Aerosol Can Market Outlook:

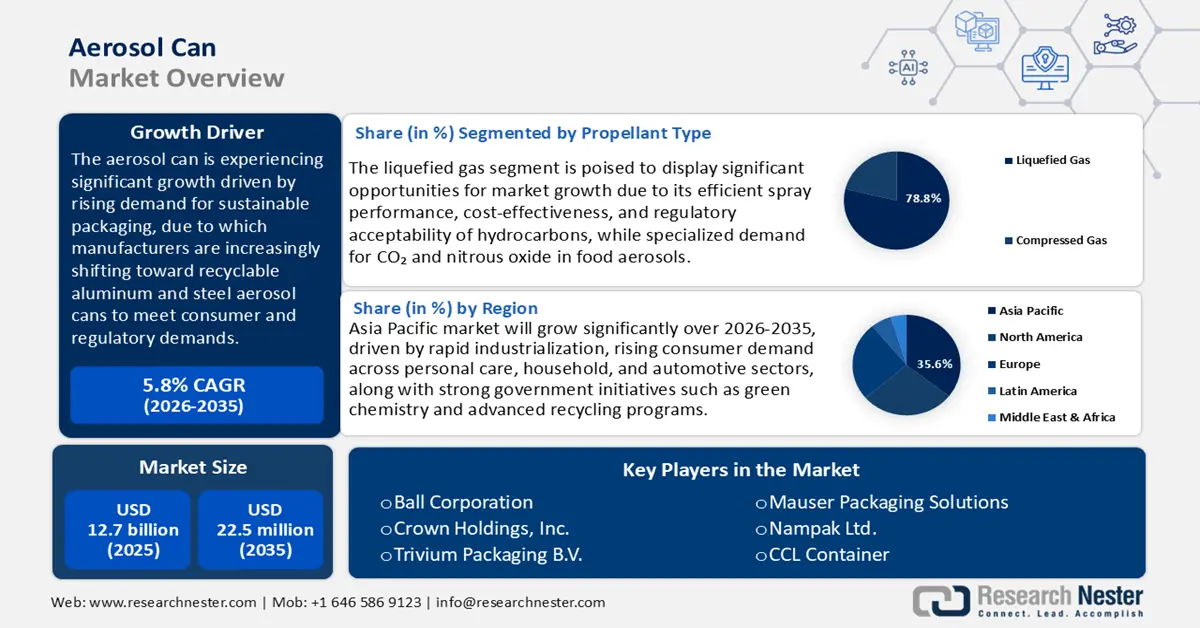

Aerosol Can Market size was valued at USD 12.7 billion in 2025 and is projected to reach USD 22.5 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, from 2026 to 2035. In 2026, the industry size of aerosol can is estimated at USD 13.4 billion.

The global aerosol can market is expected to grow significantly over the projected years, primarily driven by regulatory pressure to improve recyclability and reduce hazardous waste, especially in the U.S. As part of its plan to streamline and enhance proper handling and recycling of industrial waste across the board, the U.S. Environmental Protection Agency (EPA) has reclassified aerosol cans as universal waste under the Resource Conservation and Recovery Act (RCRA). This grouping reduces the regulatory burdens for collection and transport and therefore further stimulates bulk recycling and recycling of metal parts, primarily aluminium and steel. In addition to these initiatives, the EPA's National Recycling Strategy has set the ultimate goal of a 50% national recycling rate by 2030 for recyclable metals, where cans are utilized as an essential component of product packaging, including aerosol cans.

In addition, construction regulations have greatly affected procurement behavior and the selection of materials in the industry. The Department of Energy (DOE) is providing federal funding through its Advanced Manufacturing Office (AMO) for sustainable packaging innovations that can have indirect benefits for aerosol can manufacturers by improving propellant and energy-efficient metal forming technologies. Government administrative guidance coupled with R&D investment is therefore having a material impact on capital flow, product design, and supplier engagement across the entire aerosol can value chain.

The primary raw materials used for the production of aerosol cans are aluminum and steel, and the supply chain is closely tied to the global trade structures of these materials. From May 2023 to April 2024, the U.S. imported 87,138 thousand pounds of disposable aluminum containers, with a large portion of imports being supplied by China. The U.S. manufacturers exported 224.9 million pounds worth USD 1.0 billion, 72.6% of which had been consumed in the U.S. in apparent form, and 85% of which was valued. These figures highlight the substantial reliance on both domestic production and imports in the U.S. aluminum container market, which displays increasing dependence on international raw materials and semi-fabricated steel can bodies.

Steel manufacturing capacity has grown slightly domestically, fueled by Defense Department initiatives facilitated by the Department of Commerce's Advanced Manufacturing Programs to help bring back key production lines and shorten lead times. The Producer Price Index (PPI) of metals and metal products, such as metal cans, increased to 329.0 in September 2025, with a 2.7% rise in manufacturing inputs prices. This represents a growth of 320.2 in Q1 2024 to 329.0 forecasted in Q3 2025, demonstrating consistent cost growth in the industry. The DOE still invests more than USD 20 million a year into competitive grants focused on packaging innovation to reduce material usage and low-emission materials within the pressurized containers market. These figures support constant manufacturing expansion, price growth, and public-sector support of innovation in the market.

Key Aerosol Can Market Insights Summary:

Regional Highlights:

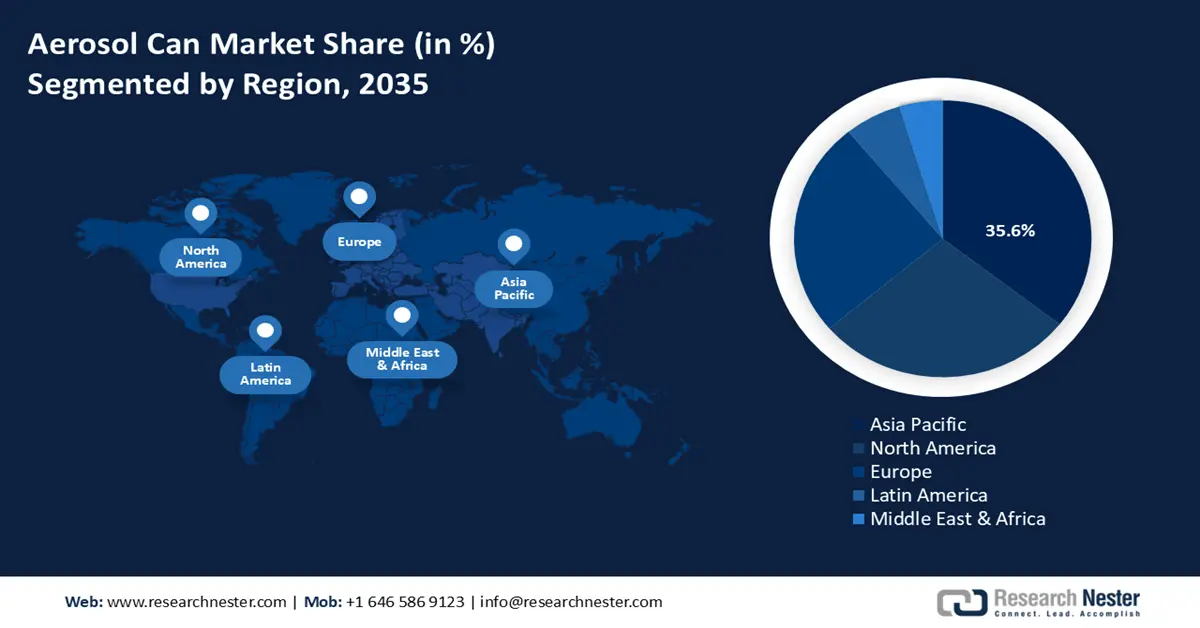

- The Asia Pacific region in the aerosol can market is projected to hold the largest share of 35.6% from 2026 to 2035, owing to increasing industrialization, expanding consumer demand across personal care and automotive sectors, and the adoption of sustainable chemical practices under APEC’s green chemistry initiatives.

- North America is expected to secure a 28.2% share by 2035, impelled by strong regulatory pressure toward recyclable packaging, rising investments in clean energy chemical production, and the enforcement of green chemistry programs.

Segment Insights:

- The liquefied gas segment in the aerosol can market is projected to command the largest share of 78.8% during the forecast period, driven by its superior spray performance, affordability, and the regulatory acceptance of hydrocarbon-based, non-ozone-depleting propellants.

- The aluminum segment is expected to account for a 45.6% share by 2035, propelled by its lightweight structure, recyclability, and alignment with the growing sustainability and eco-friendly packaging initiatives.

Key Growth Trends:

- Packaging restrictions under EU PPWR via ECHA

- Growing demand for renewable/bio-based chemicals

Major Challenges:

- VOC and coating reformulation costs

- Unequal treatment of small vs large entities

Key Players: Ball Corporation, Crown Holdings, Inc., Trivium Packaging B.V., Mauser Packaging Solutions, Nampak Ltd., CCL Container, Silgan Holdings Inc., Ardagh Group S.A., Bharat Containers Pvt. Ltd., Exal Corporation, Muda Container Berhad, Kureha Corporation, Toyo Jidoki Co., Ltd., Ikezaki Tekindo Tama, Toyo Seikan Group Holdings Ltd.

Global Aerosol Can Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.7 billion

- 2026 Market Size: USD 13.4 billion

- Projected Market Size: USD 22.5 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, United States, Germany, India

- Emerging Countries: Indonesia, Brazil, Mexico, Vietnam, South Africa

Last updated on : 1 October, 2025

Aerosol Can Market - Growth Drivers and Challenges

Growth Drivers

- Packaging restrictions under EU PPWR via ECHA: The European Union's Packaging and Packaging Waste Regulation (PPWR), reinforced in 2023, authorizes the European Chemicals Agency (ECHA) to review and restrict dangerous chemicals in packaging, including coatings and linings on aerosol cans. ECHA's new role will help update safety evaluations and enforce outright restrictions on substances that are supposed to have adverse environmental and health risks within the European Union. The aerosol can producers are set to invest in safer substrate formulations, in place of PFAS-coated liners and bisphenol-A-based substrates. This regulatory shift is expected to drive the growth in demand for sustainable, compliant packaging solutions in Europe. In addition, service providers of alternative barrier technologies can expect increased demand given the need for tied vendors to respond to changing compliance requirements of downstream users.

- Growing demand for renewable/bio-based chemicals: Growing demand for renewable and bio-based chemicals for lockdown propellants (aerosol cans) and as solvents is increasing because of environmental regulations and changing consumer preferences. According to the U.S. Department of Energy's 2023 Billion-Ton Report, the U.S. can triple its biomass production to over 1 billion tons per year. This could generate around 60 billion gallons of low-emission liquid fuels annually while still meeting food, feed, fiber, and forest product demands. Utilizing unused biomass could add 350 million tons annually, further expanding the bioeconomy. This also represents a new trend in the manufacturing environment and will create new B2B channels for aerosol can manufacturers toward ecologically sound aerosol packaging products. Regulatory conformity and differentiation - Integrating bio-based solvents or compressed air/CO2 as propellants can help companies take advantage of both regulatory conformity and differentiation in environmentally-minded markets or regions, such as Europe and North America.

- Carbon-neutrality commitments by leading chemical manufacturers: The greener goals for carbon neutrality are driving the Aerosol can market, as more than 70% of chemical companies worldwide, including Dow, BASF, and LyondellBasell, have made commitments for net-zero emissions by 2050. These strategic commitments are driving innovation in lower-carbon solvents, coatings, and propellants for use in aerosol applications. The industry's focus on reducing environmental impact by growing the use of recycled materials such as aluminum and steel in aerosol packaging. It also highlights the importance of implementing low-emission gases with reduced global warming potential (GWP) to support sustainability goals. These efforts replicate a wider commitment across the aerosol supply chain to lower greenhouse gas emissions and improve the environmental performance of aerosol products. Aligned with ESG mandates and government procurement policies that favor low-carbon products, sustainable aerosol cans look to become a lifestyle product in both consumer and industrial end-use markets.

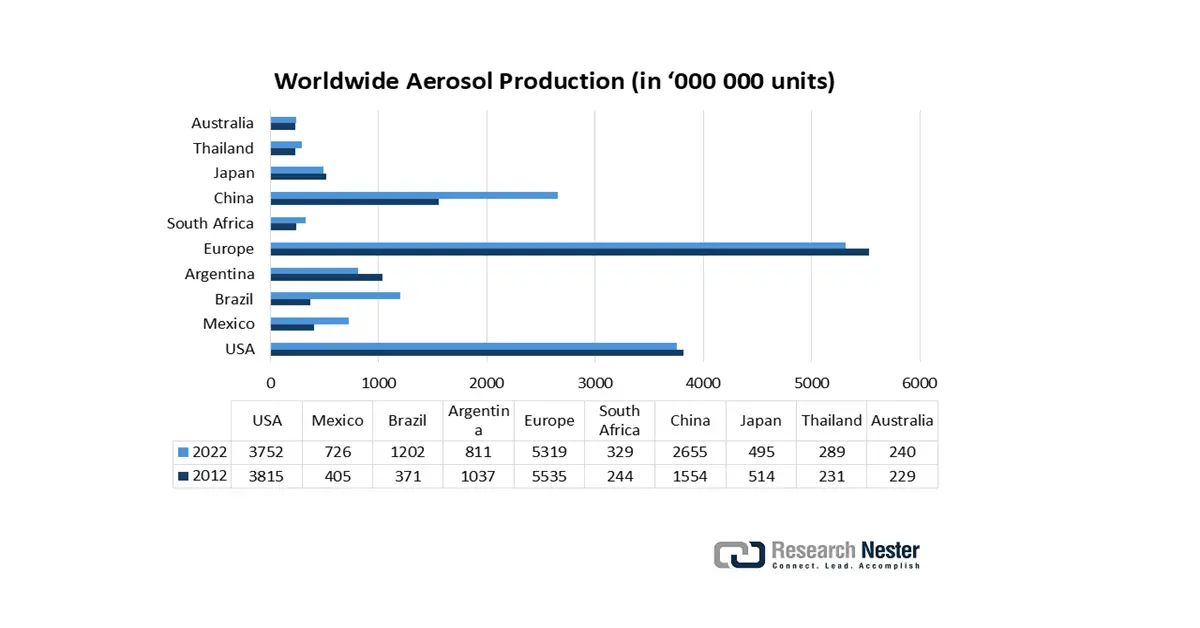

- Global Aerosol Production Aerosol production directly drives the growth of the aerosol can market by increasing demand for specialized packaging across personal care, household, and industrial sectors. As manufacturers expand product lines such as deodorants, disinfectants, and automotive sprays, the need for durable, pressurized containers rises in parallel. Aerosol cans offer functional benefits like controlled dispensing, extended shelf life, and portability, making them indispensable in modern consumer goods. Innovations in lightweight materials and eco-friendly propellants further enhance their appeal. With sustainability and convenience shaping consumer preferences, aerosol packaging continues to gain traction globally.

Challenges

- VOC and coating reformulation costs: Volatile Organic Compound (VOC) regulations, notably in California, have a tremendous impact on aerosol can manufacturers, leading to reformulation of coatings and propellants. EPA's Regulatory Impact Analysis for small-scale manufacturers has found that, in California, the costs to comply with the new air quality standards for small manufacturers occur for each formulation. These costs are relatively high for contract fillers and niche producers that lack the R&D that the large competitors benefit from. Compounding the burden is regulatory fragmentation at the state level, where U.S. firms must invent different formulations to meet different VOC limits, a loss of economies of scale, and market inefficiency across regions.

- Unequal treatment of small vs large entities: Costly paperwork to comply with environmental regulations becomes a significant financial burden for small manufacturers. According to the EPA's cost study of emission controls, small companies average USD 90,000 per year in compliance-related costs. These costs include testing, recordkeeping, and equipment upgrades. This imbalance hampers the ability of smaller manufacturers to scale up, invest in innovation, or compete on price, sometimes even in export markets where other certification and safety requirements are required. As a result, consolidation in the market tends to favour larger vertically integrated companies.

Aerosol Can Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 12.7 billion |

|

Forecast Year Market Size (2035) |

USD 22.5 billion |

|

Regional Scope |

|

Aerosol Can Market Segmentation:

Propellant Type Segment Analysis

The liquefied gas segment is anticipated to grow with the largest revenue aerosol can market share of 78.8% over the forecast period, attributed to its efficient spray performance and cost-effectiveness. The EPA states that hydrocarbons are the most widely used because of developed supply chains and regulatory acceptability for non-ozone-depleting alternatives. Compressed carbon dioxide and nitrous oxide account for 12% and 8% respectively, and are generally used in specialized applications like food aerosols (e.g., whipped cream) where the properties of the inert gases are desired. Compressed gases suffering from low volumes and limited pressure offer an improved environmental outlook compared to hydrocarbons; however, the lower pressures and volumes deter the general-purpose aerosol cans from more general uses.

Hydrocarbon propellants are widely used for personal care and household products due to their cost-effectiveness and efficient spray characteristics. However, hydrocarbons are combustible and must be handled very carefully. Dimethyl ether (DME) is a developing alternative due to characteristics such as non-flammability and lower environmental impact, particularly in areas where safety regulations are most restrictive. DME also has improved solubility in many formulations and product stability. In spite of the increased production costs up to 100% higher than hydrocarbons, DME is gaining adoption with the effect of growing R&D investments and attractive regulatory models.

Material Type Segment Analysis

The aluminum segment is anticipated to grow with a substantial aerosol can market share of 45.6% during the forecast years, owing to the low weight, resistance to corrosion, and recyclability of aluminum aerosol cans. According to the Environmental Protection Agency, aluminum recycling uses just 5% of the necessary energy to achieve primary production, which in turn aids sustainability efforts. In addition, Aluminum allows for easy customization in shapes and sizes, and high-speed manufacturing. Its compatibility with numerous coatings and printing technologies improves branding appeal, while its recyclability and lower carbon footprint align with the growing focus on eco-friendly packaging solutions.

Recyclable aluminum cans are increasingly considered the preferred recyclable cylindrical package. Aluminum takes about 5% of the energy that it takes for primary production, so it turns aluminum into one of the lowest-carbon energy materials available. This recent eco-efficiency is therefore a key motivating factor for adoption in markets with stringent environmental policies, such as Europe and North America. Coated Aluminum Aerosol Cans allow better corrosion resistance to the product and metal interaction for enhanced formulation efficiency and product compatibility. Coatings improve shelf life and help ensure that products remain protected from contamination, which is important for healthcare and personal care aerosols. At the same time, while the coating process is an expense and step, it is a cost that most manufacturers feel is justified by the strengths of the coat and the quality of a finished part, thereby propelling the market by 2035.

Product Type Segment Analysis

The straight wall aerosol cans segment is predicted to grow at a notable aerosol can market share of 59.9% by 2035, valued for the ease of manufacture and suitability for a range of uses, ranging from personal care products to household products. Their consistent diameter means that they can be filled and capped by automated lines, saving costs. The straight wall design is also efficient in stacking, storage, and transportation in terms of cost reduction in logistics by manufacturers. Its smooth profile facilitates fast labeling and printing and promotes brand recognition. Similarly, the structural stability of the cans provides product safety at high pressure, and the cans are suitable in aerosol formulations that have volatile propellants. The increased need to use sustainable and lightweight packaging further increases usage in the international market.

Our in-depth analysis of the aerosol can market includes the following segments:

|

Segment |

Subsegment |

|

Material Type |

|

|

Propellant Type |

|

|

Product Type |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerosol Can Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific is projected to dominate the global aerosol can market with the largest revenue share of 35.6% from 2026 to 2035, primarily due to growing industrialization and rising consumer demand in sectors like personal care, household, and automotive. The region is anticipated to grow with a CAGR of 4.5% from 2025 to 2030 and accounts for the maximum market share by 2035. Government initiatives in sustainable manufacturing and in chemical safety are also fueling market development. For instance, Asia Pacific Economic Cooperation (APEC) has been promoting the adoption of green chemistry principles by its member economies, notably by events such as the Green Chemistry and Sound Chemicals Management Workshop. These initiatives have led to improved sustainable chemical practice, such as more innovation and partnering, which can be used to improve environmental performance in a broad range of industries, such as aerosol manufacturing. Such green chemistry efforts within APEC since 2021 have contributed to significant decreases in the use of hazardous chemicals and improvements in safer management of chemicals in the region. In addition, investments in modern material recycling programs and supply chain improvements are increasing the efficiency in manufacturing as well as in operations and environmental compliance. All these factors together provide a good set of conditions for long-term market growth in the region.

The aerosol can market in China is likely to lead the region with the highest share over the projected years, driven by the development of strong policies by the government of China for industrial upgrading and environmental protection. According to the Ministry of Ecology and Environment (MEE), China registered remarkable results in terms of emission cuts between 2020 and 2023 due to tougher policies and adherence to stringent regulations, and the upgrading of industrial technologies. This work continued to help China shift to sustainable industrial processes and environmental management as outlined in the 2023 Climate Action Report.

Moreover, the circular economy outlined in the 14th Five-Year Plan in China reflects the emphasis of the country on the rapid expansion of the circular economy as one of the most important stages of its ecological civilization building. The plan focuses on deepening the combination of resource conservation, environmental protection, and climate action, with economic growth, and developing a modern industrial system to facilitate sustainable development and carbon neutrality by 2060. In addition, the government's support measures (tax incentives) enlist national manufacturers to increase production underwater the holding, and the aerosol cans provide production in several provinces. Due to these conducive policies, China acts as a major force in the global aerosol can trade.

India aerosol can market is expected to grow with the fastest CAGR over the projected years, by 2035. Growing urbanization, along with rising disposable incomes, is encouraging demand from the personal care and household industries for the market. The MoCF raised the output of chemical manufacturing by 9% year-on-year in 2021-26, doubling down on self-reliance-centric Make in India initiatives. In addition, the BIS recently revised the safety standards for aerosol cans in order to ensure the quality of aerosol products and safeguard the safety of consumers using them. To incentivize research and development of alternative and recycled materials for aerosol cans, or cans that can be readily recycled and/or certified to be biodegradable, the government has invested ₹63,42,203 toward developing edible and biodegradable packaging solutions using fruit and vegetable peels. The initiative includes the development of machinery such as edible film, semi-automatic cup, and carton-making equipment for scale-up and transfer to MSMEs and SHGs. All these factors, along with the increasing export opportunities, make India a rapidly developing market for the global aerosol can industry.

North America Market Insights

By 2035, the North American aerosol can market is expected to grow at a significant revenue share of 28.2% of the total market share globally and record a CAGR of 4.8% during the forecast period. This growth is driven by rising consumer demand for sustainability and recyclability in personal care, household, and automotive sectors, and rising regulatory pressure to switch to sustainable and recyclable packaging are the key drivers for this growth. In 2022, the government invested USD 5.2 billion in clean energy chemical production, which represented a 12% increase from 2020, demonstrating a strong commitment to sustainable manufacturing. A program of the U.S. Environmental Protection Agency, Green Chemistry, has been effective in facilitating a fifteen percent decrease in the production of hazardous waste since 2021 by implementing more than 50 green chemistry processes. Additionally, strict regulatory foundations and OSHA chemical safety standards have not only created safer production environments but also driven innovation and compliance across the aerosol can business.

The aerosol can market in the U.S. is expected to dominate the North American region during the projected years, owing to increasing environmental policies and consumer demand for safer propellants. In 2023, the U.S. Environmental Protection Agency (EPA) put into effect new toxic chemical regulations of the Toxic Substances Control Act (TSCA) that compel manufacturers and importers of PFAS chemicals to disclose more detailed information on the substances they produce, use, and dispose of. These rules increase the cost to comply and are estimated at approximately USD 800 million on an industry basis, compelling manufacturers to spend more on less polluting and less hazardous chemical technologies.

The Occupational Safety and Health Administration (OSHA) reports that aerosol manufacturing plants have seen chemical incidents decrease by 10% over the past five years as a result of increased safety measures. In addition, the Department of Energy has an Innovation Grant program that supports technologies related to more energy-efficient aerosol manufacturing processes, with USD 500 million for industrial energy efficiency upgrades. Both these initiatives fuel the market for sustainable growth and are also increasing the understanding of operational safety.

The aerosol can market in Canada is expected to expand at a steady pace by 2035, attributed to the efforts by the government to promote sustainable packaging and waste management. The Environment and Climate Change Ministry of Canada announced an increase of 20% in the recycling rates of aluminum aerosol cans in the last three years, as part of a plan to exceed the 2026 interim target of a 20% reduction in greenhouse gas emissions. In addition, the higher recycling helps support the overall emissions decrease trajectory mentioned in the 2023 Progress Report on the 2030 Emissions Reduction Plan. As of 2022, the Government of Canada is heavily investing in clean energy, addressing Indigenous and rural communities, and allocating funds to these projects to the tune of about CAD 300 million. Such investments are expected to support the shift to clean energy, enhance energy efficiency, and lower greenhouse gas emissions, which will promote sustainable development and economic growth in those areas. This investment is a subset of Canada-wide programs in climate and clean technology to promote a low-carbon economy and environmental-related objectives.

Europe Market Insights

The European aerosol can market is projected to account for a notable revenue share of 25.3% from 2026 to 2035. The growth is mainly due to strict environmental regulations and rising consumer demand for sustainable packaging solutions in the personal care, household, and automotive industries. A review of its fee regulation under REACH is being carried out by the European Chemicals Agency (ECHA) to enhance the financial sustainability of the agency as well as to promote small and medium-sized enterprises (SMEs). This update proposes a 19.5 percent rise in the standard charges to reflect inflation of 2021-23, but with no rise in SME charges. Further, the status of SMEs will no longer be self-declared and then validated, but (ex-ante) will be validated, with companies being required to apply and provide documents at the onset of their three-year validity period. In the UK, the government pays a Plastics Packaging Tax, which is levied at a rate of 210.82 per ton on plastic packaging components that contain less than 30% of plastic that has been reused in 2023. It impacts upon businesses that produce or import 10 tons or over of plastic packaging into the UK and encourages the further use of recycled materials.

Germany is the largest chemical manufacturer in Europe with a 2023 chemical industry turnover of EUR 218 billion, which represents nearly one-third of the total sales of the EU-27. The nation is a high-ranking exporter of chemical products, the third largest in the world, with exports of EUR 142 billion. The German chemical industry has been very active in investment activities between 2019 and 2023, aiming at updating production technology to ensure global competitiveness. Taken together, these policies and investments make Europe a leader in sustainable aerosol can innovation.

Key Aerosol Can Market Players:

- Ball Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crown Holdings, Inc.

- Trivium Packaging B.V.

- Mauser Packaging Solutions

- Nampak Ltd.

- CCL Container

- Silgan Holdings Inc.

- Ardagh Group S.A.

- Bharat Containers Pvt. Ltd.

- Exal Corporation

- Muda Container Berhad

- Kureha Corporation

- Toyo Jidoki Co., Ltd.

- Ikezaki Tekindo Tama

- Toyo Seikan Group Holdings Ltd.

The global aerosol can market is highly competitive, and is dominated by the various multinational companies mainly from the USA and Japan. Major players such as Ball Corporation, Crown Holdings, and Toyo Seikan, who have strong global manufacturing footprints and invested heavily in R&D, are leading the way in creating sustainable and eco-friendly aerosol solutions. Japanese firms, such as Toyo Seikan Group Holdings, Ikezaki Tekindo Tama, Kureha Corporation, and Toyo Jidoki Co., rely on advanced manufacturing technologies and higher quality standards based on the Japan Industrial Standard to set their products apart worldwide. Production capacity expansion initiatives with emerging markets, strategic alliance initiatives for material innovation, an increased focus on recyclable aluminum cans, and low-global-warming-potential propellants are key strategic initiatives across the board. These transitions are part of an all-out attempt to be compatible with increasingly tighter environmental regulations and adapt to changing consumer requirements in the personal, household, automotive, and industrial products areas.

Top Global Aerosol Can Manufacturers

Recent Developments

- In April 2025, Nouryon introduced Demeon ReNu100, a new fully animal-based dimethyl ether (DME) propellant, at in-cosmetics Global, Amsterdam. This technology applies to aerosols such as personal care and household goods and is far less damaging to the environment than the established DME, and its carbon footprint can be as much as 100% smaller than commercial DME. The introduction also indicates the concern Nouryon has about sustainability and other regulations in general, as the quest to find environmentally friendly propellants is on the rise in Europe and other parts of the world. Combining the best aerosol spray performance with low emissions, Demeon ReNu100 is suitably placed as one of the most significant advances in the international aerosol chemicals market.

- In May 2025, Honeywell and Lupin Pharmaceuticals announced that they would promote Solstice Air (HFO-1234ze(E)) as a green propellant in pressurized metered-dose inhalers (pMDIs). The global warming potential (GWP) of Solstice Air is less than 1, and the reduction of greenhouse gas emissions is 99.9% in comparison with HFC-134a. The partnership assists the pharmaceutical industry in transitioning to low-emission aerosol solutions in line with the world's sustainability and healthcare objectives. The partnership is a significant step toward reducing the environmental impact of respiratory care products without reducing the efficacy and patient safety of inhaler use.

- Report ID: 8142

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerosol Can Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.