Accelerometer Market Outlook:

Accelerometer Market size was over USD 6 billion in 2025 and is estimated to reach USD 17.2 billion by the end of 2035, expanding at a CAGR of 10.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of accelerometer is assessed at USD 6.6 billion.

The growing automotive industry is supporting the growth of the market as it is required in controlling the motion and measuring the acceleration of the vehicle. ADAS has become a common feature in vehicle which prevents it from moving away from the lane and ensuring safety of the passengers. The ADAS system further prohibits the vehicle from rolling over and collision as the system slows the vehicle, enabling better stability. The sensors are connected to the accelerometer that limits the motion upon threat detection, supporting a safe driving experience.

Electric vehicles have been dominating the market over the past few years, owing to the rising fuel prices and maintenance standards followed across regions for vehicles, creating a challenge for consumers to adopt gasoline or diesel cars. Electric vehicles employ an accelerometer to enhance battery performance and stability of the vehicles. According to IEA in 2024, 17.3 million electric vehicles were produced, with China leading the market in terms of production, demonstrating the rising growth of electric vehicles, impacting the enhancement of the market.

Key Accelerometer Market Insights Summary:

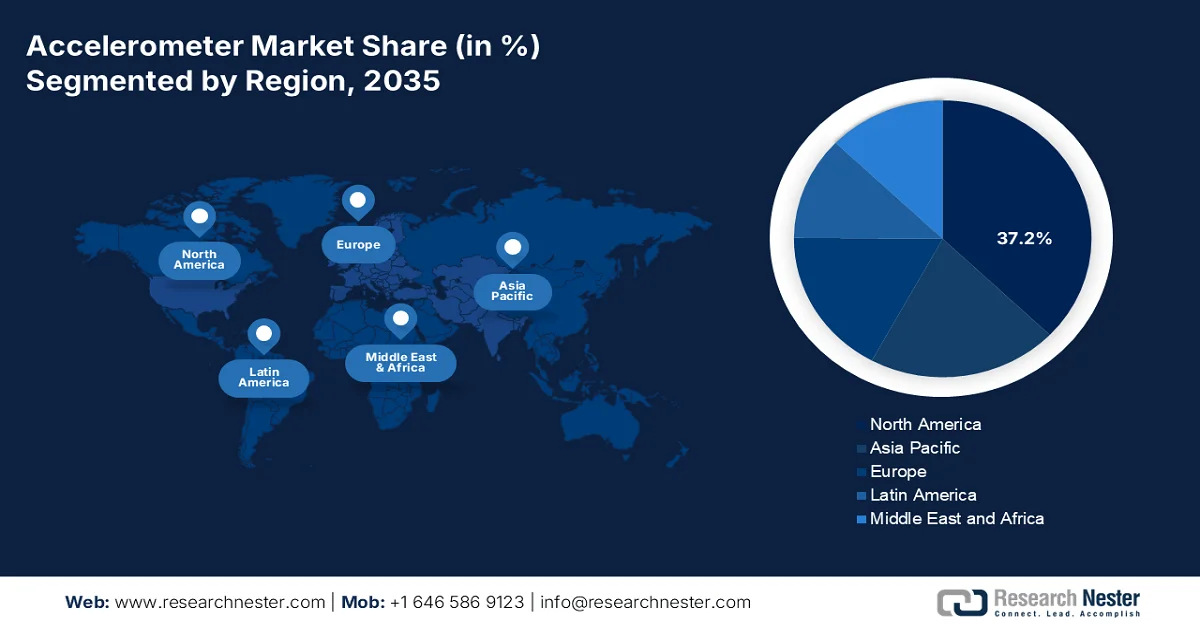

Regional Highlights:

- North America is projected to account for a 37.2% share by 2035 in the accelerometer market, supported by substantial defense investments, rapid electric vehicle adoption, and strong consumer electronics innovation.

- Europe is anticipated to witness notable expansion through 2035, reinforced by stringent environmental regulations and rising electric vehicle penetration encouraged by government incentives.

Segment Insights:

- The capacitive MEMS accelerometer segment is forecast to hold the highest share of 45% by 2035 in the accelerometer market, attributed to its low power consumption, high sensitivity, and extensive adoption across aerospace, defense, and consumer electronics.

- The airborne segment is expected to command the largest share by 2035, fueled by escalating demand for precision navigation systems in commercial aircraft, UAVs, and defense drones.

Key Growth Trends:

- Increasing demand for smartphones

- Growing aerospace and defence sector

Major Challenges:

- Environmentally sensitive

- High cost of advanced accelerometers

Key Players: Bosch Sensortec (Germany), Analog Devices (U.S.), STMicroelectronics (Switzerland/France), Honeywell International (U.S.), Texas Instruments (U.S.), Murata Manufacturing Co. (Japan), Qualcomm Technologies (U.S.), NXP Semiconductors (Netherlands), TDK Corporation (Japan), Kionix (a Rohm Company) (U.S.).

Global Accelerometer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6 billion

- 2026 Market Size: USD 6.6 billion

- Projected Market Size: USD 17.2 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Australia, Saudi Arabia, United Arab Emirates

Last updated on : 10 February, 2026

Accelerometer Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for smartphones: Consumer electronics such as mobile phones and tablets employ an accelerometer to detect motion and screen orientation. The rising demand for mobile phones and tablets is potentially enhancing the demand of market. According to data from World Economic Forum, in 2022, over 8.3 million people had access to smartphones, demonstrating the growing demand for smartphones that is driving the market. Other factors, such as the expansion of 5G networks and their global adoption is propelling the growth of consumer electronics, supporting the expansion of the market.

- Growing aerospace and defence sector: The demand for accelerometers is also driven by the aerospace sector that demands precision motion and thrust control. The use is also extended towards missiles, owing to its use in missile guidance, enabling target-oriented use. Globally, countries are heavily investing in the defence sector, leading to advancement in fighter aircraft and drones, needing the use of accelerometers. In 2024, the U.S. invested 3.3% of the national GDP to strengthen the defence sector, arising from recent threats. The investment has illustrated the growing demand to strengthen the fleets, which will further impact the growth of the market.

- Growth in health tracking devices: The ageing population has become a common challenge for many countries, including Japan, where more than 35 million people are over the age of 65, who are at a higher prevalence of health risks, which requires frequent monitoring. The adoption of health tracking devices, such as fitness bands are often equipped with an accelerometer, which senses motion, pulse, oxygen levels and other saturations of the body, enabling faster detection of anomalies. The cumulative features of health tracking enable the growth of the market.

Challenges

- Environmentally sensitive: Modern accelerometers are prone to temperature and harsh weather, which tends to damage them, leading to frequent replacement. Extreme heat and cold often challenge its capability to detect motion and maintain sensor proximity, hindering the growth of the market. Alternative motion control systems, such as IMUs, can withstand higher temperatures and can reduce the frequency of replacements.

- High cost of advanced accelerometers: Advanced accelerometers used in aerospace and defence are costly because of the manufacturing complexities involved, leading to enhancement in price. The precision of manufacturing requires skills, possible for limited manufacturers, which further limits the adoption of the market. Geopolitical risks and trade barrier further restrict the manufacturers to obtain raw materials for accelerometers leading to price increase and declining the adoption.

Accelerometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 6 billion |

|

Forecast Year Market Size (2035) |

USD 17.2 billion |

|

Regional Scope |

|

Accelerometer Market Segmentation:

Technology Segment Analysis

The capacitive MEMS accelerometer is predicted hold the highest share of 45% by the end of 2035, owing to its widespread use in the aerospace and defence sector. This type of accelerometer is low in power consumption and is highly sensitive, enabling its use in high-performance environments. In unmanned vehicles and missiles, the meters can enhance efficiency and maintain precision. Capacitive MEMS are highly used within smartphones because of their easy integration and low cost, enabling wider adoption. MEMS saves a considerable amount of energy and limits the damage to the screen, enhancing its use in different devices such as laptops, smartphones and tablets.

Platform Segment Analysis

The airborne segment is anticipated hold the largest share by the end of 2035 because of high demand in commercial jets, which heavily rely on navigation for precision landing and takeoff. The accelerometers are connected to sensors that enable weather reports and motion of the aircraft to determine altitude and speed, enhancing the growth of the global accelerometer market. Modern defence equipment includes UAVs and drones that require motion sensing and precise navigation, which includes the use of an accelerometer. As countries are accelerating their investment for defence and equipment’s, drones and UAVs are highly being employes to strengthen security and safety, which is directly amplifying the growth of the airborne segment, impacting the growth of the market

End user Segment Analysis

The aerospace and defence sector is highly dependent on accelerometers because of large-scale development within navigation and precision landing. Military aircraft are often designed to land on rugged airstrips that are not aligned with the navigation systems. The accelerometer enables the pilots to land with precision even in rough terrains, enabling wider adoption of the accelerometer. Countries like the U.S. and China are increasing their space missions with ultramodern spacecraft, demanding the use of the market. The use of spacecrafts and aerial vehicles has demands the use of accelerometer to improve the motion and thrust control enhancing its growth in the global market.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Platform |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Accelerometer Market - Regional Analysis

North America Market Insights

The region is expected to hold a market share of 37.2% share by the end of 2035, owing to the large-scale investment of the region in defence equipment, enabling broader usage of accelerometers. The region has further experienced growth in electric vehicles, primarily because of sustainability measures taken by the government at the country level. The region is developing measures to curb pollution and reduce carbon emissions. The consumer electronics market of the region is also growing rapidly, enabling more scope for the market. Popular manufacturers such as Apple’s presence and innovation capabilities have enhanced the growth of advanced accelerometer which enhance the orientation of the screens, amplifying the expansion of the North America accelerometer market.

The U.S. has accelerated in terms of sustainability, where it has focused greatly on electric vehicles to reduce emissions, fueling the growth of the accelerometer market. The Bipartisan Infrastructure Law of 2021 and the Inflation Reduction Act of 2022 are functioning as key catalysts in the adoption of electric vehicles in the region. According to the World Resources Institute, in Q3 of 2023, the net sales of EVs in the U.S. reached a value of 4.2 million, which demonstrates the rising domination of EVs in the U.S, enhancing the demand for the market. The strong integration of electric vehicles and government strategies to curb emissions is supporting the growth of advanced and sustainable mobility, fueling the expansion of the market.

Canada is seeing a surge in smartphone usage as the active number of smartphone users in the region grew to 33 million in 2024, enabling wider adoption of accelerometers to align the screen orientations and motion gestures. Canada’s sustainability is peaking, which has enabled the growth of pollution-free mobility, such as electric vehicles, which is enhancing the demand for advanced accelerometers. Canada is home to a large population that demands urban mobility and safer vehicles owing to the increased risk from traffic accidents. The employment of ADAS within cars can prevent unnecessary collisions and enhance the safety of the passengers, fueling the demand for the accelerometer market.

Europe Market Insights

Europe has laid stringent policies and protocols to enhance the safety of the environment, which is pushing European automotive manufacturers to increase the sales of electric vehicles. According to IEA, in 2023, Europe registered close to 3.2 million electric vehicles demonstrating the rising demand for sustainable and advanced vehicles that employe accelerometer. Europe has a large population that requires mobility in transportation. The regional government integrated electric mobility with the transportation system, impacting the growth of the market. Private vehicle owners can now avail a subsidy from the government to buy new electric vehicles, which further propels the growth of the accelerometer market in Europe.

The UK is a major hub for automotive manufacturers that often test the vehicles in local markets. The large population level of the country enables the manufacturers to test their vehicles before making a global debut, which largely helps in accelerating the market. The demand in UK market is also driven by the rise in consumer electronics, due to rise in educational institutions that demand modern study materials such as tablets, increasing the market potential and scope. The healthcare sector of the region is also strengthening in order to ensure better health among the older patients. According to the National Council of Ageing, more than 78% of the current population will be aged over 65 by 2040, which may bring chronic challenges. To enhance better health, the NHS is planning for remote monitoring through wearables which employ an accelerometer, demonstrating the growing demand.

Germany accelerometer market is driven by key automotive players, such as Mercedes-Benz and Audi, are embedding ADAS in their vehicles as a part of complimentary safety feature. The feature is connected to the sensor that detects motion and navigation, enabling the growth of the accelerator market. The automotive manufacturers have advanced their production towards ultra modern EV propelled by the rising cost of fuel. Electric vehicles employs capacitive MEMS accelerometer which detects the motion and recharges the EV battery, enabling a higher driving range.

Asia Pacific Market Insights

Asia Pacific has a strong base of manufacturing, especially for electrical and electronics, including the manufacturing of accelerometers. The electric vehicle market in the region is booming, with a major contribution. Inexpensive labour and raw material prices have led to massive cost-cutting within the electric vehicles, increasing the adoption and supporting the growth of the market. The low cost of electronic components has propelled the sales of smartphones and other consumer electronic devices that employs accelerometer for motion detection, enhancing the growth of the market. Various initiatives by the local and state governments are supporting the enhancement of the Asia Pacific market.

China holds a strong market for electrical and electronics, which propels the growth of the accelerometer market. Low-cost manufacturing and high skill level enable the manufacturers to minimise the cost, enabling higher growth of the market. The demand for the market is also driven by electric vehicle production, demonstrating the rising domination in EV production, enabling a higher scope for the market. According to IEA, in 2024, more than 70% of the of the global production of electric vehicles was in China, demonstrating the rising demand for sustainable mobility solutions, which is directly impacting the growth of the market.

India has accelerated semiconductor production, giving rise to electric vehicle production and enabling wider adoption. The steady and sustained growth of the semiconductor industry has enabled wider adoption of electric vehicle enhancing the market. India is emerging as a consumer electronics market that demands accelerometers to detect motion, enhancing the market for global accelerometers. India has witnessed FDI from different countries and improved trade relations, which are supporting innovation and material procurement enabling low cost manufacturing of accelerometers.

Key Accelerometer Market Players:

- Bosch Sensortec (Germany)

- Analog Devices (U.S.)

- STMicroelectronics (Switzerland/France)

- Honeywell International (U.S.)

- Texas Instruments (U.S.)

- Murata Manufacturing Co. (Japan)

- Qualcomm Technologies (U.S.)

- NXP Semiconductors (Netherlands)

- TDK Corporation (Japan)

- Kionix (a Rohm Company) (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bosch Sensortec: The business is a leading producer of MEMS accelerometers with a strong focus on sensors for consumer electronics, automotive and smart home devices. The business has a global reach with manufacturing hubs across regions that is accelerating the growth of innovation. The business has also integrated intelligence within its smart sensors that can process data and make decisions of its own.

- Analog Devices: The firm is a leading manufacturer of DSP systems with focus on high-performance semiconductors for applications such as automotive, communication and consumer electronics. The business has acquired a number of f manufacturers to enhance their sensor manufacturing and production. The business is a strong player in 5G communications and fiber optic systems.

- STMicroelectronics: A global pioneer in semiconductor and sensor production, used in applications such as industrial automation, automotive and microcontrollers. The products are highly energy efficient which has significantly enhanced the demand. It also specailses in microprocessors and controllers used in smartphones and other consumer electronic devices. The sensors are specifically designed for accelerometers that can detect vehicle motion and power the engine.

- Honeywell International: A multinational conglomerate that sells and designs a wide range of accelerometers and sensors for automotive, aerospace, and performance materials. The firm has played a key role in building smart cities. The business primarily manufactures and designs cockpit instrumentation systems and weather radar systems that improve flight operations. The radar systems employ accelerometers and other sensors to detect the weather and set flights to autopilot during an extreme turbulent event.

- Texas Instruments: One of the largest semiconductor manufacturing companies with digital semiconductor solutions and integrated circuits. The products are used in various sectors, including defence, aerospace and automotive. The brand has effectively maintained sustainability in its product offering. The products offered are highly energy efficient which supports in maintenance minimization.

Here is a list of key players operating in the global market:

The players operating in the global market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialized manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate Landscape of the Accelerometer Market:

Recent Developments

- In May 2024, Bosch Sensortec developed a new generation MEMS sensor aimed for the automotive and IOT applications, which offers superior accuracy and better performance, making it ideal for driver assistance systems.

- In August 2023, NXP and Bosch formed a joint venture to integrate MEMS accelerometer and sensor fusion technologies within the automotive safety systems. The safety feature focused on airbag deployment and stability control systems.

- Report ID: 8389

- Published Date: Feb 10, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Accelerometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.