Air Fryer Market Outlook:

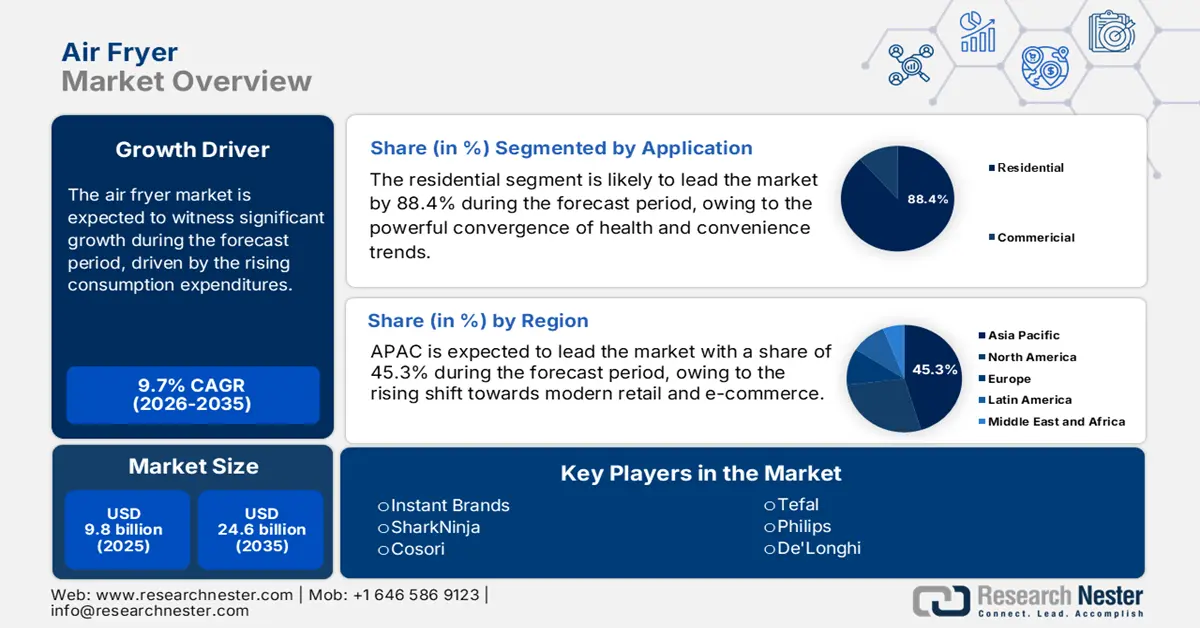

Air Fryer Market size was valued at USD 9.8 billion in 2025 and is projected to reach USD 24.6 billion by the end of 2035, rising at a CAGR of 9.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of air fryer is assessed at USD 10.7 billion.

The demand environment for small kitchen cooking appliances, including air-frying units, has been shaped by consumption expenditures, import dependencies, and supply-side manufacturing indicators. Personal consumption expenditures for small electric appliances climbed from USD 11,750 billion in Q1 2025 to USD 11,891 billion in Q2 2025, according to BEA statistics released in September 2025. Further, as per the OEC 2023 data, the global trade of domestic electric housewares reached USD 30.2 billion in 2023. These figures indicate the industry’s heavy dependence on Asia-based component manufacturing and final assembly. Regulatory frameworks that are mainly concerned with energy consumption and material safety continue to evolve, mandating continuous adaptation in product design and manufacturing processes across the supply chain.

The distribution landscape for the air fryers has undergone a significant transformation with a structural shift in the e-commerce channels. This transition was surged by the changes in the consumer purchasing behavior, as stated in the official retail trade data. Further post-pandemic analysis depicts that there is a strong and permanent elevation in the online share of small appliance sales, which necessitates the manufacturers and distributors to prioritize digital shelf presence and logistics for direct-to-consumer shipping. Concurrently, international trade policies and tariffs on small electrical appliances influence sourcing decisions and final product pricing. From a regulatory standpoint, manufacturers are increasingly engaged with waste electrical and electronic equipment directives and energy labeling requirements, such as the EU Energy Label, which are becoming critical factors in product development and market access across various regions.

Key Air Fryer Market Insights Summary:

Regional Insights:

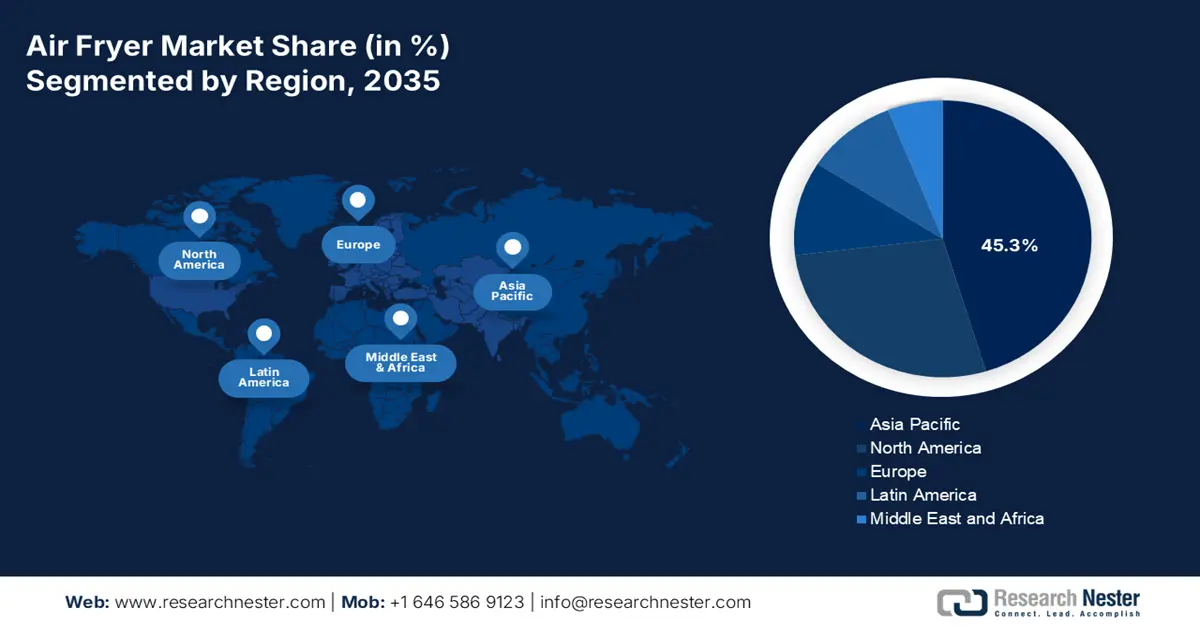

- By 2035, the Asia Pacific region is expected to secure a 45.3% share in the air fryer market, bolstered by rapid urbanization and the growing adoption of modern retail and e-commerce ecosystems.

- During 2026–2035, North America is set to expand at a CAGR of 4.5%, strengthened by rising household penetration and heightened consumer focus on premium product replacement.

Segment Insights:

- By 2035, the residential segment in the air fryer market is projected to command an 88.4% share, supported by the strong convergence of health consciousness and convenience-focused cooking preferences.

- By 2035, the online sub-segment is anticipated to lead the distribution channel segment with a considerable share, underpinned by rising influencer-driven engagement and increasing reliance on e-commerce product evaluations.

Key Growth Trends:

- Health and wellness policy alignment

- WHO guidelines on the fat reduction

Major Challenges:

- Strong regulatory compliance and safety standards

- Rapid pace of technology innovation

Key Players: Instant Brands (U.S.), SharkNinja (U.S.), Cosori (U.S.), Tefal (France), Philips (Netherlands), De'Longhi (Italy), Sage (UK), Russell Hobbs (UK), Princess (Netherlands), Klarstein (Germany), LG Electronics (South Korea), Samsung (South Korea), Cuckoo Electronics (South Korea), Toshiba (Japan), Mitsubishi Electric (Japan), Sharp (Japan), Breville (Australia), Philips India (India), Wonderchef (India), Pensonic Holdings (Malaysia).

Global Air Fryer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.8 billion

- 2026 Market Size: USD 10.7 billion

- Projected Market Size: USD 24.6 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.3% Share by 2035)

- FastesEmiratest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, United Arab

Last updated on : 26 November, 2025

Air Fryer Market - Growth Drivers and Challenges

Growth Drivers

- Health and wellness policy alignment: The government-led public health campaign promoting reduced fat consumption directly benefits the adoption of air fryers. Agencies such as the World Health Organization have advised reducing the intake of saturated and trans fats to avoid cardiovascular diseases. The Cleveland Clinic data in January 2024 has indicated that air fryers reduce the usage of oil by 80% compared to deep frying and are positioned as a practical solution for households to align with these guidelines. As a result, preventative health becomes a powerful demand driver. Manufacturers can use this by underpinning the specific nutritional benefits in marketing and seeking endorsements from public health bodies.

- WHO guidelines on the fat reduction: The global public health agenda, as stated by the WHO, actively promotes the reduction in the consumption of saturated and trans fats to avoid certain diseases. Air fryer technology directly supports this initiative by enabling the preparation of foods with lower oil content compared to the traditional method of cooking. This creates a powerful demand and an evidence-based marketing narrative for the manufacturers. By relating the product benefits to the WHO guidelines, companies strengthen their brand position and further enhance the credibility with health-conscious consumer, and differentiate their offering in the crowded marketplace. This strategic partnership with an internationally renowned health authority provides an alluring value proposition that goes beyond practicality and capitalizes on a larger cultural movement toward preventive wellness.

- Rising spending on household appliances: The annual expenditure on the consumer unit reached USD 77,280 in 2023, with household appliance expenditures being the major and increasing component, based on the data released in September 2024 by the U.S. Bureau of Labor Statistics. This sustained investment in the upgrades of the kitchen appliances and advanced cooking technology aims for a strong and resilient market for products such as air fryers. This data provides a critical opportunity for manufacturers and suppliers. Further, the data also validates a strategy focused on boosting the distribution via major U.S. retail partnerships and developing bundled product offerings. To take advantage of this proven readiness to spend on household durables and increase the share of the market, companies must partner with merchants who can effectively reach these engaged consumers.

Challenges

- Strong regulatory compliance and safety standards: The manufacturers navigate the complex electrical safety, material safety, and electromagnetic compatibility regulations that vary by region. The non-compliance can lead to costly recalls and reputational damage. Instant Brands has arranged a separate compliance team to manage this across its product lines. The U.S. Consumer Product Safety Commission has announced a focus on the safety of cooking appliances, increasing inspections on all the new startups in the market, and on their manufacturing process.

- Rapid pace of technology innovation: In order to stay competitive in the market, companies require continuous R&D by integrating smart features and cooking algorithms. The new startup companies must invest significantly just to keep pace. For instance, companies such as LG and Samsung incorporate their air fryers into a broader smart home ecosystem, which is a high R&D challenge. SsharkNinja consistently files numerous patents for its cooking technology, creating a patent moat that protects its innovations and legally challenges potential infringers, creating a significant roadblock for followers.

Air Fryer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 9.8 billion |

|

Forecast Year Market Size (2035) |

USD 24.6 billion |

|

Regional Scope |

|

Air Fryer Market Segmentation:

Application Segment Analysis

Under the application segment, residential is dominating the segment and is set to hold the share value of 88.4% by 2035. The segment dominance is due to the powerful convergence of health and convenience trends. A global rise in health consciousness is a primary driver, with consumers actively seeking practical methods to reduce oil consumption for improved cardiovascular outcomes. This aligns directly with the public health guidance from organizations such as WHO, which advises taking reduced fat to avoid chronic diseases. Further, the rising demand for time-saving and convenient cooking solutions demands the air fryer as an essential kitchen appliance, hence providing a simplified path for preparing meals with less effort and cleanup.

Distribution Channel Segment Analysis

By 2035, online sub segment is expected to lead the distribution channel segment and is poised to hold a considerable share value during the forecast period. The segment is driven by the unparalleled convenience, rising influencer marketing, and vast product selection. Consumers always rely on detailed reviews, video demos, and comparison tools on e-commerce platforms to inform their purchases. The August 2025 data from the U.S. Census Bureau, e-commerce sales in the second quarter of 2025 accounted for USD 304.2 billion, which is an increase of 1.4% from the first quarter. According to this data, online shopping for consumer durables has been steadily increasing since the pandemic, and the shift in customer behavior has validated this, hence making the digital storefront the primary sales channel for appliances, including air fryers.

Basket Style Segment Analysis

In the basket style segment, the square or oval basket style is expected to maintain the highest revenue share by 2035. The dominance is due to the superior capacity and efficient use of kitchen counter space. This design of the air fryer is developed to use larger or irregularly shaped food items more effectively than cylindrical models, which aligns with the consumer demand for versatility when cooking for families. The preference for practical, multi-functional home appliances is a main market driver. The U.S. Bureau of Labor Statistics in December 2023 highlights that the average consumer unit spent over USD 9,343 on food at home, indicating the demand for kitchen tools that optimize the meal preparation efficacy and value, a need met by a square or oval air fryer.

Our in-depth analysis of the air fryer market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Basket Style |

|

|

Price Range |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Fryer Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the market and is expected to hold the market share of 45.3% by 2035. The market is driven by rapid urbanization and the rising shift towards modern retail and e-commerce. Countries such as China and India are actively adopting Western cooking trends and also focusing on health-conscious appliances, which is the primary demand fueling the market. The key drivers are the government initiatives promoting healthy lifestyles to reduce the growing rates of obesity and the influence of digital media showcasing the convenience. A dominant trend is the demand for compact and multi-cooker models that are suited to smaller urban kitchens. The region also presents a significant replacement market in mature economies like Japan and South Korea, where consumers seek advanced, connected features.

China’s air fryer market is leading the APAC region and is driven by a robust manufacturing base, strong e-commerce penetration, and the growing urban middle class. Consumer demand is highly reliant on the health consciousness that aligns with the Healthy China 2030 initiative on improved nutrition. Companies such as Supor and Midea dominate via advanced smart features and competitive pricing. According to the People’s Republic of China data in July 2023, the online retail sales of physical goods increased by 10.8% in 2023. This data indicates the critical e-commerce channel that surges the appliance sales, including air fryers. This growth of the market is expected to continue, setting the online platforms as the primary sales channel. On the other hand, to take advantage of this growing market, manufacturers are also prioritizing direct-to-consumer tactics and collaborations with significant e-commerce giants.

The air fryer market in India is growing rapidly and is fueled due to the expansion of modern retail. The government initiative, such as Make in India, supports local manufacturers to make appliances more affordable. Further, the young population in the country is actively adopting these appliances for their convenience and perceived health benefits over traditional frying. The OEC 2023 data depict that India has exported over USD 99.5 million worth of domestic electric housewares, which include air fryers. This data underscores the strong demand that is driving the market expansion for kitchen appliances. Further, this export growth data not only satisfies the domestic demand but also positions India as an emerging manufacturing hub in the global market, attracting investment further in the sector.

North America Market Insights

North America is the fastest growing market and is expected to grow at a CAGR of 4.5% during the forecast period 2026 to 2035. The market is driven by the household penetration and a focus on product replacement and premiumization. The key drivers of the market include strong consumer expenditure on household appliances, as stated in the U.S. Bureau of Labor Statistics. Further, the sustained consumer base focuses on health-conscious cooking methods, which can reduce oil consumption, aligning with the public health guidelines. The primary trend is the rising shift towards the smart connected appliances with the multi-functionality integrating with broader smart home ecosystems. The market is highly competitive, with success hinging on innovation, strategic e-commerce placement, and leveraging established retail partnerships.

The U.S. market is leading the North America market and is defined by the trend towards advancement in technology in household appliances, including air fryers. The consumers are moving from the basic to advanced smart appliances with Wi Fi connectivity, companion apps for recipe guidance, and multi-cooking functionalities that replace several single-use devices. This is related to the high consumer expenditure on household durables and a focus on convenience. As per the OEC 2023 data, the U.S. has imported over USD 1.67 billion worth of domestic appliances with electric motors, which include air fryers. This data highlights the rising demand for household appliances in the country. Market players are actively competing via innovation in digital features and using strong e-commerce channels to reach a tech-savvy consumer base, making the replacement cycle a primary sales driver.

In Canada, the air fryers market is mainly stimulated by the energy efficiency considerations and the demand for space-saving designs that are suited to urban living. The government standards under the National Energy Efficiency Act drive the manufacturers to aim for lower-wattage models that are cost-effective and meet the needs of environmentally conscious consumers. The market shows a distinct preference for compact, multi-functional units that provide baking, roasting, and air frying in one single component, hence maximizing the utility in Canada kitchen. According to OEC statistics from 2023, Canada exported household appliances with electric motor components valued at USD 5.76k, demonstrating the growing number of manufacturers in the market. This trend is further aided by the consumer spending patterns that favor versatile and efficient home appliances.

Domestic Appliances, with Electric Motor Including Air Fryer

|

Country |

Import (USD) |

Export (USD) |

|

U.S. |

1.67 billion |

6.84 million |

|

Canada |

273 million |

5.76 k |

Source: OEC 2023

Europe Market Insights

Europe market is defined by a strong consumer focus on health, premium product innovation, and energy efficiency. The demand is mainly driven by the alignment with the public health initiatives from the European Commission that advocate for reducing oil consumption and fat. Further robust EU energy labelling laws have also pushed manufacturers to innovate and make energy efficiency a key purchasing criterion. The most important trend is the change in consumer activity on the reliance on connected appliances that incorporate with the home ecosystem, mainly in Western Europe. The market growth is mainly dependent on the replacement cycles and trading up to multi-functional models. The market is highly competitive, with established brands like Tefal (France) and Philips (Netherlands) leveraging their strong regional presence.

Germany is expected to hold the largest share in the Europe air fryer market and is driven by its strong consumer base on engineering quality, energy efficiency, and product durability. The consumers in the country seek a high brand loyalty to both domestic and international brands that meet the strong performance criteria. The growth is driven by the country’s widespread awareness among consumers of the health and sustainability. The data from the German Federal Ministry for the Environment indicates that the national push for energy-efficient products via initiatives such as the Blue Angel eco label influences the purchasing decisions and makes energy saving a critical feature for market success.

The UK is set to be the second-largest market, and the growth is driven by the rising digital marketing, online competition, and high rate of new product launches. The market is defined by a strong consumer base with awareness of the food intake with low-carb and air-fried recipes, which is promoted by the National Health Service as a healthier alternative. Further, as per the government of UK statistics the family spending on the UK households allocate a significant portion of their budget towards electrical appliances, indicating a resilient market. The trend is towards compact, design-oriented models that suit urban kitchens, and the powerful presence of brands like Ninja and Tefal continues to stimulate a vigorous replacement cycle and market expansion.

Key Air Fryer Market Players:

- Instant Brands (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SharkNinja (U.S.)

- Cosori (U.S.)

- Tefal (France)

- Philips (Netherlands)

- De'Longhi (Italy)

- Sage (UK)

- Russell Hobbs (UK)

- Princess (Netherlands)

- Klarstein (Germany)

- LG Electronics (South Korea)

- Samsung (South Korea)

- Cuckoo Electronics (South Korea)

- Toshiba (Japan)

- Mitsubishi Electric (Japan)

- Sharp (Japan)

- Breville (Australia)

- Philips India (India)

- Wonderchef (India)

- Pensonic Holdings (Malaysia)

- Instant Brands has carved a significant position in the air fryer market by using its strong brand reputation from iconic products such as Instant Pot. Their strategic initiative focuses on multi-functionality and brand trust, providing devices that combine an air fryer with pressure cooking, roasting, and baking.

- SharkNinja has become a dominant player in the air fryer market via strong innovation and consumer-centric design. The company focuses on high-impact marketing and a portfolio that spans from entry-level to premium models. The net sales in 2024 reached USD 5.5 billion.

- Cosori has rapidly ascended in the competitive air fryer market by strategically highlighting smart technology integration and digital engagement. The product connects its appliances with a user-friendly mobile app, offering access to hundreds of recipes and customizable cooking programs.

- Tefal holds a strong position in the Europe air fryer market. Their strategy is to build a foundation of engineering excellence and a trusted brand heritage. Additionally, the company wants to focus on user-friendly features like digital interfaces and automatic programming, and develop cutting-edge, even-cooking technologies like the Turbo Star system.

- Philips is a leading and innovator leader in the air fryer market, which is largely defined by its patented TurboStar technology. Philips' core strategic initiative has been to own the health and wellness narrative, consistently promoting its air fryers as a solution for reducing fat intake by up to 90% compared to traditional frying.

Here is a list of key players operating in the global market:

The global air fryer market is very competitive and is defined by innovation and strategic diversification. The companies in the manufacturing of air fryers are actively investing in R&D to improve energy efficiency, integrate smart features, and improve the cooking performance. Market growth is another critical strategy that companies use to strengthen their distribution networks and forge tie-ups with retailers and e-commerce platforms to expand their reach. Brand positioning also remains important given that major players such as Samsung and LG compete on technology grounds, while others focus on low pricing or health-conscious marketing. Further, this involves mergers and acquisitions with a continued stream of new product launches in order for companies to maintain market share and satisfy consumers' changing preferences. For instance, Nestle has extended its range of air fryers in the U.S. with the intention of offering delightful meal moments in May 2025.

Corporate Landscape of the Air Fryer Market:

Recent Developments

- In June 2024, TTK Prestige Ltd. has announced the launch of the Prestige 4.5-liter Nutrifry air fryer. This product uses smart airflow 360-degree hot air circulation for frying, which result in a crisp texture.

- In February 2024, SharkNinja has unveiled a new product innovation and category expansions at its first EMEA product forum. The company has launched an industry-first vertically designed two-basket air fryer, the Ninja DoubleStack XL.

- Report ID: 2759

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Fryer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.