Aerosol Refrigerants Market Outlook:

Aerosol Refrigerants Market size was valued at USD 1.3 billion in 2025 and is set to exceed USD 1.91 billion by 2035, registering over 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerosol refrigerants is estimated at USD 1.35 billion.

Aerosol refrigerants market growth is driven by the increasing need for cooling appliances, propellants in personal care items, and propellants in food and beverage packaging. Furthermore, increased awareness of environmental sustainability and the phase-out of traditional refrigerants are projected to accelerate the adoption of aerosol refrigerants. The growing technological advancements and the development of novel aerosol formulations with greater performance and safety features are opening up new prospects. The trend towards miniaturization and portability in electronic devices is also helping to drive the growth of the aerosol refrigerants market, since these refrigerants are working in electronic device cooling systems.

Honeywell introduces a new low-global-warming-potential refrigerant for the supermarket industry. The product fulfills the needs of grocers and retailers looking for low-carbon solutions ahead of upcoming regulatory changes. Solstice N71 (R-471A), the latest addition to Honeywell's proprietary low-GWP (Global Warming Potential) series of Solstice solutions for a variety of applications, is the grocery industry's first non-flammable and energy-efficient solution with a GWP less than 150. Honeywell has developed the next-generation solution, Solstice N71, to fulfill more strict climate change rules and accelerate the industry's ability to reach carbon neutrality.

Following the phaseout of CFCs and the ongoing phaseout of Hydrochlorofluorocarbons (HCFCs), manufacturers of aerosols shifted to non-ozone-depleting propellants and solvents, some of which have high GWPs, such as Hydrofluorocarbons, which include HFC-134a, HFC-227ea, HFC-43-10mee, HFC-365mfc, and HFC-245fa, as well as several low-GWP alternatives. Urbanization and commercialization are also driving up demand, which in turn is driving up the use of aerosol refrigerants in the building and construction and automobile sectors.

Key Aerosol Refrigerants Market Insights Summary:

Regional Highlights:

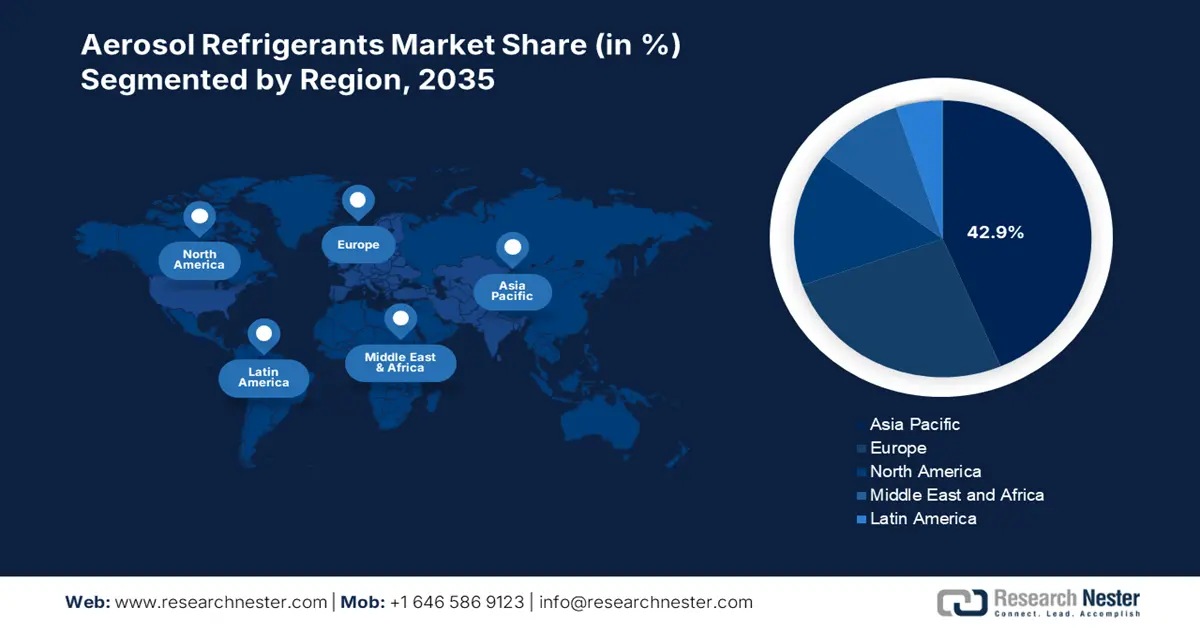

- Asia Pacific holds a 42.9% share of the Aerosol Refrigerants Market, fueled by rapid urbanization, industrialization, and growing demand for air conditioning and refrigeration, supporting growth through 2026–2035.

Segment Insights:

- The HFC-143a segment of the Aerosol Refrigerants Market is projected to achieve a 30.50% share from 2026 to 2035, fueled by its widespread use in aerosol applications and cooling solutions across multiple industries.

Key Growth Trends:

- Increasing environmental awareness with regulatory changes

- Advancement in technology

Major Challenges:

- Rising safety concerns and flammability

- Availability of alternative refrigeration technologies

- Key Players: Dongyue Group, Navin Fluorine International Ltd, SINOCHEM GROUP CO., LTD., SRF Limited, A-Gas.

Global Aerosol Refrigerants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.35 billion

- Projected Market Size: USD 1.91 billion by 2035

- Growth Forecasts: 3.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Aerosol Refrigerants Market Growth Drivers and Challenges:

Growth Drivers

- Increasing environmental awareness with regulatory changes: The need for alternative, environmentally benign aerosol refrigerants is driven by the growing global requirements to phase out high-GWP and ozone-depleting substances (ODS) refrigerants. Hydrofluorocarbons (HFCs) with negligible ODP but high GWPs are scheduled to phase down in India with a freeze in 2028 under the Kigali Amendment to the Montreal Protocol. This indicates that the cooling sector in India is having to meet targets for reducing refrigerants and switching to alternative refrigerants while also battling rising demand.

India is currently in the second phase of the HCFC phase-out management program (HPMP), which aims to phase out these gases entirely by 2030. The Kigali Amendment to the Montreal Protocol, which calls for a 10% reduction in HFCs by 2032 (compared to baseline years of 2024, 2025, and 2026), is implemented concurrently in India in 2028. Due to this overlap in India's refrigerant transition, multiple refrigerants are available at any given time for a particular sector and application.

- Advancement in technology: Technological developments in air conditioning, such as the creation of more energy-efficient systems and the incorporation of energy-saving features, raise demand for aerosol refrigerants, which can improve system efficiency and performance. The need for aerosol refrigerants is being further increased by manufacturers creating air conditioners with energy-saving features.

Haier unveiled its new Heavy-Duty line of air conditioners, which can save up to 65% on energy costs, have a 4-way swing feature for precise control over the direction of airflow, and use supersonic cooling technology to deliver fresh cold air in just 10 seconds. They also have a frost self-clean feature to ensure the freshest air quality, which eliminates dust, bacteria, and odors, leaving your room feeling fresh. For cooling purposes, these systems need efficient refrigerants, and these characteristics are influencing the aerosol refrigerants market share.

Challenges

- Rising safety concerns and flammability: The usage of certain aerosol refrigerants poses a safety risk to end users due to their extreme flammability. The likelihood of flames and fires is higher for hydrocarbons, especially propane and isobutane. These flammability problems raise the risk of usage, storage, and transportation, necessitating stringent handling guidelines and specific tools.

- Availability of alternative refrigeration technologies: While refrigerants are still necessary in the cooling sector, alternative refrigeration technologies such as magnetic refrigeration and thermoelectric cooling are beginning to gain market share. The increasing adoption of these cutting-edge refrigeration technologies is projected to have an impact on the global aerosol refrigerants market forecast in the future years.

Aerosol Refrigerants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 1.91 billion |

|

Regional Scope |

|

Aerosol Refrigerants Market Segmentation:

Product type (HFC-143a, HFC-32, HFC-125, and SF6)

By the end of 2035, HFC-143a segment is estimated to account for more than 30.5% aerosol refrigerants market share. When compared to other refrigerants in aerosol cooling applications, HFC-143a's substantial market share demonstrates its widespread use in aerosol applications and cooling solutions, solidifying its position as a major player in this market. HFC-143a's widespread use across multiple industries makes it indispensable in air conditioning and automotive cooling systems.

Numerous benefits of using HFC-32 include that it can lessen the environmental impact of heat pumps and air conditioning systems. The global warming potential (GWP) of HFC-32, a non-ozone-depleting refrigerant, is one-third that of R-410A, the current standard. It is also widely accessible and offers outstanding system performance.

Pentafluoroethane, or HFC-125, is a component of various HFC refrigerant blends and is employed as a fire extinguisher in certain applications, taking the place of halon, as well as a refrigerant in air conditioning and refrigeration systems. Both commercial and residential applications employ these mixtures in refrigeration and air conditioning systems.

End use (Residential, Commercial, and Industrial)

The aerosol refrigerants market is anticipated to witness significant growth in the forecast period, driven by the increasing need across several end use industries. The residential segment is poised to grow at a significant market share by 2035. Growing rates of urbanization around the world are driving the rise of the residential segment in the aerosol refrigerants market, which in turn is driving up demand for residential spaces and environmentally friendly and effective cooling solutions. The need for air conditioning and refrigeration systems has increased due to growing urban populations, which has encouraged the use of environmentally friendly aerosol refrigerants.

The commercial segment is expected to follow closely, driven by the growing use of aerosol refrigerants in supermarkets, restaurants, and other commercial establishments. It keeps things cold, so food stays fresher for longer. The reliance on refrigeration systems in a variety of situations, from food storage to medicines, emphasizes the importance of effective refrigerants such as those used in aerosols, strengthening their dominance in the aerosol refrigerants market.

Our in-depth analysis of the global aerosol refrigerants market includes the following segments:

|

Product Type |

|

|

Container Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerosol Refrigerants Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific aerosol refrigerants market is expected to dominate revenue share of around 42.9% by the end of 2035. Rapid urbanization and industrialization have increased the demand for cooling solutions in the manufacturing, construction, and consumer sectors. The growing population and increasing living standards are driving up the demand for air conditioning, refrigeration, and cold storage facilities, resulting in the use of aerosol refrigerants.

Refrigerant Management Regulations are in place to prevent the uncontrolled discharge of refrigerants into the atmosphere and to manage refrigerants from their sale to disposal. (Refrigerants have 140–11,700 times more GWP than CO2. This law governs the manufacture, use, recovery, and disposal of refrigerants by requiring associated businesses or organizations to report sales records (every half year), management records (annually), and recovery records (every half year).

China is actively creating and enforcing regulations to reduce the use of hydrofluorocarbons (HFCs) and hydrochlorofluorocarbons (HCFCs) in the air conditioning and refrigeration industries. These regulations include encouraging the use of R290 refrigerant and outlawing the manufacture of specific HFC-based refrigerants. China agreed to several targets and actions to help reduce fluorinated gases, including the prohibition of direct refrigerant emissions and the requirement for recycling, reuse, and harmless disposal of these substances throughout servicing and end-of-life procedures. These limitations are incorporated in the recently modified regulation on the administration of ozone-depleting substances.

China's Ministry of Commerce, along with eight other national ministries and agencies, released policy recommendations to promote household appliance recycling, to increase the recycling rate by 15% by 2025 compared to 2023 levels. It intends to achieve its goals by establishing pilot recycling cities, growing the recycling industry, promoting best practices/models, and implementing legislation, policies, and standards.

India is expanding significantly due to the rising demand for aerosols across several industries, most notably manufacturing and the automobile sector. Several causes, including rising global warming temperatures and increased prosperity, are contributing to India's 10-15% yearly growth in demand for air conditioning. Compared to other growing and developed nations, air conditioners marketed in India have among the lowest average energy efficiency.

They also employ refrigerants with GWPs ranging from medium to high. India can cut cooling energy demand by 40% and greenhouse gas (GHG) emissions by 400 million tons yearly by 2030 if it begins to double the existing rate of AC energy efficiency improvements (from 3% to 6% annually) and switch to natural refrigerants from medium- to high-GWP refrigerants. Compared to installing 100 Gigawatt (GW) of solar PV facilities, this reduces greenhouse gas emissions more. The results of this study were presented at the iFOREST-organized webinar on "Green Cooling in India," which influenced the conversation around eco-friendly and clean cooling solutions in the country.

Europe Market Analysis

In Europe, the development of aerosol refrigerants market is driven by rigorous environmental regulations and an increasing need for sustainable, low-GWP solutions, resulting in a trend toward natural refrigerants and alternatives to high-GWP refrigerants. The widespread usage of this substance in mobile air conditioning and household refrigeration has resulted in a large growth in hydrocarbon and inorganic refrigerants across Europe.

R134a, a refrigerant used in automotive air conditioning, is restricted in new cars under EU Directive 2006/40/EC on mobile air-conditioning systems (the 'MAC Directive'). The R1234yf is the most common replacement, being used almost completely. The sole option is CO2, which is already utilized by some automobile manufacturers and is likely to become more common in the future. CO2 is also predicted to be accessible as an alternative in the future for heavy vehicles, buses, and trains.

In the U.K., aerosol refrigerants market uses, commonly referred to as aerosol propellants, for air conditioning, refrigeration, and other purposes. Their use is impacted by the F-gas rule, which mandates that technicians handling them receive certification and training. Electrical switchgear (4.1%), closed-cell insulation foams (3.3%), fire protection systems (2.5%), medical inhalers and aerosols (9.8%), refrigeration, air conditioning, and heat pumps (79.5% of 2020 emissions), and other specialized applications (0.8%), including the production of semi-conductors, solvents, and tracer gases, are among the applications for F gases.

The Kigali Amendment to the Montreal Protocol was ratified in 2016, and the Protocol's Parties agreed to minimize worldwide HFC production and consumption. According to this Amendment, the affluent U.K. must cut HFC production and consumption by 85% by 2036. The eventual goal of the phasedown under the Kigali Amendment thus goes further than the current F-gas Regulation, while the phasedown under the Regulation means the U.K. is now well ahead of the timeframe set by the Kigali Amendment.

In Germany, the purpose of strict regulations on the use of fluorinated greenhouse gases (F-gases), such as those used as aerosol propellants and refrigerants, is to phase out high GWP refrigerants and promote natural alternatives. The global greenhouse effect is caused by F-gases to the tune of about 1.3%. A 2010 UBA research estimates that, in the absence of the Kigali Amendment, F-Gas emissions would have accounted for 7.9% of direct global CO2 emissions by 2050.

The principal applications for fluorinated greenhouse gases today are fire extinguishing agents, foam and insulation blowing agents, aerosol propellants, and refrigerants. Aside from technical solutions, the introduction of targeted substitute agents or alternative technologies is crucial to lowering emissions from these compounds. This is where the European Union's Regulation (EU) on fluorinated greenhouse gases and the Directive on emissions from motor vehicle air conditioning systems begin.

Key Aerosol Refrigerants Market Players:

- Тhе Chemours Соmраnу

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arkema Group

- Groupe Gazechim

- Honeywell International Inc.

- Baltic Refrigeration Group

- Dongyue Group

- Navin Fluorine International Ltd

- SINOCHEM GROUP CO., LTD.

- SRF Limited

- A-Gas

Leading companies in the aerosol refrigerants market are constantly conducting research and development to stay ahead of the competition and launch new products. The majority of the major firms are developing new production facilities both domestically and abroad to strategically increase their geographic footprint. Achieving sustainable growth in the aerosol refrigerants market requires long-term initiatives such as investment, manufacturing, expansion, distribution agreements, collaborations, new establishments, mergers, and acquisitions.

Recent Developments

- In July 2024, Honeywell paid USD 1.81 billion to acquire the LNG process technology and equipment division from Air Products, a producer of industrial gases. The sale, according to the industrial gas giant, would help it concentrate more on its two-pillar strategy: becoming a leader in clean hydrogen and expanding its industrial gas business, including associated technologies and equipment.

- In July 2024, Honeywell announced that Actrol would use Honeywell's energy-efficient and low global warming potential (GWP) refrigerant Solstice L40X (R-455A) in their condensing units, which are commonly found in supermarkets, convenience stores, restaurants, and other standalone equipment.

- Report ID: 7515

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerosol Refrigerants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.