AI Chip Market Outlook:

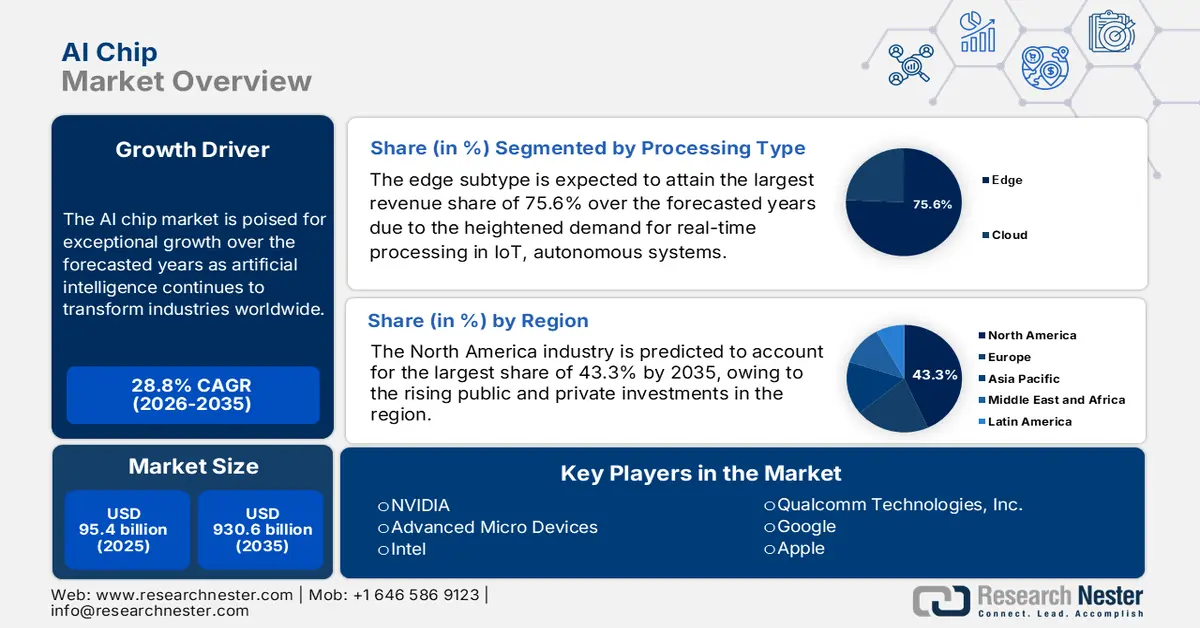

AI Chip Market size was valued at USD 95.4 billion in 2025 and is projected to reach USD 930.6 billion by the end of 2035, rising at a CAGR of 28.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of AI chip is estimated at USD 122.8 billion.

The artificial intelligence (AI) chip market is poised for exceptional growth over the forecasted years as artificial intelligence continues to transform industries worldwide. Similarly, the heightened demand for AI-based applications in data centers, edge devices, autonomous systems, and robotics is continuously fueling innovation in high-performance computing and specialized AI accelerators. In this regard, the Biden-Harris Administration in February 2024 announced more than USD 5 billion in CHIPS R&D investments, which includes the National Semiconductor Technology Center as part of the USD 11 billion R&D program under the CHIPS and Science Act. It also mentioned that these funds aim to accelerate semiconductor innovation, strengthen the workforce, and foster public-private collaboration across the U.S. semiconductor ecosystem. In addition, the initiative complements the USD 39 billion in manufacturing incentives, supporting advanced semiconductor research, packaging, metrology, and the CHIPS Manufacturing U.S. Institute.

Furthermore, the National Institute of Standards and Technology in October 2024 announced a federal commitment of up to USD 100 million over a span of five years for AI-powered autonomous experimentation in sustainable semiconductor materials, supporting industry-university collaborations. Besides, this initiative aims to accelerate the discovery, design, and deployment of new materials and processes, improve manufacturing efficiency, reduce environmental impact, and expand the U.S. semiconductor R&D workforce. It also mentioned that this AI/AE combines automated laboratory tools, data analysis software, and machine learning to optimize materials development for next-generation microelectronics, hence positively impacting the AI chip market growth.

Key AI Chip Market Insights Summary:

Regional Highlights:

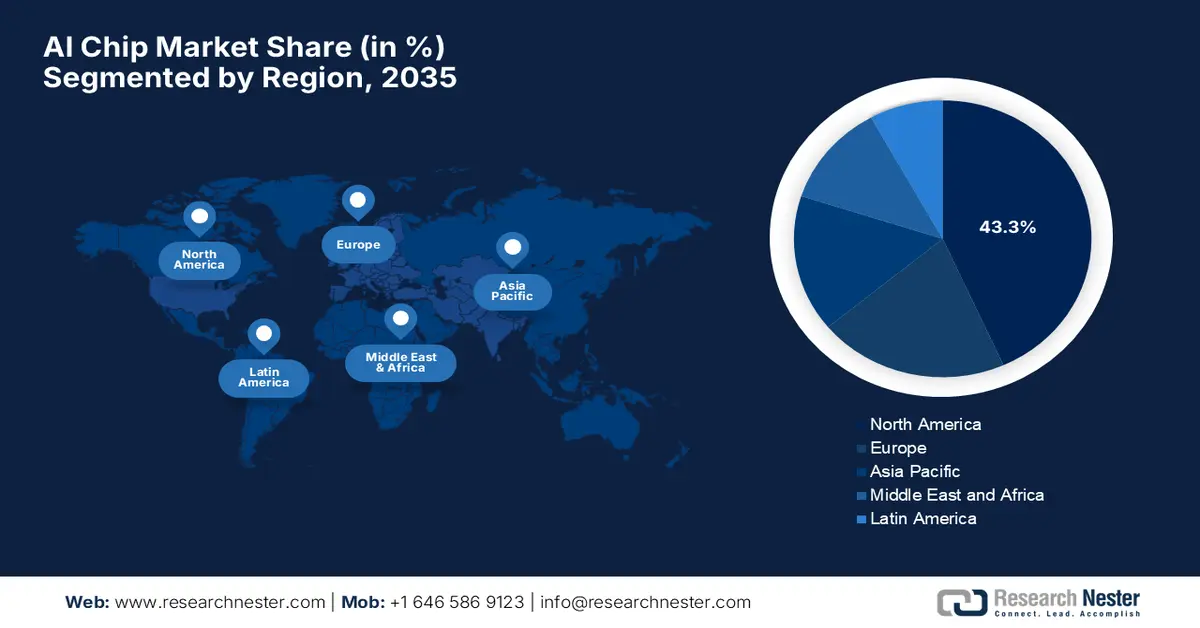

- North America is projected to command a 43.3% share by 2035 in the ai chip market, strengthened by escalating public–private investments and continuous innovation from leading technology players.

- Asia Pacific is expected to witness the fastest expansion by 2035, stimulated by accelerating adoption of AI chips in manufacturing and robotics alongside strong government-backed semiconductor R&D initiatives.

Segment Insights:

-

In the artificial intelligence chip market, the edge processing type segment is projected to capture a dominant 75.6% revenue share by 2035, underpinned by accelerating requirements for real-time AI execution across IoT, autonomous systems, and industrial automation that benefit from low latency and energy-efficient on-device computing.

-

The CPU segment is anticipated to expand at a substantial rate by 2035, supported by its flexibility in managing heterogeneous AI workloads across training and inference environments and its broad compatibility across cloud and edge infrastructures fueling adoption across industries.

-

Key Growth Trends:

- Explosive demand for AI workloads

- Data center & cloud expansion

Major Challenges:

- Supply chain constraints and geopolitical risks

- Software and ecosystem compatibility

Key Players: NVIDIA, Advanced Micro Devices, Intel, Qualcomm Technologies Inc, Google, Apple, Samsung Electronics, Huawei HiSilicon, SK Hynix, Micron Technology, Graphcore, Cerebras Systems, Hailo Technologies Ltd, Cambricon Technologies, Horizon Robotics

Global AI Chip Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.4 billion

- 2026 Market Size: USD 122.8 billion

- Projected Market Size: USD 930.6 billion by 2035

- Growth Forecasts: 28.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Vietnam, Malaysia, Singapore, Brazil

Last updated on : 2 January, 2026

AI Chip Market - Growth Drivers and Challenges

Growth Drivers

- Explosive demand for AI workloads: This is the primary driver for the AI chip market since they are highly essential for powering advanced artificial intelligence applications from large language models and generative AI to deep learning, predictive analytics, and real-time inference. In October 2025, AMD and OpenAI announced that they had entered into a multi-year partnership to deploy 6 gigawatts of AMD Instinct GPUs, starting with a 1-gigawatt deployment of MI450 series GPUs, to power next-generation AI infrastructure. This collaboration enables large-scale, multi-generational AI deployments and optimizes hardware and software integration for generative AI workloads. Furthermore, both of the firms aim to accelerate high-performance AI computing, meeting growing global demand and advancing the broader AI ecosystem in the future years.

- Data center & cloud expansion: The hyperscale data centers, such as AWS, Google Cloud, and Microsoft Azure, are deliberately upgrading infrastructure to support AI model training and inference. This leads to increased purchases of GPUs, AI accelerators, and ASICs, which are designed to handle parallel AI workloads even more efficiently. In this regard, in November 2025, Microsoft and G42 together announced that they are expanding the UAE’s digital infrastructure with a 200-megawatt data center capacity increase through Khazna Data Centers, thereby supporting Microsoft’s USD 15.2 billion investment in the country. In addition, the firm also mentioned that this expansion will enhance AI and cloud capabilities, advance cybersecurity and responsible AI, and support the UAE’s national digital economy strategy. Furthermore, it also creates opportunities for domestic talent in AI and cloud services, positively impacting innovation and digital transformation in the artificial intelligence chip market.

- Growth of edge computing & IoT: Smart devices, wearables, autonomous vehicles, drones, smart cameras, and industrial IoT necessitate low-power, high-performance AI chips to support real-time decision‑making, which is efficiently driving growth in the AI chip market. In May 2025, Qualcomm announced that it is collaborating with Advantech to accelerate edge AI innovation for IoT, integrating Qualcomm’s Dragonwing processors into Advantech’s edge computing platforms with a prime focus on enabling high-performance, low-latency AI solutions. In this context, this partnership supports scalable applications across robotics, smart manufacturing, medical, retail, and urban infrastructure, by also fostering developer-friendly tools for faster deployment. Together, they aim to advance intelligent, autonomous systems at the edge, driving next-generation AI adoption across industries.

NVIDIA AI Initiatives and Market Opportunities 2025

|

Event |

Key Points |

AI Chip Market Opportunity |

|

DGX Spark Launch |

1 PFLOP performance, 128GB unified memory, supports models up to 200B parameters, compact desktop form factor |

Boosts demand for high-performance GPUs, AI software, local AI compute, and agentic AI development |

|

£2 billion (USD 2.46 billion) U.K. AI Investment |

Funding for startups, AI infrastructure in London, Oxford, Cambridge, Manchester, and support from top VCs |

Expands AI hardware adoption in Europe, fuels startup demand for GPUs and AI supercomputing, and strengthens the AI ecosystem. |

Source: Company Official Press Releases

Challenges

- Supply chain constraints and geopolitical risks: This is a major factor hindering the expansion of the artificial intelligence (AI) chip market since it is dependent on a very complex global supply chain, which includes raw materials, semiconductor foundries, and specialized equipment such as EUV lithography machines. Simultaneously, the aspect of geopolitical tensions, trade restrictions, or natural disasters can disrupt these supply chains, which in turn causes delays or increased costs. For example, reliance on a few advanced chip manufacturers such as TSMC or Samsung can create additional bottlenecks in this field. Furthermore, rare earth materials and high-purity silicon wafers are critical inputs, and any shortage can affect production, making supply chain management a major challenge for AI chip manufacturers.

- Software and ecosystem compatibility: AI chips do not operate in isolation, wherein their effectiveness depends on robust software stacks, libraries, frameworks, and developer tools. Therefore, ensuring compatibility with popular AI frameworks such as TensorFlow, PyTorch, or ONNX is essential for adoption. In this context, companies must also provide APIs, compilers, and optimization tools to enable proper integration with AI workloads. In addition, any type of inconsistent or poorly optimized software can drastically reduce chip performance, limiting adoption despite superior hardware in the AI chip market. Furthermore, AI workloads vary widely, from data center training to edge inference, requiring flexible and adaptive software support, presenting a continuous challenge for AI chip developers as well as vendors.

AI Chip Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28.8% |

|

Base Year Market Size (2025) |

USD 95.4 billion |

|

Forecast Year Market Size (2035) |

USD 930.6 billion |

|

Regional Scope |

|

AI Chip Market Segmentation:

Processing Type Segment Analysis

In the artificial intelligence (AI) chip market, the edge subtype based on processing type is expected to attain the largest revenue share of 75.6% over the forecasted years. The heightened demand for real-time processing in IoT, autonomous systems, and industrial automation is the key factor solidifying the segment’s dominance. Simultaneously, edge deployment reduces latency and increases energy efficiency, driving sustained market growth. In November 2025, Kneron announced the launch of its KL1140 NPU chip, which is the first to run full Mamba networks on-device that enabling powerful LLMs at the edge with up to 3 times better energy efficiency and 10 times lower cost when compared to cloud-based AI. This KL1140 allows real-time, secure AI applications such as robotics, automotive systems, and private enterprise assistants without any reliance on cloud connectivity, reducing latency and energy use, hence denoting a wider segment scope.

Chip Type Segment Analysis

By the conclusion of 2035, the CPU based on chip type will grow at a considerable rate in the artificial intelligence chip market due to its versatility in handling diverse AI workloads, supporting both training and inference tasks across cloud and edge platforms. Also, their compatibility and widespread deployment make them a top revenue contributor in this sector. In September 2025, NVIDIA and Intel announced that they had entered into a strategic collaboration to develop next-generation AI infrastructure and personal computing products, tightly integrating NVIDIA’s AI and accelerated computing with Intel’s x86 CPU technologies using NVIDIA NVLink. In this context, Intel will design custom x86 CPUs for NVIDIA’s data center AI platforms and new x86 SoCs with NVIDIA RTX GPU chiplets for high-performance PCs, targeting hyperscale, enterprise, and consumer markets. Furthermore, as part of the deal, NVIDIA will invest USD 5 billion in Intel’s common stock, underscoring a long-term partnership to shape the future of AI-based computing.

Technology Segment AnalysisBottom of Form

In the technology segment, machine learning is expected to grow with a significant share in the AI chip market over the discussed time frame. The wide adoption in applications such as NLP, computer vision, and predictive analytics is the key factor behind this leadership. ML workloads require advanced compute and specialized AI chips, driving continued revenue growth in the sector. In addition, the rising deployment rates of AI at the edge, expansion of AI data centers, and growing demand for real-time inference are accelerating chip innovation, whereas increased investments in custom AI processors and heterogeneous architectures are efficiently strengthening market momentum. Moreover, the existence of supportive software ecosystems and frameworks is also improving the accessibility and scalability of ML solutions. Furthermore, these trends reinforce machine learning’s significant role in shaping the future of the AI chip market.

Our in-depth analysis of the artificial intelligence (AI) chip market includes the following segments:

|

Segment |

Subsegments |

|

Processing Type |

|

|

Chip Type |

|

|

Technology |

|

|

Function |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI Chip Market - Regional Analysis

North America Market Insights

North America is expected to dominate the international artificial intelligence chip market with a share of 43.3% by the end of 2035. The region’s dominance in this field is efficiently propelled by rising public and private investments. The presence of key market players and their continued innovations is also fostering a profitable business environment in the region. In this regard, Apple in October 2025 announced its M5 system-on-a-chip, delivering a major leap in on-device AI performance with over 4× peak GPU compute for AI versus M4, powered by a next-generation GPU with built-in Neural Accelerators, a faster CPU, and an enhanced Neural Engine. It was built on third-generation 3nm technology. M5 significantly boosts unified memory bandwidth and energy efficiency, enabling advanced AI workloads such as local LLMs and diffusion models across MacBook Pro, iPad Pro, and Apple Vision Pro. Hence, such instances reinforce Apple’s growing influence in the market by advancing high-performance, power-efficient AI compute directly on consumer devices without any reliance on the cloud.

The U.S. is considered to be the key growth engine for the upliftment of the regional artificial intelligence (AI) chip market, owing to the widespread adoption of AI-based applications in various industries. The country’s market also benefits from a strong consumer base and substantial federal grants from the government. In October 2025, Intel unveiled the Panther Lake architecture, which is the first AI PC platform built on the advanced Intel 18A process, delivering major gains in AI acceleration, CPU, and GPU performance for client and edge devices. Along with Panther Lake, Intel previewed its 18A-based Xeon 6+ Clearwater Forest server processors, highlighting improved efficiency and scalability for AI-based data centers. In addition, this launch reinforces Intel’s strategic push in AI-focused CPUs and manufacturing leadership, strengthening its position in the evolving global artificial intelligence chip market dynamics.

In Canada, the AI chip market is growing on account of the presence of research institutions and startups, which are focusing on healthcare and natural language processing applications. The country’s emphasis on AI ethics and privacy has also fostered the development of locally optimized edge AI chips for secure deployments. In September 2025, TELUS announced that it had launched the country’s first-ever fully sovereign AI Factory in Rimouski, Quebec, to provide advanced AI compute capabilities with NVIDIA GPUs and HPE infrastructure by ensuring full control over data and operations in the country. The firm also underscored that this facility enables businesses, researchers, and public institutions to train, fine-tune, and deploy AI models securely within Canada. In addition, it is powered by 99% renewable energy and TELUS’ PureFibre network. The AI Factory supports AI innovation across various sectors while also maintaining data sovereignty.

APAC Market Insights

Asia Pacific is anticipated to register the fastest growth in the international AI chip market owing to the rising adoption of AI chips across the manufacturing and robotics sectors. Governments in this region are proactively making investments in semiconductor R&D hubs, supporting both domestic AI startups and large-scale production facilities to accelerate AI hardware innovation. In this context, EdgeCortix announced that it has raised over YEN 17 billion (about USD 110 million) through a combination of venture capital funding and government grants, and is considering further fundraising to accelerate growth. The Series B round, which closed in stages between August and November 2025, attracted both new and existing investors and will be used to expand engineering efforts for its chiplet-based accelerator, SAKURA-X. It is especially designed for applications such as robotics, telecommunications, aerospace, defense, and industrial automation. SAKURA-X is expected to drive cost-effective processing for complex commercial applications.

China is solidifying its dominance over the regional artificial intelligence (AI) chip market owing to its strong focus on domestic AI chip development to reduce reliance on foreign technology. The market is mainly oriented toward cloud AI, autonomous vehicles, and smart city applications, wherein the national initiatives are promoting high-performance AI chip fabrication and ecosystem growth. Baidu, in November 2025, unveiled two AI chips, the M100 for inference and the M300 for both training and inference, during its annual Baidu World conference, offering a domestically produced alternative to address the U.S. export restrictions. The company also introduced Tianchi supernode clusters by combining multiple P800 chips to scale AI compute power for advanced applications. Further, this move strengthens the country’s AI semiconductor independence, thereby supporting domestic companies and ensuring uninterrupted access to critical computing resources.

India is efficiently growing in the AI chip market due to the presence of government-backed AI initiatives, fintech solutions, and edge computing for rural connectivity. The country’s market also benefits from startups that are innovating in low-power AI accelerators for IoT devices and industrial automation. In December 2025, Tata Group and Intel announced that they had entered into a strategic alliance to strengthen the country’s semiconductor and AI compute ecosystem, focusing on local manufacturing, packaging, and tailored AI PC solutions. Besides, this collaboration leverages Intel’s AI compute designs and Tata Electronics’ EMS and OSAT capabilities to support domestic production and meet the growing demand for AI hardware in India. Furthermore, this partnership aims to build a resilient supply chain, accelerate time-to-market, and position India as a key player in the worldwide artificial intelligence chip market.

Snapshot of India’s AI Infrastructure and Programs as of October 2025

|

Category |

Key Figures |

|

India AI Mission Budget |

INR 10,371.92 crore (USD 1.25 billion) over five years |

|

GPUs Deployed |

38,000 GPUs |

|

Tech & AI Workforce |

6 million people |

|

Tech Sector Revenue |

Projected to cross USD 280 billion (2025) |

|

AI Contribution to the Economy |

USD 1.7 trillion by 2035 (projected) |

|

Global Capability Centres |

1,800+ (500+ focused on AI) |

|

Startups in India |

180,000; 89% of new startups use AI |

|

AI Adoption in Enterprises |

87% enterprises use AI (NASSCOM AI Adoption Index 2.45/4) |

|

AI Maturity at Scale |

26% of companies achieved scale |

|

AI Models & Datasets |

243 AI models, 3,000+ datasets on AIKosh |

|

India AI Startups Global Program |

10 startups expanded to Europe |

|

AI Labs |

570 labs pan-India (27 first launched) |

Source: Government of India

Europe Market Insights

Europe is yet another dominant force in the international AI chip market, owing to the strong emphasis on energy-efficient and secure AI chips for industrial and automotive applications. Research collaborations across the region are fostering open-source AI hardware platforms and supporting sustainable chip manufacturing practices. In this regard, VSORA, in October 2025, announced that it has successfully tape-out its Jotunn8 AI inference chip, which marks a major milestone for Europe in next-generation AI hardware. It is designed to overcome the memory wall bottleneck in which the Jotunn8 delivers 3,200 Tflops of compute power with 288 GB HBM3e memory, by using 50% less energy when compared to current market-leading chips. Furthermore, this breakthrough positions the region as a key player in large-scale AI data center deployments and showcases the continent’s growing innovation in AI infrastructure.

Germany is presenting lucrative growth opportunities for the domestic pioneers in the artificial intelligence (AI) chip market since it is witnessing rapid adoption in automotive and industrial automation by integrating AI accelerators into manufacturing lines and smart factory systems. The country’s market also benefits from collaborations between universities and semiconductor firms to develop high-performance, resilient chips. In December 2025, the European Commission approved €623 million (about USD 680 million) for the country to support the establishment of two first-of-a-kind semiconductor facilities by GlobalFoundries in Dresden and X-FAB in Erfurt. It also mentioned that these facilities will produce advanced chips for aerospace, defense, AI, automotive, and medical applications, strengthening Europe’s semiconductor supply chain and technological autonomy, hence benefiting the overall artificial intelligence chip market growth.

In the U.K., the AI chip market is mainly highly driven by AI software companies and cloud service providers who are seeking high-performance computing for finance, healthcare, and defense. The country’s market also benefits from increasing investments in AI chip R&D centers, which are supporting domestic innovation and edge AI solutions suitable for enterprise applications. In November 2025, the UK government announced a major AI investment package, including billions of pounds (around USD 4.3 to 4.5 billion) in funding, new AI Growth Zones, and support for startups, researchers, and businesses across the country. Projects such as the South Wales AI Growth Zone are expected to create over 5,000 jobs and attract private and international investment, strengthening the country’s position as a global AI hub. It also stated that with up to £137 million (USD 171 million) for scientific breakthroughs and £250 million (USD 312 million) for AI compute access, these initiatives aim to accelerate innovation, drive economic growth, and ensure communities across the country benefit from AI technology.

Key AI Chip Market Players:

- NVIDIA (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advanced Micro Devices (AMD) (U.S.)

- Intel (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Google / Alphabet (U.S.)

- Apple (U.S.)

- Samsung Electronics (South Korea)

- Huawei / HiSilicon (China)

- SK Hynix (South Korea)

- Micron Technology (U.S.)

- Graphcore (United Kingdom)

- Cerebras Systems (U.S.)

- Hailo Technologies Ltd. (Israel)

- Cambricon Technologies (China)

- Horizon Robotics (China)

- NVIDIA is identified to be the undisputed leader in AI chips, particularly in GPUs for training and inference workloads. The company leverages a combination of high-performance hardware, robust software ecosystems like CUDA, and strategic partnerships with companies such as Samsung, OpenAI, and Palantir. NVIDIA continues to expand more than data centers into autonomous vehicles, robotics, and industrial AI applications, positioning itself as a full-stack AI solutions provider at the global level.

- Advanced Micro Devices has efficiently strengthened its position in AI through high-performance GPUs and accelerated computing solutions for data centers and edge AI applications. The firm leverages Radeon and Instinct GPU lines and targets AI workloads with scalable performance and energy efficiency. AMD is also focused on software optimization through ROCm and AI libraries, aiming to compete in terms of enterprise AI by providing high-performance alternatives for cloud providers and AI-driven applications.

- Intel is yet another major player in AI chips, which is focused on both CPUs and specialized accelerators such as the Habana Gaudi and Ponte Vecchio series for training and inference. The company emphasizes end-to-end AI infrastructure by integrating processors, networking, memory, and AI software tools. Furthermore, Intel is leveraging acquisitions and partnerships to enhance AI performance across data centers, edge computing, as well as autonomous systems.

- Qualcomm Technologies, Inc. is also a dominant force in this market which specializing in terms of AI acceleration for mobile, edge, and data center applications. The company’s AI200 and AI250 chips target rack-scale AI inference by delivering high memory capacity, energy efficiency, and low total cost of ownership. In addition, Qualcomm integrates hardware with software, thereby supporting leading AI frameworks and model deployment, making it ideal for scalable generative AI workloads.

- Google develops its tensor processing units for AI training and inference, powering both internal applications as well as cloud AI services. Besides, the company’s strategy is focused on custom silicon optimized for AI workloads, thereby enabling high throughput and energy efficiency in data centers. Furthermore, Google combines hardware innovation with advanced software frameworks such as TensorFlow, enabling end-to-end AI solutions.

Below is the list of some prominent players operating in the global artificial intelligence chip market:

The AI chip market is dominated by U.S. giants such as NVIDIA, AMD, Intel, and Qualcomm, which lead in terms of data center GPUs, NPUs, and inference accelerators, whereas the hyperscalers, such as Google and Apple, develop custom silicon for optimized AI performance. Vertical integration, custom chip roadmaps, ecosystem software stacks, partnerships, and domestic supply chain initiatives are a few strategies opted for by the global pioneers to strengthen their market positions. NVIDIA in September 2025 reported that it entered into a partnership with OpenAI to deploy 10 gigawatts of NVIDIA systems, representing millions of GPUs, for OpenAI’s next-generation AI infrastructure. In this context, NVIDIA will invest up to USD 100 billion progressively as each gigawatt is deployed. In addition, this collaboration aims to scale AI compute, co-optimize hardware and software roadmaps, and accelerate AI breakthroughs, strengthening NVIDIA’s position in the high-performance market and supporting OpenAI’s mission to advance artificial general intelligence.

Corporate Landscape of the AI Chip Market:

Recent Developments

- In October 2025, Qualcomm introduced AI200 and AI250 rack-scale AI inference accelerators, delivering high memory capacity, near-memory computing, and over 10x effective memory bandwidth for efficient data center AI workloads.

- In October 2025, NVIDIA announced a collaboration with Samsung to build a next-generation AI factory powered by over 50,000 NVIDIA GPUs, aiming to revolutionize semiconductor manufacturing, mobile devices, and robotics through AI-driven production.

- In October 2025, OpenAI and Broadcom announced a collaboration to deploy 10 gigawatts of custom AI accelerators by 2029. This partnership integrates OpenAI-designed chips with Broadcom’s networking solutions to meet global AI demand, strengthening scalable AI infrastructure.

- Report ID: 3084

- Published Date: Jan 02, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI Chip Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.