Accounts Payable Automation Market Outlook:

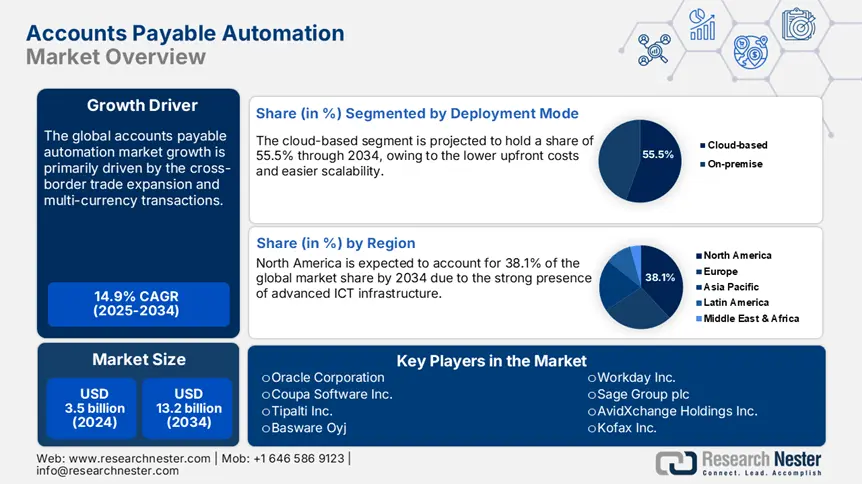

Accounts Payable Automation Market size was USD 3.5 billion in 2024 and is estimated to reach USD 13.2 billion by the end of 2034, expanding at a CAGR of 14.9% during the forecast period, i.e., 2025-2034. In 2025, the industry size of accounts payable automation is assessed at USD 4.1 billion.

The trade of accounts payable automation systems is mainly dependent on the stable supply chain of cloud computing, cybersecurity, and tools & components that connect different software solutions. The U.S. Census Bureau reveals that the production of software and IT services, including AP automation, is growing steadily. In 2023, the U.S. exported around USD 71.1 billion worth of IT services. Many parts of these systems, including hardware and IT consulting, were sourced from India, Ireland, and Canada, which accounted for more than 60% of imported IT services in 2023, per the data from the Bureau of Economic Analysis. The imports of data processing equipment registered a 12% hike in 2023, indicating a high need for the infrastructure behind these automation systems, according to the U.S. International Trade Commission (USITC).

Considering the cost perspective, the U.S. Bureau of Labor Statistics (BLS) reveals that the producer price index for software publishing grew by 3.5% year-over-year by Q4 2024. This reflected high costs associated with R&D, cybersecurity, and cloud infrastructure. Further, the consumer price index for information technology services rose by 1.9% year-over-year during the same period, indicating a moderate upward shift in pricing for end-client automation services. The ongoing investment strategies across the world are likely to propel the sales of accounts payable automation systems in the years ahead.

Accounts Payable Automation Market - Growth Drivers and Challenges

Growth Drivers

- Demand for real-time payment (RTP) and faster reconciliation: The expansion of real-time payment infrastructure is expected to boost the adoption of accounts payable automation systems. The U.S. FedNow Service, launched in July 2023, has raised expectations for instant supplier payments and cash reconciliation. Moreover, Europe's SEPA Instant Credit Transfer, used by more than 60.5% of payment service providers, is making payments faster and easier. Modern AP automation tools are now connecting directly with banking systems through APIs. The companies are investing heavily in automated systems to avoid late payment fees and enhance their days payable outstanding (DPO).

- Cross-border trade expansion and multi-currency transactions: The booming global trade is fueling the demand for accounts payable systems that manage several complex international invoices. The accounts payable software solutions that handle foreign exchange and follow local tax laws are gaining traction. In Southeast Asia and Sub-Saharan Africa, where cross-border trade is increasing, AP systems tailored to local needs are more in demand. Companies using these advanced accounts payable systems for handling multiple currencies and locations are completing their financial processes up to 25.3% faster across their global operations. This reflects that the robust effectiveness of these solutions is expected to boost their sales in the years ahead.

- Government funding for SME digitalization in AP and procurement: The hefty public spending for digitalization across small and mid-sized enterprises is anticipated to amplify the sales of accounts payable automation systems during the foreseeable period. Many countries are taking initiatives to promote digital tools and technologies. For example, Japan’s Digital Transformation Support program, covering up to 49.5% of software costs, is estimated to accelerate the trade of accounts payable automation solutions. Moreover, the favorable grants by governments are likely to boost the production and commercialization of accounts payable automation solutions. One such example is the EU’s Digital Europe Programme that allocated €2.0 billion for business process automation between 2021 and 2025.

Technological Advancements in the Market

|

Technology |

Industry |

Adoption Rate |

Use Case / Result |

|

AI-based Invoice Capture |

Finance |

61.5% |

A fall in processing time by 35.5% |

|

Cloud-Native Platforms |

Healthcare |

48.3% |

Transitioned to paperless AP systems |

|

API Integration |

Manufacturing |

56.6% |

Siemens cut invoice cycle times by 40.2% using SAP |

Pricing Trends in the Accounts Payable Automation Market

|

Region |

2020 Avg. Price/Seat (USD) |

2024 Avg. Price/Seat (USD) |

CAGR (%) |

Key Drivers |

|

North America |

$101 |

$79 |

–6.1% |

Cloud shift, SaaS pricing models |

|

Europe |

$93 |

$84 |

–2.4% |

AI adoption, e-invoicing mandates |

|

Asia Pacific |

$71 |

$82 |

+3.9% |

5G rollout, compliance reforms, and onboarding |

Challenges

- Cybersecurity compliance and associated costs: The government’s strict cybersecurity rules for accounts payable automation software are making market entry more complex and costly for small and medium-sized companies. For example, in the U.S., a rule called NIST SP 800-218 demands secure software development, which substantially increases the cost of accounts payable automation system production. The World Trade Organization estimates that aligning with cybersecurity requirements increases the cost of setting up AP systems by 21% to 25%. Some of the big companies are mitigating these situations by integrating zero-trust systems into their platforms.

- Inconsistent procurement and digital infrastructure policies: In many developing countries, government procurement policies with unclear plans for digitalization are likely to hinder the trade of accounts payable automation solutions in the years ahead. The World Trade Organization (WTO) discloses that unclear public procurement laws in Sub-Saharan Africa are lowering the adoption of accounts payable automation technologies in public sector finance. In 2024, only 15% of government purchasing processes in African countries were digital, according to the same source. Thus, the lack of advanced infrastructure hinders the adoption of accounts payable automation systems in developing regions.

Accounts Payable Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

14.9% |

|

Base Year Market Size (2024) |

USD 3.5 billion |

|

Forecast Year Market Size (2034) |

USD 13.2 billion |

|

Regional Scope |

|

Accounts Payable Automation Market Segmentation:

Deployment Mode Segment Analysis

The cloud-based segment is projected to account for 55.5% of the global accounts payable automation market share by 2034, owing to the lower upfront costs, easier scalability. The compliance with evolving data privacy laws is expected to boost the adoption of cloud-based solutions. The National Institute of Standards and Technology (NIST) states that the benefits of cloud services under the NIST SP 800-146 guide emphasize cost-efficiency and rapid deployment. Such outlines are poised to boost the trade of cloud-based solutions in the coming years. The U.S. federal government’s Cloud Smart Strategy is also promoting the adoption of cloud platforms in public institutions. Furthermore, the government incentives for digital transformation are promoting the deployment of cloud accounts payable automation systems.

Organization Size Segment Analysis

The large enterprise segment is anticipated to capture 63.1% of the global market share throughout the forecast period. The high invoice volumes, the need for global compliance, and complex multi-currency operations are promoting the deployment of accounts payable automation technologies among large enterprises. According to the U.S. Census Bureau, the large companies accounted for more than 69.5% of all B2B invoice flows in 2023, owing to the stringent audit and data traceability requirements. The AI-powered fraud detection and real-time analytics are also gaining traction among large enterprises as they aid in mitigating risks and optimizing cash flow visibility.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Mode |

|

|

Organization Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Accounts Payable Automation Market - Regional Analysis

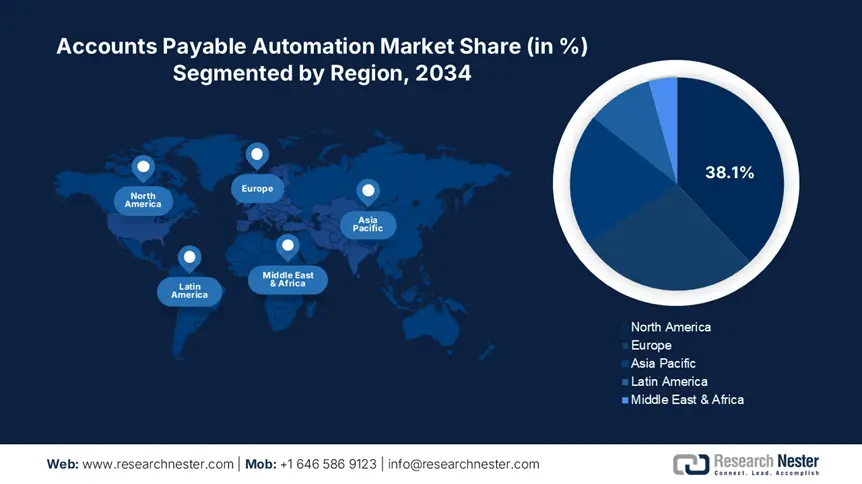

North America Market Insights

The North America accounts payable automation market is expected to hold 38.1% of the global revenue share through 2034, owing to the strong presence of advanced ICT infrastructure. The high enterprise digital maturity and federal digital transformation funding are boosting the demand for accounts payable automation solutions. High adoption of 5G-enabled ERP systems and AI-integrated invoice processing tools by large enterprises is further accelerating the trade of accounts payable automation technologies. The public sector procurement automation initiatives across federal agencies are also set to drive the adoption of advanced accounts payable solutions in the years ahead.

The sales of accounts payable automation solutions in the U.S are driven by the aggressive digitization across federal and enterprise sectors. The federal funding via the National Telecommunications and Information Administration (NTIA) and the Federal Communications Commission’s (FCC) digital initiatives are contributing to the increasing adoption of accounts payable automation technologies. In 2023, NTIA’s USD 1.1 billion Middle Mile grant boosted fiber backbone expansion for remote enterprise access across the country.

The Canada market is projected to increase at a high pace owing to the government-led digital programs. The enterprise cloud shift in both public and private sectors is boosting the demand for advanced accounts payable solutions. The Innovation, Science and Economic Development (ISED) commitment of more than CAD 3.3 billion under the Innovation Superclusters Initiative is driving cloud ERP innovation and AI integration across finance departments. Furthermore, the strong regulatory groundwork for trust-based AP automation systems is expected to boost the revenues of key players by the end of the forecast period.

Europe Market Insights

The Europe accounts payable automation market is anticipated to account for 27.6% of the global revenue share throughout the study period. The region's digital maturity and strong regulatory alignment are boosting the sales of accounts payable automation solutions. The consistent public-private investments are also propelling their adoption rates. The European Commission allocated around €7.6 billion under the Digital Europe Programme between 2021 and 2027, with ~€1.3 billion directed toward automating enterprise workflows across member states. The EU Digital Strategy and Digital Europe Programme are accelerating the deployment of accounts payable automation solutions across finance, manufacturing, and public sectors.

The demand for accounts payable automation technologies in Germany is driven by industrial digitalization and federal e-invoicing laws. The allocation of more than €800.4 million to digital infrastructure upgrades in 2023. The manufacturing sector’s need for streamlined procurement is increasing the application of accounts payable automation solutions. The country’s Digital Now funding program and BMDV’s digital infrastructure grants are key factors amplifying the trade of accounts payable automation systems.

The France market is estimated to increase at a robust pace, owing to the hefty public spending in the ICT and digital programs. The government-backed mandates on e-invoicing are accelerating the adoption of accounts payable automation technologies. The government’s 2024 finance bill mandating B2B e-invoicing for all enterprises by 2026 is pushing companies to adopt AP automation platforms proactively. The domestic fintech companies are set to double the revenues of key players in the years ahead.

Country-Specific Insights

|

Country |

2023 - ICT Budget Spent on AP Automation |

2023 National Trend |

|

United Kingdom |

12.5% |

Strong SaaS adoption; NHS invoice digitization |

|

Germany |

13.7% |

SAP cloud rollouts; Manufacturing ERP upgrades |

|

France |

11.9% |

Public sector e-invoicing mandates |

APAC Market Insights

The Asia Pacific accounts payable automation market is foreseen to increase at a CAGR of 13.1% from 2025 to 2034. The rising ICT infrastructure investments and digital transformation initiatives are boosting the adoption of accounts payable automation solutions. The government-backed automation mandates are also accelerating the sales of accounts payable automation technologies. The boom in cross-border transactions is leading to a surge in real-time payment solution adoption. The push for public-sector digital procurement in China and India is poised to propel the revenues of key players in the years ahead.

China is expected to lead the sales of accounts payable automation solutions due to the presence of aggressive digital policy frameworks. The MIIT’s 2023 Smart Enterprise Upgrade program and China Academy of Information and Communications Technology’s (CAICT) Cloud ERP expansion roadmap are opening high-earning opportunities for accounts payable automation technology producers. According to CAICT, more than 3.6 million enterprises adopted AP automation solutions in 2023.

The India accounts payable automation market is set to be driven by the massive digital adoption programs and hefty ICT investments. The public spending jumped by 41.4%, hitting USD 1.4 billion in 2023. The rollout of BharatNet Phase II enabled small and medium enterprises (SMEs) in more than 550,000 villages to access cloud-based financial tools. The public-private investment strategies and the Digital India initiatives are expected to push the demand for accounts payable automation solutions in the years ahead.

Country-Specific Insights

|

Country |

Gov. Spending Increase (2015-2023) |

Adoption Growth |

|

Japan |

22.4% |

+1.2M orgs |

|

Malaysia |

33.5% |

+1.0M orgs |

|

S. Korea |

29.2% |

+1.6M orgs |

Key Accounts Payable Automation Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market is characterized by the presence of key players and the increasing emergence of start-ups. The leading companies are more focused on the production of AI-powered solutions and targeting fintech companies. Some players are also focusing on mid-sized markets to boost their customer base. The industry giants are collaborating with other players to enhance their product offerings. They are also expanding their operations in the emerging markets to earn fruitful gains from untapped opportunities.

Here is a list of key players operating in the global market:

|

Company Name |

Country of Origin |

Revenue Share 2024 |

|

SAP SE |

Germany |

9.7% |

|

Oracle Corporation |

USA |

9.0% |

|

Coupa Software Inc. |

USA |

7.5% |

|

Tipalti Inc. |

USA |

6.4% |

|

Basware Oyj |

Finland |

5.8% |

|

Workday Inc. |

USA |

xx% |

|

Sage Group plc |

UK |

xx% |

|

AvidXchange Holdings Inc. |

USA |

xx% |

|

Kofax Inc. |

USA |

xx% |

|

Yooz Inc. |

France |

xx% |

|

Esker S.A. |

France |

xx% |

|

Xero Ltd |

Australia |

xx% |

|

Happay (CRED-owned) |

India |

xx% |

|

Invu Plc |

UK |

xx% |

|

Datamation Group Berhad |

Malaysia |

xx% |

Below are the areas covered for each company in the market:

Recent Developments

- In April 2024, Coupa Software unveiled Coupa Pay GenAI Suite, which combines generative AI with dynamic payment scheduling and anomaly detection. The company reported a 17.5% rise in usage across its mid-market clients in North America in the second quarter of 2024.

- In March 2024, SAP SE introduced SAP Business Network for Finance, integrating AI-powered invoice matching and compliance auditing tools. The move led to a 12.5% hike in enterprise subscriptions across Europe in the second quarter of 2024.

- Report ID: 7970

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Accounts Payable Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert