

Study Design |

Phase III, multicentre, randomized, double-blind, placebo-controlled withdrawal studies |

|

Primary Purpose |

To assess safety and efficacy of amifampridine phosphate in adult patients with LEMS |

|

Eligibility Highlights |

Adult patients with confirmed LEMS; amifampridine-naïve required ≥3-point QMGS improvement during run-in; all patients required ≥91 days of prior amifampridine and ≥7 days stable dosing. |

|

Ongoing Use |

Responders expected to continue therapy lifelong. Non-responders discontinue based on combined subjective and objective criteria (patient response, neurologic exam, 3TUG/QMGS, electrophysiology). |

|

CADTH Conclusion (Implied) |

Amifampridine phosphate demonstrates statistically significant efficacy vs. placebo in LEMS withdrawal studies; improvements in functional outcomes and patient-reported benefit support clinical relevance; manageable safety profile. |

Source: NCBI, CADTH (Canadian Agency for Drugs and Technologies in Health) – Clinical Review, 2024

Key Amifampridine Market Insights Summary:

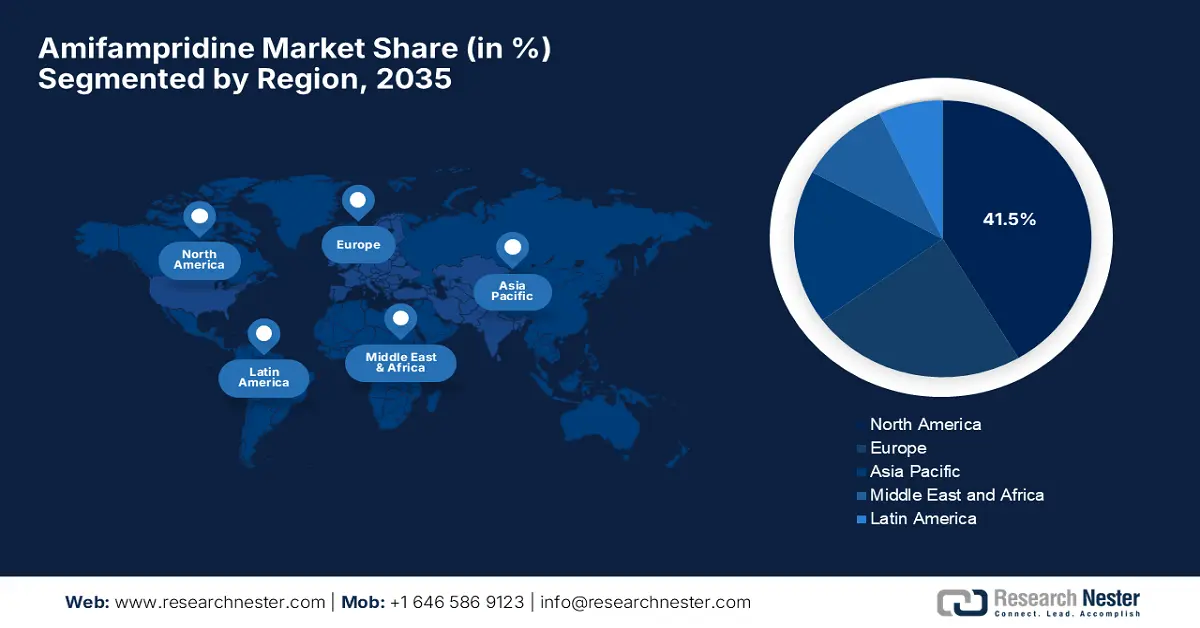

Regional Highlights:

- North America amifampridine market is estimated to account for a share of approximately 41.5% by 2035, driven by robust medical infrastructure and rising awareness of neuromuscular diseases.

- Asia Pacific market is poised to witness significant growth during 2026-2035, owing to increasing instances of neuromuscular diseases and enhanced treatment access.

Segment Insights:

- Generic segment is anticipated to garner the highest share of 75.4% by 2035 in the amifampridine market, propelled by the increased demand for affordable therapeutic solutions.

- Myasthenia gravis segment is projected to account for a lucrative share during 2026-2035, owing to the rising prevalence of this disease treatable with amifampridine.

Key Growth Trends:

- Focus on reducing drug costs for drug affordability

- Rising investments in research activities

Major Challenges:

- High treatment costs and regulatory hurdles

Key Players: Catalyst Pharmaceuticals (U.S.), BioMarin Pharmaceutical (U.S.), Jacobus Pharmaceutical (U.S.), Medunik Canada (Canada), ORSPEC Pharma (Australia), Shilpa Medicare (India), SERB SA (France), Tiefenbacher Pharmaceuticals (Germany), Chiracon GmbH (Germany), Zydus Cadila (India), Apotex (Canada), Sandoz (Switzerland), Teva Pharmaceuticals (Israel).

Global Amifampridine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 162 million

- 2026 Market Size: USD 174.9 million

- Projected Market Size: USD 349.7 million by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, Japan, China

- Emerging Countries: India, Malaysia, South Korea, Brazil, Mexico

Last updated on : 3 November, 2025

Amifampridine Market - Growth Drivers and Challenges

Growth Drivers

- Focus on reducing drug costs for drug affordability: The payers' pricing analysis by the NCBI in July 2022 implies that Firdapse treatment costs about USD 51,993/ year per patient in Canada. CADTH anticipates that further cost reduction is pivotal to foster market penetration and achieve the USD 50,000 willingness-to-pay threshold. According to the CADTH clinical review 2020, the submitted price of amifampridine phosphate was USD 21.90 per 10 mg tablet, or 20% lower than the publicly available cost of amifampridine base. At the typical daily dose of 61.5 mg, amifampridine phosphate and amifampridine base treatment costs USD 51,993 and USD 65,051 per patient annually. The annual amifampridine phosphate drug savings are USD 13,058 per patient, excluding dispensing fees and markups.

Summary of the Sponsor’s (KYE Pharmaceuticals Inc.) Economic Evaluation Results

|

Drug |

Total drug costs ($) |

Incremental drug costs ($) |

Total costs ($) |

Incremental costs ($) |

|

Amifampridine phosphate |

51,993 |

Reference |

55,220 |

Reference |

|

Amifampridine |

65,051 |

–13,058 |

69,062 |

–13,841 |

Source: CADTH Clinical Review

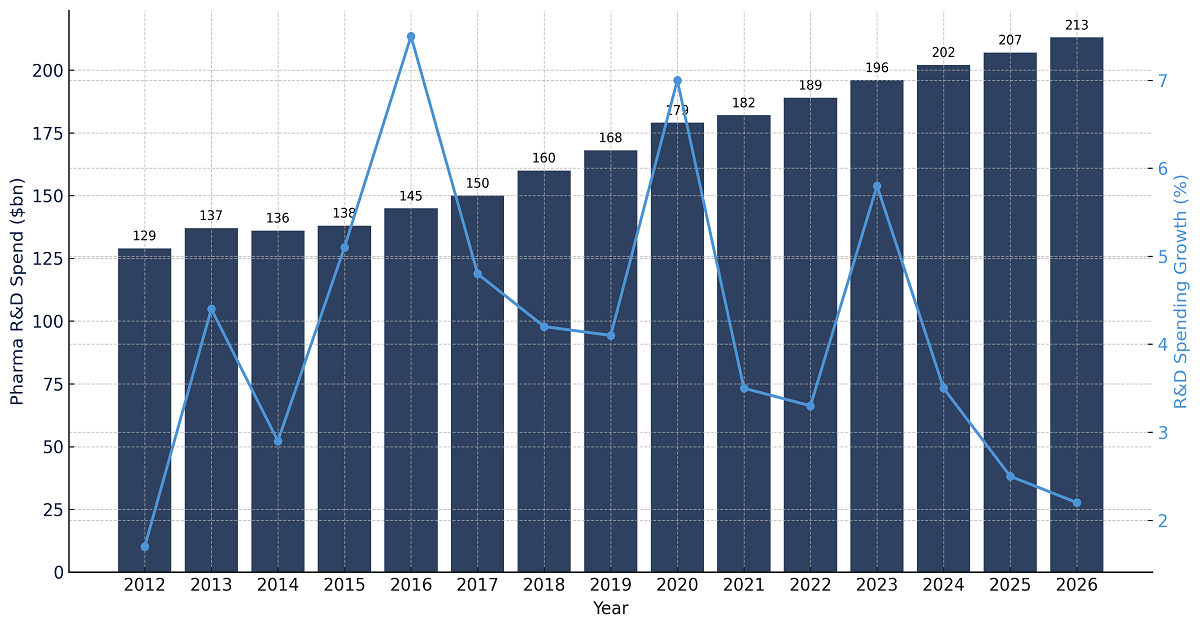

- Rising investments in research activities: Another major driver for the amifampridine market is the increasing investments in research and development initiatives. In this regard, the research-based biopharmaceutical sector had spent approximately USD 198 billion globally on R&D in 2020. International Federation of Pharmaceutical Manufacturers & Associations 2022 report data shows that the combined indirect, direct, and induced effects of the industry’s cumulative contribution to the global GDP are USD 1,838 billion. Compared with all other high-technology sectors, the yearly expenditure by the biopharmaceutical industry is roughly 8.1 times more than that of the aerospace and defense industries, 7.2 times greater than the chemicals segment, and 1.2 times higher than the software & computer services sector.

Biopharmaceutical R&D Spending

Source: IFPMA

Challenges

- High treatment costs and regulatory hurdles: This is one of the most significant barriers for the amifampridine market to achieve entry in almost all nations. The high treatment costs associated with the advanced treatment procedures cannot be affordable to people from price-sensitive regions. Budget constraints act as a major hurdle for the market to penetrate in all nations. Besides the existence of stringent regulations ensuring therapeutic safety, these can create a hurdle for the amifampridine market to achieve a substantial consumer base. The regulatory challenges result in delayed market entry, which is often experienced by key regions such as Japan and Canada.

Amifampridine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 162 million |

|

Forecast Year Market Size (2035) |

USD 349.7 million |

|

Regional Scope |

|

Amifampridine Market Segmentation:

Type Segment Analysis

Generic segment is anticipated to garner the highest share of 75.4% in the market by the end of 2035. The segment's dominance is attributable to the increased demand for affordable therapeutic solutions across all nations in the world. Generic drugs form the base of cost-effective therapeutics, making treatment accessible to a wider consumer base as an ideal alternative to branded medications. For instance, the Centers for Medicare & Medicaid Services initiated programs to encourage the use of generic drugs for both patients and healthcare providers, thereby reducing medical expenditure. Thus, driving the segment’s growth.

Application Segment Analysis

The myasthenia gravis segment is projected to account for a lucrative share in the amifampridine market during the forecast period. The growth in the segment is attributable to the increasing instances of this disease that can be potentially treated by amifampridine drugs due to their higher efficacy. Moreover, amifampridine is considered highly effective in improving patient outcomes by reducing hospitalizations, leading to its widespread adoption across diverse markets globally.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End user |

|

|

Patient Demographics |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amifampridine Market - Regional Analysis

North America Market Insights

North America market is estimated to account for a share of approximately 41.5% by the end of 2035. The region’s growth is attributed to the robust medical infrastructure, increasing awareness about neuromuscular diseases, and highly responsible regulatory frameworks. Besides this, the region benefits from substantial investments by both public and private healthcare organizations for the rare diseases. It hosts a huge number of neurology facilities that facilitate early diagnosis, thereby promoting trustworthy solutions to patients with unmet medical needs.

U.S. dominates the North America amifampridine market with assistance from the medical investments by public healthcare groups to tackle the rare neuromuscular diseases. For instance, the Centers for Medicare & Medicaid Services (CMS) has significantly increased healthcare expenditure for neuromuscular treatments. Furthermore, it also stated that the coverage for rare disease therapies comprising amifampridine has been expanded to improve patient access. Additionally, the National Institute of Health assigned significant funding for research activities, reflecting the market strength. The table below denotes the expenditure on the overall biopharma research, including amifampridine, in 2020.

R&D Expenditures in the US, 2020

|

Function |

Dollars (USD Million) |

Share (%) |

|

Pre-Human / Pre-Clinical |

13,604.0 |

14.9% |

|

Phase I |

6,968.3 |

7.6% |

|

Phase II |

8,429.4 |

9.3% |

|

Phase III |

24,773.1 |

27.2% |

|

Approval |

3,932.5 |

4.3% |

|

Phase IV |

10,512.4 |

11.5% |

|

Uncategorized |

22,906.6 |

25.1% |

|

Total R&D |

91,126.3 |

100.0% |

Source:IFPMA

There is a great opportunity for amifampridine in Canada, fueled by its large consumer base and government-backed funding initiatives. Canada’s invoice spending in generic and biosimilar drugs was USD 27.4 billion and is estimated to reach USD 32-36 billion by the end of 2026, expanding at a CAGR of 3-6%, thereby underscoring the industry’s economic footprint. Furthermore, the provincial health ministries such as Ontario and British Columbia have upped their investments, resulting in benefits for LEMS patients annually. Hence, these factors are anticipated to boost the country’s market, demonstrating lucrative growth opportunities by 2035.

APAC Market Insights

Asia Pacific market is poised to witness significant growth during the forecast period, owing to the increasing instances of neuromuscular diseases, their treatment access, and substantial healthcare investments by the region’s governments. Moreover, the growth in the region is subject to the developmental tendency of countries such as Japan, China, India, Malaysia, and South Korea. These factors make up the dynamic market landscape in the country, aiming to improve patient outcomes, thereby augmenting industry expansion.

India’s market is unfolding remarkable growth opportunities driven by increasing demand for amifampridine drugs in the country. For instance, in 2023, the country’s medical expenditure reached 2.1% of GDP, with a considerable amount assigned towards the medical system and therapeutic initiatives. India witnessed a prominent rise in spending for rare diseases, owing to the prevalent market gap in demand and supply of treatments. In India, there are approximately 8000 rare diseases, and 5% have treatments available, thereby affecting nearly 1/5th of the population.

The China amifampridine market is gaining immense exposure with great support from the country’s governing bodies. Factors such as favorable administrative policies are fostering a positive business environment for the domestic players. Government expenditure on rare diseases in China has increased significantly over the last five years due to the increasing awareness of addressing these complex conditions. Moreover, China is the leading exporter of anime compounds, which are primarily used for amifampridine production. The export value of anime compounds, as per OEC, was valued at USD 2.57 billion in 2023, and the trade surplus was USD 1.83 billion, signifying China’s dominance in the global production and shipments of market products.

Europe Market Insights

During the forecast period, the Europe amifampridine market is anticipated to demonstrate lucrative growth opportunities due to the developmental tendency of countries such as Germany and France, accounting for the highest revenue shares.

Germany's market is immensely supported by innovative therapeutic measures and reimbursement policies aiming to position the country as a key leader in Europe. Besides, the adoption of advanced treatments and medical research is also contributing to business growth in the region.

The market in France is poised for significant growth, owing to its commitment to providing excellent healthcare services and improved patient access. Moreover, the market receives utmost support from the government in treating rare diseases, and the reimbursement coverage allows accustoming to the heightened use of the therapeutic drug. Additionally, there is a contribution from domestic pharmaceutical firms in enhancing the development and treatment associated with the product.

Key Amifampridine Market Players:

- Catalyst Pharmaceuticals (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioMarin Pharmaceutical (U.S.)

- Jacobus Pharmaceutical (U.S.)

- Medunik Canada (Canada)

- ORSPEC Pharma (Australia)

- Shilpa Medicare (India)

- SERB SA (France)

- Tiefenbacher Pharmaceuticals (Germany)

- Chiracon GmbH (Germany)

- Zydus Cadila (India)

- Apotex (Canada)

- Sandoz (Switzerland)

- Teva Pharmaceuticals (Israel)

- Catalyst Pharmaceuticals, Inc.: is a commercial-stage biopharmaceutical company headquartered in Coral Gables, Florida. The firm focuses on in-licensing, developing, and commercializing treatments for rare diseases. Their flagship product is FIRDAPSE, which is the only evidence-based, FDA-approved treatment for adult patients with LEMS. Catalyst Pharmaceuticals. The company launched the product commercially in January 2019, after FDA approval in November 2018.

- BioMarin Pharmaceutical Inc. is a U.S.-based biotechnology company, headquartered in San Rafael, California, specializing in treatments for rare and orphan diseases. BioMarin develops, acquires, and commercializes therapeutics for severe or rare conditions. Their pipeline includes enzyme replacement therapies, small-molecule orphan drugs, and neuromuscular medicines. Their strategy emphasizes regulatory incentives (orphan drug designations, exclusivity periods) and global rollout for rare-disease indications.

- Jacobus Pharmaceutical Company, Inc. is a privately held U.S. pharmaceutical company headquartered in Princeton / Plainsboro, New Jersey. It specializes in developing and manufacturing medicines for rare diseases, often based on small-molecule therapies. Jacobus is notable for its role in producing and supplying amifampridine (also known as 3,4-diaminopyridine or 3,4-DAP) under the brand name Ruzurgi, particularly for pediatric patients (ages 6-16) with Lambert‑Eaton Myasthenic Syndrome (LEMS).

- Médunik Canada was founded in December 2009 and is a subsidiary of the Duchesnay Pharmaceutical Group (DPG). Its mission is to improve the health and quality of life of Canadians living with rare diseases by partnering with international companies to bring orphan drugs to Canada. Médunik Canada is headquartered in Canada (Quebec) as part of the DPG network.

- Orspec Pharma describes itself as a boutique pharmaceutical company focusing on providing access to medicine for patients with a rare or specific need. The company operates in the Asia Pacific, focusing on named-patient supply, orphan drug registration, and early access programs. The main entity appears to be based in Australia (West Gosford, NSW) with operations covering APAC markets.

Here is a list of key players operating in the global market:

Companies involved in the amifampridine market are emphasizing several strategic activities to enhance their market presence globally. Companies such as Catalyst Pharmaceuticals and BioMarin Pharmaceutical gained great exposure with the innovation and marketing of Firdapse. Additionally, Medunik Canada and Jacobus Pharmaceutical enhanced patient access for Ruzurgi, which is meant to be indicated for pediatric patients. Besides, companies are also prioritizing product portfolio, funding initiatives, and encouraging a healthy competition between the players.

Recent Developments

- In August 2025, Catalyst Pharmaceuticals, Inc. announced that the Company and its licensor SERB S.A. signed a settlement agreement with Lupin Pharmaceuticals, Inc. and Lupin Ltd. that resolves the patent litigation brought by Catalyst and SERB in response to Lupin’s Abbreviated New Drug Application (ANDA) to seek approval for the launch of a generic version of FIRDAPSE 10 mg tablets.

- In January 2025, Tiefenbacher Pharmaceuticals disclosed the launch of Amifampridine in Europe. This is considered a generic drug for Lambert-Eaton Myasthenic Syndrome across Europe, creating a noteworthy market presence.

- Report ID: 7694

- Published Date: Nov 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amifampridine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.