Advanced Glass Market Outlook:

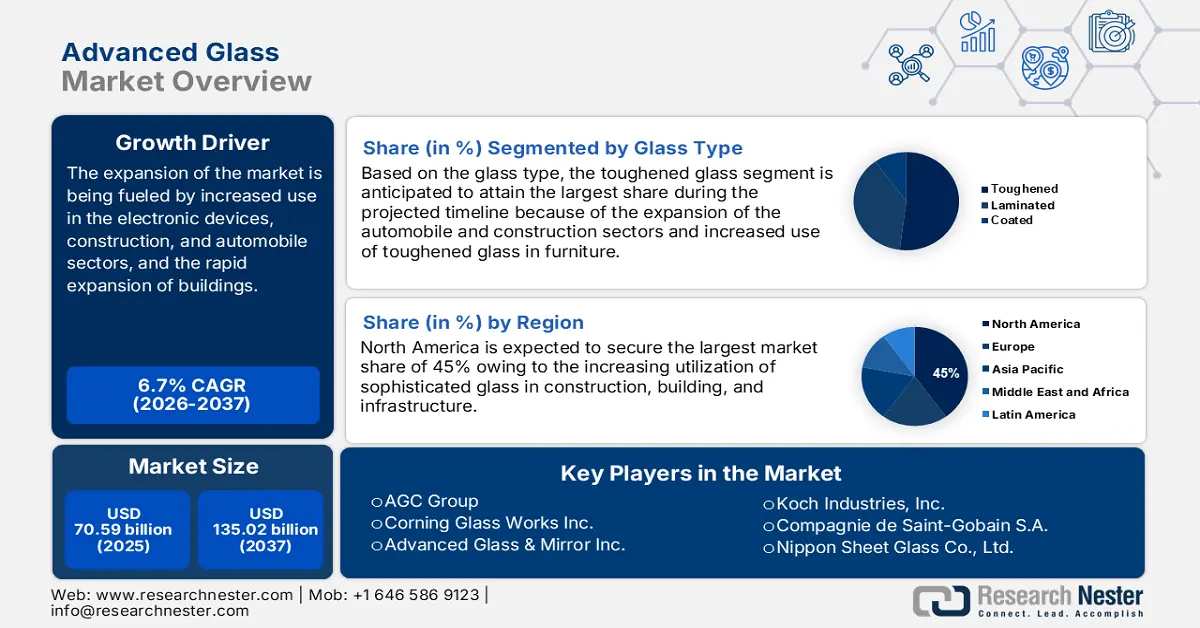

Advanced Glass Market size was valued at USD 70.59 billion in 2025 and is set to exceed USD 135.02 billion by 2035, expanding at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of advanced glass is estimated at USD 74.85 billion.

The increased application of glass in the construction sector is the principal factor contributing to the market's expansion. Glass is a versatile construction element that may be used for everything from lighting to insulation to enhancing a building's appearance. The primary benefits of employing glass in a building include up to 80% natural light transmittance, acoustic proofing, and thermal insulation, weather resistance, holding up well to the impacts of rain, sun, and wind.

Furthermore, increased adoption in the aerospace sector would fuel advanced glass market expansion. Aerostructures use aerospace glass to reduce weight, boost payload capacity, and enhance fuel efficiency. It is frequently used in interior applications where weight savings of up to 20% are possible, such as cargo liners, floors, chairs, and other secondary structural sections. Production of aircraft is anticipated to increase by 57% over 2022-2028 across the globe. For instance, the Arlington, Virginia-based business stated that they are anticipating delivering 400 to 450 of its 740 aircraft by the end of 2023, an increase from approximately 375 aircraft in 2022.

Key Advanced Glass Market Insights Summary:

Regional Highlights:

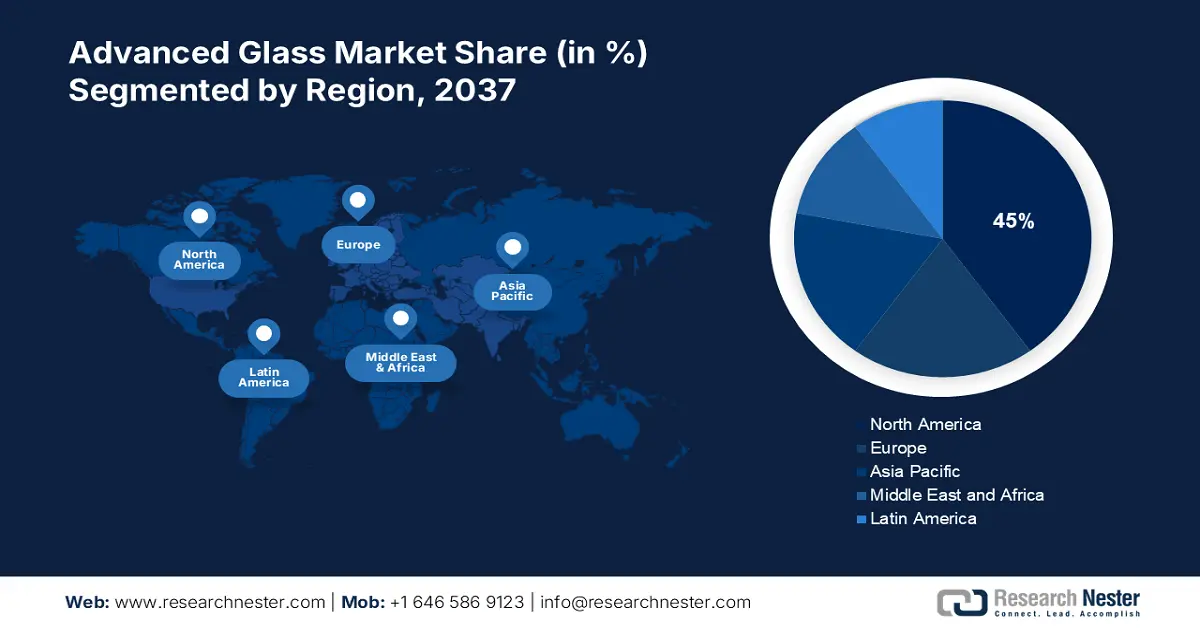

- North America advanced glass market is predicted to capture 45% share by 2035, driven by the expanding building sector and increasing solar energy consumption.

Segment Insights:

- The toughened glass segment in the advanced glass market is forecasted to hold the largest share by 2035, driven by its application in construction, vehicles, household appliances, and gadgets.

- The residential construction segment in the advanced glass market is forecasted to achieve noteworthy growth during 2026-2035, influenced by increasing spending on residential construction.

Key Growth Trends:

- Higher Utilization of Advanced Glass in Solar Panel Manufacturing

- Growing Demand for Safety Glasses

Major Challenges:

- Presence of Alternatives in the Market

- Decline in the Supply-Chain followed by COVID-19

Key Players: Compagnie de Saint-Gobain S.A, Fuyao Glass Industry Group Co., Ltd., Guangzhou Huihua Packaging Products Co, Ltd, Koch Industries, Inc., Nippon Sheet Glass Co., Ltd., Corning Glass Works Inc.

Global Advanced Glass Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 70.59 billion

- 2026 Market Size: USD 74.85 billion

- Projected Market Size: USD 135.02 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 10 September, 2025

Advanced Glass Market Growth Drivers and Challenges:

Growth Drivers

- Higher Utilization of Advanced Glass in Solar Panel Manufacturing - In 2018, approximately 25 exajoules of renewable energy were consumed across the globe while the demand for solar PV is projected to reach around 100 gigawatts by 2024. Photovoltaic cells collectively make up solar panels which are being highly installed across the globe. Photovoltaic glass is the main technology behind the functionality of solar panels. Other benefits of solar control glass are cutting off the sun’s heat, allowing optimum light transmission, and others.

- Growing Demand for Safety Glasses - It is estimated that nearly 75% of eye injuries are caused by sparks striking the eye. Moreover, around 1500 sustain job-related eye injuries in the United States every day.

- Rising Sales of Optics & Lighting Across the Globe - As of 2022, the global lamps & lighting segment was estimated to generate a total revenue of approximately USD 70 billion.

- Spiking Inclination of the Global Population and Sales of Television - In 2022, the television segment was anticipated to hit around USD 150 billion.

Challenges

- Massive Price for Raw Materials and Their Limited Availability - It is projected that the market will be hampered by the rising price of advanced glass, its limited accessibility owing to the widening gap between supply and demand, and the unreliable supply of raw materials. In the coming years, it is predicted that rising raw material costs will restrict the advanced glass market.

- Presence of Alternatives in the Market

- Decline in the Supply-Chain followed by COVID-19

Advanced Glass Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 70.59 billion |

|

Forecast Year Market Size (2035) |

USD 135.02 billion |

|

Regional Scope |

|

Advanced Glass Market Segmentation:

Glass Type Segment Analysis

The toughened glass segment is anticipated to hold the largest market share over the projected time frame. Safety glass that has undergone precise thermal or chemical processing to make it stronger than regular glass is known as tempered or toughened glass. Constructions including commercial, residential, and industrial buildings, vehicle mirrors and windows, greenhouses, household appliances (such as microwaves, refrigerators, cookware, and others), and gadgets such as computers, tablets, and mobile phones can all benefit from the usage of tempered glass.

End-user Segment Analysis

The residential construction segment is projected to witness noteworthy growth over the forecast period. In addition to being utilized to create standard windows and sensitive-looking fenestrations on facades in residential construction, glass is increasingly used as a building thermal insulation material, structural element, façade glazing component, and cladding material. The growth of the segment can be accounted to the increasing spending on construction.

Our in-depth analysis of the global advanced glass market includes the following segments:

|

By Glass Type |

|

|

By End Use Sector |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Advanced Glass Market Regional Analysis:

North American Market Insights

Since advanced glass is widely utilized in the North America, it is predicted that the region will have the biggest market share of 45% by the end of 2035. Since the region's expanding building sector and increasing consumption of solar energy are dynamically accelerating the utilization of solar panels which is further anticipated to fuel the market in the region over the forecast period. For instance, more than 20 million solar panels were deployed in the USA in 2022, and around 1.5 million American houses used solar energy. Whereas, it was anticipated that the construction sector, would expand at a rate of more than 8% in the United States. A total of 1,337,800 dwelling units were constructed in the US in 2021 and had a growth of 4% from 2020. Moreover, the development of energy-efficient construction works, strong R&D spending, greater consumer awareness, and technological improvements all contribute to the further propulsion of the advanced glass market in the region.

Advanced Glass Market Players:

- ·Tyneside Safety Glass Co. Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Advanced Glass & Mirror Inc.

- Türkiye ÅžiÅŸe ve Cam Fabrikaları A.Åž.

- AGC Group

- Compagnie de Saint-Gobain S.A

- Fuyao Glass Industry Group Co., Ltd.

- Guangzhou Huihua Packaging Products Co, Ltd

- Koch Industries, Inc.

- Nippon Sheet Glass Co., Ltd.

- Corning Glass Works Inc.

Recent Developments

-

Huihua Co., Limited created novel patterns of glass with silk road. Laminated, tempered, textured, and etched glass were among the types of glass employed. The enterprise also intends to introduce and manufacture additional glass lines in the ensuing years.

-

Fuyao Group won the "Global Excellence Gold Award" at the 2018 Jaguar Rand Rover Supplier Conference held in the UK. The accolade was given in recognition of establishing an excellent working relationship with Jaguar Rover by providing wired heated glass and other standard-setting items.

- Report ID: 4664

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Advanced Glass Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.