Global Aluminum Hydroxide Market

- An Outline of the Global Aluminum Hydroxide Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

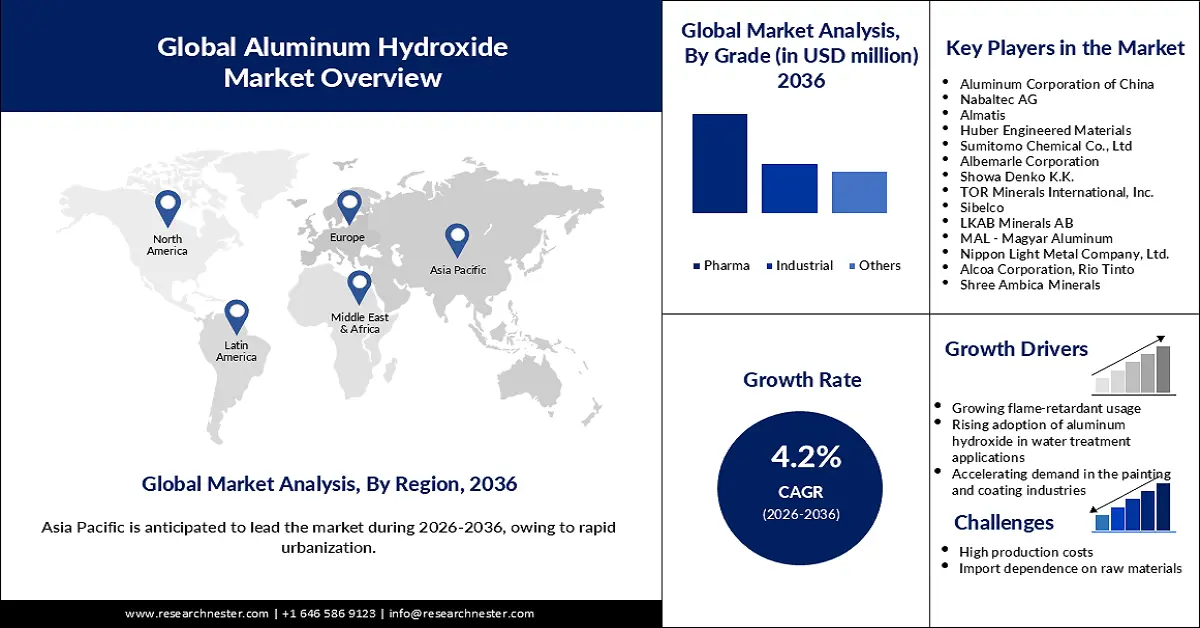

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Aluminum Hydroxide

- Recent News

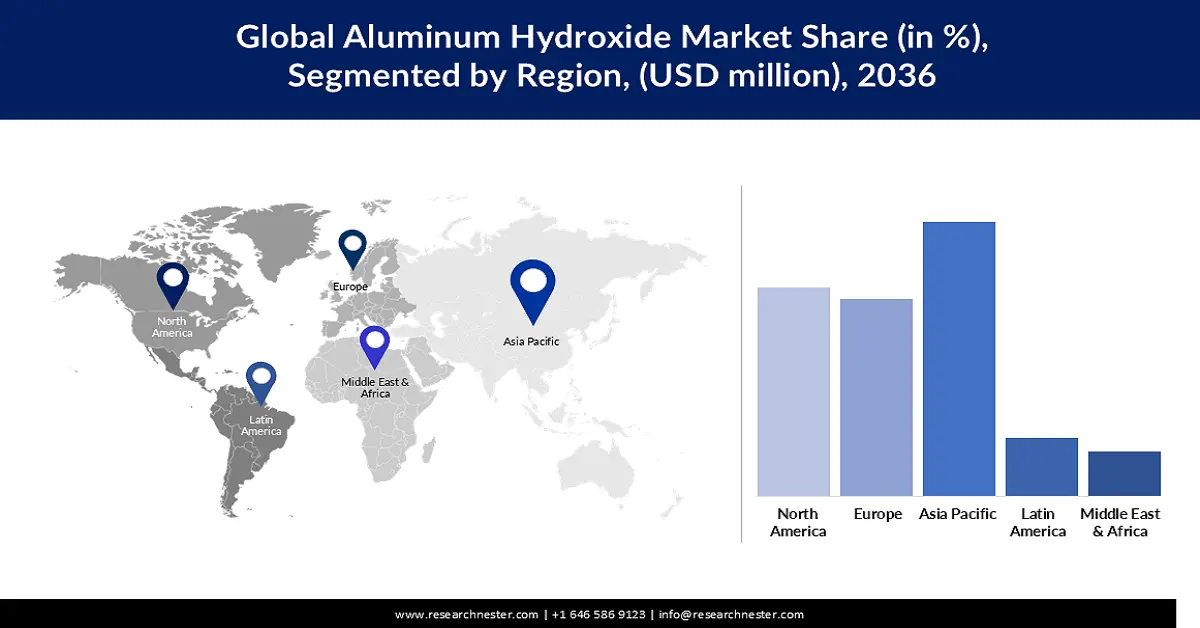

- Regional Demand

- Aluminum Hydroxide Market by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Aluminum Hydroxide Demand Landscape

- Aluminum Hydroxide Demand Trends Driven by Electrification, Downsizing, and Lightweighting (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Aluminum Hydroxide Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Aluminum Hydroxide Market – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Aluminum Corporation of China

- Nabaltec AG

- Almatis

- Huber Engineered Materials

- Sumitomo Chemical Co., Ltd

- Albemarle Corporation

- Showa Denko K.K.

- TOR Minerals International, Inc.

- Sibelco

- LKAB Minerals AB

- MAL - Magyar Aluminum

- Nippon Light Metal Company, Ltd.

- Alcoa Corporation

- Rio Tinto

- Shree Ambica Minerals

- Business Profile of Key Enterprise

- Global Aluminum Hydroxide Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Aluminum Hydroxide Market Segmentation Analysis (2026-2036)

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Grade

- Pharma, Market Value (USD Million), and CAGR, 2026-2036F

- Industrial, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Form

- Powder, Market Value (USD Million), and CAGR, 2026-2036F

- Gel, Market Value (USD Million), and CAGR, 2026-2036F

- By Application

- Flame-Retardant and Smoke-Suppressant, Market Value (USD Million), and CAGR, 2026-2036F

- Antacid, Market Value (USD Million), and CAGR, 2026-2036F

- Filler and Pigment, Market Value (USD Million), and CAGR, 2026-2036F

- Water-Treatment Chemicals, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By End use

- Plastics and Rubber, Market Value (USD Million), and CAGR, 2026-2036F

- Pharmaceuticals, Market Value (USD Million), and CAGR, 2026-2036F

- Paints, Coatings, Adhesives and Sealants (CASE), Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Product Type

- High Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Low Purity, Market Value (USD Million), and CAGR, 2026-2036F

- Activated, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer Process

- Bayer Method, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Grade

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Aluminum Hydroxide Market Outlook:

Aluminum Hydroxide Market size is valued at USD 12.5576 billion in 2025 and is anticipated to surpass USD 19.7448 billion by 2036, expanding at a CAGR of 4.2% during the forecast period, i.e., 2026 to 2036. In 2026, the industry size of aluminum hydroxide is evaluated at USD 13085.0 billion.

The rapid expansion of the global pharmaceutical industry is fueling the growth of the aluminum hydroxide market worldwide. The white, inorganic salt is widely utilized in managing and treating acid indigestion or topical burns in the pharmaceutical industry. Therefore, the demand for the component increases with the expansion of the pharmaceutical industry. As reported by the Press Information Bureau in August 2024, the value of the pharmaceutical sector in India is estimated to reach USD 100 billion by the end of 2025, expanding at a CAGR of 10-12%. Similarly, according to the disclosure by the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) in 2023, around 12,425 new patent applications were submitted in the pharmaceutical industry globally, indicating demand for aluminum hydroxide for drug invention. The expansion of the pharmaceutical industry in terms of new drug development also fuels the demand for aluminum hydroxide, specifically in the pharmaceutical-grade and gel forms.

Further, the rising use of aluminum hydroxide in the chemical industry is fueling the market growth as well. The use of the chemical compound is widespread in the chemical industry for its water solubility, reactive behavior, thermal behavior, coefficient nature in thermal expansion, chemical resistance and inertness, and environmental compatibility. Strategic acquisitions are also noticed in the chemical industry to strengthen the use of the material. For instance, in May 2025, J.M. Huber Corporation announced the acquisition of the R.J. Marshall Company, including its Alumina Trihydrate (ATH) assets. The motive behind the acquisition was to enhance the organizational product portfolio.

Key Aluminum Hydroxide Market Insights Summary:

Regional Insights:

- By 2036, the Asia Pacific aluminum hydroxide market is expected to secure a 38.8% share during 2026–2035, spurred by rapid urbanization.

- North America is anticipated to capture a notable share by 2036, underpinned by escalating demand for battery technologies driven by rising EV adoption.

Regional Insights:

- By 2036, the industrial segment is projected to command a 61.2% share in the aluminum hydroxide market, propelled by growing utilization in polymers and composites production.

- The powder segment is anticipated to secure a significant share by 2036, supported by its adaptability across water treatment, polymers, healthcare, and paper applications owing to its cost-efficient production process.

Key Growth Trends:

- Rising adoption of aluminum hydroxide in water treatment applications

- Accelerating demand in the painting and coating industries

Major Challenges:

- High production costs

- Import dependence on raw materials

Key Players: Aluminum Corporation of China (China), Nabaltec AG (Germany), Almatis (Germany), Huber Engineered Materials (U.S.), Sumitomo Chemical Co., Ltd (Japan), Albemarle Corporation (U.S.), Showa Denko K.K. (Japan), TOR Minerals International, Inc. (U.S.), Sibelco (Belgium), LKAB Minerals AB (Sweden), MAL - Magyar Aluminum (Hungary), Nippon Light Metal Company, Ltd. (Japan), Alcoa Corporation (U.S.), Rio Tinto (UK), Shree Ambica Minerals (India).

Global Aluminum Hydroxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD12.5576 billion

- 2026 Market Size: USD 13085 billion

- Projected Market Size: USD 19.7448 billion by 2036

- Growth Forecasts: 4.2% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2036)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 5 November, 2025

Aluminum Hydroxide Market - Growth Drivers and Challenges

Growth Drivers

- Growing flame-retardant usage driven by strict safety regulations in the construction and electronic industries: Regulations across different regions globally are encouraging the use of aluminum hydroxide for its flame-retardant properties in fire safety cross-check, particularly in the construction and electronics industries. As a result, the use of the component is surging in the mentioned industries. For instance, as revealed by the Publications Office of the EU in December 2024, harmonized rules were laid down by the Regulation (EU) 2024/3110 of the European Parliament and of the Council of 27 November 2024 to obligate the construction industry to design, construct, maintain and deconstruct works and relevant parts in ways that can be proven preventive to fire outbreaks.

- Rising adoption of aluminum hydroxide in water treatment applications: Aluminum hydroxide is rapidly being adopted in water treatment plants as a coagulant for the removal of impurities, suspended solids, and turbidity from water. The solubility of the compound in water treatment and solute species containing aluminum and hydroxide is likely to remain a significant area of study in organizations and research institutions. This is likely to lead to enhancements in the use of the component in water treatment plants.

- Accelerating demand in the painting and coating industries: The demand for aluminum hydroxide is growing in the painting and coating industries, due to the cost-effectiveness and the scope of using the compound to enhance coating performance in construction, electronics, and automotive industries. Investments in research and development are also taking place to use aluminum hydroxide nanoparticles in enhancing sensitivity and thermal resistance in painting and coatings. Key players in the market are also active in the development of novel aluminum hydroxides, especially ultra-fine ATH, best suited for the enhancement of coatings.

Challenges

- High production costs: The high cost of production of aluminum hydroxide is hindering the entry of new key players in the market and is expected to limit overall market accessibility of the component. The production of the chemical compound costs high mainly because of the constraints in the supply of aluminium sulfate. This is expected to obligate the suppliers to raise the prices, which ultimately hampers the market affordability of the chemical compound.

- Import dependence on raw materials: The dependence of the producers on the import of required raw materials, including bauxite ore from certain countries, is likely to make the key market players vulnerable to production delays. The suppliers in the market can also be influenced to raise the prices of the compound due to the dependence on imports. As indicated in the report by the DevelopmentAid in July 2025, global suppliers of the aluminum hydroxide are dependent on Guinea, Australia, Brazil, China, and India for bauxite ore, though Brazil produces three times less bauxite ore compared to China, whereas India produced 23 million metric tons of bauxite ore in 2023.

Aluminum Hydroxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 12.5576 billion |

|

Forecast Year Market Size (2036) |

USD 19.7448 billion |

|

Regional Scope |

|

Aluminum Hydroxide Market Segmentation:

Grade Segment Analysis

The industrial segment is expected to dominate with a remarkable market share of 61.2% by the end of 2036, owing to the growing demand for aluminum hydroxide in the production of polymers and composites. In this process, the material is widely used as a flame retardant and filler. Companies are active in the development of the industrial-grade components, processed from aluminum hydroxide. For instance, in August 2023, Sumitomo Chemical unveiled its groundbreaking success in pioneering ultra-fine α-alumina production technology. The achievement of this type of milestone is likely to fuel the use of aluminum hydroxide in advanced ways.

Form Segment Analysis

The powder segment is projected to account for a significant market share during the forecast period, owing to extreme adaptability and the scope of widespread use across water treatment, plastics and polymers, healthcare, and paper manufacturing industries. The use of aluminum hydroxide powder is anticipated to increase for relieving symptoms of indigestion, heartburn, and acid reflux for neutralization of excess stomach acid. The use of the gibbsite as an adjuvant in vaccines is also likely to be common in the upcoming financial years. The process of producing aluminum hydroxide powder is cheaper, helping the keep the prices of the component lower and increase its affordability in the market.

End use segment analysis

The plastics and rubber segment is anticipated to acquire a large market share by 2036, due to rising demand for aluminum hydroxide to be used as an environmentally-friendly filler and flame retardant in the production of plastics and rubber. Key players in the market are also taking measures to meet the market demand for flame retardants, increasing the scope of using aluminum hydroxide more widely in plastics and rubber production. Regulatory push to enhance fire safety in the industrial production processes is also likely to accelerate the use of the component in the plastics and rubber industry. The expansion of the automotive industry is also influencing the domination of the segment, since the need for plastics and rubber increases for seat covers, electrical wiring, and dashboards.

Our in-depth analysis of the aluminum hydroxide market includes the following segments:

|

Segment |

Subsegments |

|

Grade |

|

|

Form |

|

|

Application |

|

|

End use |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Manufacturer Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Hydroxide Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific aluminum hydroxide market is expected to witness a steady growth of 38.8% share by 2036, owing to rapid urbanization. This is expected to fuel the consumption of the flame retardant for construction purposes. According to UN-Habitat, around 54% of the global urban population (over 2.2 billion) is residing in Asia, and the proportion is likely to grow by 50% by 2050. The automotive industry within the region is also experiencing rapid expansion. As a result, the demand for aluminum hydroxide is expected to increase as a flame retardant and filler.

The market in China is anticipated to witness a rapid CAGR during the stipulated timeframe, on account of the rapid EV adoption. Aluminum hydroxide is widely used as a flame retardant in battery casings, cables, and electronic elements, helping to prevent fires in high-voltage systems. The thermal management properties of the chemical compound support battery safety by mitigating overheating and thermal runaway. The use of the compound is also expected to be wider in lightweight composites with the motive of enhancing vehicle efficiency and driving range. The use of the material in manufacturing safer, lighter, and more reliable vehicles is expected to increase with the expanding EV adoption. According to the International Energy Agency, sales of electric cars surpassed 1 million in the first three quarters of 2025, and 60% of the trade took place in China. The demand for the component is also likely to increase with the growing expansion of the consumer electronics sector, owing to its insulation and flame-retardant properties. According to the report by the State Council, published in July 2025, major companies in the consumer electronics sector in China increased their value-added industrial output by 11.1% year on year during the first five months of 2025.

Battery electric vehicle sales in China from 2020 to 2024

|

Year |

Volume of car sales (in millions) |

|

2020 |

0.9 |

|

2021 |

2.7 |

|

2022 |

4.4 |

|

2023 |

5.4 |

|

2024 |

6.4 |

Source: IEA

India is set to emerge as a growing aluminum hydroxide market during the study period, as a consequence of the rising adoption of construction projects. A report by Invest India, published in June 2025, reveals that NICDC Industrial Corridors and Smart Cities, PM Gati Shakti Master Plan, Bharatmala Pariyojana Project, Digital Highways Initiative, and Western Dedicated Freight Corridor are some of the recently launched large construction projects. This indicates the likelihood of India’s emergence as the global construction hub. Further, the growing need for water treatment, driven by rapid pollution, is also likely to accelerate the use of the gel. As reported by the DevelopmentAid in July 2025, more than 2 million of the population were affected by groundwater contaminants in 2024, caused by heavy metals and nitrates.

North America Market Insights

The North America aluminum hydroxide market is projected to acquire a significant revenue share during the forecast timeline, owing to the growing need for battery technologies, driven by rapid EV adoption. As disclosed by the Federal Reserve Bank of Chicago in December 2022, North America accounted for 4% of the light vehicle sales in that financial year. Moreover, growing water pollution across the region is increasing the need for wastewater treatment, leading to rising demand for aluminum hydroxide. According to the disclosure by the U.S. Environmental Protection Agency in November 2024, the U.S. wastewater treatment facilities process around 34 billion gallons of wastewater per day.

The aluminum hydroxide market in the U.S. is expected to witness a robust expansion, attributed to the regulatory push for different business industries to limit the utilization of toxic halogenated flame retardants. This enhances the attractiveness of aluminum hydroxide as a mineral-based alternative. Growth in construction and renovation activities within the country is also likely to accelerate the demand and use of the component. As reported by the U.S. Census Bureau in September 2025, the seasonally adjusted annual rate of construction spending was estimated at USD 2,139.1 billion.

The Canada market is anticipated to grow rapidly throughout the forecast timeline, due to growing preference for sustainable consumption. As disclosed by Natural Resources Canada in January 2025, the government of Canada is promoting sustainable construction through the implementation of the Canada Green Buildings Strategy. The government's push for sustainable construction can increase the use of the compound to improve the resilience of buildings in combating climate change. The demand for aluminum hydroxide as a coagulation chemical is likely to surge with the rising need for improved water treatment. For instance, the Canada Water Agency is collaborating with territories, provinces, indigenous people, scientists, local authorities, and other administrative entities to find the best-suited ways to keep water safe, well-managed, and clean for the upcoming generations.

Europe Market Insights

The aluminum hydroxide market in Europe is expected to acquire an extensive revenue share by the end of 2036, due to the regulatory push that prohibits the use of certain toxic flame retardants. In March 2025, a public consultation was carried out by the European Union, encouraging industries to use alternatives to harmful polybrominated diphenyl ether (PBDE) flame retardants. This is increasing the attractiveness of the aluminum hydroxide, which contains very low toxicity at certain levels of exposure. The use of aluminum hydroxide as a fire-safe material is also expected to surge, owing to new building standards. For example, in November 2023, the European Commission adopted the new Delegated Regulation (C(2023)7486), requiring wood products used in construction to meet the D-s2, d0 fire safety classification standards that encourage the use of fire-retardant additives, such as aluminum hydroxide.

Germany aluminum hydroxide market is anticipated to witness the highest expansion in Europe during the forecast timeline with the rapid adoption of EVs. As revealed by the European Alternative Fuels Observatory in May 2025, registration of battery electric vehicles surged by 54% in Germany in April 2025. This is likely to lead to a growing use of the material in the production of EV batteries. The expansion of the pharmaceutical industry is also increasing the probability of a more widespread use of the antacid for the management and treatment of acid indigestion or topical burns. According to Germany Trade & Invest, sales in the pharmaceutical industry grew by 5.8% to around USD 69.5 billion.

The UK market is projected to grow rapidly, owing to advancements in nanotechnology. This is anticipated to enable improved and more sustainable production of the component. The use of the material is also expected to be fueled by the growing preference for EV adoption. The surging water pollution across the country is also accelerating the demand for aluminum hydroxide to be used in water treatment. According to the update by the Environmental Agency in July 2025, water pollution incidents increased by 60% in 2024 compared to the previous fiscal year, leading companies to witness a record-breaking 2,801 incidents.

Key Aluminum Hydroxide Market Players:

- Aluminum Corporation of China (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nabaltec AG (Germany)

- Almatis (Germany)

- Huber Engineered Materials (U.S.)

- Sumitomo Chemical Co., Ltd (Japan)

- Albemarle Corporation (U.S.)

- Showa Denko K.K. (Japan)

- TOR Minerals International, Inc. (U.S.)

- Sibelco (Belgium)

- LKAB Minerals AB (Sweden)

- MAL - Magyar Aluminum (Hungary)

- Nippon Light Metal Company, Ltd. (Japan)

- Alcoa Corporation (U.S.)

- Rio Tinto (UK)

- Shree Ambica Minerals (India)

- Aluminum Corporation of China is one of the world’s largest producers of alumina and aluminum. The company plays a major role in the aluminum hydroxide supply chain, leveraging its vertically integrated operations from bauxite mining to refining. Chalco’s aluminum hydroxide products are used extensively in flame retardants, water treatment, and chemical applications. Its large-scale production capacity supports both domestic and export markets across Asia.

- Nabaltec AG specializes in producing fine precipitated aluminum hydroxide (ATH) and other functional fillers. The company is a global leader in halogen-free flame retardants, with its Martinal series widely used in cables, plastics, and rubber products. Nabaltec focuses heavily on innovation and sustainability, investing in advanced refining processes to enhance product purity and performance. Its strong European base and global distribution network ensure steady market penetration.

- Almatis GmbH is a major supplier of premium alumina materials, including high-purity aluminum hydroxide. The company serves diverse industries such as refractories, ceramics, and flame retardants. Almatis’ expertise lies in producing tailored grades of aluminum hydroxide with specific particle size distributions and thermal properties. Its global presence and integration within the aluminum value chain make it a key player in the specialty alumina segment.

- Huber Engineered Materials, a division of J.M. Huber Corporation, is one of the leading global manufacturers of aluminum hydroxide and magnesium hydroxide. Its Hydral and Martinal brands are recognized for flame-retardant and smoke-suppressant applications. The company emphasizes environmentally friendly, halogen-free solutions for the polymer and construction industries. With strong R&D capabilities, Huber continues to expand its portfolio toward sustainable material technologies.

- Sumitomo Chemical is a diversified chemical manufacturer actively involved in the production of high-performance aluminum hydroxide for flame retardant, catalyst, and filler applications. Leveraging advanced materials science and strong R&D infrastructure, the company focuses on high-purity and value-added formulations. Sumitomo’s integration across petrochemicals, performance materials, and environmental solutions supports its competitive position in the Japanese and global aluminum hydroxide markets.

Below is the list of the key players operating in the global market:

Competition in the global aluminum hydroxide market is highly intensified. The market is highly concentrated at the same time, as a consequence of the domination of the large key players, who are acquiring the majority of the revenue shares. A vast pool of key players is operating from the Asia Pacific region. Research and development are at the core of all the key players, influencing further advancements in the production of the component. Key players in the market are significantly attracted to the use of nanotechnology in organizational production processes.

Corporate Landscape of the Global Aluminum Hydroxide Market:

Recent Developments

- In May 2025, J.M. Huber Corporation announced the acquisition of The R.J. Marshall Company’s alumina trihydrate (ATH), antimony-free flame retardant, and molybdate-based smoke suppressant assets. These assets will be integrated into the Huber Advanced Materials (HAM) strategic business unit under Huber Engineered Materials, an operating division of J.M. Huber Corporation. The acquisition is expected to expand HAM’s product portfolio and reinforce its leadership in the North American flame retardant and smoke suppressant market.

- Report ID: 8217

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Hydroxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.