Aircraft Turbofan Engine Market Aircraft Turbofan Engine Market Outlook:

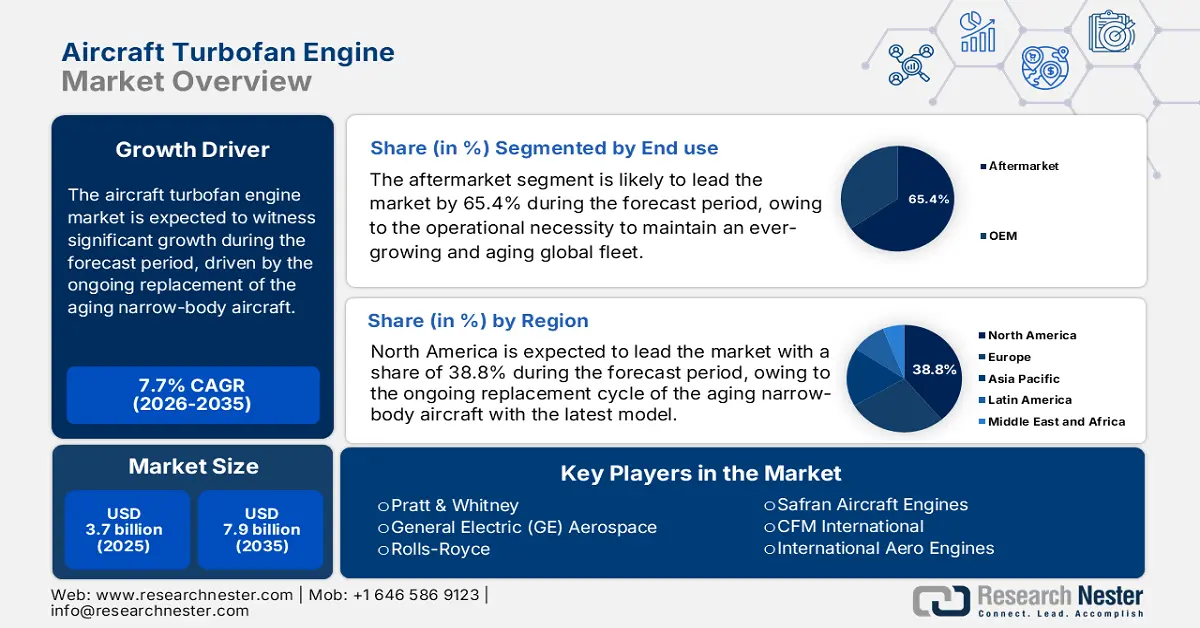

Aircraft Turbofan Engine Market size was valued at USD 3.7 billion in 2025 and is projected to reach USD 7.9 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aircraft turbofan engine is estimated at USD 4.1 billion.

The demand for the aircraft turbofan engine market is primarily driven by the sustained fleet growth in the commercial aviation, ongoing replacement of the aging narrow-body aircraft, and regulatory pressures to improve the fuel efficiency and emissions performance. The report from the U.S. Department of Transportation data in March 2023 reported that the airline passenger enplanements in the U.S. are surging, and in 2022, it has accounted for 853 million. This data indicates the higher aircraft utilization and a recovery toward long-term traffic growth trends. Further, the fleet expansion directly supports the long-term procurement of the turbofan engines for the original equipment installation and for the aftermarket services. The FAA further notes that the U.S. air carrier fleet is expected to rise from 4,829 to 6,854 by 2045, sustaining utilization rates that increase engine maintenance, repair, and overhaul (MRO) demand.

Further, the aircraft turbofan engine market’s financial structure is heavily weighted toward the aftermarket, where maintenance, repair, and overhaul services generate a substantial and recurring revenue stream. This is linked directly to the operational lifecycle of an installed engine base that numbers in the tens of thousands worldwide. The International Air Transport Association notes that the MRO spending represents a critical cost center for the airlines, with the engine-related work constituting the major portion. The industry health is closely tied to the airline's profitability and traffic recovery. For instance, the IATA data in January 2024 indicates that the global revenue passenger kilometers accounted for 94.1% in 2023. This report indicates a strong rebound in engine utilization and associated service needs. This recovery supports both OEM production rates for new engines and sustained aftermarket activity, though the sector remains susceptible to macroeconomic cycles and supply chain constraints.

Key Aircraft Turbofan Engine Market Insights Summary:

Regional Insights:

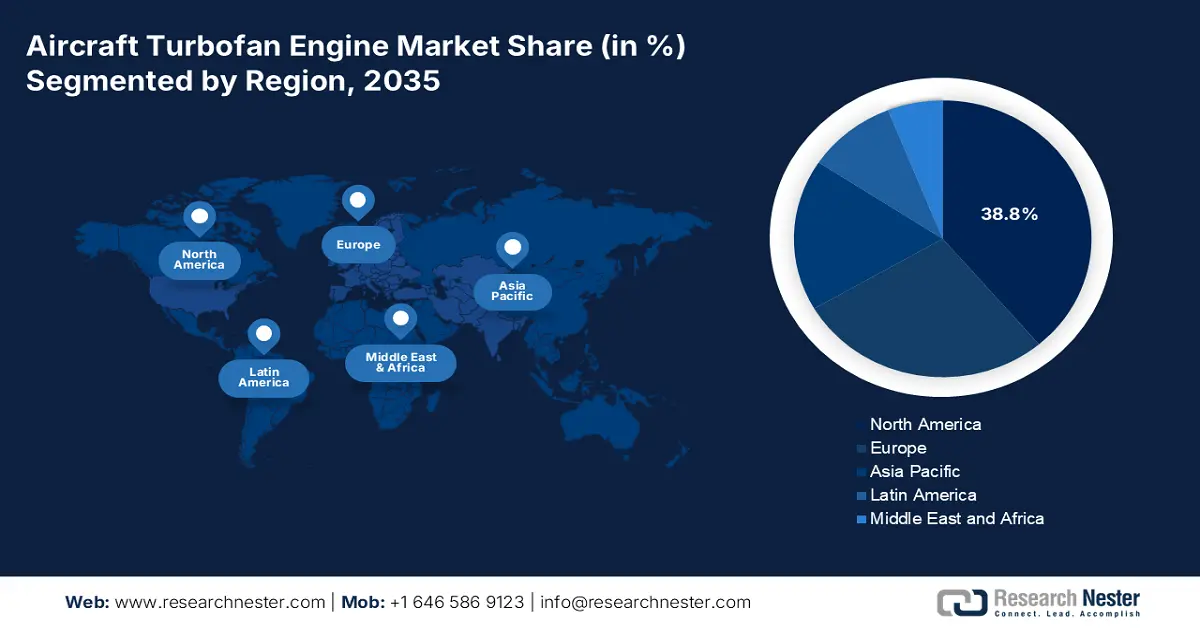

- North America is projected to command a 38.8% share of the aircraft turbofan engine market by 2035, underpinned by a large installed base and OEM concentration, supported by continuous narrow-body replacement cycles and defense-backed R&D investment.

- Asia Pacific is anticipated to expand at a CAGR of 5.8% during 2026–2035, fueled by rapid passenger traffic growth, accelerated airline fleet additions, and state-led aerospace industrialization initiatives.

Segment Insights:

- Within the aircraft turbofan engine market, the aftermarket end use sub-segment is forecast to account for 65.4% share by 2035, sustained by rising maintenance intensity from an expanding and aging global fleet and the widespread adoption of long-term performance-based service contracts.

- In the platform segment, commercial aviation represents the dominant share through the forecast period, strengthened by global fleet modernization programs and passenger traffic recovery supporting large-scale engine procurement and servicing demand.

Key Growth Trends:

- Rising commercial air passenger traffic and fleet utilization

- Government defense and military aviation spending

Major Challenges:

- Immense capital and R&D costs

- Complex long-cycle supply chain integration

Key Players: General Electric (GE) Aerospace (U.S.), Rolls-Royce (UK), Safran Aircraft Engines (France), CFM International (U.S.), International Aero Engines (IAE), Engine Alliance (U.S.), MTU Aero Engines (Germany), Avio Aero (Italy), IHI Corporation (Japan), Mitsubishi Heavy Industries Aero Engines (Japan), Kawasaki Heavy Industries (Japan), Honeywell Aerospace (U.S.), Textron Aviation (U.S.), GKN Aerospace (UK/Sweden), Bharat Electronics Limited (BEL) (India), Hindustan Aeronautics Limited (HAL) (India), Korean Aerospace Industries (KAI) (South Korea), Composite Technology Research Malaysia (CTRM) (Malaysia), Quickstep Holdings (Australia).

Global Aircraft Turbofan Engine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.7 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 7.9 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, France, United Kingdom, Germany, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 22 December, 2025

Aircraft Turbofan Engine Market - Growth Drivers and Challenges

Growth Drivers

- Rising commercial air passenger traffic and fleet utilization: Government air traffic data shows a sustained rebound and long term growth in passenger volumes, directly increasing the demand for the turbofan engine via higher utilization, stimulated maintenance cycles, and fleet renewal. The IATA report in August 2025 has indicated that the 116.9 million airline passenger enplanements in 2024 rose further, reflecting a return toward the demand levels. Higher traffic forces the airlines to maximize the aircraft availability, increasing the engine flight hours, shop visits and spare engine requirements. From the procurement standpoint, airlines respond by extending long-term engine service agreements and stimulating the replacement of older, fuel-inefficient aircraft. This trend is structurally important for turbofan OEMs, and MRO provides, as utilization-driven wear is non-discretionary.

- Government defense and military aviation spending: Rising defense budgets directly support the demand for the military turbofan engines used in transport surveillance and next-gen fighter aircraft. The U.S. Department of War in March 2023 depicts that the U.S. Department of Defense allocates the budget of USD 842 billion in 2024, with aviation propulsion listed as a core sustainment and modernization priority. The U.S. Air Force continues funding the engine upgrades and adaptive engine programs to improve the range, thrust, and fuel efficiency. Similar trends are visible in Asia and Europe, where the governments are expanding airlift and patrol capabilities. Unlike commercial aviation, defense-driven engine demand is less cyclical and contractually secured, offering stable long-term revenue visibility. For suppliers, defense programs provide multi-decade sustainment and overhaul contracts, often insulated from commercial downturns.

Department of Defense Spending in the U.S. (2022-2025)

|

Year |

U.S. Defense Budget Authority (USD bn) |

Aviation / Propulsion Relevance |

|

2022 |

766 |

Fleet sustainment, engine overhauls |

|

2023 |

816 |

Aircraft readiness, engine upgrades |

|

2024 |

842 |

Next-gen propulsion programs |

|

2025 |

880+ (proposed) |

Advanced engine R&D, sustainment |

Source: Comptroller April 2024

- Government supported research funding for advanced propulsion: Public R&D funding stimulates the commercialization of next-gen turbofan technologies. The NASA and the U.S. Department of Energy jointly support the propulsion research under the sustainable aviation propulsion improvements, which could reduce the aviation fuel use by billions of gallons over the coming decades, reinforcing the long term engine replacement demand. These programs lower the technical risk for OEMs and shorten the innovation cycles. For suppliers, the government-backed R&D creates early mover advantages and future procurement alignment with the public sector fleets. It also strengthens domestic supply chains and long-term aerospace manufacturing competitiveness.

Challenges

- Immense capital and R&D costs: Developing a new turbofan engine requires a minimum investment and a decade-long development cycle. This high-risk barrier limits the entrants to only the largest, most captivated firms. For instance, leading companies have been investing heavily for more than two decades in their geared turbofan before achieving a return. This financial commitment is prohibitive for new players, as underscored by the aircraft turbofan engine market’s consolidation around three major OEMs. Financing in aerospace highlights that engine programs are the single largest R&D line item for major aerospace firms, consuming capital for years before the first sales.

- Complex long-cycle supply chain integration: The supply chain for turbofan engines is a global network of specialized tier 1 and tier 2 suppliers producing high-integrity components such as the single-crystal turbine blades. Entrants must secure and manage these relationships, which are often locked in by incumbents via long term contract. For example, a company in Germany has secured its role as a high-pressure turbine specialist for decades via deep partnerships.

Aircraft Turbofan Engine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 3.7 billion |

|

Forecast Year Market Size (2035) |

USD 7.9 billion |

|

Regional Scope |

|

Aircraft Turbofan Engine Market Segmentation:

End use Segment Analysis

Under the end use segment, the aftermarket sub-segment is dominating in the aircraft turbofan engine market and is expected to hold the share value of 65.4% by 2035. The segment is driven by the operational necessity to maintain an ever-growing and aging global fleet where maintenance costs constitute a significant portion of an airline's operating expenses. The shift toward long-term performance-based service agreement such as power by the hour, ensures a steady, high-margin revenue stream for the OEMs, independent of new engine sales cycles. A key statistical driver is the sustained demand for air travel and subsequent maintenance activity. The report from the FAA in June 2025 has stated that the IFR flights represent the commercial airline cargo and business jet operation using turbofan engines have increased by 3.4% to 16.1 million, indicating a recovery in the aircraft utilization and flight hours.

Platform Segment Analysis

Within the platform segment, commercial aviation is the unequivocal leader, accounting for the vast majority of the aircraft turbofan engine market demand and revenue. This is fueled by the massive global fleet renewal and expansion programs aimed at improving fuel efficiency and meeting the stringent emissions targets. The segment’s growth is intrinsically linked to the passenger traffic recovery and long-term growth projections, mainly in the Asia Pacific region. The critical statistical indicator from 2023 underscores the sector’s rebound and scale according to the U.S. Bureau of Transportation Statistics in September 2023. U.S. Airlines gained USD 5.5 billion in Q2 2023, which is an improvement over the second quarter of 2022, indicating the robust financial recovery and the operational scale of the commercial sector that drives the engine procurement and servicing.

Engine Type Segment Analysis

The narrow-body aircraft engines sub-segment commands the leading revenue share within engine types, serving as the workhorse of global aviation. This dominance is due to the high-volume production of aircraft such as the Airbus A320neo and Boeing 737 MAX families, which are powered almost exclusively by next-generation engines, such as the top players in the aircraft turbofan engine market. The demand is propelled by the growth of low-cost carriers and the need for efficient short-to-medium-haul connectivity worldwide. A pivotal statistic highlighting this trend is the continued order backlog and delivery focus. For example, the Federal Aviation Administration's aerospace forecast notes that the single-aisle aircraft are projected to make up a high proportion of the new commercial jet deliveries, solidifying the long-term primacy of this engine type.

Our in-depth analysis of the includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Thrust |

|

|

Technology |

|

|

Platform |

|

|

Component |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Turbofan Engine Market - Regional Analysis

North America Market Insights

North America is dominating the aircraft turbofan engine market and is expected to hold the market share of 38.8% by 2035. The major OEMs and a vast, mature installed fleet drive the market. The primary commercial driver is the ongoing replacement cycle of the aging narrow-body aircraft with the next-gen fuel-efficient models to comply with the emissions standards and reduce the operating costs. This is reinforced by the steady domestic air traffic recovery, with the FAA forecasting U.S. airline passenger growth. This is reinforced by the steady domestic air traffic recovery, with the FAA forecasting U.S. airline passenger growth. The dominant trend is the deep integration of defense spending that provides stable R&D funding and production baseload via programs such as the F-35. Currently, robust environmental regulations are stimulating the investment in sustainable aviation fuel-compatible and advanced hybrid electric propulsion technologies.

The U.S. aircraft turbofan engine market is defined by the synergistic push of Department of Defense investment and regulatory-driven commercial innovation. The defense spending provides foundational R&D and production scale with the programs such as the next-generation air dominance fighter demanding breakthroughs in adaptive cycle and thermal management engine technology, as outlined in the U.S. the report from the CSIS in October 2022 has reported that army spending to improve the turbine engine program allocated USD 270 million in 2022. Additionally, Pratt & Whitney in September 2025 announced that it has completed the critical testing on its small turbofan engine family for use on Collaborative Combat Aircraft, or CCAs. This testing has confirmed that the business can raise the thrust on these existing engines for use on CCA platforms. This announcement supports growth in military turbofan demand, engine retrofit and upgrade programs, and long-term sustainment contracts.

U.S. DoD Aircraft Turbofan Investments (2022-2025)

|

Year |

Program |

Funding Amount (USD million) |

Details |

|

2022 |

Army ITEP (Turboshaft) |

260 |

Peak funding for Black Hawk/Apache engines |

|

2022-2027 |

Army Improved Turbine |

921 (total) |

Next-gen turboshaft development |

|

2023+ |

F-35 AETP (Turbofan) |

Under debate |

Adaptive engine vs. Enhanced Package |

|

2025 |

DARPA AFRE (Turbofan) |

65.1 |

Turbine-based combined-cycle engine |

Source: CSIS October 2022

The aircraft turbofan engine market in Canada is shaped by the strong specialization in the business aviation and regional connectivity, aided by the domestic industrial expertise. This sector received a significant boost in May 2023 when Pratt & Whitney Canada announced its new PW545D engine had been selected to power the Cessna Citation Ascent business jet. This engine is designed mainly for its application, promising improved fuel efficiency, greater thrust, and an extended 6,000-hour Time Between Overhauls. This development leverages the proven PW500 platform that has over 4,600 units and 22 million flight hours of operational history, demonstrating Canada’s strategic role in providing reliable, economically attractive propulsion for the global light to mid-size business jet segment. This aligns with the national aerospace strengths and support fleet modernization goals.

APAC Market Insights

Asia Pacific is the fastest-growing aircraft turbofan engine market and is expected to grow at a CAGR of 5.8% during the forecast period 2026 to 2035. The market is driven by the three interconnected factors: explosive commercial air traffic growth, aggressive fleet expansion by the regional airlines, and strategic national policies aimed at achieving aerospace industrial sovereignty. China is at the forefront with its state-backed initiative to develop the COMAC C919 narrow-body aircraft, directly creating a demand for its indigenous CJ-1000A turbofan and challenging the Airbus-Boeing duopoly. This projected growth solidifies the region’s position as the primary revenue driver for the global industry within the next decade. Further, all the major engine OEMs are intensifying local partnerships and supply chain investment across the region to secure the aircraft turbofan engine market position and access to this long term demand.

China’s aircraft turbofan engine market is driven by the state-led strategy for aerospace sovereignty centered on reducing dependency on the western technology. The cornerstone is developing indigenous powerplants for the COMAC C199 narrow-body jet with the Aero Engine Corporation of China leading the CJ-1000A high-bypass turbofan program, based on ORCASIA June 2024. Further, the push is backed by the immense domestic demand and investment. The Civil Aviation Authority in December 2023 reported that nearly 2,320 aircraft will retire in 2042, expecting continued fleet modernization, creating a captive aircraft turbofan engine market for engines in China. China's aviation authority actively supports this modernization, having approved a comprehensive roadmap for the development of green, smart, and safe aviation technologies by 2035, which includes significant funding for next-generation engine R&D.

India’s aircraft turbofan engine market is expanding rapidly via foreign technology partnerships and ambitious domestic manufacturing goals. This is positioning the country as a global aerospace and MRO hub. A transformative development was the June 2023 agreement between GE Aerospace and Hindustan Aeronautics Limited. Sanctioned by the U.S. government, this deal facilitates the co-production of the GE F414 engines in India. These engines will power the Tejas MkII fighter and future advanced aircraft. This initiative is a direct outcome of India’s defense offset policy and aligns with the broader Make in India campaign, which aims to develop a comprehensive indigenous defense industrial ecosystem and significantly increase the sector’s contribution to the national economy.

Europe Market Insights

Europe’s aircraft turbofan engine market is a global powerhouse anchored by the engineering prowess of its top player such as Rolls-Royce in the UK, Safran in France, and MTU Aero Engines in Germany. The region’s strategy is defined by the deep collaborative partnerships, most notably the Franco-American CFM International Joint venture between GE and Safran, which dominates the narrow-body segment. The core aircraft turbofan engine market drivers include the robust EU emissions regulations pushing the development of revolutionary technologies, such as the open rotor CFM RISE program and the continent's ambitious military programs, the Franco-German Spanish Future Combat Air System, and the UK-led Tempest, which are funneling billions in government R&D funding into the next-gen adaptive cycle and high-thrust military engine.

The aircraft turbofan engine market in Germany is defined by its role as a world-leading specialist in high-integrity engine modules and advanced manufacturing, serving as a critical tier one supplier to the global OEMs rather than a full engine prime contractor. Its industrial backbone, MTU Aero Engines, is a pivotal partner in major programs such as the Pratt & Whitney GTF and the Rolls-Royce UltraFan, specializing in high-pressure compressors and low-pressure turbines. A key government backed initiative driving technological advancement is the National Aerospace Research Program, which funds advanced R&D. For instance, the RWI May 2024 report depicts that LUFO VI-1 project for the year 2020 to 2024 allocated 164 million for the east region mainly for the research into next generation climate neutral propulsion technologies including advanced components for future engines securing Germany’s position in the high value segment of the global supply chain.

Source: RWI May 2024

France’s aircraft turbofan engine market is dominated by Safran Aircraft Engines, a global prime contractor and the co-leader of the CFM International joint venture that holds a commanding share of the global narrow-body engine market with its LEAP engine. The strategy is heavily oriented toward state-supported innovation for next-gen sustainability. A flagship initiative is the France 2030 investment plan, which earmarks substantial funds for decarbonizing aviation. Safran is the lead industrial partner in the CFM RISE Technology Demonstration Program launched in June 2021, which aims to develop an advanced open fan engine architecture targeting 20% reduction in fuel consumption compared to today’s most efficient models, securing France’s leadership in defining the future of commercial propulsion.

Key Aircraft Turbofan Engine Market Players:

- Pratt & Whitney (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- General Electric (GE) Aerospace (U.S.)

- Rolls-Royce (UK)

- Safran Aircraft Engines (France)

- CFM International (U.S.)

- International Aero Engines (IAE)

- Engine Alliance (U.S.)

- MTU Aero Engines (Germany)

- Avio Aero (Italy)

- IHI Corporation (Japan)

- Mitsubishi Heavy Industries Aero Engines (Japan)

- Kawasaki Heavy Industries (Japan)

- Honeywell Aerospace (U.S.)

- Textron Aviation (U.S.)

- GKN Aerospace (UK/Sweden)

- Bharat Electronics Limited (BEL) (India)

- Hindustan Aeronautics Limited (HAL) (India)

- Korean Aerospace Industries (KAI) (South Korea)

- Composite Technology Research Malaysia (CTRM) (Malaysia)

- Quickstep Holdings (Australia)

- Pratt & Whitney is the dominant player competing intensely in the aircraft turbofan engine market by pioneering geared turbofan technology. The company's strategic initiative focuses on fuel efficiency and noise reduction, targeting the next-gen narrowbody aircraft to capture the aircraft turbofan engine market share from competitors and secure long term service agreements.

- General Electric Aerospace leverages its deep expertise in material science and digital analytics within the aircraft turbofan engine market. A key initiative is the development of the GE9X for widebody efficiency and the RISE program investing in open fan architectures and sustainable aviation fuel compatibility to define the future of propulsion. The company has invested USD 2.7 billion in research and development in open fan engine architecture in 2024.

- Rolls-Royce adopts a strategic focus on the high-thrust widebody segment of the aircraft turbofan engine market. Their initiatives center on the UltraFan engine design for unprecedented efficiency and building comprehensive TotalCare service networks, ensuring profitability via the entire engine lifecycle. The total R&D in 2024 was 2024 £133 million.

- Safran Aircraft Engines strengthens its position in the aircraft turbofan engine market via the revolutionary LEAP engine program and heavy investment in sustainable R&D. The key strategies include leading the CFM RISE open fan project and vertical integration, controlling advanced component manufacturing like ceramic matrix composites.

- CFM International, the dominant joint venture, maintains its lead in the narrowbody aircraft turbofan engine market via the high-volume LEAP engine. Its primary strategic initiative is the forward-looking RISE technology demonstration program, aiming to develop a radically efficient hydrogen-capable engine for the 2030s.

Here is a list of key players operating in the global aircraft turbofan engine market:

The aircraft turbofan engine market is an oligopoly dominated by a few integrated giants from the U.S. and Europe, defined by the immense capital barriers and technological complexity. The key strategic initiatives are focused on the next-generation propulsion for sustainability. Leaders are heavily investing in advanced technologies such as geared turbofans, open rotor concepts, and hybrid electric research. For example, in May 2024, FTAI Aviation agreed to purchase Lockheed Martin Commercial Engines Solutions. Concurrently securing lucrative aftermarket service contracts via Power by the Hour models is crucial for long-term revenue. To mitigate risk and access global talent, strategic international partnerships and supply chains are essential, involving the specialized manufacturers from Japan, India, and other nations as vital tier one suppliers in composites, castings, and subsystems.

Corporate Landscape of the Aircraft Turbofan Engine Market:

Recent Developments

- In September 2025, Honeywell has unveiled a new small-thrust-class engine, the HON1600, for the collaborative combat aircraft (CCA) and unmanned aircraft system (UAS) market during the annual Air, Space & Cyber Conference organized by the Air & Space Forces Association in Washington, D.C.

- In January 2025, Safran Aircraft Engines announced that it had finalized the acquisition of Component Repair Technologies (CRT), a world leader in the repair of aircraft engine parts with a 450-plus workforce based in Mentor, Ohio.

- In August 2024, StandardAero has announced that it has acquired Aero Turbine Inc., a comprehensive provider of maintenance, repair, and overhaul (MRO) services and consultative repair solutions for military engines and accessories from Gallant Capital, a Los Angeles-based private equity firm.

- Report ID: 2758

- Published Date: Dec 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Turbofan Engine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.