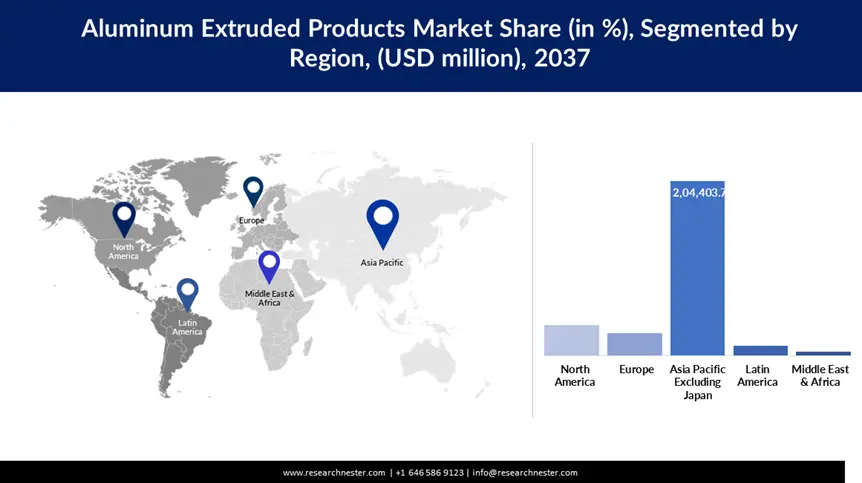

Aluminum Extruded Products Industry - Regional Synopsis

APEJ Market Statistics

Asia Pacific excluding Japan (APEJ) is anticipated to dominate the aluminum extruded products market with a 69.9% share during the forecast period. China and India are both scaling capacity and automation to meet their local demand as well as the demand for export. In March 2024, Padmawati Extrusion introduced 2000 and 7000 series profiles to reduce import dependence. This step makes India more self-reliant in precision manufacturing. Cost efficiencies and rising domestic consumption are also good for regional suppliers. Additionally, exports to Africa, the Middle East, and Southeast Asia are supported by trade agreements.

In terms of production scale and downstream integration, China is anticipated to remains dominant. JMA Aluminum expanded operations in March 2024 with 50 active extrusion machines. With large-format profiles, the company aims for global construction markets. Government subsidies for smart cities and solar infrastructure fuel long-term extrusion demand. China has a structural advantage in terms of midstream capacity and tooling access. The rising ESG scrutiny, however, propels firms to source greener inputs.

Extrusion is being rapidly adopted in India transport, infrastructure, and renewable energy sectors. In April 2025, Hindalco announced a commitment to spend USD 5 billion to expand its aluminum operations. High precision engineered extrusions are the focus of investment for global aluminum extruded products markets. There is a rising demand from India’s PLI schemes, rail modernization, and EV policies. Additionally, domestic producers are also investing in alloy diversification and recycling. Lightweight engineered aluminum profiles are emerging as an important supply base for India.

North America Market Analysis

The aluminum extruded products market in North America is projected to expand at a CAGR of 9.5% through 2037. Federal investments in green infrastructure and domestic supply chain resilience support this growth. In April 2024, Kaiser Aluminum modernized its Tennessee facility with automated casting lines. This move is beneficial for aerospace and defense applications where consistent mechanical properties are required. Buy American policies and inflation reduction acts favor U.S.-based extruders. The domestic use of aluminum is expected to surge as infrastructure bills unlock new projects.

Aluminum extrusions play a central role in energy and transport initiatives in the U.S. According to the Aerospace Industries Association, in March 2023, aerospace contributed 1.6% to GDP, and aluminum is a structural part of it. Wings, landing gear bays, and interior framing are made of mill-finished and 6000 series profiles. Global supply chain disruptions are prompting U.S. OEMs to source more domestically. These fuels localized extrusion investments. Also, producers with high precision and certified facilities are favored by the U.S. aluminum extruded products market.

Canada is integrating hydropower to focus on green aluminum output. In April 2024, Rio Tinto started producing billet with clean energy at its Canada site. This supports national decarbonization targets and expanding demand from EV and construction clients. Due to their proximity to the U.S. and Europe markets, Canada manufacturers are well-positioned to serve them. Low-carbon metal sourcing has been favored by export incentives and ESG reporting mandates. Canada’s market share is expected to rise as global buyers seek out sustainable aluminum.