ADAS Radar Systems Market Outlook:

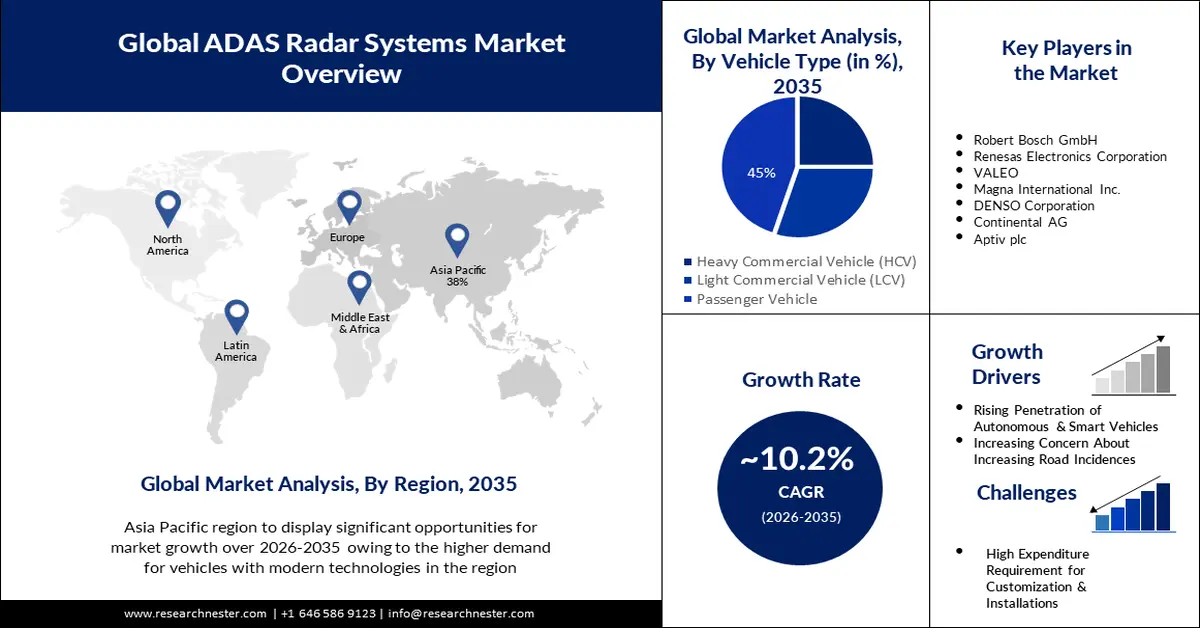

ADAS Radar Systems Market size was over USD 14.23 billion in 2025 and is poised to exceed USD 37.59 billion by 2035, witnessing over 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ADAS radar systems is evaluated at USD 15.54 billion.

The major factor accredited to the market growth is the rising demand for safety feature-enabled vehicles owing to the surging cases of road accidents worldwide. World Health Organization 2022 statistics state that each year, road crashes are responsible for over 1 million deaths worldwide. Advanced Driver-Assistance Systems (ADAS), support driver in navigation, and parking, along with several other applications, whereas, ADAS radars sensors are mounted on vehicles for detecting objects in front of the vehicle which basically deliver drivers with safety alerts and enable in execution of safety operations such as automatic emergency braking (ABS), adaptive cruise control (ACC), and blind spot monitoring among others. Hence, the augmenting use of aforementioned advanced features and sensory technology in automobiles to ensure the safety of vehicles, drivers, and pedestrians is bolstering the market growth. As per findings over 9.6 billion automotive sensors were sold globally in 2021.

Key ADAS Radar Systems Market Insights Summary:

Regional Highlights:

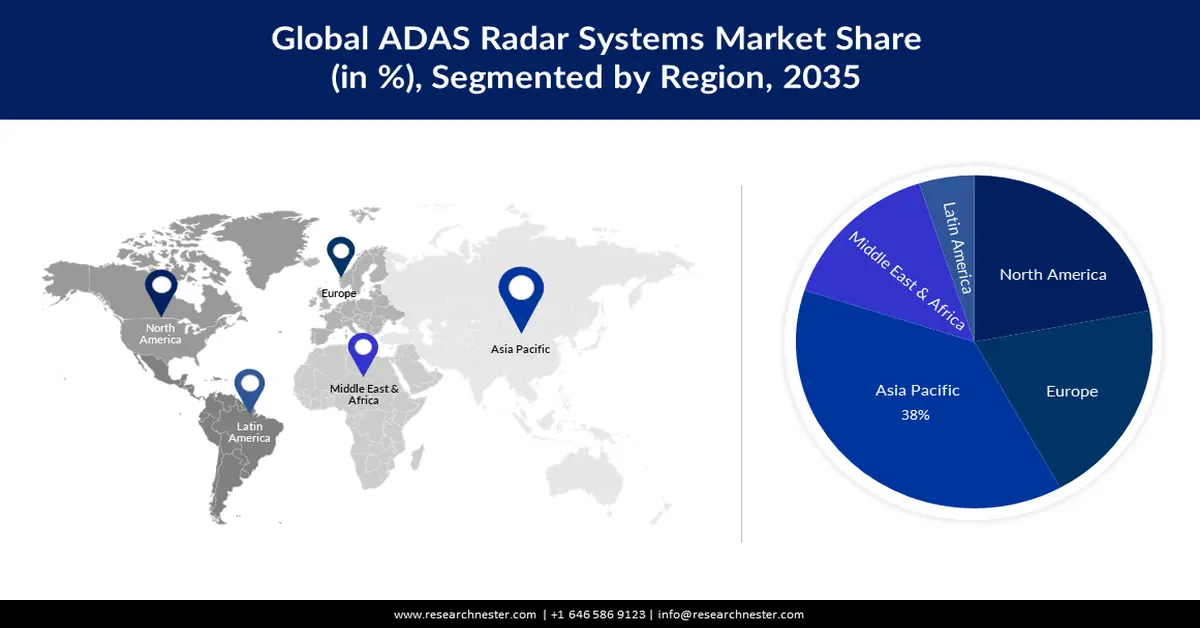

- The Asia Pacific adas radar systems market is projected to command nearly 38% share by 2035, supported by the strong presence of major automobile manufacturers and the region’s increasing production of smart vehicles driven by advanced automotive technology adoption.

- North America is expected to capture about 22% share by 2035, underpinned by the rising penetration of connected vehicles and the growing preference for cars equipped with radar-based ADAS technologies to enhance road safety.

Segment Insights:

- By 2035, the passenger vehicle segment in the adas radar systems market is anticipated to secure around 45% share, reinforced by mounting demand for electric and autonomous passenger cars and the broader integration of semiconductor-based vision systems.

- The adaptive cruise control segment is forecast to hold the leading share in 2035, stimulated by rapid advancements in active safety systems that autonomously manage a vehicle’s acceleration and braking.

Key Growth Trends:

- Growing Penetration of Autonomous & Smart Vehicles

- Rising Number of Vehicles Production & Growing Demand for Luxury Cars

Major Challenges:

- Concern Related Sensor Limitations

- Expensive Charges for Customization & Installations

Key Players: Renesas Electronics Corporation, Robert Bosch GmbH, VALEO, Magna International Inc., DENSO Corporation, Continental AG, Aptiv plc, Hyundai Mobis (Hyundai Motor Group), Veoneer Inc., ZF Friedrichshafen AG.

Global ADAS Radar Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.23 billion

- 2026 Market Size: USD 15.54 billion

- Projected Market Size: USD 37.59 billion by 2035

- Growth Forecasts: 10.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

ADAS Radar Systems Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Penetration of Autonomous & Smart Vehicles – In 2022, China had more than 55% of all smart vehicles in the world with different levels of automation. Autonomous cars assure safe driving with no human interaction supported by the installation of a wide range of sensors in these vehicles to build reliable vision. The sensors technologies such as ultrasonic, LiDAR, and RADAR help autonomous vehicles detect blockages in the driving environment and ensure vehicle movement without facing any fatalities. Hence, with the rising shift of the automotive industry from human-driven vehicles to self-driven vehicles with higher levels of autonomy, the demand for such technologies is also expected to expand, propelling the growth of the ADAS radar system market in the near future.

- Rising Number of Vehicles Production & Growing Demand for Luxury Cars – The surging production of vehicles worldwide which in number reached to be around 80 million motor vehicles worldwide in 2021, owing to their rising demand is responsible for growing innovation and advancements in the automotive industry. Moreover, the increasing disposable income and the rising standard of living of the global population are augmenting the demand for premium cars with more advanced features which is further estimated to boost the market growth. For instance, in 2021, luxury car retails in India exhibited an upward trend and grew by ~19% compared to 2020.

Challenges

-

Concern Related Sensor Limitations – The available current sensor technologies have difficulty detecting small objects or fast-moving things and may fail in traffic safety tasks. These limitations need development and are currently hampering the market growth.

-

Expensive Charges for Customization & Installations

-

Complex In-built Functions

ADAS Radar Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 14.23 billion |

|

Forecast Year Market Size (2035) |

USD 37.59 billion |

|

Regional Scope |

|

ADAS Radar Systems Market Segmentation:

Vehicle Type {Heavy Commercial Vehicle (HCV), Light Commercial Vehicle (LCV), Passenger Vehicle}

The passenger vehicle segment is predicted to garner the largest market share of around 45% by the end of 2035. The growing demand for electric & autonomous passenger cars globally and the rising adoption of vision systems in passenger vehicles that employ technologies such as semiconductor-based vision sensors, light-based LIDAR, and radio-based radar is projected to augment the segment growth in the upcoming years.

System Type (Blind Spot Detection, Parking Assistance, Lane Departure Warning System, Autonomous Emergency Braking, Intelligent Headlights, Adaptive Cruise Control, Heads-up Display)

The adaptive cruise control segment is projected to generate the highest market share during 2035 owing to the ongoing advancements in the active safety system of vehicles to automatically controls the acceleration and braking of a vehicle. Adaptive cruise control works on sensory technology and uses a radar sensor or laser sensor or camera setup that allows the car to discover an object and warn the driver about potential forward collisions.

Moreover, the autonomous emergency braking segment is estimated to witness major growth on the back of a growing number of vehicles and a surge in road crash incidences which is responsible for the elevating demand for advanced pre-crash or collision avoidance systems (CAS) to prevent the severity of a vehicle collision.

Our in-depth analysis of the global market includes the following segments:

|

Vehicle Type |

|

|

System Type |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ADAS Radar Systems Market - Regional Analysis

APAC Market Forecast

The ADAS radar systems market in Asia Pacific is projected to be the largest with a share of about 38% by the end of 2035. The presence of giant automobile manufacturing leaders in countries such as China and the high production of vehicles owing to its rising demand for smart vehicles together with the adoption of advanced automotive technology in the region are leading to the expansion of the regional market.

Additionally, the incorporation of technologies, such as advanced driver assistance systems in vehicles and installations of ADAS sensor components for driving safer and more comfortably is projected to boost the regional market growth.

North American Market Statistics

The North America ADAS radar systems market is estimated to be the second largest, registering a share of about 22% by the end of 2035, owing to the rising penetration of connected vehicles in the region. Moreover, the rising rate of road vehicle accidents in countries such as the United States and the increased demand for cars with advanced features such as radar system that is becoming breakthrough automotive ADAS technology for improving road safety and enabling driver convenience is also predicted to rapidly expand the ADAS radar systems market in the region. According to the statistics, in the United States, there were 39,508 fatal motor vehicle crashes in 2021 resulting in nearly 42,939 deaths.

ADAS Radar Systems Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Renesas Electronics Corporation

- Valeo

- Magna International Inc.

- DENSO Corporation

- Continental AG

- Aptiv plc

- Hyundai Mobis (Hyundai Motor Group)

- Veoneer Inc.

- ZF Friedrichshafen AG

Recent Developments

-

October 21, 2021: Robert Bosch GmbH to participate in publicly funded CONCORDA project in a consortium headed by Ertico project which is innovated to secure data transmission supports assistance systems in safety-critical driving situations and used for future automated driving functions.

-

September 29, 2021: Horizon Products and Continental AG to join hands for the commercialization of automotive AI technology. The main focus of this venture are the artificial intelligence processors and algorithms for intelligent driving.

- Report ID: 3787

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ADAS Radar Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.