4-Tert-Butylcyclohexanone Market Outlook:

4-Tert-Butylcyclohexanone Market size was over USD 2.43 billion in 2025 and is anticipated to cross USD 4.19 billion by 2035, growing at more than 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 4-tert-butylcyclohexanone is assessed at USD 2.55 billion.

The growth of the market can be attributed to the rising demand for 4-tert-butylcyclohexanone in the personal care industry. personal care industry comprises products associated with nails, oral, and skincare. For instance, around 15 million Americans were observed to be using facial lotions, creams, and gels.

Furthermore, the 4-tert-butylcyclohexanone is less polar than 4-tert-butylcyclohexanol and both are generally separated by the chromatography method. 4-tert-butylcyclohexanone is soluble in alcohol and ethanol but not in water with an experimental density of 0.893g/mL. It is an organic chemical associated with the C10H180 ketones family and is sold in the market under CAS number 98-53-3. 4-tert-butylcyclohexanone is nontoxic in nature and this is one of the major reasons for its utilization in the manufacturing of flavors, fragrances, and various cosmetics products. Edible flavors are generally added to junk food to make it more appealing to customers and a higher prevalence of junk food can be observed across the globe. For instance, the total size of the quick service restaurant industry was valued at USD 700 billion in 2021 globally. Hence, all these factors are expected to propel the market growth over the forecast period.

Key 4-Tert-Butylcyclohexanone Market Insights Summary:

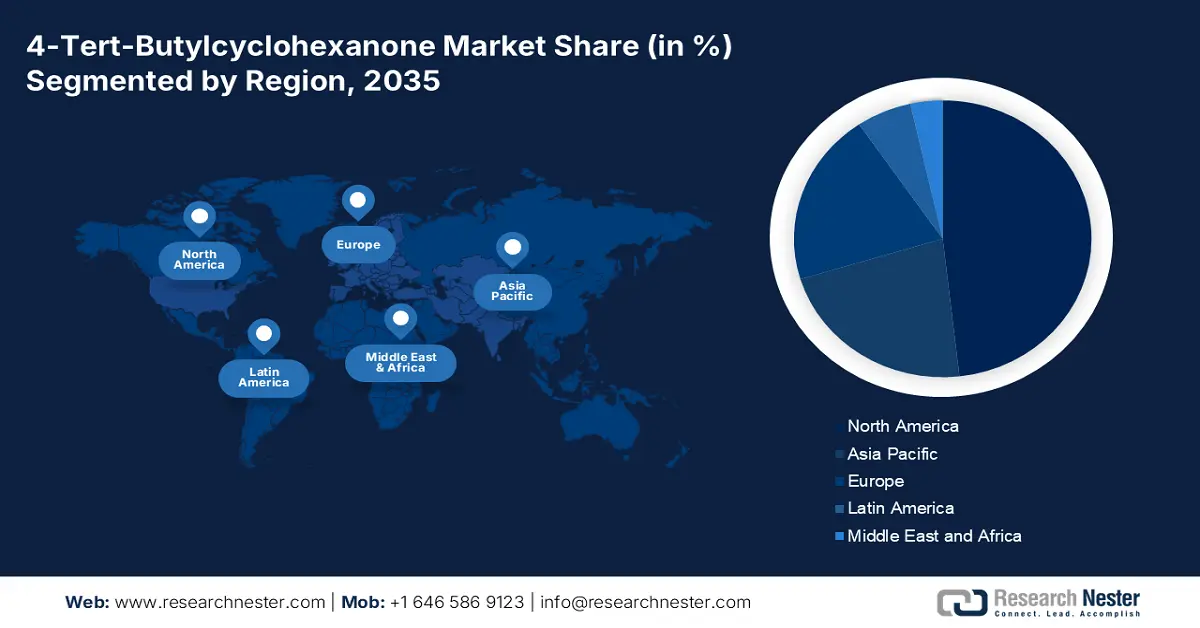

Regional Highlights:

- North America is projected to secure the largest revenue share by 2035 in the 4-tert-butylcyclohexanone market, underpinned by escalating sales of perfumes, deodorants, and skincare products owing to rising beauty and personal care preferences.

- Asia Pacific is estimated to hold the second-largest share by 2035, supported by expanding disposable incomes and heightened demand for hygiene and fragrance products across the region.

Segment Insights:

- The perfumes & fragrances segment is expected to command the largest share by 2035 in the 4-tert-butylcyclohexanone market, bolstered by surging global demand for deodorants and personal hygiene products.

- The cleaning & washing segment is anticipated to capture the second-largest share by 2035, reinforced by growing awareness regarding hygiene to prevent infections and related diseases.

Key Growth Trends:

- Up Surged Demand for the Product in the Cosmetic and Personal Care Industry to Hike the Market Growth

- Rising Demand for the Product in the Flavor and Fragrance (F&F) Industry

Major Challenges:

- Possibility of Adverse Effects on the Environment and Health

- Strict Regulations Imposed by the Government on the Utilization

Key Players: Dayang chem (Hangzhou) Co., Ltd., Thermo Fisher Scientific Holdings, Inc., Hubei Jusheng Technology Co., Ltd., Merck KGaA, Lanxess AG, Tokyo Chemical Industry Co., Ltd., WeylChem International GmbH, Jordan Bromine Company, IRO Group Inc., ICL Industrial Products Ltd.

Global 4-Tert-Butylcyclohexanone Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.43 billion

- 2026 Market Size: USD 2.55 billion

- Projected Market Size: USD 4.19 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 21 November, 2025

4-Tert-Butylcyclohexanone Market - Growth Drivers and Challenges

Growth Drivers

- Up-Surged Demand for the Product in the Cosmetic and Personal Care Industry to Hike the Market Growth - As of 2022, about 300 contract manufacturers of personal care products were active in the US. 4-tert-butylcyclohexanone is used in several cosmetic products since it has been observed that 4-tert-butylcyclohexanone has required properties to treat facial dermatitis, pruritus, redness, burning, dryness, and also tightens the skin. 4-tert-butylcyclohexanone is used in various skin care creams to provide a more calming effect on the skin. Hence, higher utilization of 4-tert-butylcyclohexanone owing to all these properties is projected to influence the market growth positively over the forecast period.

- Rising Demand for the Product in the Flavor and Fragrance (F&F) Industry - In the flavor and fragrance (F&F) industry, the fragrances division was estimated to generate revenue of approximately USD 10 billion in 2021 across the globe. Perfume composition has a certain amount of 4-tert-butylcyclohexanone mixed in them to keep the fragrance for a longer duration.

- Spiking Inclination of the Global Population Toward Hygiene and Personal Grooming - It was observed that around 40% of males across the globe prioritized self-care and personal grooming. Since men across the globe are buying personal care products, it is estimated to accelerate the production and sales of hygiene products.

- Growing Utilization of the Product in Making Cleaning and Washing Products - In 2019, the toilet cleaners’ segment was valued at around USD 7 billion globally.

- Escalating Demand for Perfumes and Deodorants - The revenue generated by the deodorant segment per person in the year 2022 was estimated to be around USD 4 . 4-tert-butylcyclohexanone is heavily used in the production of perfumes and deodorants as a perfuming agent since it is soluble in ethanol and alcohol.

Challenges

- Possibility of Adverse Effects on the Environment and Health

- Strict Regulations Imposed by the Government on the Utilization

- Harmfulness on the Aquatic Life - 4-tert-butylcyclohexanone is considered to be toxic to aquatic life since it has hazardous properties that can leave a harmful effect for a very long time if swallowed by aquatic animals. Additionally, 4-tert-butylcyclohexanone is insoluble in water which also makes it quite harmful to sea life. Therefore, this factor is estimated to hamper the market growth over the forecast period.

4-Tert-Butylcyclohexanone Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 2.43 billion |

|

Forecast Year Market Size (2035) |

USD 4.19 billion |

|

Regional Scope |

|

4-Tert-Butylcyclohexanone Market Segmentation:

Application Segment Analysis

The global 4-tert-butylcyclohexanone market is segmented and analyzed for demand and supply by application into perfumes & fragrances, biocides, cleaning & washing, and others. Out of these applications, the perfumes & fragrances segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the higher demand for perfumes and deodorants across the globe. In the past few years, the surge in fitness activities and inclination toward personal hygiene has made a significant place in people’s lives across the globe which in turn, is set to boost the growth of the perfumes & fragrances segment over the forecast period. For instance, the revenue generated by the deodorants segment in the associated industry amounted to approximately USD 5 billion in 2022. A growing inclination of people toward personal care has been observed in recent decades that is projected to hike the growth of the segment over the forecast period.

Purity Segment Analysis

Furthermore, the cleaning & washing segment on the market is also projected to obtain the second largest share during the forecast period. 4-tert-butylcyclohexanone is used in cleaning and washing products along with alcohol and other chemicals. Cleaning is mainly a term to remove additional items or spots to make the surface look organized. Washing is a process of cleaning detergent and soap to maintain good hygiene and health. Poor hygiene may cause several serious diseases and infections such as pinworms, tinea pedis, lymphatic filariasis, body & head lice, chronic diarrhea, dental caries, and many more. For instance, in 2019, more than 350,000 children became victims of diarrheal disease owing to poor sanitation. Hence, all these factors are projected to influence segment growth positively over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Purity |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

4-Tert-Butylcyclohexanone Market - Regional Analysis

North American Market Insights

North America industry is anticipated to account for largest revenue share by 2035. The growth of the market can be attributed majorly to the spiking sales of skincare products, perfumes, deodorants, and other sorts of cosmetics owing to the higher inclination of the regional population towards beauty and personal care. In 2021, the sales of facial cosmetics in the United States were valued at almost USD 1 billion. Additionally, the increasing demand for perfume and deodorants owing to the growing awareness of personal hygiene is further anticipated to boost the growth of the market in the region during the forecast period. The USA was observed to generate the highest revenue in the deodorant segment in the global comparison in 2022 of about USD 5000 million.

APAC Market Insights

Furthermore, the Asia Pacific region is anticipated to obtain the second-largest share of the market during the forecast period. The growth of the market is attributed to similar factors such as the growing demand for personal hygiene products, perfumes, deodorants, and others and the increasing disposable income in the region. For instance, the value of the Asian fragrance segment was estimated to be around USD 10 billion in 2022. Moreover, a notable boom in the regional population Hence, all these factors are projected to influence the growth of the market in the region positively over the forecast period.

4-Tert-Butylcyclohexanone Market Players:

- Dayang chem (Hangzhou) Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific Holdings, Inc.

- Hubei Jusheng Technology Co., Ltd.

- Merck KGaA

- Lanxess AG

- Tokyo Chemical Industry Co., Ltd.

- WeylChem International GmbH

- Jordan Bromine Company

- IRO Group Inc.

- ICL Industrial Products Ltd.

Recent Developments

-

Merck KGaA to announce the collaboration with Agilent Technologies to enable Bioprocessing 4.0 and real-time release. The company plans to include a critical tool for online process analytical technologies. Process analytical technologies (PAT) are promoted by regulatory authorities across the globe enabling the release of Bioprocessing 4.0.

-

Lanxess AG merges its path with Advent International to develop engineering polymers of high performance by obtaining the required materials from DSM.

- Report ID: 4170

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

4-Tert-Butylcyclohexanone Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.