AKD Emulsifier Market Outlook:

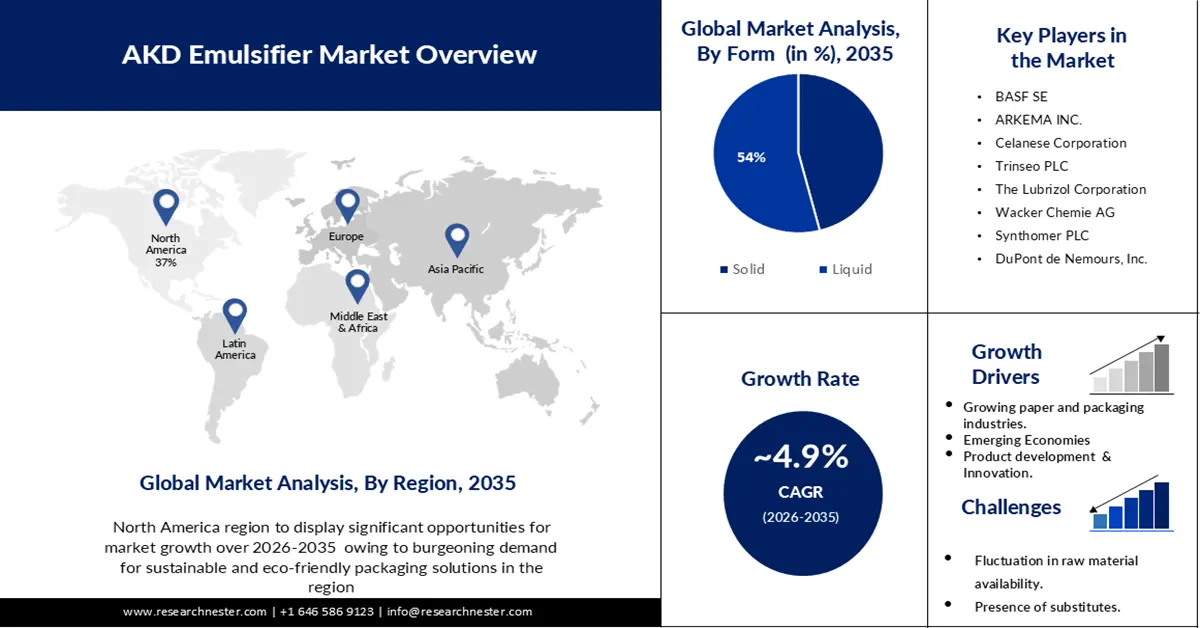

AKD Emulsifier Market size was valued at USD 1.74 billion in 2025 and is expected to reach USD 2.81 billion by 2035, registering around 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AKD emulsifier is evaluated at USD 1.82 billion.

The growth of the paper and pulp industry, which is a major user of AKD emulsifiers, has been an important driver for the market. They are widely used as sizing agents in the paper and pulp industry, helping to increase the water resistance and printability of the paper. According to analysts at Research Nester, the world's production of pulp and paper is still above 180 million tonnes a year. Today, paper is the most sustainable and recycled packaging material available in the world. Consumers and manufacturers are switching their preferences to more environmentally friendly paper packaging solutions as a result of increased environmental concerns, thereby driving market growth.

Further, As compared to other sizing agents used in the paper and pulp sector, demand for AKD emulsifiers has also increased owing to their eco friendly nature. For the paper and pulp industry, which is increasingly focused on sustainable and environmentally friendly products, AKD emulsifiers are an attractive option due to their biodegradable nature.

Key AKD Emulsifier Market Insights Summary:

Regional Highlights:

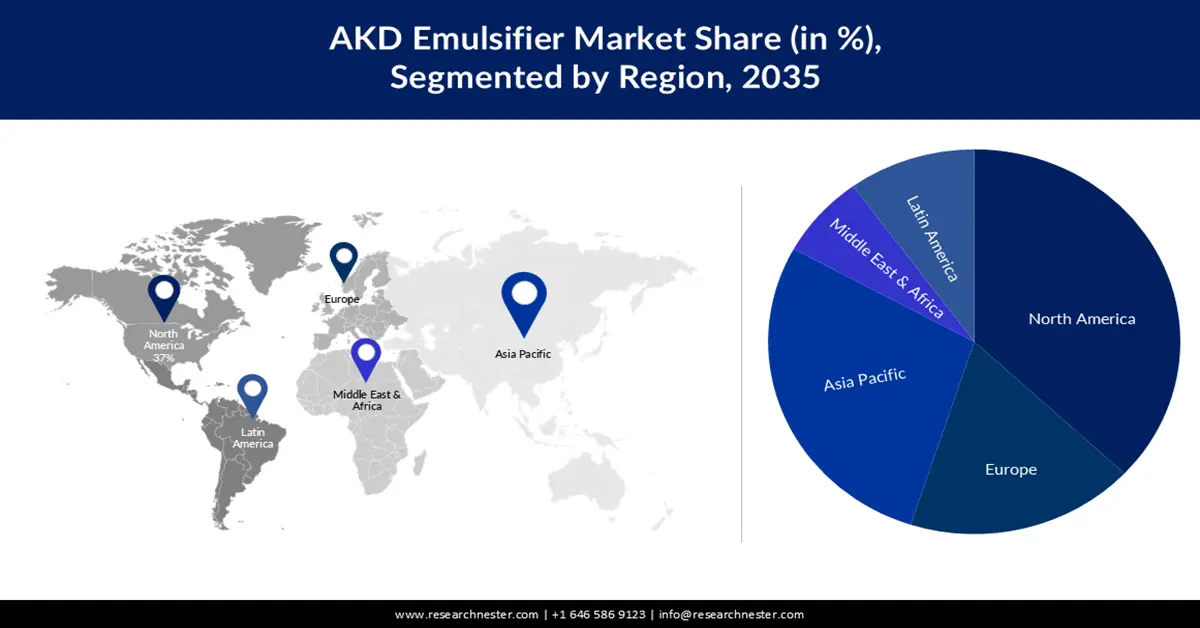

- By 2035, North America is projected to command a 37% share of the AKD emulsifier market, attributed to the rising demand for sustainable and eco-friendly packaging solutions.

- Across 2026–2035, Asia Pacific is anticipated to observe strong expansion, supported by the region’s rapidly expanding paper and packaging industry amid accelerating industrialization.

Segment Insights:

- By 2035, the liquid segment of the AKD emulsifier market is expected to account for a 54% share, owing to their ease of handling, efficient mixing capabilities, and versatile application.

- Over 2026–2035, the cosmetics segment is set to secure a leading revenue position, propelled by the increasing demand for stable, high-performance emulsions and sustainable packaging.

Key Growth Trends:

- Increasing Demand for Sustainable Packaging

- Growth in the Chemical and Coatings Industry

Major Challenges:

- Fluctuating Raw Material Costs

- Lack of awareness amongst end users about the advantages and uses of AKD emulsifiers.

Key Players: BASF SE, ARKEMA INC., Celanese Corporation, Trinseo PLC, The Lubrizol Corporation, Wacker Chemie AG, Synthomer PLC, DuPont de Nemours, Inc., Solenis LLC, DIC CORPORATION.

Global AKD Emulsifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.74 billion

- 2026 Market Size: USD 1.82 billion

- Projected Market Size: USD 2.81 billion by 2035

- Growth Forecasts: 4.9%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Indonesia, Vietnam, Mexico

Last updated on : 27 November, 2025

AKD Emulsifier Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing Demand for Sustainable Packaging- With a rising emphasis on sustainability, AKD emulsifiers play a significant role in producing environmentally friendly and recyclable packaging materials. It has been observed, that the willingness of consumers to pay more for sustainability packaging was 82 % among those aged between 18 and 34. As consumer preferences shift towards sustainable packaging solutions, the demand for AKD emulsifiers, which enable the production of eco-friendly paper and board, experiences growth.

-

Growth in the Chemical and Coatings Industry- The AKD emulsifiers market is positively influenced by the growth in the chemical and coatings industry. AKD emulsifiers find applications in coatings and sizing formulations, contributing to the production of coated papers and boards. The expansion of the chemical and coatings sector, driven by various end-user industries, supports the growth of AKD emulsifier demand.

-

Rising E-commerce and Packaging – The flourishing e-commerce industry contributes to increased demand for packaging materials, supporting the AKD emulsifier market. As online retail continues to grow, the need for robust and high-quality packaging solutions, where AKD emulsifiers play a role, is on the rise to ensure the protection and presentation of shipped goods.

-

Increasing Demand for Speciality Papers- The growing demand for specialty papers, including packaging materials, labels, and high-quality printing papers, boosts the AKD emulsifier market. AKD emulsifiers are essential in producing specialty papers, where precise sizing and coating processes are required to meet specific performance and quality standards.

Challenges

-

Fluctuating Raw Material Costs- One of the primary challenges in the AKD emulsifier market is the fluctuation in raw material costs, particularly those associated with the production of alkyl ketene dimer (AKD). Variability in raw material prices can impact the overall production costs of AKD emulsifiers, affecting the pricing and profitability for manufacturers in the market.

-

Lack of awareness amongst end users about the advantages and uses of AKD emulsifiers.

-

High market competition from alternative chemicals and sizing agents for paper manufacturing.

AKD Emulsifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 1.74 billion |

|

Forecast Year Market Size (2035) |

USD 2.81 billion |

|

Regional Scope |

|

AKD Emulsifier Market Segmentation:

Form Segment Analysis

The liquid segment is anticipated to hold 54% share of the global AKD emulsifier market by 2035. This is attributed to their ease of handling, efficient mixing capabilities, and versatile application across various industries. Liquid AKD emulsifiers offer convenient integration into production processes, ensuring seamless dispersion and improved product performance. Their fluid nature facilitates uniform distribution, enhancing overall operational efficiency. As a result, the practical advantage of liquid formulations positions them as the preferred choice, driving their dominance in the AKD emulsifiers market.

End-User Segment Analysis

The cosmetics segment in the AKD emulsifier market is poised to capture the majority of revenue share, driven by increasing demand for stable and high-performance emulsions in skincare and beauty products. AKD emulsifiers play a pivotal role in enhancing formulation stability, texture, and shelf life, meeting the stringent requirements of the cosmetics industry. As consumers prioritize quality and functionality in personal care items, the cosmetics sector’s reliance on advanced emulsifiers for improved product attributes positions it at the forefront. As observed by Research Nester analysts, in the case of LOreal, which made its commitment to 100% recyclable packaging by 2025 in association with Albea group, it introduced products into recycled paper packaging in 2019. This anticipated preference for enhanced cosmetic formulations & sustainable packaging is expected to propel the cosmetics segment to the forefront of the AKD emulsifiers Market.

Our in-depth analysis of the global AKD emulsifier market includes the following segments:

|

Form |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AKD Emulsifier Market - Regional Analysis

North American Market Insights

North America industry is estimated to dominate majority revenue share of 37% by 2035. The region’s burgeoning demand for sustainable and eco-friendly packaging solutions drives the adoption of AKD emulsifiers in the paper and packaging industry. As environmental consciousness grows among consumers and businesses, AKD emulsifiers play a pivotal role in producing recyclable and biodegradable materials. The continuous expansion of the paper and pulp industry, coupled with technological advancements in papermaking processes, boosts the demand for AKD emulsifiers, which enhance the quality and properties of paper products. In 2021, the region’s paper &pulp industry garnered a revenue around USD 64 billion, accounting for 20% of the global industry. Additionally, collaborations between AKD emulsifier manufacturers and major players in the paper industry contribute to market growth by fostering innovation and ensuring the seamless integration of these emulsifiers into sustainability, coupled with robust industrial growth, positions the AKD Emulsifier Market for sustained expansion.

APAC Market Insights

Asia Pacific AKD emulsifier market is set to experience robust growth driven by several key factors. The region’s thriving paper and packaging industry, fuelled by rapid industrialization and urbanization, contributes significantly to the demand for AKD emulsifiers. As Asia Pacific nations witness increased consumerism and e-commerce activities, there is a growing need for high-quality, sustainable packaging materials where AKD emulsifiers play a vital role. The emphasis on technological advancements in the papermaking sector enhances the adoption of AKD emulsifiers, which aid in achieving superior paper properties. The region’s commitment to environmental sustainability aligns with the eco-friendly applications of AKD emulsifiers, fostering their widespread use. Additionally, collaborations and partnerships among industry players and research initiatives contribute to innovations, further propelling the growth of the AKD Emulsifier market in the Asia Pacific.

AKD Emulsifier Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- ARKEMA INC.

- Celanese Corporation

- Trinseo PLC

- The Lubrizol Corporation

- Wacker Chemie AG

- Synthomer PLC

- DuPont de Nemours, Inc.

- Solenis LLC

Recent Developments

- March 2023- Dow showcased their latest cutting-edge compounds at in-cosmetics Global 2024. The new product launches, including the introduction of the ECOllaboration 2.0 Concepts Collection, commemorate one of the broadest portfolios in the personal care sector that prioritizes sustainable and high-performance solutions.

- October 2023- At the SEPWA Congress, BASF presented an innovative new line of products for personal care, home care, and industrial and interior cleaning trends. The company launched Emulgade Verde 10 Ms, an emulsifier for natural personal care formulations, which is an oil and water combination.

- Report ID: 5574

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AKD Emulsifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.