AIOps Market Outlook:

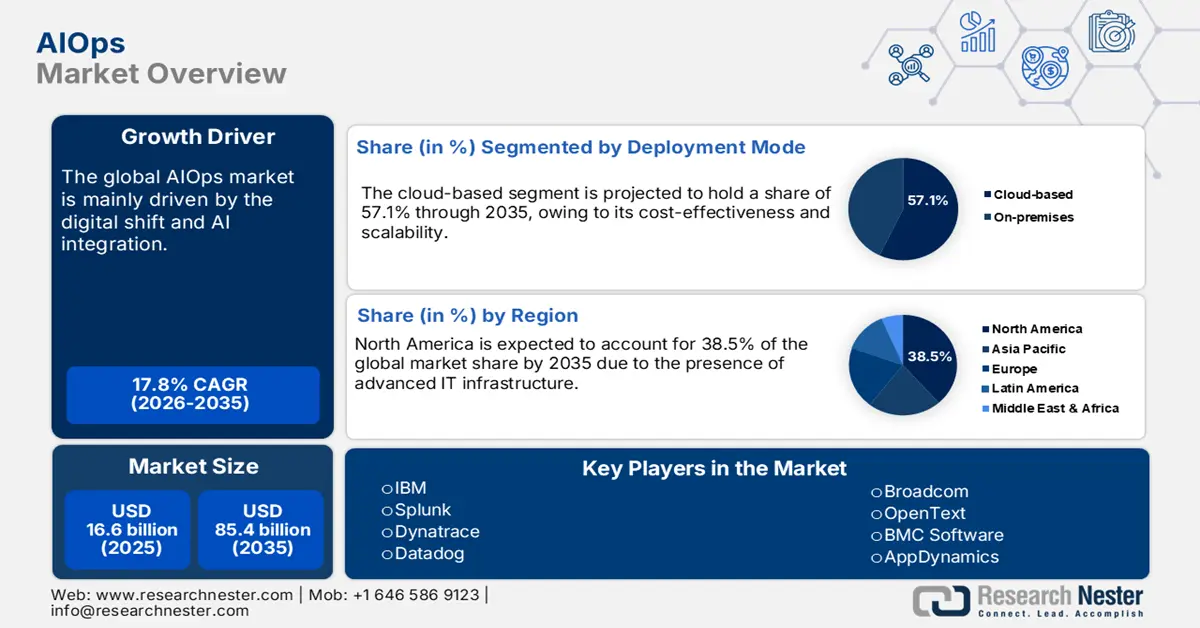

AIOps Market size was valued at USD 16.6 billion in 2025 and is projected to reach USD 85.4 billion by the end of 2035, rising at a CAGR of 17.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of AIOps is estimated at USD 19.5 billion.

The growth of the market is driven by the rising need for enhanced IT operations and the increasing inclusion of AI for better decision-making. Various government agencies, such as the U.S. General Services Administration (GSA), are harnessing the potential of AIOps to upgrade their IT services and infrastructure. The GSA’s Technology Transformation Services is highlighting the significance of considering ROI and costs related to the AIOps initiatives. The companies are making investments in software, hardware, and human capital. Other than this, the market is poised to witness significant growth due to a combination of factors such as international trade considerations and supply chain dynamics.

The market is also governed by the supply chain dynamics, as it affects the procurement of the hardware components, such as servers, semiconductors, and networking equipment. According to the data published by the U.S. Bureau of Economic Analysis in 2023, the exports of telecommunications, computer, and information services increased to USD 7.1 billion. The smooth trade of computers and peripheral equipment reflects a positive influence on the sales of AIOps solutions. According to the Federal Reserve Bank of St. Louis, the producer price index for computer and electronic product manufacturing stood at 106.876 in August 2025.

Key AIOps Market Insights Summary:

Regional Insights:

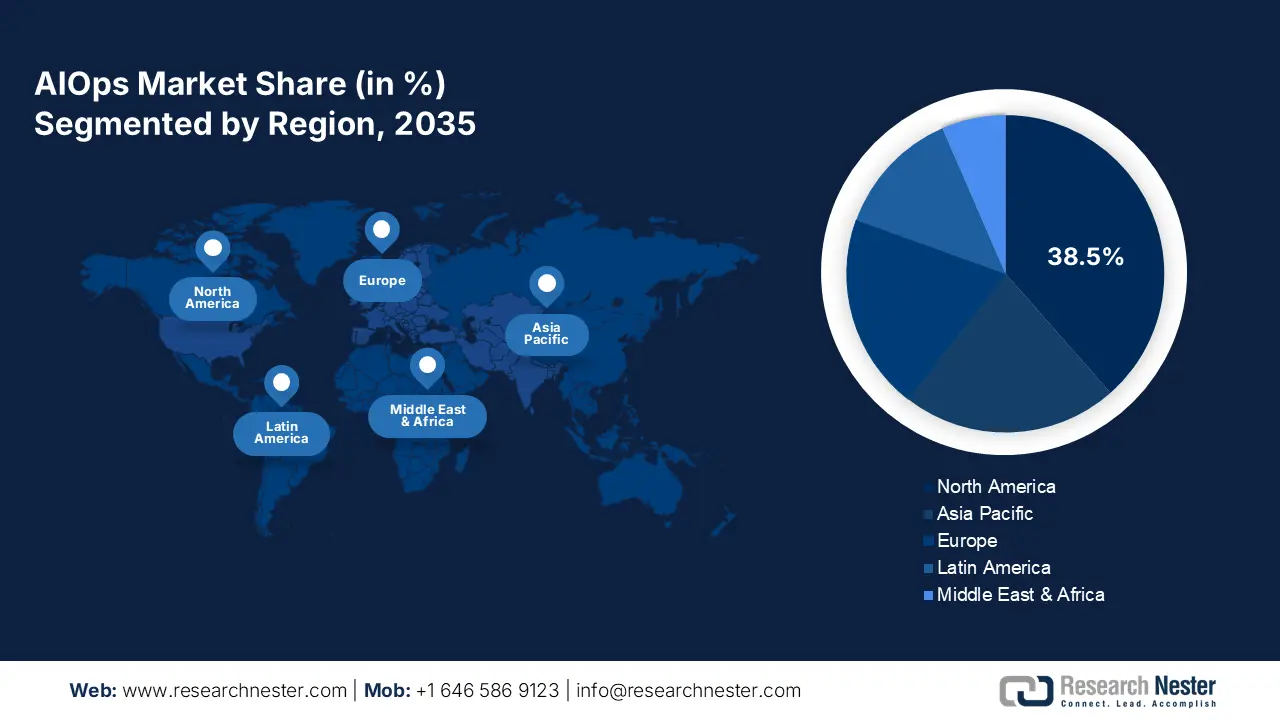

- Across 2026–2035, North America is projected to hold a 38.5% share of the AIOps Market, attributed to the presence of advanced IT infrastructure.

- By 2035, the Asia Pacific region is anticipated to command 28.3% of the market share, underpinned by the rising need for companies to manage high data generation.

Segment Insights:

- By 2035, the cloud-based segment in the AIOps Market is expected to account for a 57.1% share, fueled by escalating adoption of multi-cloud environments for IT operations.

- Across 2026–2035, the large enterprises segment is projected to secure a 73.5% share, sustained by the expanding need for distributed IT ecosystems.

Key Growth Trends:

- Adoption of the NIST Cybersecurity Framework (CSF) 2.0

- Surge in demand for operational efficiency

Major Challenges:

- Requirement for data sovereignty and localization requirements

- High initial costs

Key Players: IBM,Splunk,Dynatrace,Datadog,ServiceNow,Broadcom (CA Tech),OpenText (Micro Focus),BMC Software,AppDynamics (Cisco),Moogsoft,ScienceLogic,New Relic,BigPanda,AIMS Innovation,Interlink Software

Global AIOps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.6 billion

- 2026 Market Size: USD 19.5 billion

- Projected Market Size: USD 85.4 billion by 2035

- Growth Forecasts: 17.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: USA, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Australia, France

Last updated on : 3 October, 2025

AIOps Market - Growth Drivers and Challenges

Growth Drivers

- Adoption of the NIST Cybersecurity Framework (CSF) 2.0: There has been a mushrooming rise in the incidents of cybersecurity breaches all across the world. Taking this into consideration, the NIST Cybersecurity Framework 2.0 provides organizations with a well-structured guide to handle cybersecurity challenges effectively. The framework highlights the inclusion of cybersecurity into enterprises' risk management, which further emphasizes the adoption of automated solutions, including AIOps. This helps in elevating threat detection and the response capabilities of the companies. The worldwide recognition of the NIST Cybersecurity Framework has led to its espousal on a global level.

- Surge in demand for operational efficiency: There has been a surge in demand for high operational efficiency, and AIOps are acting as efficient tools for this. The utilization of AIOps limits the manual workloads and enhances the system uptime. The organizations that are utilizing AI-enabled operations garner lucrative gains in productivity. More companies are incorporating anomaly detection and moving towards automated repairs.

- AI & ML adoption trends: The inclusion of AI and ML has remarkably influenced the product development results in the AIOps ecosystem. Various prominent companies have utilized these advanced technologies to lower the time for development cycles and enhance the uptime for systems. Also, companies are deploying AIOps to automate operations and lower the AI-driven environments. Moreover, the AIOps platforms are using LLMs for enhancing root cause analysis. The AI-enabled menaces instill the demand for AIOps-powered SecOps for active detection of the threat. In September 2025, Ribbon Communications Inc. unveiled Acumen. This is a new platform that uses AI and automation to help service providers and businesses manage complex operations. It aims to make their shift to self-running networks faster and easier. This also indicates that automation developments are set to double the revenues of key players in the years ahead.

Challenges

- Requirement for data sovereignty and localization requirements: Various governments are forcing data localization laws, convincing companies to gather data inside the national borders. For example, the strict laws of the European Union for data privacy standards and India’s data protection regulations are resulting in delays in product launches. The unavailability of universally accepted data protection regulations is hindering the market growth.

- High initial costs: The deployment of AIOps platforms is a capital-intensive process. The involvement of substantial upfront investment acts as a key restraint for many small and new enterprises. The incorporation of these advanced AIOps solutions with existing infrastructure also adds to the overall installation costs. Thus, cost is a limiting factor for the budget-constraint markets.

AIOps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.8% |

|

Base Year Market Size (2025) |

USD 16.6 billion |

|

Forecast Year Market Size (2035) |

USD 85.4 billion |

|

Regional Scope |

|

AIOps Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is anticipated to garner a 57.1% share of the market throughout the study period. The segment growth is attributed to the rising demand for multi-cloud environments for conducting IT operations. According to the National Institute of Standards and Technology, the adoption of cloud strategies is exponentially rising owing to the need for AI-enabled analytics. The AIOps-enabled cloud-based platform is flexible and scalable, making it adequate for handling various fragmented environments.

Organization Size Segment Analysis

The large enterprises segment is anticipated to register 73.5% of the market share during 2026-2035. The growth of the segment is attributed to the rising demand for distributed IT ecosystems. Also, there has been a surging need for real-time automation and regulatory compliance. Large organizations are opting for AIOps for conducting faster detection of anomalies. They are giving importance to AIOps for operating incident automation. The big companies are also adopting AIOps to prevent service degradation.

Industry Vertical Segment Analysis

The BFSI segment is projected to capture 27.8% of the AIOps market share through 2035. The critical dependence of BFSI institutions on uninterrupted IT operations is a prime factor influencing the sales of AIOps solutions. The strict regulations and vast generation of transactional and operational data are also accelerating the adoption of AIOps. The expanding adoption of digital banking, mobile wallets, and fintech solutions by consumers at large has further boosted the demand for AIOps in the BFSI sector.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Deployment Mode

|

|

|

Offering |

|

|

Organization Size

|

|

|

Application

|

|

|

Industry Vertical

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AIOps Market - Regional Analysis

North America Market Insights

North America market is projected to garner a significant share of 38.5% through 2035. The growth of the market is ascribed to the presence of advanced IT infrastructure, such as IBM and VMware, which render AI-enabled services. Also, the region has exponentially high cloud adoption, facilitating the integration of AIOps. The financial services, telecom, and healthcare sectors are prime end users of algorithmic IT operation platforms.

The sales of AIOps solutions in the U.S. are driven by its advanced IT ecosystem and strong enterprise cloud adoption. The growth of the market is aided by significant investment by the government in strengthening the digital infrastructure of the country. For instance, the government has allocated USD 65.0 billion via the Infrastructure Investment and Jobs Act for the widespread expansion of broadband. The government is also pushing efforts for data privacy and cybersecurity, bolstering the adoption of AIOps solutions.

In Canada, the market is propelled by various initiatives taken by the government for digital transformation. Under the Canada Digital Adoption Program (CDAP), the government allocated USD 1.9 billion to assist SMEs in adopting various digital technologies. The program gives financial grants to catalyze the amalgamation of AIOps in various sectors. The country is focused on upgrading its IT infrastructure and encouraging digital equity, aligning with the rising demand for intelligent IT operations solutions for management.

APAC Market Insights

The Asia Pacific AIOps market is anticipated to capture 28.3% of the revenue share by 2035. The growth of the market is augmented by the rapid adoption of automation in various sectors and the rising need for companies to manage high data generation. In Japan, the government has infused USD 3.53 billion of budget to strengthen the supply chain and domestic production in 2022. Additionally, China has executed a national regulatory framework for AI to guide the development. Overall, APAC is an investment-worthy market for AIOps companies.

The sales of AIOps solutions in China are expected to be driven by the government-backed AI strategies and the massive scale of its digital economy. The expanding telecom, finance, and e-commerce sectors are also prime drivers of the AIOps technologies. The cloud-first strategies are further accelerating the application of AIOps systems in both public and private sectors. The government’s emphasis on AI as a strategic industry under its New Generation AI Development Plan is estimated to drive innovations in the AIOps solutions.

India market is fueled by the rapid digital transformation and cloud-first strategies. The country’s booming BFSI and IT services sectors are emerging as revenue boosters for AIOps technology manufacturers. The government’s Digital India initiative, along with rising cloud investments, is set to drive investments in the years ahead. The Ministry of Electronics and IT states that the digital industry is a major booster of the country’s economy, making up 11.74% of the GDP, which equals about USD 402 billion, in 2022-23. This indicates investing in India is likely to double the returns.

Europe Market Insights

The Europe market is set to expand at the fastest CAGR from 2026 to 2035, owing to the IT infrastructure modernization and shift towards cloud-native operations. The banking, telecom, automotive, and manufacturing sectors are leading adopters of the AIOps solutions. The governments’ emphasis on digital sovereignty and AI innovation is further expected to fuel the overall market growth. The U.K., Germany, and France are some of the leading marketplaces for AIOps companies.

Germany leads the sales of AIOps solutions owing to its advanced industrial sector and emphasis on digital transformation. The Industry 4.0. and the automation trends are also boosting the adoption of AIOps solutions among German enterprises. The sectors, including automotive, manufacturing, and financial services, are prime adopters of AIOps in the country. The strong push toward smart factories and connected infrastructure is also accelerating the trade of AIOps platforms.

U.K. market is projected to be driven by its mature financial services sector and thriving digital economy. The modern IT infrastructure is also accelerating the application of AIOps solutions in both SMEs and large enterprises. The financial sector, governed by strict regulations from the Financial Conduct Authority (FCA), is also a key booster for AIOPs sales.

Key AIOps Market Players:

- IBM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Splunk

- Dynatrace

- Datadog

- ServiceNow

- Broadcom (CA Tech)

- OpenText (Micro Focus)

- BMC Software

- AppDynamics (Cisco)

- Moogsoft

- ScienceLogic

- New Relic

- BigPanda

- AIMS Innovation

- Interlink Software

The key players in the AIOps market are employing several organic and inorganic marketing strategies to boost their revenue shares and reach. They are investing heavily in R&D to introduce next-gen solutions. Leading companies are collaborating with other players to expand their customer base. The industry giants are also entering emerging markets to earn lucrative returns from untapped opportunities.

Here is a list of key players operating in the market:

Recent Developments

- In September 2024, ServiceNow, an AI platform for improving businesses, announced plans to add Agentic AI to its system. This is set to boost productivity 24/7 on a large scale for various tasks, including IT, customer service, purchasing, human resources, software development, and more.

- In May 2024, Cisco introduced a new virtual tool for its AppDynamics On-Premises platform, which helps customers monitor their applications using a self-hosted system. This tool uses AI to detect problems, find their causes, secure applications, and monitor SAP systems.

- Report ID: 3309

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AIOps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.