Biochemical Reagents Market Outlook:

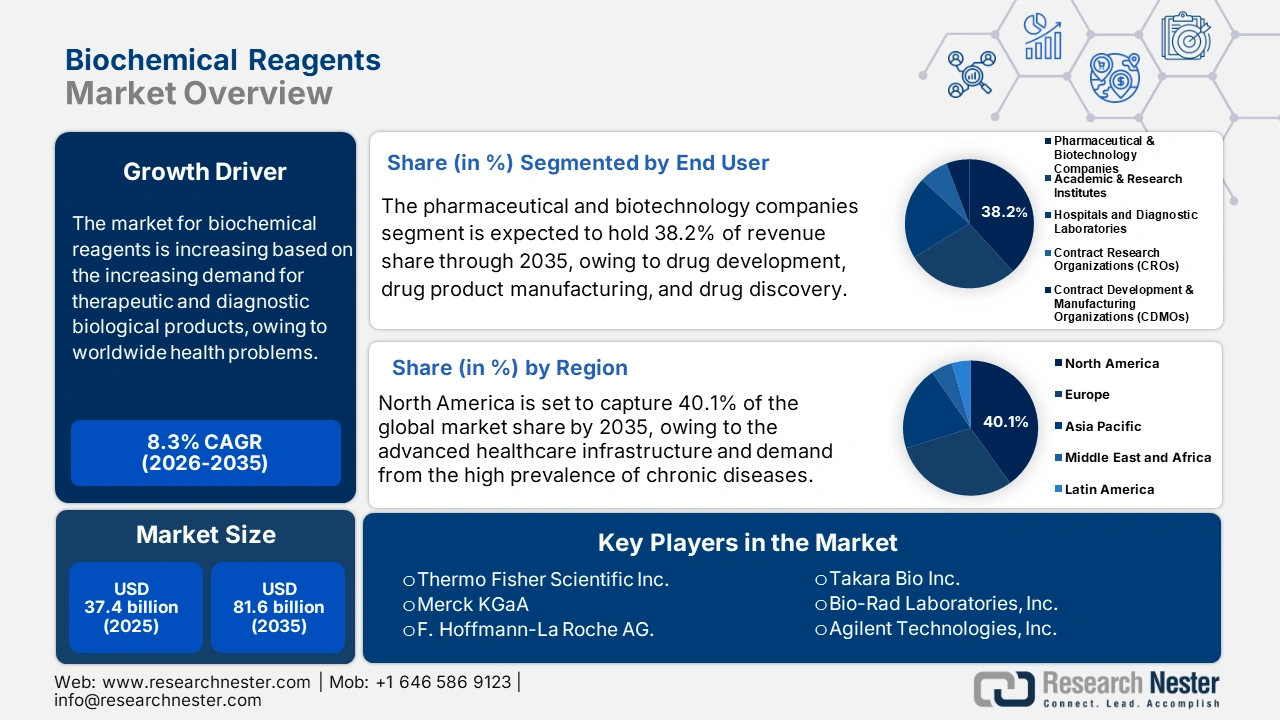

Biochemical Reagents Market size was valued at USD 37.4 billion in 2025 and is predicted to reach USD 81.6 billion by the end of 2035, expanding at around 8.3% CAGR during the forecast period, from 2026 to 2035. In 2026, the industry size of biochemical reagents is assessed at USD 40.5 billion.

The global biochemical reagents market is expected to grow notably during the forecast years, primarily driven by a rise in biomedical research and development, demand for high-technology diagnostics, and growth in biologics and gene therapy. For example, the U.S. National Institutes of Health (NIH) has committed to funding almost USD 48 billion in FY2024, and more than USD 35 billion on almost 50,000 competitive research grants in 2023, reflecting the increasing use of biochemical reagents in laboratory assays and clinical research studies. At the same time, the World Health Organization emphasizes the existence of over 40,000 in vitro diagnostic products in the market, with the coronavirus testing segment in Europe alone contributing to the growth of the COVID-19 pandemic to more than 3.67 billion, doubling the volumes of the IVD market in 2021 and raising demand levels in PCR and immunoassay reagents in large-scale diagnostics. Moreover, according to the U.S. Food and Drug Administration, biologics, such as CAR-T cell and gene therapies, approvals are on the increase by a significant margin, necessitating special biochemical reagents, such as viral-vector production kits and cell culture media, to facilitate their production and clinical trials. These drivers together support the global biochemical reagents market through funding, expansion of diagnostics, and advanced therapeutics innovation.

The supply chain of biochemical reagents is complex and globally linked, involving sourcing of raw materials, manufacturing, regulatory issues, and distribution. Around 10% of all U.S. exports are in the U.S. chemical manufacturing sector. More than half of all U.S. chemical imports are used as inputs in domestic production, and major growth in areas such as biochemical reagents is expected through competition in production costs. In addition, the U.S. imports of biochemical reagents were approximately USD 1.2 billion in 2020, with high demand and trade. The CPC framework allows this level of tracking of production and trade, and it helps in the quantification of an increase in biochemical reagents. The U.S. Bureau of Labor Statistics (BLS) monitors the producer price index (PPI) of pharmaceutical preparation production that incorporates biochemical reagents. By August 2025, the PPI of this industry had been 914.336 (base June 1981 = 100), indicating the increased prices of wholesale goods over the years. These statistics demonstrate the significance of a strong and diversified supply chain of reagents in biochemicals. The diversification of suppliers, investment into the domestic production capacity, and enhancement of the logistics and distribution channels are strengthening the Supply chain of the market effectively.

Key Biochemical Reagents Market Insights Summary:

Regional Insights:

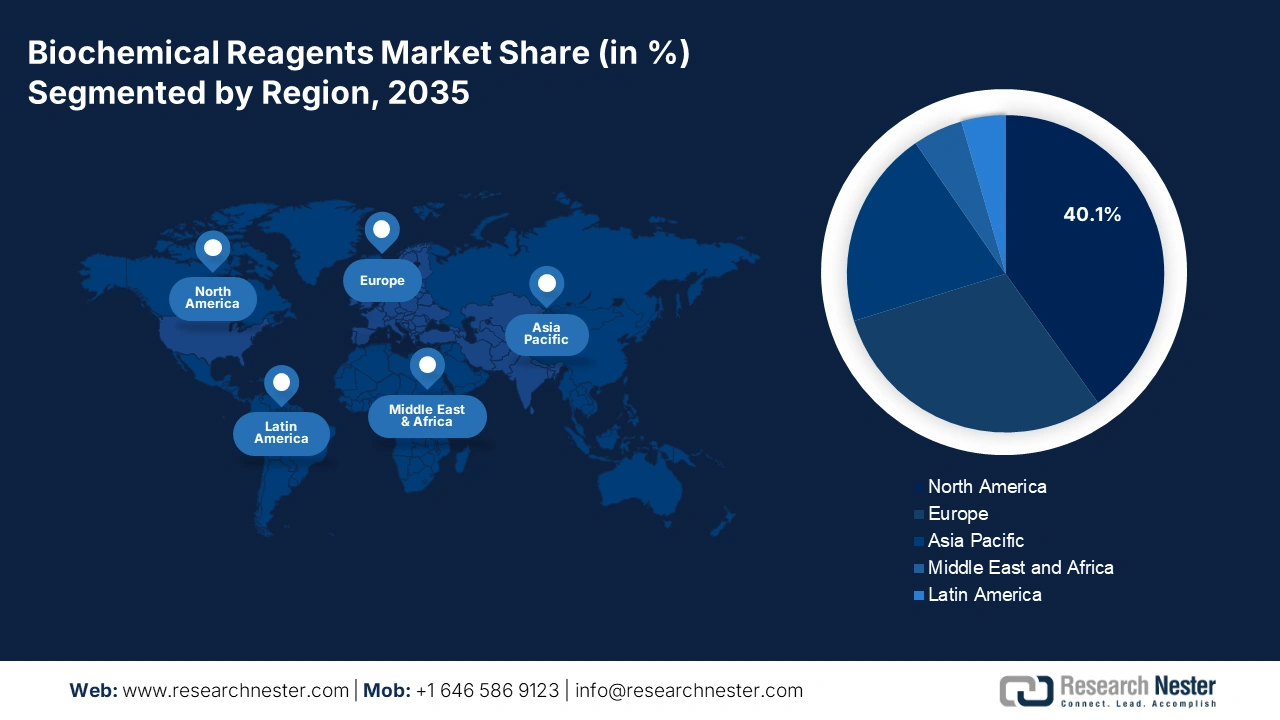

- By 2035, the North American market is expected to hold 40.1% share, impelled by advanced healthcare infrastructure, substantial R&D expenditures, and high prevalence of chronic diseases.

- The Asia-Pacific market is projected to reach a 20.2% share during 2026–2035, driven by growing R&D potential, increased healthcare spending, and strong investment in life sciences and biotechnology.

Segment Insights:

- The pharmaceutical and biotechnology companies’ segment is projected to account for 38.2% share by 2035, propelled by the expanding personalized medicine approach, growth in biologics, and higher R&D expenditures.

- The diagnostics segment is expected to hold a 35.1% share by 2035, owing to the rising demand for accurate and timely diagnostic testing and the expansion of point-of-care testing.

Key Growth Trends:

- Increased oversight of PFAS

- Progress in green chemistry

Major Challenges:

- Complex regulatory landscapes

- Fluctuating raw material prices

Key Players: Thermo Fisher Scientific, Merck KGaA, F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Agilent Technologies, QIAGEN N.V., Danaher Corporation, Abbott Laboratories, Siemens Healthineers AG, Becton, Dickinson and Company, Promega Corporation, Waters Corporation, Fujirebio, BioMérieux SA, Takara Bio Inc.

Global Biochemical Reagents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.4 billion

- 2026 Market Size: USD 40.5 billion

- Projected Market Size: USD 81.6 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.1% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, South Korea, Singapore, Australia

Last updated on : 7 October, 2025

Biochemical Reagents Market - Growth Drivers and Challenges

Growth Drivers

- Increased oversight of PFAS: The U.S. Environmental Protection Agency (EPA) has adopted stricter laws under the Toxic Substances Control Act (TSCA) to increase its monitoring of per- and polyfluoroalkyl substances (PFAS). The EPA would demand manufacturers and importers of PFAS to submit detailed information about their production, use, disposal, and risks to human health and the environment, effective May 8, 2025. This involves information on volumes of production, byproducts, exposure to workers, and effects on the environment. Such strict actions will help the EPA obtain all the necessary data to evaluate and regulate the risks of PFAS with improved protection of human health and the environment.

- Progress in green chemistry: Green chemistry progress is contributing to the achievement of more sustainable and more environmentally friendly chemistry. Techniques designed to produce an energy-efficient process, the use of catalysts and solvents that are environmentally benign, and the application of green chemistry principles to minimize the production of hazardous materials are all innovations. For instance, Emission and production costs are reduced with energy-efficient chemical processes (catalytic reactions can consume up to 50% of overall energy and process intensification can consume up to 80% of overall energy), and with process intensification. Such developments promote sustainable development of biochemical reagent production by boosting the cost-efficiency and environmental friendliness. Such innovations not only reduce environmental effects but also help the companies to reach their sustainability objectives.

- Rising government R&D funding: The increasing government investments are also increasing the global market. U.S. Department of Energy and the Department of Biotechnology in India have grossly budgeted on sustainable biomanufacturing and research on pharmaceuticals. For example, the U.S. Department of Energy dedicated USD 74 million to EV battery recycling, improving the domestic supply chains of critical minerals, sustainable production technologies, and stimulating the need for biochemical reagents in recycling technologies. In addition, the goals of the National Biotechnology Development Strategy 20212025 of the Department of Biotechnology are a bioeconomy of USD 150 billion by 2025, sustainable biomanufacturing, Bio foundries, and Biomanufacturing hubs, and all of them demand biochemical reagents in pharmaceuticals, diagnostics, and green biotech uses. Such government programs increase the pace of innovation and capacity building in the case of increased demand for biochemical reagents that are required in drug discovery, diagnostics, and environmental testing.

Challenges

- Complex regulatory landscapes: The absence of harmonized international standards for biochemical reagents makes compliance difficult for manufacturers. For instance, the European Union's REACH regulation is cumbersome in terms of extensive documentation and testing, a burden to firms dealing with various jurisdictions. Complexity may discourage market entry and expansion. Moreover, constant revisions of local and international regulations, labeling, transport, and safety variations, and divergent acceptability of methods of analysis across countries all augment administration burdens, product delays, and compliance expenses, especially to small and mid-sized firms trying to conduct operations in more than one location at any one time.

- Fluctuating raw material prices: The biochemical reagents market is sensitive to raw material price fluctuations, including enzymes and specialty chemicals. Fluctuating prices disrupt supply channels and influence profit margins. Suppliers need to manage these fluctuations while keeping prices competitive, which can prove to be difficult in a diverse global economy. Additionally, global occurrences like geopolitical unrest, trade limits, natural disasters, or inaccessibility of essential chemicals may increase volatility. This makes it hard to plan in the long term, as costs of production rise, manufacturers must employ dynamic pricing or hold larger inventories, which impacts overall profitability and market stability.

Biochemical Reagents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 37.4 billion |

|

Forecast Year Market Size (2035) |

USD 81.6 billion |

|

Regional Scope |

|

Biochemical Reagents Market Segmentation:

End User Segment Analysis

The pharmaceutical and biotechnology companies’ segment is predicted to gain the largest biochemical reagents market share of 38.2% during the projected period by 2035. Biochemical reagents are important in drug development, drug product manufacturing, and drug discovery. The pharmaceutical and biotechnology industries drive significant demand for these reagents. By improving research timeliness and product ease of use, they can do high-accuracy compound analytical work, purification work, and quality control. Advanced reagents are increasingly utilized to support the complexity of molecular research, driven by an expanding personalized medicine approach, a growth in biologics, higher R&D expenditures, trade pipeline expansion in biopharmaceuticals, and other factors, and the recent legislation to create tighter veterinary legislation that stresses quality testing.

The drug development teams play a central role in pharmaceutical development, as evidenced by the industry spending over 83 billion on research and development in 2019, which consists of discovery, clinical trials, and incremental innovation. In the period between 2010 and 2019, the FDA had an average of 38 new drug approvals each year, and 59 new drug approvals in 2018. Nevertheless, a relatively low percentage of drugs that go into clinical trials are approved by the FDA, as a result of high turnover in development. Over 70% of the drugs in late-stage (Phase III) clinical trials are small companies, which are then usually acquired by larger companies, which handle expensive clinical phases and market access. Biologic manufacturers play is crucial role by engaging in stringent manufacturing procedures that must adhere to stringent regulatory standards. In addition, the FDA approved 18 biosimilars, referring to 8 biologic products in 2024, the most it has ever done in one year. Of these, 9 were interchangeable biosimilars, which can be substituted at the pharmacy level, which is an indicator of massive development in biologic alternatives. These statistics demonstrate that both subsegments are essential in generating innovation, product safety, and pharmaceutical pipeline development in the industry.

Application Segment Analysis

The diagnostics segment is anticipated to grow with a 35.1% biochemical reagents market share by 2035. The growing requirement for accurate and timely diagnostic testing for diseases is driving the market. Biochemical reagents are intended for use in the important components of diagnostic assays used to detect and quantify biomarkers associated with diseases, including infectious diseases, cancers, cardiovascular disorders, autoimmune diseases, and metabolic disorders. The expansion of point-of-care testing (POCT) in healthcare is driving the need for biochemical reagents used in rapid diagnostic tests. Furthermore, there are increasing numbers of cancer patients and chronic diseases.

CDC provides an excellent addition to infectious disease detection through its National Notifiable Diseases Surveillance System (NNDSS) that publishes finalized data on reportable infections annually, facilitating timely outbreak tracing and diagnostics decision support. Meanwhile, the Early Detection Research Network (EDRN), a division of the National Institute of Standards and Technology, under the NCI, is a Biomarker Reference Laboratory that helps in the validation and standardization of assays in cancer biomarker testing, which expedite early cancer detection and risk stratification. Together, these subsegments provide infectious disease surveillance and standardized biological biomarker assays, stimulating the increase in diagnostic need and capacity.

Product Type Segment Analysis

The PCR Reagent Kits segment is likely to grow significantly during the projected years from 2026 to 2035, owing to its significant role in biochemical research and diagnostics, which also allows the specific amplification of DNA. The National Institute of Biomedical Imaging and Bioengineering (NIH) singles out PCR as one of the pillars in the detection of infectious diseases, genetic mutations, as well as supporting forensic science. The use of PCR in COVID-19 screening showed the relevance it has in the world, where hundreds of millions of PCR diagnoses have been conducted worldwide. This extensive use sped up innovation and scaling of biochemical reagents. PCR remains a major technology in federal research funding portfolios and has stimulated reagent utilization and methodology development.

Our in-depth analysis of the biochemical reagents market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biochemical Reagents Market - Regional Analysis

North America Market Insights

By 2035, the North American market is expected to hold 40.1% of the biochemical reagents market share due to its advanced healthcare infrastructure, significant R&D expenditures, and demand from the high prevalence of chronic diseases. For example, Medical and health R&D investment in the U.S. was USD 245.1 billion, of which industry and the federal government invested 161.8 billion (66%) and 61.5 billion (25%), respectively. Advanced healthcare infrastructure and a high incidence of chronic diseases have led to this heavy investment in R&D, thereby expanding the biochemical reagents market in North America. Additionally, increased automation in laboratories, advancements in innovative types of reagents, and sustainability concerns related to manufacturing are the main trends. For instance, automation and IT integration helped Swedish Covenant Hospital save more than 45% of the normal turnaround time on tests. This efficiency improvement indicates the way automation improvements in North American laboratories can maximize the use of biochemical reagents, which directly leads to the expansion of the biochemical reagents industry.

The U.S. biochemical reagents market is anticipated to lead the North American region with the highest revenue share by 2035, attributed to federal funding of innovation, high-tech manufacturing programs, sustainability-oriented industrial policies, higher funding in biomedical research, and government-supported commercialization of new technology in the fields of energy, healthcare, and life sciences. For instance, the 48 billion NIH budget (FY 2022) includes 82 percent extramural research through 50,000 competitive grants in over 300,000 scientists in 2,500+ institutions, 11% internal laboratory work, and 6% administration and facilities. These extended large federal research generates demand in biochemical reagents, enzymes, probes, kits, buffers, and by funding lab projects and increasing experimental throughput in the U.S.

Furthermore, the National Institute for Innovation in Manufacturing Biopharmaceuticals (NIIMBL) of the Manufacturing USA network declared USD 15.8 million of planned project activities in the Institute Project Call 5.2 of 14 new projects in technology and workforce development. This funding will aid in the development of new manufacturing technologies and the training of a skilled labor force, which will have a direct effect on production and demand of these reagents. Moreover, the National Science Foundation (NSF) also invests about USD 200 million annually in about 400 startups via its Advanced Manufacturing Seed Fund. The money enables the commercialization of new technology, further contributing to the necessity to have highly specific biochemical reagents in numerous industries.

The biochemical reagents market in Canada is expected to grow steadily over the forecast years, mainly due to significant government investment in sustainability and clean tech. The Canadian government Clean Technology Manufacturing Investment Tax credit (CTMI ITC) is a refundable tax credit of up to 30% of capital investments in machinery and equipment to be utilized in the manufacturing and processing of clean technology, including critical mineral extraction and processing. This credit covers eligible property that was acquired and put in service between January 1, 2024, and December 31, 2034. Furthermore, the CTM ITC supports market expansion of biochemical reagents in Canada by promoting innovation and sustainability, and by incentivizing investments in clean technology. In addition, the government also allocated over 60 billion in Budget 2023 to clean energy, clean technology, and sustainable manufacturing, which will motivate innovation and growth in such areas as biochemical reagents and high-tech production of clean technologies. These substantial initiatives by the government indicate a notable policy change in the funding availability for such expenditures, as this portion alone, representing the taxes, clean energy tax credits, or, in some cases, refundable tax credits of unnecessary business facility costs, represents an increase from its previous Clean Economy Policy.

Asia Pacific Market Insights

The Asia-Pacific market is projected to grow significantly, with a revenue share of 20.2% during the forecast years from 2026 to 2035, primarily attributed to the increased research and development (R&D) potential, increased spending on healthcare, and continued investment in life sciences and biotechnology. The World Intellectual Property Organization (WIPO) estimates that in 2023, Asia was home to about 40% of the world's R&D spending, which means that the region has a high level of innovation. Moreover, according to the OECD report, pharmaceuticals and medical products constitute a major part of the health spending in the Asia-Pacific countries, and the investment in health infrastructure and technology is on the rise. This increasing distribution gives credence to the increasing demand for biochemical reagents in diagnostics and therapeutics, fundamental uses of biochemical reagents. BIRAC also cultivates biotech entrepreneurship, having more than 11,000 aspiring entrepreneurs and 6,700+ startups, with 4,800+ being funded, bio-incubators, and mentored. Its AcE Fund raised 120 million dollars to speed up innovation, similar to the dynamic expansion of biochemical reagents in the Asia Pacific, which was motivated by innovation and investments through startups. All this is favorable to the continual demand of biochemical reagents in molecular biology, genomics, diagnostics, and industrial biotech in the Asia-Pacific.

The market in China is anticipated to dominate the Asia Pacific region by 2035, driven by the growing investments in life sciences, the development of biotechnology, and firm encouragement of innovations by the government, e.g., genetically engineered products and diagnostic reagents. As of 2025, the biological and biochemical product manufacturing industry in China will be worth 96.7billion and will increase with a CAGR of 16.7. The demand for genetically engineered products and diagnostic reagents drives growth, which is in line with the expansion of the biochemical reagents market.

In addition, in 2023, the National Natural Science Foundation of China granted 31,879 prizes with a total fund of 31.879 billion yuan, with the focus on original innovation and strategic research. This high investment helps in the development of biotech, and this is a direct contribution to the increase in the biochemical reagents market in China. Furthermore, the market has dominant firms, such as Chongqing Zhifei Biological Products and China National Biotec Group, which can strengthen the capacity and innovative power of the market.

India’s market is expected to grow with the fastest CAGR over the forecast years, owing to the growing healthcare consciousness, growing chronic and genetic illnesses, and the growing body of biotechnology research due to government efforts such as the National Biotechnology Strategy. For example, the Department of Biotechnology (DBT) has recognized biotechnology as a strategic sector in fulfilling the Indian objective of becoming a USD 5 trillion economy in the year 2024. The growth in this sector is fuelled by efforts, including the National Biotechnology Development Strategy, that emphasize issues such as human genome investigation, vaccines, and chronic illness biology. These have had profound effects on the health of the people, agriculture, the environment, and industrial processes, resulting in a high demand for biochemical reagents in the country. The market has even more opportunities owing to the emphasis on personalized medicine in India, the growing application of sophisticated diagnostic equipment, and the rising demand for quality reagents in clinical chemistry. The diagnostic industry in India is expected to reach USD 25 billion by FY28 because of technological advancements and state programs such as Ayushman Bharat, which increase the need for biochemical reagents needed to perform high-level diagnostics.

Europe Market Insights

Europe is projected to see significant growth of 30.1% of biochemical reagents market share by 2035, owing to strong regulation, sustainability plans, and advances in technology. A significant driver influencing growth includes the European Green Deal and the Horizon Europe program, with a total budget of €95.5 billion for research and innovation, clearly focused on sustainable chemical processes and developments. In addition, the UK's biochemical reagents market is experiencing modest growth that is sustained by its commitment to a circular economy and sustainable practices. The UK government is promoting eco-friendly practices in the chemical sector, and this sector is contributing to a positive environment for the growth of biochemical reagents. For example, the Royal Society of Chemistry gives up to 10,000 pounds in the Sustainable Laboratories Grant, that are used to fund projects that will improve environmentally friendly laboratory practices. This project aims to provide a positive incentive to use more sustainable approaches in chemical research, which is consistent with the UK policy of sustainability.

Furthermore, Germany is capitalizing on its position as a European biochemical reagents market leader, investing heavily to drive its green transformation. For example, one of the major chemical complexes, the Leuna Chemical Complex in Saxony-Anhalt, has been invested in to the tune of more than 2 billion euros. With a growing number of 100+ companies that manufacture 12 million tons annually, continuous modernization of the industry costing €300 million is driving the growth of the German biochemical reagents industry. These important steps show Germany's effort to decarbonize the chemical industry and the successful development of innovation and sustainable growth in the area of biochemical reagents.

Key Biochemical Reagents Market Players:

- Thermo Fisher Scientific

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories

- Agilent Technologies

- QIAGEN N.V.

- Danaher Corporation

- Abbott Laboratories

- Siemens Healthineers AG

- Becton, Dickinson and Company

- Promega Corporation

- Waters Corporation

- Fujirebio

- BioMérieux SA

- Takara Bio Inc.

The biochemical reagents market is highly competitive, driven by innovation and global expansion. Leading firms such as Thermo Fisher, Merck KGaA, and Roche enhance their portfolios through acquisitions and R&D. Agilent, QIAGEN, and Japanese players like Takara Bio focus on advanced diagnostics and nucleic acid technologies. European companies such as BioMérieux expand via collaborations, all aiming to meet growing demand in research, diagnostics, and personalized medicine.

Top Global Biochemical Reagents Manufacturers:

Recent Developments

- In July 2025, Bio-Rad Laboratories announced four additional new Droplet Digital PCR (ddPCR)-based applications, the QX Continuum ddPCR system and the QX700 series, after acquiring Stilla Technologies. These platforms have superior multiplexing features and are meant to be used in oncology, infectious disease, and genetic research. The QX Continuum system has four-color multiplexing and a maximum of eight discrete thermal profiles per plate, whereas the QX700 series has seven-color multiplexing and a maximum of more than 700 samples per day. The complementary product portfolio alongside the existing QX200 and QX600 ddPCR systems will deliver solutions that cover the entire range of digital PCR applications of Bio-Rad.

- In June 2025, Thermo Fisher Scientific announced the Thermo Scientific Orbitrap Astral Zoom and the Orbitrap Excedion Pro mass spectrometers at the American Society for Mass Spectrometry (ASMS) annual conference. These are state-of-the-art instruments with increased speed, sensitivity, and multiplexing, which leads to a new standard of high-resolution, reliable mass spectrometry. The Orbitrap Astral Zoom is intended to support precision medicine and offer an insight into complicated diseases like Alzheimer's and cancer, with a 35x faster scan rate, a 40x higher throughput, and 50x more multiplexing data. The Orbitrap Excedion Pro is a hybrid-based next-generation Orbitrap mass spectrometry coupled with alternative fragmentation methods that can be used to analyze complex biomolecules.

- In May 2024, Cytek Biosciences reported that the 1-laser and 2-laser 6-color TBNK reagent cocktails had been approved by the National Medical Products Administration (NMPA) in China to use in clinical diagnosis with the Cytek Northern Lights-Clinical (NL-CLC) cell analysis systems. It is the first clinical 1-laser-based 6-color TBNK assay that has Full Spectrum Profiling (FSP) support. These reagents facilitate the detection and measurement of important lymphocyte subsets, which are used in the diagnosis and treatment of immune-related disorders, including immunodeficiencies, autoimmune diseases, infectious diseases, and cancers. The licence broadens the markets in China and increases the competitive edge of Cytek in the cell analysis solutions industry.

- Report ID: 7699

- Published Date: Oct 07, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biochemical Reagents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.