Airlift Bioreactors Market Outlook:

Airlift Bioreactors Market size was over USD 2.27 billion in 2025 and is anticipated to cross USD 6 billion by 2035, growing at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airlift bioreactors is assessed at USD 2.48 billion.

This growth is due to the rising need for customized medications leading to the growth of the pharmaceutical industry.

The Congressional Budget Office reports that the pharmaceutical industry invested USD 83 billion in research and development in 2019. In addition, it is assessed that India's pharmaceutical sector will generate USD 130 billion by 2030 and USD 65 billion by 2024. Furthermore, Canada ranks eighth in the world for pharmaceutical sales, accounting for 2.2% of the global market.

The growth in the airlift bioreactor market in the near future can be attributed to advancements in healthcare technology. Growing output of various research and development of biochemicals and its activities are expected to present profitable growth prospects for the biochemical industry.

Key Airlift Bioreactors Market Insights Summary:

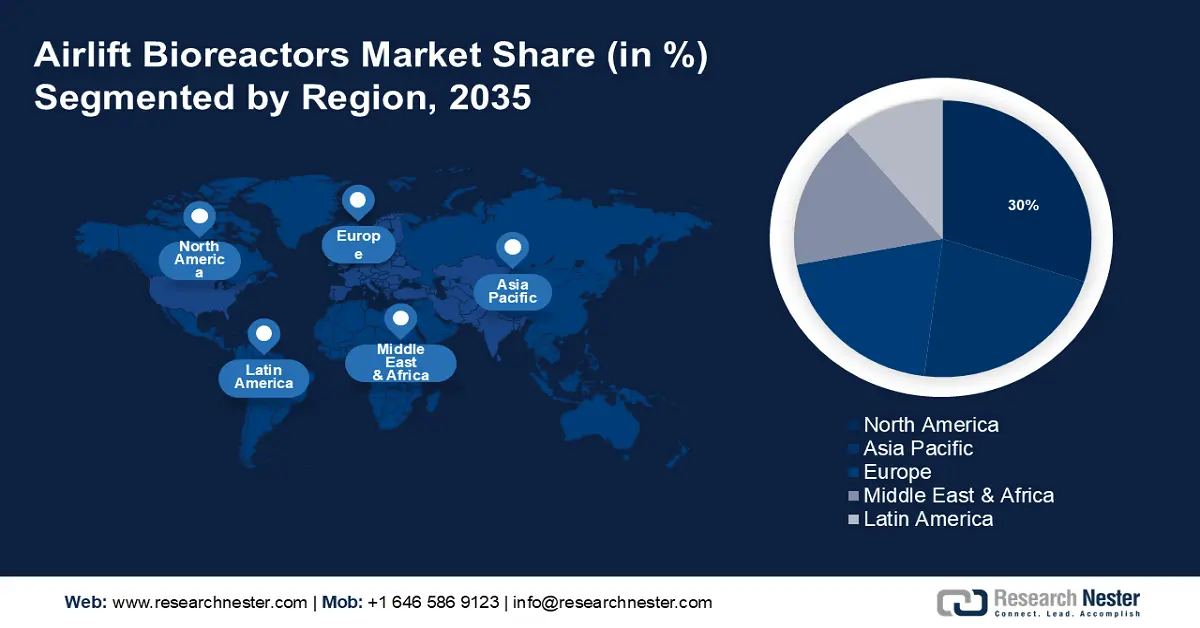

Regional Highlights:

- North America airlift bioreactors market will hold more than 30% share, driven by biotechnology advancements and robust R&D investments, forecast period 2026–2035.

- Asia Pacific market will capture a 22% share, fueled by demand for bio-based products and advantages of airlift bioreactor technology, forecast period 2026–2035.

Segment Insights:

- The internal airlift loop bioreactor segment in the airlift bioreactors market is projected to hold a 56% share by 2035, driven by the scalability of internal airlift bioreactors suitable for various production scales.

- The biopharmaceutical companies segment in the airlift bioreactors market is projected to hold a 53% share by 2035, fueled by the rising demand for personalized medicine and scalable production solutions.

Key Growth Trends:

- Rising demand for biopharmaceuticals

- Expanding biotechnology industry

Major Challenges:

- High initial investment needed

- Regulatory hurdles may hinder market growth

Key Players: Kuhner Shaker, Cellexus, Sartorius, Lonza, Electrolab Biotech, Shree Biocare, Rotech, Knik Technology, Solida Biotech, Zeta.

Global Airlift Bioreactors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.27 billion

- 2026 Market Size: USD 2.48 billion

- Projected Market Size: USD 6 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Airlift Bioreactors Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for biopharmaceuticals - The aging population, rising incidence of chronic illnesses, and advances in medical treatments are all leading to increased demand for biopharmaceuticals, which in turn raises production costs. Airlift bioreactors offer scalable and effective options for large-scale biopharmaceutical manufacturing, enabling firms to meet rising demand.

Bioreactors provide several advantages over traditional bioreactor systems, including increased oxygen transfer, higher mass transfer rates, and less shear stress on cells. These qualities make biopharmaceutical manufacturing more productive and efficient.

- Expanding biotechnology industry - Bioprocessing equipment, such as bioreactors, is highly dependent on the biotechnology sector for several uses, including fermentation, protein expression, and cell culture. To support research, development, and production activities, there is a corresponding rise in demand for bioprocessing equipment as the biotechnology sector grows.

Continuous innovation and technical breakthroughs are what define the biotechnology sector and result in the creation of innovative treatments, diagnostics, and industrial bioproducts. Airlift bioreactors, which offer a versatile platform for bioprocess development and optimization, are essential in facilitating these improvements due to their capacity to handle a broad variety of cell types and process conditions. The need for sophisticated bioprocessing machinery, such as airlift bioreactors, is growing as biotechnology research advances, propelling market expansion.

Challenges

- High initial investment needed - Airlift bioreactors require specialized engineering and design in order to be most successful for certain applications. Creating trustworthy and efficient systems requires significant research and development (R&D) costs, including prototype, testing, and iteration. It is frequently required to modify and integrate airlift bioreactors into existing manufacturing facilities or processes.

To meet the specific requirements of each application, the bioreactor's size, design, and control systems may need to be adjusted. Because customization is challenging, it takes longer and costs more to implement, making it harder for firms to justify the investment—especially if they anticipate low production numbers or fluctuating demand. - Regulatory hurdles may hinder market growth

- Lack of awareness among the people related to airlift bioreactors

Airlift Bioreactors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 2.27 billion |

|

Forecast Year Market Size (2035) |

USD 6 billion |

|

Regional Scope |

|

Airlift Bioreactors Market Segmentation:

Product Segment Analysis

In airlift bioreactors market, internal airlift loop bioreactor segment is poised to dominate over 56% share by 2035. Numerous industries have begun to use and pay attention to bioreactors. These bioreactors are well-liked and dominate the market because they provide special benefits. They offer effective mass transport of gases and nutrients as well as good liquid phase mixing.

Because of their considerable scalability, internal airlift loop bioreactors can be easily adapted to various production scales. The market landscape is also influenced by recent developments, changing uses, and rising technology.

End-User Segment Analysis

In airlift bioreactors market, biopharmaceutical companies segment is estimated to account for around 53% revenue share by 2035. The demand for customized medicine, the rising incidence of chronic diseases, and innovative therapies have all contributed to the biopharmaceutical industry's recent significant rise.

These businesses frequently need scalable manufacturing solutions to keep up with the demands of their expanding commercial production needs. For biopharmaceutical businesses looking to go from laboratory-scale to commercial-scale production, airlift bioreactors offer an appealing alternative due to their scalability and capacity to maintain stable hydrodynamic conditions during scale-up. Aside from this, airlift bioreactors help biopharmaceutical businesses achieve their goals by offering ideal conditions for cell development and product creation. These organizations place a high priority on protecting the integrity and purity of their goods.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Capacity |

|

|

Material |

|

|

Usage |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airlift Bioreactors Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 30% by 2035. Product launches regularly, biotechnology developments, and other encouraging elements propel the industry in this region.

The United States alone accounts for about one-third of the worldwide biopharmaceutical industry and leads in biopharmaceutical R&D, demonstrating the region's strong infrastructure for biopharmaceutical manufacturing. For instance; the Pharmaceutical Research and Manufacturers Association (PhRMA) estimates that more than any other industry in the United States in 2017, biopharmaceutical companies invested around USD 97 billion in research and development (R&D). These mostly foreign-owned companies invested roughly USD 20 billion in R&D in the same year. The adoption of airlift bioreactors is fueled by the substantial investments in the biotechnology and pharmaceutical sectors that this rich ecosystem draws.

APAC Market Insights

By 2035, Asia Pacific Region in airlift bioreactors market is anticipated to dominate over 22% revenue share. Its rise is driven by the increase in demand for bio-based products such as bio-based leather, which is especially evident in China given its emphasis on ethanol production.

Improved mass transfer and increased oxygen transfer rates are two of the unique benefits that make airlift bioreactors a desirable option for bio-based manufacturing in the region. This crucial component is foreseen to fuel revenue growth in the Asia Pacific market, solidifying its standing as a major force behind the advancement of the sector.

Airlift Bioreactors Market Players:

- Kuhner Shaker

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cellexus

- Sartorius

- Lonza

- Electrolab Biotech

- Shree Biocare

- Rotech

- Knik Technology

- Solida Biotech

- Zeta

Recent Developments

- Mar 2022- Cellexus partnered with Verder Liquids, a Castleford based company. By this move, companies aimed to offer pumps for acid/base pump that is included with its CellMaker Plus and Low Flow bioreactor systems. The CellMaker bioreactor system is used by researchers all over the world to cultivate cells in their labs for use in novel drug and vaccination trials.

- Mar 2022- Zeta established a new subsidiary in Singapore so that Asian biotechnology and pharmaceutical businesses may take advantage of customer-specific services.

- Report ID: 5765

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airlift Bioreactors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.