Acetyl-L Carnitine Market Outlook:

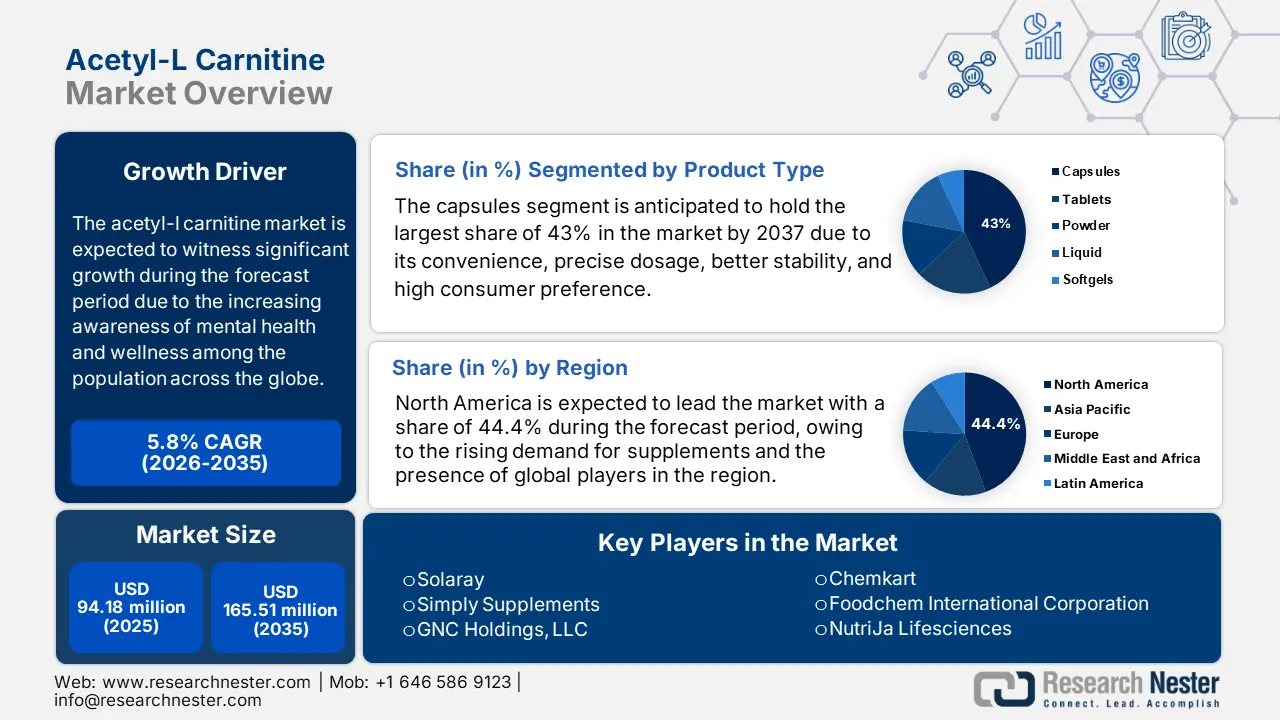

Acetyl-L Carnitine Market size was over USD 94.18 million in 2025 and is projected to reach USD 165.51 million by 2035, growing at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acetyl-l carnitine is evaluated at USD 99.1 million.

The growth of the acetyl-l carnitine market can be characterized by contemporary lifestyle and social changes that emphasize immense consumer awareness regarding cognitive health and overall wellness. The market has benefited from a substantial patient pool leveraging the ingredient as a dietary supplement in enhancing brain functioning and reducing mental fatigue. According to the WHO report in March 2024, one out of three people globally is concerned with neurological concerns, that is, 3 billion people, which is a rise of 18% over the past few decades. The mortality rate is 80% higher in developing countries than the developed countries, which underscores the health disparities and the requirement for effective supplements to mitigate risk.

In addition, the global market has benefited from the exceptional research capabilities of the pharmaceutical and healthcare organizations in incorporating acetyl-l-carnitine into a wide range of therapeutic applications, such as fat conversion and anti-aging. For instance, in April 2023, Eli Lilly and Company notified that tirzepatide 10 mg and 15 mg demonstrated 15.7% weight loss in adults with obesity and type 2 diabetes in 72 weeks, resulting from SURMOUNT-2 clinical trials. This growing interest in weight management and metabolic health supports the accessible demand for supplements such as acetyl-l-carnitine in the global market toward betterment in the health status of the affected population.

Key Acetyl-L Carnitine Market Insights Summary:

Regional Highlights:

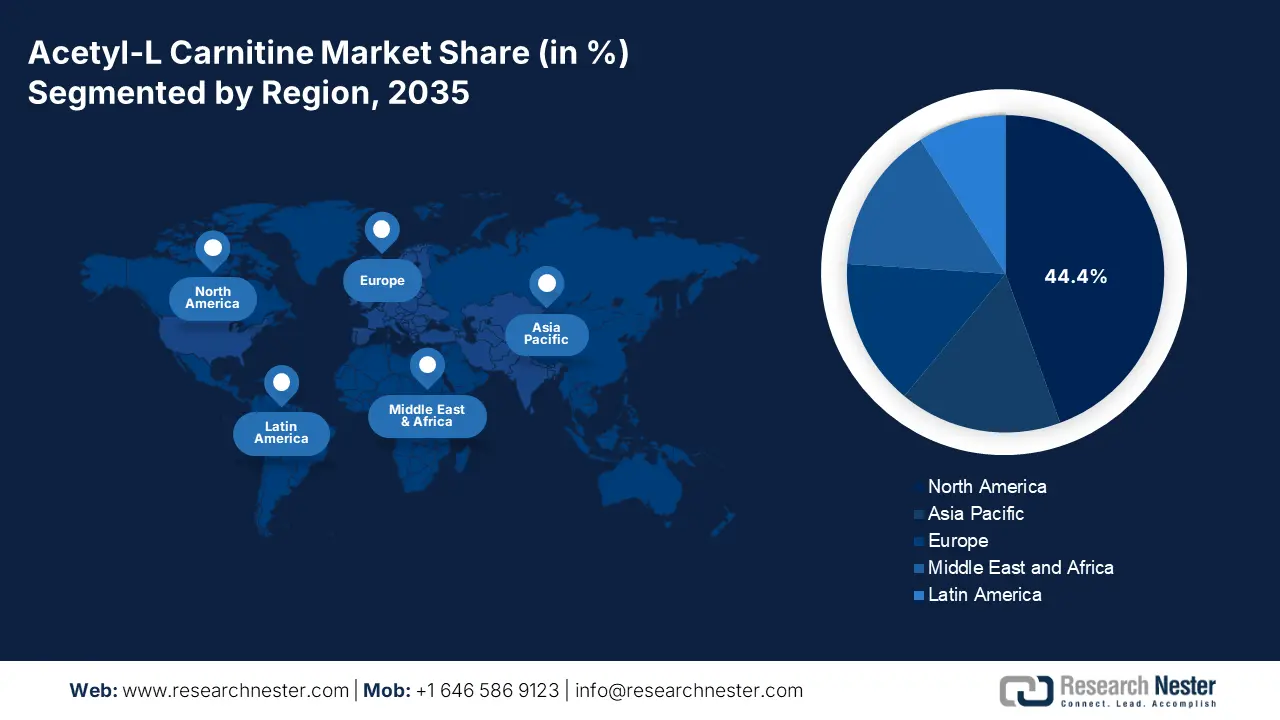

- North America dominates the Acetyl-L Carnitine Market with a 44.4% share, fueled by the rising burden of chronic diseases and the substantial expansion of pharmaceutical and healthcare organizations, ensuring robust growth through 2035.

- Asia Pacific's acetyl-L carnitine market anticipates lucrative growth by 2035, fueled by a substantial patient population diagnosed with neurological disorders necessitating acetyl-l-carnitine as a therapeutic.

Segment Insights:

- The Capsules segment is anticipated to achieve a 43% share by 2035, driven by rising consumer preference for precise dosage in dietary supplements.

- The seniors segment is anticipated to hold a 32% share by 2035, fueled by increased use of carnitine drugs to improve RBC function and reduce oxidative stress in aging populations.

Key Growth Trends:

- Increasing acquisitions

- Pharmaceutical developments

Major Challenges:

- Limited clinical evidence

- Higher production costs

- Key Players: Post Holdings, GNC, Nature's Way, Nature's Bounty, NOW, and more.

Global Acetyl-L Carnitine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.18 million

- 2026 Market Size: USD 99.1 million

- Projected Market Size: USD 165.51 million by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Acetyl-L Carnitine Market Growth Drivers and Challenges:

Growth Drivers

- Increasing acquisitions: The major driver of the acetyl-l carnitine market is the rising pharmaceutical acquisitions. With its ability to support mental clarity and age-associated cognitive decline, the element is driving interest from healthcare firms. In September 2024, Hikma Pharmaceuticals PLC finalized the acquisition of Xellia Pharmaceuticals’ US finished dosage form business with a deal including a facility in Ohio, Sales and marketing capabilities, and an R&D center in Croatia, aiming to strengthen the commercial portfolio and production supplements. Hence, this denotes a positive outlook for the market with an enhanced acetylcysteine injectables portfolio.

- Pharmaceutical developments: The principal driver for the market is pharmaceutical development. This would allow treatments of overall health aside from the standard stimulants. For instance, in December 2020, Body&Fit, Glanbia Performance Nutrition partnered with Lonza Group AG to use its Duocap capsule technology and specialty ingredients, aiming to launch new supplements targeting joint health, immunity, and beauty. Such innovative solutions in supplemental treatment with a proper regulatory approval fuel the market growth through catering to the ever-increasing interest in the effective management of health and wellness.

Challenges

- Limited clinical evidence: The main bottleneck in the market is the low clinical evidence, which is often confused with broader health claims. Despite potential in managing neurological disorders and fatigue, the lack of consistent, regulatory-approved outcomes restricts manufacturers from marketing for diverse therapeutic uses. This fact hinders consumer trust and affects product positioning, particularly in markets with stringent health claim regulations.

- Higher production costs: Another major limiting factor in the market is the higher costs associated with the production procedure of acetyl-l-carnitine, which can overburden the consumers with higher prices of the final product. These costs are further exacerbated by the extraction process from a source that is quite complex and expensive. These factors can negatively impact the consumers from price-sensitive regions where the disposable income is low, further widening health disparities.

Acetyl-L Carnitine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 94.18 million |

|

Forecast Year Market Size (2035) |

USD 165.51 million |

|

Regional Scope |

|

Acetyl-L Carnitine Market Segmentation:

Product Type (Capsules, Tablets, Powder, Liquid, Softgels)

Based on product type, the capsules segment in acetyl-l carnitine market is expected to garner the highest share of 43% in the market by the end of 2035. The dominance of the segment is attributable to the rising consumer preference for a precise dosage of dietary supplements. As per the April 2023 NLM study evaluating a total of 21 clinical trials comprising 1,204 adults diagnosed with gentle cognitive impairment, incorporated supplements having 1.5 to 3.0 g/day acetyl-L-carnitine or placebo for about 3 to 12 months that resulted in greater improvements in participants who used supplements when compared to placebo participants. Thus, it highlights the role of this element in improving cognitive functions with significant outcomes, widening the market’s scope.

End User (Seniors, Adults, Pediatric, Athletes & Fitness Enthusiasts, Patients)

Based on end user, the senior segment is projected to account for a lucrative share of 32% in the acetyl-l carnitine market during the forecast period. This is an area of growth because, increasingly, prescribers in the health industry are using these agents and stimulant medications for treating health concerns. As per a June 2024 Ash Publications Organization study found that the genetic factors significantly influence carnitine levels in the stored blood cells (RBCs), affecting their quality. It further stated that specific gene polymorphisms in carnitine were linked to aging, so carnitine is found to help improve RBC functioning and reduce oxidative stress, hence, entrench the use of carnitine drugs in managing cognitive and RBC storage functioning.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetyl-L Carnitine Market Regional Analysis:

North America Market Statistics

The North America acetyl-l carnitine market is anticipated to register a significant share of 44.4% by 2035. The dominance in the region is attributable to the rising burden of chronic diseases and the substantial expansion of pharmaceutical and healthcare organizations. Due to the increased demand for the supplements, the firms are leveraging approvals to benefit from the revenues. In March 2025, Glenmark Pharmaceuticals Inc. USA notified the launch and acquisition of acetylcysteine injection, 6 gm/30 ml (200 mg/ml) single-dose vials from Aspen Pharma USA Inc., which matches the efficacy of Acetode by Cumberland Pharmaceuticals. Such factors may boost market upliftment and indicate demand for affordable hospital treatments.

The U.S. market is unfolding remarkable growth opportunities attributable to the increased healthcare spending due to the increasing instances of cognitive and other chronic disorders. This is inspiring the domestic players to launch effective acetyl formulations with a supportive regulatory framework. For instance, in January 2025, Nacuity Pharmaceuticals, Inc., was presented with the Fast Track designation for NPI-001 (N-acetylcysteine amide) tablets from the U.S. FDA, which is to be indicated for retinitis pigmentosa. Thus, such milestones are a positive outlook for the market to expand more during the forecast period.

The market in Canada is witnessing significant growth due to the growing emphasis on aging support and energy metabolism, with a large consumer base. In addition, the rising demand for dietary supplements among the country’s geriatric population is a key factor driving growth in Canada. In February 2023, Celanese Corporation declared the completion of a low-capital project to expand the ethylene vinyl acetate (EVA) capacity at its Alberta facility. This move supports the growing global demand for EVA in various applications such as food packaging, medical devices, and drug delivery solutions, strengthening the country’s acetyl value chain.

Asia Pacific Market Analysis

The acetyl-l carnitine market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast period. The region hosts a substantial patient population diagnosed with neurological disorders that necessitate the use of acetyl-l-carnitine as a therapeutic application. Moreover, the formulation is being investigated for its potential in managing male and female infertility with an antioxidant nature for enhanced reproductive health. This is the evidence for a wider scope, which is why the role of the ingredient has become more prominent in this region, thereby supporting market progression.

The market in India is expecting substantial growth owing to the increased awareness of the benefits offered by acetyl-l-carnitine in various health applications. It has the potential to improve focus and memory enhancement, which is inspiring the international players to establish their footprint in the country. In May 2024, Celanese Corporation announced its expansion in India with two new facilities at Silvassa and Hyderabad to offer its services in the global market with enhanced capabilities. Such factors are anticipated to augment the country’s growth with increased outcomes.

The acetyl-l carnitine market in China is gaining traction due to growing collaborations between chemical companies with a collective goal of improving health and wellness through their expansion strategies. For instance, in December 2023, Handsome Chemical Group Co. Ltd. declared the beginning of a 500,000-ton Acetate and 100,000-ton electronic grade ethyl acetate project in Jingmen to expand its industrial chain and meet the huge demand of acetates in wider applications. The project includes multiple acetate types marking a major milestone in enhancing its global acetate production capacity thereby supporting market expansion.

Key Acetyl-L Carnitine Market Players:

- Solaray Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Post Holdings

- Nature's Way

- Nature's Bounty

- NOW

- Swanson

- MRM

- Myprotein

- Primaforce

- Vitamin World

- Post Holdings

- NutraKey

- Nutraceutical

- INEOS Acetyls

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd

- KBR, Inc.

- Applied Nutrition PLC

- Glenmark Pharmaceuticals Inc.

- Nacuity Pharmaceuticals, Inc.,

- Celanese Corporation

- Eli Lilly and Company

- Hikma Pharmaceuticals PLC

- Lonza Group AG

The company’s landscape in the acetyl-l carnitine market is rapidly changing due to its increased focus on innovation, product formulation, and clinical research. This has been translated into the incorporation of high-quality supplements targeting cognitive health, energy metabolism, and age-associated concerns. For instance, in March 2022, Applied Nutrition PLC announced the launch of Carni-Tone, which is its first flavored spring water infused with L-Carnitine and B-vitamins which marking the brand’s entry into the L-carnitine ready-to-drink products. This strong focus on the market presence with increasing product launches is anticipated to boost the market growth further.

Here's the list of some key players:

Recent Developments

- In November 2024, INEOS Acetyls with Gujarat Narmada Valley Fertilizers & Chemicals Ltd declared that they have signed an MOU to establish an exclusive 600kt Acetic Acid plant at Bharuch, Gujarat, India, to reduce dependency on imports.

- In March 2023, KBR, Inc. finalized the acquisition of Acetica, which is an acetic acid production technology that enables CO2 utilization for the production of high-value chemicals such as vinyl acetate monomer crucial ingredient in various materials.

- Report ID: 7667

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetyl-L Carnitine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.