Acute Hepatic Porphyria Treatment Market Outlook:

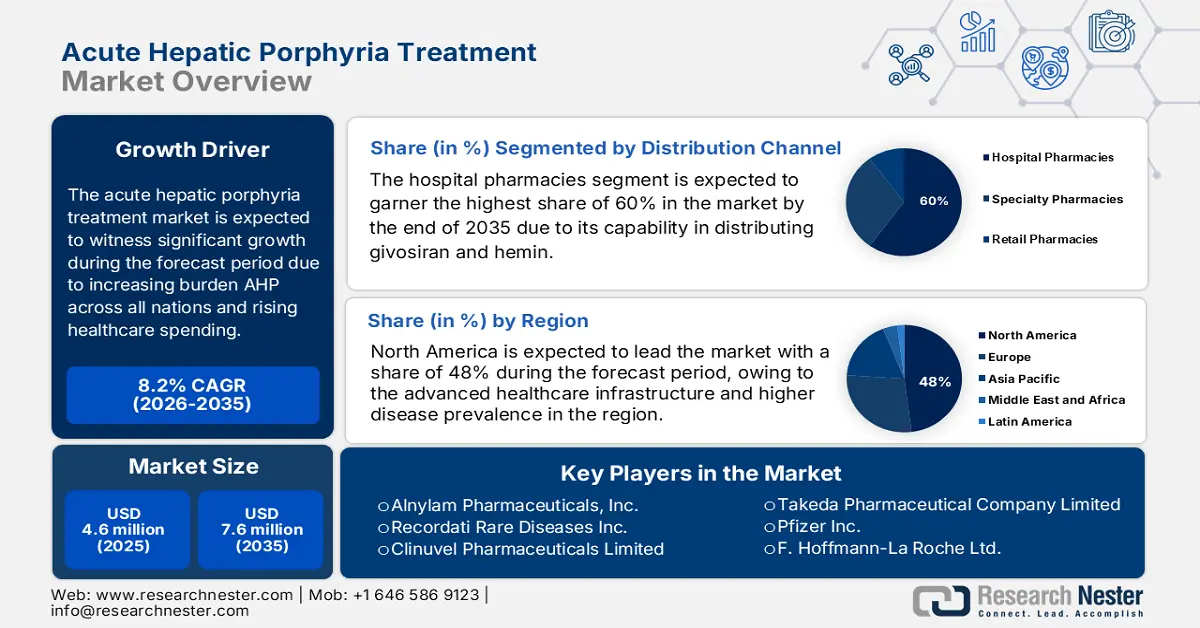

Acute Hepatic Porphyria Treatment Market size was estimated at USD 4.6 million in 2025 and is projected to reach USD 7.6 million by the end of 2035, rising at a CAGR of 8.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of acute hepatic porphyria treatment is assessed at USD 920.6 million.

The global acute hepatic porphyria treatment market is evolving rapidly, driven by its extensive patient pool and ongoing technological advancements in therapeutic procedures. The NLM study in December 2024 has clearly depicted that the symptomatic population prevalence ratio is 1:20,000. The supply chain for AHP treatments is highly specialized, involving the synthesis of complex active pharmaceutical ingredients (APIs) like hemin and givosiran under stringent current good manufacturing practices. Further, rising government and institutional investments in rare disease research are supporting the development and wider availability of acute hepatic porphyria therapies worldwide.

Additionally, the global trade in AHP treatments is witnessing significant developments. In 2023, the OEC states that Germany is marked as a major exporter of pharmaceutical products, accounting for USD 115 billion, and similarly, the U.S. is the leading importer, holding the worth of USD 170 billion. Besides, the research activities also drive business in the sector, gaining the interest of global leaders to invest in such therapeutics. In this regard, in March 2025, the Ministry of Health and Family Welfare has allocated Rs. 118.82 crore for R&D in rare diseases for the fiscal year 2024-2025. Similarly, Europe gained public-private funding initiatives to focus on gene therapy and heme biosynthesis modulation. Hence, these factors will readily boost the acute hepatic porphyria treatment market development by 2035.

Key Acute Hepatic Porphyria Treatment Market Insights Summary:

Regional Insights:

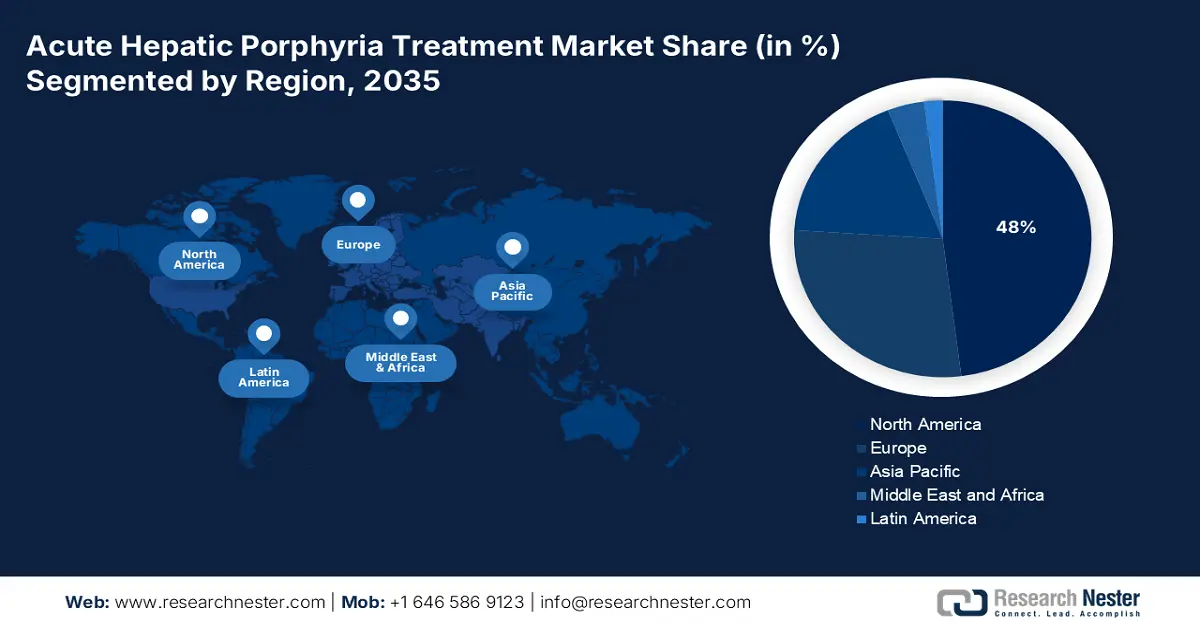

- By 2035, the North America Acute Hepatic Porphyria Treatment Market is projected to secure a dominant 48% share, supported by advanced healthcare infrastructure and favorable FDA orphan drug policies.

- During 2026–2035, Asia Pacific is anticipated to experience the fastest expansion in the region’s acute hepatic porphyria treatment landscape, fueled by rising disease awareness and the emergence of targeted therapies.

Segment Insights:

- By 2035, the hospital pharmacies segment in the Acute Hepatic Porphyria Treatment Market is projected to command a 60% share, bolstered by its expanding capability in distributing givosiran and hemin.

- By 2035, the prophylactic therapy segment is positioned as the leading treatment type based on its paradigm-shifting clinical and economic value, underpinned by the long-term cost-effectiveness of prophylactic intervention.

Key Growth Trends:

- Unmet medical needs

- Investment in research on novel therapeutic modalities

Major Challenges:

- High costs of treatment

- Orphan drug pricing pressures and caps

Key Players: Alnylam Pharmaceuticals, Inc.,Mitsubishi Tanabe Pharma Corporation,Recordati Rare Diseases,Medunik USA,Teva Pharmaceutical Industries Ltd.,JCR Pharmaceuticals Co., Ltd.,Pfizer Inc.,Sanofi S.A.,Fresenius Kabi AG,Daiichi Sankyo Company, Limited,Takeda Pharmaceutical Company Limited,Hikma Pharmaceuticals PLC,Sun Pharmaceutical Industries Ltd.,Dr. Reddy's Laboratories Ltd.,CSL Limited,Novartis AG,Ipsen Pharma,Mylan N.V. (now part of Viatris),Teijin Pharma Limited

Global Acute Hepatic Porphyria Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.6 million

- 2026 Market Size: USD 920.6 million

- Projected Market Size: USD 7.6 million by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: India, South Korea, Brazil, Italy, Canada

Last updated on : 29 September, 2025

Acute Hepatic Porphyria Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in diagnostic capabilities and disease awareness: Initially more accurate diagnosis was critical and difficult for expanding the treatable patient pool. Various initiatives such as NIH funded on research related to genetic testing and biomarker identification to reduce the traditional diagnostic delay. As per the NLM report on December 2024, the combined biochemical and genetic testing increases the diagnosis rate by up to 18 %, from 56% to 74%, highlighting the advances in the diagnosis. Further, the number of diagnosed patients eligible for treatment grows, directly driving demand for therapeutic interventions.

- Unmet medical needs: Another significant driver in the acute hepatic porphyria treatment market is the unmet medical needs of patients, especially from developing regions. For instance, MHLW reported that there is a huge opportunity for AHP treatment in the country, as patients are lacking access to givosiran due to its high cost. These highlighted health disparities among the patients across developing nations are anticipated to boost the market expansion for AHP treatments.

- Investment in research on novel therapeutic modalities: The continuous R&D in enhancing the treatment in AHP is improving gradually. The investment is directed towards next-gen therapies that provide more convenient administration for oral formulations, improved safety profiles, and novel mechanisms of action that overcome the main cause of the disease. The NIH report in January 2025 has stated that USD 48 billion is allocated to medical research focusing on enhancing life and minimizing illness and disability. Continuous innovation makes the evolution in the treatment environment and drives the market further.

Therapeutic siRNAs in clinical trials

|

Product |

Sponsor Company |

Target |

Disease |

Current Development |

|

Fitusiran (ALN-AT3SC) |

Sanofi Genzyme |

Antithrombin |

Hemophilia A and B |

Phase III – NCT03417245 (ATLAS-A/B) Phase III – NCT03417102 (ATLAS-INH) Phase III – NCT03549871 (ATLAS-PPX) Phase II/III – NCT03974113 (ATLAS-PEDS) Phase III – NCT03754790 (ATLAS-OLE) |

|

Nedosiran (DCR-PHXC) |

Dicerna Pharmaceuticals |

Hepatic LDH |

Primary hyperoxaluria |

Phase III – NCT04042402 (PHYOX3) Phase II – NCT05001269 (PHYOX8) |

|

Teprasiran (QPI-1002) |

Quark Pharmaceuticals |

p53 |

AKI |

Phase III – NCT02610296 (ReGIFT) |

|

Tivanisiran (SYL-1001) |

Sylentis S.A. |

Transient receptor potential cation channel subfamily V member 1 |

Ocular pain, DED |

Phase III – NCT03108664 (HELIX) |

|

Vutrisiran (ALN-TTRSC02) |

Alnylam Pharmaceuticals |

Transthyretin |

hATTR |

Phase III – NCT03759379 (HELIOS-A) Phase III – NCT04153149 (HELIOS-B) |

Source: NLM January 2023

Challenges

- High costs of treatment: One of the major restricting barriers for the acute hepatic porphyria treatment market is the high cost associated with the AHP treatments across the world. It is reported that Alnylam Pharmaceutical’s Givlaari (givosiran), which is one of the U.S. FDA-cleared therapies, costs very high for each patient. This can hinder the market penetration in price-sensitive regions, making it challenging for patients to afford them. Besides, this can create a major hurdle for healthcare facilities as the costs are unsustainable, negatively impacting market upliftment.

- Orphan drug pricing pressures and caps: Government-imposed robust price control is the key restraint for both industry players and customers. The clinical added value (ASMR), which directly influences the negotiated price in France, is assessed by the Transparency Committee (HAS). An ASMR level V rating with minor improvement translates into severe pricing restraints. Japan's NHI system also gives a robust cost-effectiveness evaluation, which tends to result in prices that are less than in the U.S., reducing profit margins for manufacturers entering the market.

Acute Hepatic Porphyria Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 4.6 million |

|

Forecast Year Market Size (2035) |

USD 7.6 million |

|

Regional Scope |

|

Acute Hepatic Porphyria Treatment Market Segmentation:

Distribution Channel Segment Analysis

The hospital pharmacies segment is projected to account for a lucrative share of 60% in the acute hepatic porphyria treatment market during the forecast period. In this regard, in 2023, the WHO reported that the growth of the segment is subject to its capability in distributing givosiran and hemin. The NLM study in October 2024 states that givosiran treatment has minimized the annualized rate of porphyria attacks by 97% and the annualized days of hemin by 96% in long-term follow-up. Thus, this is the evidence for a wider scope positioning of hospital pharmacy as the influencing segment in the market.

Treatment Type Segment Analysis

Prophylactic therapy is leading the treatment type segment and is dominated due to its paradigm-shifting clinical and economic value. By avoiding debilitating attacks, these treatments substantially minimize emergency department utilization and hospitalization, both significant drivers of costs. The NLM study in November 2024 states that 21.4% of patients with acute intermittent porphyria (AIP) were receiving prophylactic hemin therapy regularly every 1 to 4 weeks before starting givosiran treatment, highlighting the demand for the therapy. The Agency for Healthcare Research and Quality (AHRQ) highlights the long-term cost-effectiveness of prophylactic treatment over treatment-driven intervention. FDA-approved RNAi treatments, engineered for chronic prophylaxis, show better results in minimizing yearly attack rates and thus are the standard of care and the chief market growth driver.

Drug Class Segment Analysis

RNAi drugs will dominate the drug class segment share due to their targeted nature of action and robust clinical efficacy information. They work by eliminating the pathogenetic trigger of attacks by lowering hepatic levels of pathogenic precursors. The Orphan Drug program established by the FDA, which offers incentives to new therapies for orphan diseases, has played a pivotal role in their development and marketing. Their higher efficacy profile in the attainment of attack-free intervals, as reported in FDA-approved labeling, supports their premium pricing and solidifies their leadership as the best therapeutic class.

Our in-depth analysis of the acute hepatic porphyria treatment market includes the following segments:

|

Segments |

Subsegments |

|

Treatment Type |

|

|

Drug Class |

|

|

Route of Administration |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acute Hepatic Porphyria Treatment Market - Regional Analysis

North America Market Insights

The North America acute hepatic porphyria treatment market is projected to register the highest share of 48% during the forecast period. The region benefits from an advanced healthcare infrastructure and higher disease prevalence that necessitate effective treatment procedures. The main drivers of the market include favorable FDA orphan drug policies, huge commercial and federal insurance coverage, and robust patient advocacy. A primary trend is the strategic shift from acute attack management to prophylactic therapies that reduce attack frequency, improving long-term patient outcomes and quality of life. This is further driving the interest of domestic players to develop more innovative formulations in the sector.

The acute hepatic porphyria treatment market in the U.S. is driven by rapid innovation, high-cost treatments and robust federal support for orphan diseases. The key trend is the incorporation of RNAi-based prophylactic therapies into mainstream treatment, dramatically lessening disabling attacks and changing the treatment model from reactive to preventive. As per the NLM report in May 2023, 1 in 25,000 people have porphyria. CMS data shows expanding Medicare Part D coverage for these specialty drugs, though high out-of-pocket costs remain a concern.

Canada's acute hepatic porphyria treatment market is experiencing a rapid growth due to government-backed funding and rising healthcare access across. The NLM study in August 2024 depicts that the Canada government has announced a three-year funding amount of USD 1.5 billion, which is for rare disease drug access starting in 2023, highlighting its increasing demand. To minimize the differences in treatment availability, patient advocacy groups are emerging and becoming powerful for a national rare disease strategy that would standardize care and enhance access across provinces.

Prevalence of Acute Hepatic Porphyria in U.S. and Canada

|

Year |

Country |

Prevalence Estimate |

Notes |

|

2023 |

U.S. |

Approximately 1 in 20,000 |

Diagnosed symptomatic population prevalence estimate |

|

2024 |

U.S. |

Estimated 5 to 10 cases per 100,000 population |

Range for Acute Intermittent Porphyria (AIP) |

|

2023 |

Canada |

1 in 500 to 1 in 50,000 |

Based on epidemiological parallels and population size |

Source: NLM December 2024, NLM May 2023, Canadian Association for Porphyria 2023

APAC Market Insights

Asia Pacific acute hepatic porphyria treatment market is anticipated to witness the fastest growth during the forecast timeline, owing to its increased awareness of disease detection and the innovation of targeted therapies. The thriving growth in the region is mainly due to the contribution of developing countries such as Japan, China, India, Malaysia, and South Korea. Besides the government support and collaborations between leading pharmaceutical firms are enhancing patient outcomes. This adoption of innovative treatment options is expected to propel market growth across the region.

India's acute hepatic porphyria treatment market is unfolding remarkable growth opportunities during mainly fueled by the public and private healthcare collaborations and the government healthcare spending for the rare disease. In this regard, the Indian Organization for Rare Diseases report in December 2024 has announced the budget of ₹974 crore for the years 2024 to 2025 and 2025 to 2026, including the research on acute hepatic porphyria. Furthermore, the expansion of medical services and awareness campaigns is contributing to growth in India.

The acute hepatic porphyria treatment market in Japan is growing gradually due to the robust regulatory framework for orphan drugs that surges the approval and provides significant incentives for manufacturers. The AHP cases in Japan patient experience a high clinical burden due to the acute attacks and long-term complications. According to the NLM study in December 2024, nearly 88% of the study population experienced acute attacks, and 77% of patients required treatment at a healthcare facility. Widespread patient access to approved therapies is guaranteed by government support via NHI reimbursement, and continued research and growing awareness of diagnostics are expected to propel steady market growth with Japan's larger rare disease strategy.

Europe Market Insights

The acute hepatic porphyria treatment market in Europe is actively driven by a strong regulatory framework led by the European Medicines Agency (EMA), which facilitates accelerated approval pathways for orphan drugs like givosiran. Key growth drivers include rising disease cases, enhanced diagnostic capabilities, and the adoption of high-cost, innovative prophylactic therapies used to reduce attack frequency. As per the NLM report in December 2023, the prevalece of AHP in Europe is 0.5 per 100,000 population. The extension of reimbursement policies within national healthcare systems is driving the market, although market access differs among nations because of different cost-containment strategies and health technology assessment (HTA) bodies.

The UK's acute hepatic porphyria treatment market is growing and is driven by NHS England's commitment to improving rare disease care. The NHS England data in February 2025 states that the estimated people affected with acute hepatic porphyria is 1 in 100,000 people. On the other hand, according to the NHS Long Term Plan, specialized services for rare conditions are a key focus. The UK allocates significant resources to its Highly Specialised Technologies (HST) pathway for ultra-rare diseases, through which AHP treatments are evaluated.

Germany is dominating the acute hepatic porphyria treatment market in Europe. The market is driven due to its early market access system and strong orphan drug focus. The Federal Joint Committee (G-BA) provides orphan drugs with accelerated review and value-based reimbursement. Germany's expenditure on specialty pharmaceuticals include AHP treatments keeps increasing dramatically. The German healthcare system’s willingness to rapidly adopt innovative treatments, as reported by the Federal Ministry of Health (BMG), makes it a critical market for manufacturers.

Key Acute Hepatic Porphyria Treatment Market Players:

- Alnylam Pharmaceuticals, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Tanabe Pharma Corporation

- Recordati Rare Diseases

- Medunik USA

- Teva Pharmaceutical Industries Ltd.

- JCR Pharmaceuticals Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Fresenius Kabi AG

- Daiichi Sankyo Company, Limited

- Takeda Pharmaceutical Company Limited

- Hikma Pharmaceuticals PLC

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- CSL Limited

- Novartis AG

- Ipsen Pharma

- Mylan N.V. (now part of Viatris)

- Teijin Pharma Limited

Companies involved in the acute hepatic porphyria treatment market are focusing on regional expansion as each of them contributes to unique therapeutic approaches. With a collective aim of developing exclusive therapeutics, firms are leveraging different sorts of revenue-making opportunities. For example, Alnylam Pharmaceuticals leads with its RNA interference therapy, the U.S. FDA approved GIVLAARI (givosiran), for AHP treatment. Besides, companies such as Takeda, Pfizer, and F. Hoffmann-La Roche are investing in research and development to expand their product portfolios in the AHP sector. Hence, these strategies are boosting companies’ growth and maintaining competition in the market significantly.

Below is the list of some prominent players in the industry:

Recent Developments

- In June 2024, Alnylam Canada ULC announced its partnership with Prevention Genetics to offer genetic testing and counseling for patients who are pubescent and older who may carry a gene mutation known to be associated with the acute hepatic porphyrias.

- In May 2024, CRISPR Therapeutics expanded its pipeline with new pre-clinical programs utilizing LNP-mediated delivery to the liver for refractory hypertension targeting angiotensinogen (AGT) and acute hepatic porphyria (AHP) targeting 5’-aminolevulinate synthase 1 (ALAS1).

- Report ID: 2558

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.