Activated Alumina Market Outlook:

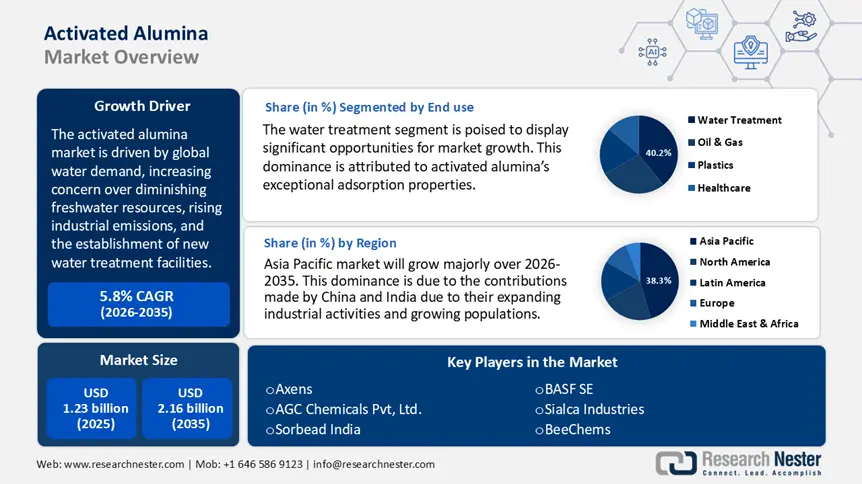

Activated Alumina Market size was over USD 1.23 billion in 2025 and is poised to exceed USD 2.16 billion by 2035, growing at over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of activated alumina is estimated at USD 1.29 billion.

The activated alumina market is experiencing significant growth, driven by escalating global water demand, increasing concern over diminishing freshwater resources, rising industrial emissions, stringent environmental regulations, and the establishment of new water treatment facilities. Its outstanding absorption capabilities render it highly suitable for applications in water treatment, air purification, and catalysis. Growing demand from the oil and gas, chemical, and pharmaceutical industries further supports market growth. Additionally, the global push for sustainable and efficient purification technologies continues to bolster the use of activated alumina across various sectors.

Activated alumina, produced through the dihydroxylation of alumina hydroxide, results in a highly porous material with an extensive surface area, making it exceptionally effective in adsorption processes. This material is instrumental in various applications, including water purification, where it effectively removes contaminants like fluoride and arsenic, as well as in gas drying, catalysis, and as a desiccant. Its high surface area and porosity also make it suitable for use in bioceramics and as a catalyst support in petrochemical industries. The versatility and efficiency of activated alumina in these applications underscore its growing demand across multiple sectors.

A notable instance is Sumitomo Chemical Co., Ltd., a leading chemical manufacturer located in Japan. Sumitomo Chemical produces high-quality activated alumina products that cater to diverse industries, including water treatment, petrochemicals, and pharmaceuticals. Their activated alumina is available in both powder and spherical forms, with controlled particle strength, surface area, pore volume, and impurity levels. Sumitomo Chemical’s commitment to quality is demonstrated by its ISO9001 certification, reflecting its dedication to maintaining high standards in product development and customer satisfaction. The company’s commitment to innovation and sustainability has positioned it as a key player in the activated alumina market, addressing global challenges related to water purification and environmental protection.

Key Activated Alumina Market Insights Summary:

Regional Highlights:

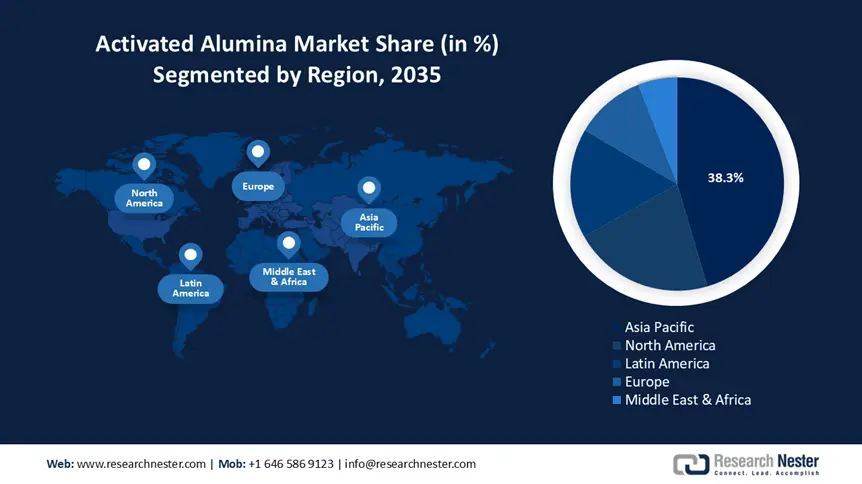

- Asia Pacific dominates the Activated Alumina Market with a 38.3% share, driven by industrial expansion in China and India and growing demand for alumina, reinforcing its leadership through 2035.

- North America's Activated Alumina Market is expected to see the fastest growth by 2035, fueled by refining capacity growth and water treatment demand in the U.S. and Canada.

Segment Insights:

- The Water Treatment segment is anticipated to hold a 40.2% share by 2035, driven by activated alumina’s exceptional adsorption properties for removing contaminants like fluoride and arsenic.

- The Powder Form segment of the Activated Alumina Market is projected to capture a significant share from 2026 to 2035, driven by its essential role in catalytic applications, particularly in the Claus reaction in gas processing and petroleum refining.

Key Growth Trends:

- Increasing demand for alumina beads

- Increasing utilization of gas as an alternative fuel

Major Challenges:

- Availability substitutes

- High production costs

- Key Players: Axens, AGC CHEMICALS PVT. LTD., Sorbead India, Shandong Zhongxin New Material Technology Co., Ltd., Luoyang Xinghua Chemical Co., Ltd., Sialca Industries, Shayan Corporation.

Global Activated Alumina Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.23 billion

- 2026 Market Size: USD 1.29 billion

- Projected Market Size: USD 2.16 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Activated Alumina Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for alumina beads: The escalating demand for alumina beads is largely driven by the urgent necessity for effective water treatment solutions, particularly in developing regions where groundwater contamination from industrial waste and naturally occurring pollutants like fluoride and arsenic presents considerable difficulties. Governments and regulatory bodies are increasingly adopting stringent water quality standards to combat these issues, thus accelerating the use of advanced filtration materials. Activated alumina beads, with their high porosity, large surface area, and superior adsorption capabilities, are proven to effectively remove harmful contaminants, making them indispensable in both municipal and industrial water treatment systems.

Beyond water purification, these beads are also used in gas drying, catalyst support, and desulfurization processes across sectors such as oil and gas, chemical manufacturing, and environmental engineering. A notable instance is BASF SE, a leading player in the activated alumina market, offering a diverse range of products for applications such as water treatment, air and gas drying, and chemical processing. Their products are recognized for consistent quality, meeting international standards, and are used globally for critical environmental and industrial operations. With growing environmental awareness and infrastructure investment, demand for alumina beads is expected to rise steadily during the forecast period. - Increasing utilization of gas as an alternative fuel: The growing utilization of gas as an alternative fuel, particularly compressed natural gas (CNG) and liquefied natural gas (LNG), has led to a substantial demand for effective gas purification techniques. Activated alumina beads play a vital role in the oil and gas industry by dehydrating and purifying gases, ensuring they remain free from moisture and contaminants such as carbon dioxide, hydrogen sulfide, and other trace impurities. As global energy policies shift towards cleaner fuel options to reduce carbon emissions, the consumption of CNG and LNG has grown by nearly one and a half times in recent years.

This surge necessitates advanced gas treatment technologies to protect infrastructure and enhance combustion efficiency. Companies like Axens, a global provider of technologies and products for the energy sector, offer high-performance activated alumina beads specifically designed for gas hydration and purification processes. Their solutions are widely adopted through refining and gas processing facilities. As cleaner energy transitions accelerate, the demand for activated alumina in gas applications is expected to continue its upward trajectory.

Challenges

- Availability substitutes: The activated alumina market is encountering significant challenges due to the increasing presence of alternatives like zeolites and activated carbon, which demonstrate similar adsorption characteristics. Furthermore, concerns over the potential decline in activated alumina’s absorption efficiency during prolonged use may hinder its demand over the forecast period. Despite these challenges, the market continues to evolve with insights into recent developments, trade dynamics, production trends, and technological innovations. Comprehensive analysis includes market share evaluations, value chain optimization, and emerging opportunities, alongside regulatory impacts, regional expansions, product approvals, and strategic growth initiatives across various application segments and geographies.

- High production costs: The manufacturing process for activated alumina is an energy-intensive process that involves high-temperature thermal treatment of aluminum hydroxide. This requirement for high energy consumption can lead to elevated production costs compared to alternative, expensive adsorbents. In a price-sensitive market, such elevated production costs can limit competitiveness and reduce profit margins for manufacturers. Additionally, fluctuations in energy prices further impact cost stability, making long-term planning challenging. These factors collectively pose constraints in market growth, especially in developing regions where cost-effectiveness is a primary consideration for industrial and municipal applications of activated alumina.

Activated Alumina Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 1.23 billion |

|

Forecast Year Market Size (2035) |

USD 2.16 billion |

|

Regional Scope |

|

Activated Alumina Market Segmentation:

End use (Water Treatment, Oil & Gas, Plastics, and Healthcare)

Water treatment is estimated to emerge as the leading end-use segment in the activated alumina market, accounting for over 40.2% of the total demand. This dominance is attributed to activated alumina’s exceptional adsorption properties, which allow it to effectively remove contaminants such as fluoride, arsenic, selenium, and sulfur from water. Its high surface area and porous structure make it ideal for municipal and industrial water purification systems, particularly in regions with groundwater contamination issues. The increasing focus on providing safe drinking water, along with stringent environmental regulations, continues to drive the adoption of activated alumina in water treatment processes globally.

A notable instance is Calgon Carbon Corporation, a U.S.-based company that specializes in water treatment applications, including systems that utilize activated alumina. The company has developed a range of adsorption systems designed to remove arsenic from drinking water, incorporating various adsorptive media such as activated alumina, titanium, and iron-based adsorbents, and ion exchange resins. These systems are part of Calgon Carbon aimed at addressing contaminants like perchlorate, nitrate, and MTBE/TBA in both drinking water treatment and groundwater remediation applications. The company’s commitment to innovation and sustainability has solidified its position as a leader in the water treatment industry.

Application (Catalyst, Desiccant, Fluoride Adsorbent, and Bio Ceramics)

Activated alumina in powder form holds a significant share of the activated alumina market, primarily because of its essential function as a catalyst or catalyst support in various industrial processes. One of its most significant applications is in the Claus reaction, where it facilitates the conversion of hydrogen sulfide into elemental sulfur in gas processing and petroleum refining. Its high surface area, thermal stability, and resistance to abrasion and thermal shock make it highly effective under demanding operational conditions. As global refining capacity continues to expand, particularly in regions like India, where Saudi Arabia has invested in large-scale refinery projects, demand for activated alumina in catalytic applications is expected to grow.

An exemplary case is Porocel Industries, a company located in Texas that is well-known for its activated alumina offerings and catalyst services. Porocel offers a range of activated alumina solutions tailored for catalytic applications, including sulfur recovery and hydro processing. Their products are engineered to provide high adsorption capacity, thermal stability, and mechanical strength, making them suitable for demanding industrial processes. Porocel’s expertise in catalyst regeneration and custom catalyst development further enhances their value proposition in the activated alumina market.

Our in-depth analysis of the global market includes the following segments:

|

End use |

|

|

Application |

|

|

Particle Size

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Activated Alumina Market Regional Analysis:

Asia Pacific Market Statistics

The activated alumina market in the Asia Pacific is expected to capture the largest share, estimated at 38.3%, by the year 2035. This dominance is due to the contributions made by China and India due to their expanding industrial activities and growing populations. China’s surge in aluminum production, particularly in Yunnan province, has intensified the need for alumina, leading to a significant increase in spot prices. For instance, CHALCO Shandon Advanced Material Co., Ltd., a subsidiary of the Aluminum Corporation of China Limited, is recognized as a leading producer of alumina and aluminum products, involved in various operations such as mining, refining, and smelting. The company is actively expanding its production capacities and investing in environmentally friendly technologies to meet the growing demand for activated alumina in various applications.

In India, the focus on enhancing refining capacities and ensuring a sustainable freshwater supply has propelled the need for activated alumina. National Aluminum Company Limited (NALCO) stands out as a leading public sector enterprise that embodies this trend. The company manages a comprehensive bauxite-alumina-aluminum-power facility and is acknowledged as the most cost-effective producer of metallurgical alumina and bauxite globally. The company’s commitment to renewable energy, with commissioned wind power plants totaling 50 MW, underscores its role in sustainable industrial practices. These developments in China and India highlight the strategic importance of activated alumina in supporting industrial growth and addressing environmental challenges in this region.

North America Market Analysis

North America has rapidly emerged as the fastest-growing activated alumina market, with the U.S. and Canada playing pivotal roles in this growth. In the U.S., the expansion of refining capacities significantly contributed to the increased demand. ExxonMobil's expansion of the Beaumont refinery has notably enhanced its capacity by 250,000 barrels per day, which has consequently heightened the demand for activated alumina in desulfurization and gas purification processes. Canada's market growth is driven by advancements in gas projects and a strong emphasis on water treatment. The country’s commitment to improving water infrastructure has led to increased utilization of activated alumina for contaminant removal. A prominent instance in this sector is Axens Canada Specialty Aluminas Inc., a subsidiary of the French group Axens. In October 2022, In October 2022, Axens enhanced its footprint in the North American market through the acquisition of the activated alumina division of Rio Tinto Alcan, situated in Brockville, Ontario. This strategic acquisition has enabled Axens to enhance its production capabilities and cater to the growing demand for activated alumina in applications such as water treatment, gas purification, and catalysis. The Brockville facility now serves as a critical hub for Axens’ operations in the region, reflecting the company’s commitment to delivering high-quality alumina products and supporting sustainable industrial practices.

Key Activated Alumina Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Axens

- AGC CHEMICALS PVT. LTD.

- Sorbead India

- Shandong Zhongxin New Material Technology Co., Ltd.

- Luoyang Xinghua Chemical Co., Ltd.

- Sialca Industries

- Shayan Corporation

- BeeChems

- Hengye Inc.

- Huber Engineered Materials

Key players in the activated alumina market leverage advanced manufacturing technologies, such as precision calcination, tailored surface modification, and nano-structuring techniques. These innovations enhance surface area, adsorption efficiency, and durability, enabling superior performance in water purification, catalysis, and gas drying applications, positioning these companies at the forefront of market competitiveness.

Recent Developments

- In August 2024, Alcoa Corporation completed its acquisition of Alumina Limited, resulting in full ownership of the Alcoa World Alumina and Chemicals (AWAC) joint venture. This strategic decision bolsters Alcoa's status as a prominent global aluminum supplier, improving its competitive advantage in essential markets. The acquisition is expected to result in long-term value creation through greater financial and operational flexibility.

- In October 2022, Axens entered into an Asset Sale Agreement (ASA) with Rio Tinto Alcan, a company based in Canada, concerning the sale of its activated alumina operations located in Brockville, Ontario. This acquisition is expected to provide opportunities for growth in new global markets.

- Report ID: 7601

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Activated Alumina Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.