Aircraft Recycling Market Outlook:

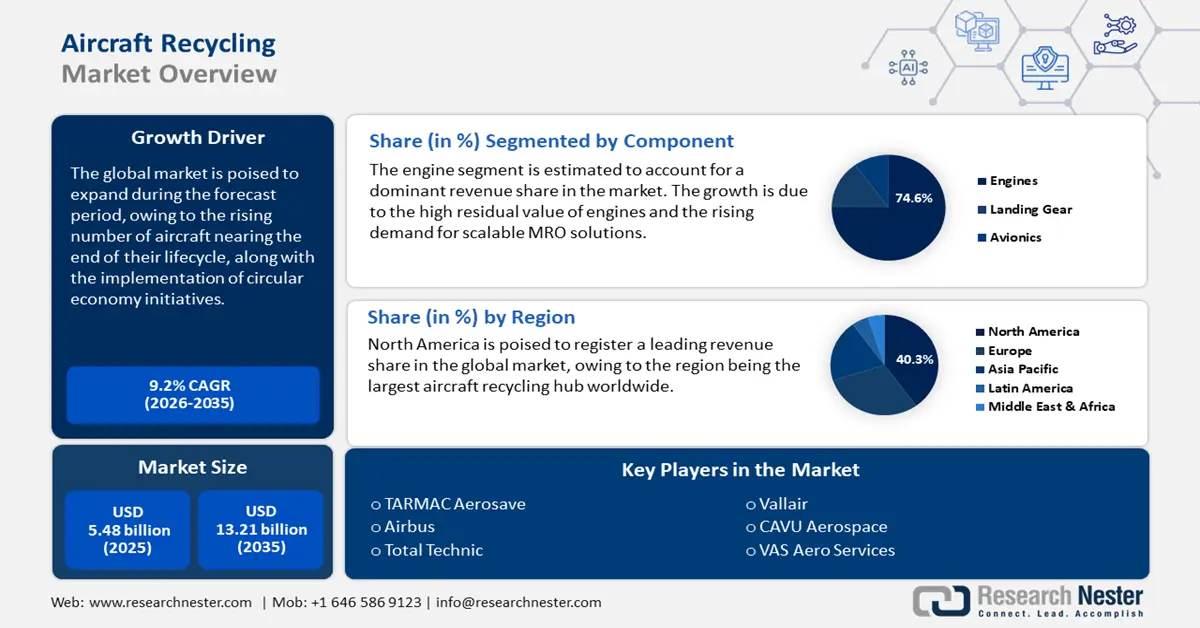

Aircraft Recycling Market size was over USD 5.48 billion in 2025 and is projected to reach USD 13.21 billion by 2035, growing at around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aircraft recycling is evaluated at USD 5.93 billion.

The aircraft recycling industry is dependent on the guidelines provided by the Aircraft Fleet Recycling Association (AFRA) on import and export regulations, tax considerations, customs valuations, and various restrictions on export. In the economic indicators of the sector, the Producer Price Index (PPI) for final demand has notably increased by 0.6% in March 2025. The change highlights a minuscule reduction in the prices received by producers for their output. Additionally, the Consumer Price Index (CPI) has notably increased for all urban customers by around 2.6% in one year from March 2024 to March 2025. The increase is an indication of a general spike in consumer prices.

Key Trends

|

Category |

Metric |

Value |

Year |

|

Aircraft Recycling Supply Chain |

Estimated number of aircraft disassembled and recycled annually |

410–460 aircraft |

2023–2024 |

|

|

The estimated value of the aircraft parts market is driven by recycle Ng |

$2.3 billion |

2023 |

|

Producer Price Index (PPI) |

Final demand (seasonally adjusted) |

-0.6% |

March 2025 |

Furthermore, the growth in investments to bolster technological advancements has become a cornerstone in improving the efficiency of the recycling process. The FAA’s Continuous Lower Energy, Emissions, and Noise (CLEEN) program, which began in 2010, reflects profitable private-public partnerships to bolster the development of aircraft technologies that are sustainable. In concurrence, the EC Leach technology has been attracting considerable investment, with an incentive package above USD 1 billion allocated for Platinum Group Metals in El Salvador. The trends bode well for the market’s consistent growth during the anticipated timeline.

Key Aircraft Recycling Market Insights Summary:

Regional Highlights:

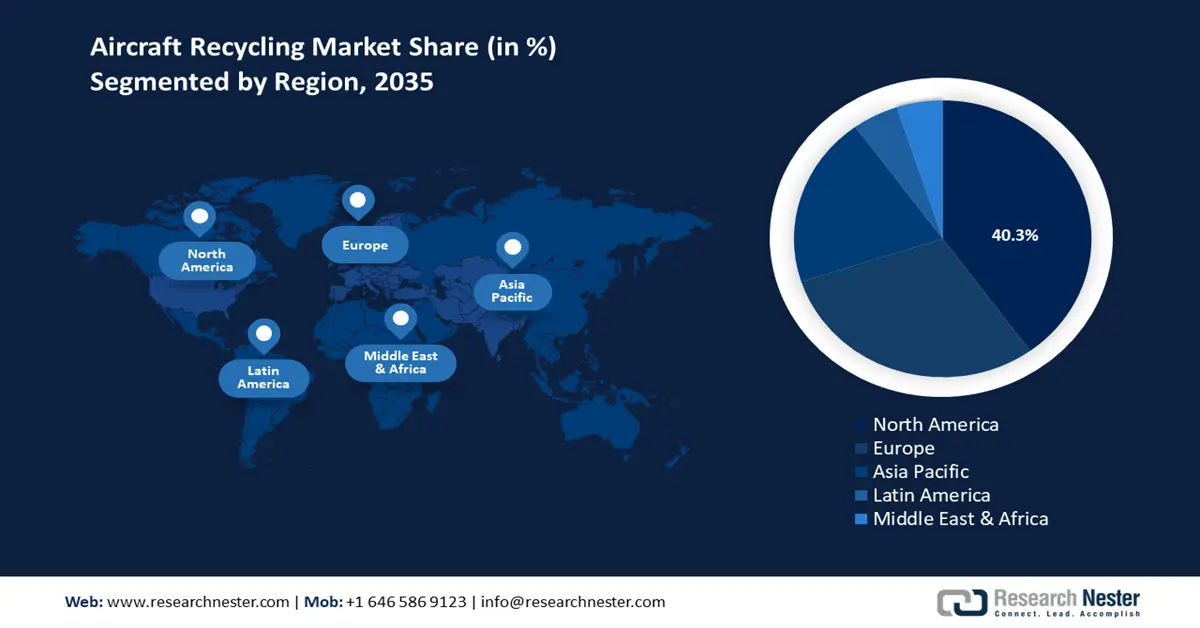

- North America aircraft recycling market will hold around 40.30% share by 2035, driven by the large aircraft fleet and early adoption of circular economy practices.

Segment Insights:

- The engine segment in the aircraft recycling market is forecasted to achieve a 74.60% share by 2035, driven by the high residual value of engines and demand for cost-effective MRO solutions.

- The aluminum segment in the aircraft recycling market exhibits robust growth, driven by its high recyclability across multiple sectors, 2026-2035.

Key Growth Trends:

- Surge in retired aircraft

- Stringent environmental regulations

Major Challenges:

- Diverse regulations across regions

- Substantial capital requirements

Key Players: TARMAC Aerosave, Airbus, Air Salvage International, Total Technic, Vallair, CAVU Aerospace, ComAV Technical Services, Sycamore Aviation, Falcon Aircraft Recycling, VAS Aero Services.

Global Aircraft Recycling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.48 billion

- 2026 Market Size: USD 5.93 billion

- Projected Market Size: USD 13.21 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, France

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 9 September, 2025

Aircraft Recycling Market Growth Drivers and Challenges:

Growth Drivers

- Surge in retired aircraft: A major trend driving the sector’s growth is the considerable number of aircraft reaching the culmination of their operational life. In approximation, around 700-1100 commercial aircraft are retired worldwide annually. Market projections of the aviation industry reflect that by the end of 2040, more than 16,000 aircraft may be retired worldwide. The trend is supported by the rapid fleet modernization efforts, especially in the established economies. In modernization efforts, older models are retrofitted with components to create fuel-efficient aircraft models, which in turn adds to the demand for recycling solutions.

- Stringent environmental regulations: The environmental regulations around the world are tightening, supported by international bodies and governments, to mitigate the ecological footprint of the aviation sector. Moreover, the net-zero initiatives pledged by a majority of countries are set to further impact the sector as time passes. For instance, initiatives such as the Clean Sky 2 program of the European Union (EU) assist in the reduction of CO2 emissions by more than 70%, while also reducing nitrogen oxides by more than 90% and aircraft noise by more than 60%. These strict regulations have ensured that companies in the sector must embrace sustainable practices, including the recycling of aircraft materials to align with lofty ESG goals.

Statistical Analysis

|

Metrics |

Value |

|

Annual retired commercial aircraft |

700–1,100 units |

|

Projected retired aircraft by 2040 |

Up to 16,000 units |

|

Clean Sky 2 CO₂ emission reduction target |

70% |

|

Clean Sky 2 NOₓ emission reduction target |

95% |

|

Clean Sky 2 aircraft noise reduction target |

60% |

Major Technological Innovations in the Aircraft Recycling Market

The global aircraft recycling sector is characterized by a rapid transformation. The industry-wide transition is impacted by the advent of new technologies that are aimed at boosting sustainability and operational efficiency. With a rising number of retired aircraft and tightening environmental regulations, major players in the industry are investing in tools such as blockchain, AI and cutting-edge recycling technologies to extract the optimum percentage of value from end-of-life aircraft components.

|

Technology |

Application |

Projected Market Size |

Year |

|

Blockchain |

Supply chain transparency in aviation |

USD 5.8 billion |

2035 |

|

AI |

Waste management and recycling optimization |

USD 20.2 billion |

2035 |

Sustainability Initiatives in the Aircraft Recycling Market

Sustainability initiatives are the cornerstone of the global aircraft recycling industry. The aviation sector contributes more than 2.0% to the global CO2 emissions. Hence, with the net-zero goals looming large, the push towards decarbonizing supply chains whilst proactively adopting renewable energy sources has intensified throughout the aviation industry. Major companies in the sector are actively implementing robust measures to usher in a reduction the carbon emissions and transition to renewable energy sources while ensuring that ROI is not adversely impacted. Below is an analysis of the major sustainability initiatives undertaken by key players in the aircraft recycling industry:

|

Company |

Sustainability Initiatives |

2030 Vision & Goals |

Business Impact |

|

Boeing |

- 9.7M gallons SAF in 2024 (+65% YoY) |

- Net-zero by 2050 |

- Boosted ESG ratings |

|

Airbus |

- Hydrogen, SAF & hybrid-electric roadmap |

- 2030: Cut CO₂ via hybrid/hydrogen |

- Innovation leadership |

|

Qantas |

- Zero landfill waste by 2030 |

- Net-zero by 2050 |

- OPEX reduction |

AI & ML Impact on the Aircraft Recycling Market

Market analysis indicates that the market has become increasingly complex. The integration of AI and ML has transformed the management of aging fleets by MROs, OEMs, recyclers, etc. AI-based analysis is actively used to automate inspection, implement predictive maintenance, and optimize the recovery value of end-of-life high-value components. Furthermore, AI assists in the reduction of costs associated with manual labor while recycling workflows. The table below indicates the impact of AI & ML on the aircraft recycling market:

|

Company |

Integration of AI & ML |

Outcome |

|

Qantas |

Implemented "Constellation" AI system for dynamic flight routing and fuel management. |

Achieved 3% fuel savings, equating to $95 million annually. |

|

Airbus |

Deployed Air-Cobot, an autonomous robot for aircraft inspection and maintenance. |

Reduced inspection time, enhancing aircraft availability, and reducing maintenance costs. |

|

Ryanair |

Utilized AI to select the most fuel-efficient aircraft for specific routes. |

Improved fuel efficiency by optimizing aircraft deployment. |

Supply Chain Resilience Strategies in the Aircraft Recycling Market

Trends in the market highlight initiatives undertaken to bolster supply chain resilience. Against the backdrop of a rise in geopolitical tensions and trade conflicts, it is essential to safeguard the supply chains to mitigate material shortages, whilst adhering to sustainability mandates. Major players in the market are actively diversifying their supplier bases, whilst leveraging digital technologies to stabilize operations. The table below highlights supply chain resilience strategies in the sector:

|

Company |

Strategy |

2023–24 Outcome |

|

Airbus |

Implemented the Skywise platform utilizing AI and ML for predictive maintenance and supply chain optimization. |

Connected 11,800 aircraft by late 2024; reduced unscheduled maintenance events |

|

Boeing |

Adopted automation and AI in manufacturing processes to improve efficiency |

Accelerated delivery timelines and reduced operational costs |

|

Qantas |

Employed AI-driven analytics for strategic investment planning |

Optimized route development and fleet expansion decisions |

Challenges

- Diverse regulations across regions: A major challenge in the aircraft recycling industry is navigating the complex regulatory landscapes, which differ based on regions. Moreover, adhering to compliance guidelines requires the investment of considerable resources, posing constraints for companies with businesses in multiple jurisdictions. The fragmented regulations also adversely impact the ease of doing business.

- Substantial capital requirements: The establishment of aircraft recycling facilities requires substantial capital investment in workforce training, specialized equipment, facilities, etc. Additionally, for companies to remain competitive in the market, the recycling facilities have to integrate cutting-edge technologies, which adds to cost as well as creates constraints for smaller market players in entering the sector.

Aircraft Recycling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 5.48 billion |

|

Forecast Year Market Size (2035) |

USD 13.21 billion |

|

Regional Scope |

|

Aircraft Recycling Market Segmentation:

Component Segment Analysis

The engine segment is poised to account for the largest revenue share of 74.6% in the aircraft recycling market by the end of 2035, owing to high residual value of engines, which constitutes more than 75% of the total value of an aircraft. Moreover, the rising demand for scalable and cost-effective MRO solutions has led to an uptick in the refurbishment of aircraft engines. Opportunities are set to be rife in the emerging economies where the labor costs are comparatively lower and the adoption of used serviceable materials (USM) is prevalent. Another key factor supporting growth is the continuous advancements in engines, which require the upgrade and retrofitting of outdated models.

Material Segment Analysis

The aluminum segment in aircraft recycling market is estimated to exhibit robust growth during the forecast timeline. The high recoverability rate, exceeding 85%, makes aluminum a vital material in end-of-life aircraft dismantling. Moreover, aluminum is cost-effective in the recycling process and can be used in multiple sectors such as aerospace, automotive, and construction. Furthermore, as of 2024, a retired aircraft yields more than 60-80 tons of recyclable aluminum, and with over 16,000 aircraft expected to retire globally by the end of 2040, the calls for this material are predicted to rise exponentially. Key investment areas include aluminum recovery solutions for the near future.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Material |

|

|

Aircraft Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Recycling Market Regional Analysis:

North America Market Insights

The North America aircraft recycling market is projected to hold a dominant revenue share of 40.3% by the end of 2035. Regionally, North America is the largest aircraft recycling hub, bolstered by the presence of the U.S. with its expansive aircraft fleet and early adoption of circular economy practices.

The U.S. market is poised to be the largest sector in North America. The regional supply chain in the U.S. is anchored by key MRO facilities, parts resellers, and salvage yards in Texas, Arizona, and California. The U.S. also boasts a strong aftermarket demand for reclaimed parts and leads in high-volume dismantling and material recovery.

Canada has a strong market presence in North America, with the country investing in the expansion of commercial and defense fleets. The fleet expansion initiatives tie with the demand for aircraft recycling. Moreover, Canada supports regional operations via component processing and ICT-enabled logistics optimization, creating a tri-national recycling corridor in North America along with the U.S. and Mexico. Despite the progress, recent tariff conflicts in the region can cause challenges to the supply chain.

Europe Market Insights

Europe represents one of the most mature and policy-driven aircraft recycling markets globally. It is also set to maintain its position as the second-largest market regionally, owing to the UK, Germany, and France leading the region in circular economy adoption, aerospace decommissioning, and digital traceability for end-of-life aircraft. In Europe, the supply chain spans MRO hubs and indicates a sprawling system benefiting the market players.

Germany remains a major market in Europe. Market analysis estimates that around 3.0% of the budget was allocated to ICT initiatives benefiting aircraft recycling in 2023, highlighting a 2.0% change from 2021. Moreover, EU-wide frameworks such as the European Green Deal and Digital Europe Program integrate innovations into aviation operations.

The France aircraft recycling market is set for robust growth during the anticipated timeline. Due to growing strategic investments in decarbonizing the aviation sector, aircraft recycling initiatives are being prompted. For instance, as per the France 2030 investment plan, the government has committed €300 million annually from 2024 to 2030 in R&D activities aimed at reducing emissions. The funding is set to benefit the development of cleaner fuels, which in turn will assist in market growth.

Aircraft Recycling Market Players:

- TARMAC Aerosave

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Airbus

- Air Salvage International

- Total Technic

- Vallair

- CAVU Aerospace

- ComAv Technical Services

- Sycamore Aviation

- Falcon Aircraft Recycling

- VAS Aero Services

- Aviation International Recycling

- ADI-Aircraft Demolition & Recycling

- KLM UK Engineering

- AELS

- Aerocycle

The rising number of fleets retiring, along with sustainability guidelines and technological advancements, has created market forces supporting the continued expansion of the aircraft recycling industry. Leading companies in the sector are actively investing in expanding market presence. For instance, in May 2024, ATR and TARMAC Aerosave strengthened their partnership to improve aircraft recycling and dismantling processes. This move indicates the industry’s shift towards sustainable aviation. Furthermore, Airbus reported the leveraging of AI-integrated sorting technologies to bolster aluminum recovery rates over 20%.

Here is a list of key players in the global market:

Recent Developments

- In January 2024, Airbus inaugurated the ALSC in Chengdu, China. The one-of-a-kind facility includes parking, maintenance, storage, conversions, dismantling, and recycling services spanning more than 700,000 square meters. The facility seeks to recover more than 90% of the aircraft’s weight during the dismantling process.

- In September 2024, Unical Aviation announced the acquisition of ecube Solutions. The latter is a leading industry player in aircraft disassembly, storage, and transition services, and the acquisition is set to bolster Unical’s capabilities in the EMEA region

- In July 2024, AFI KLM E&M and Parker Aerospace Group announced the achievement of a major milestone by deploying SkyThread’s blockchain-based aircraft parts track and trace platform for the 787 fleet. The announcement is set to improve the comprehensive tracking of aircraft parts at various stages from manufacturing to decommissioning.

- Report ID: 4098

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Recycling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.